Attorney Death Trust Paperwork Protocol

Introduction to Attorney Death Trust Paperwork Protocol

When dealing with the estate of a deceased individual, the process can be complex and overwhelming, especially when it comes to navigating the legal aspects. One crucial aspect of estate planning is the establishment of a trust, which allows for the management and distribution of assets according to the wishes of the deceased. In this context, the role of an attorney is pivotal in ensuring that the death trust paperwork protocol is followed correctly. This protocol involves a series of steps and legal documents that must be meticulously prepared and executed to avoid any disputes or legal issues.

Understanding Death Trusts

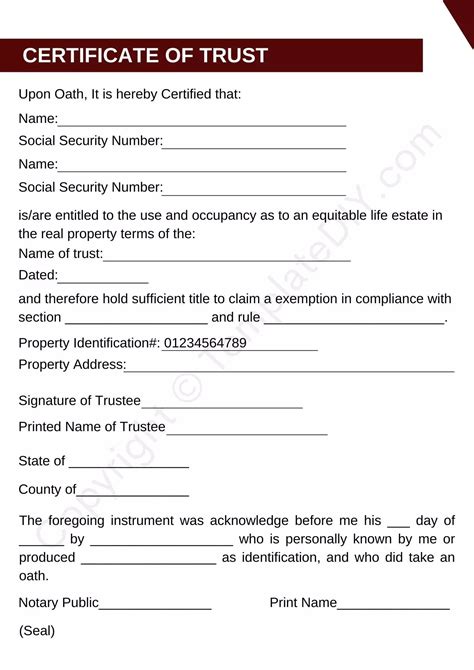

A death trust, often referred to as a bypass trust or a credit shelter trust, is a type of trust designed to minimize estate taxes by allocating assets to beneficiaries in a tax-efficient manner. It is typically established by a couple as part of their joint estate plan, aiming to maximize the use of the applicable exclusion amount for each spouse, thus reducing the overall tax liability. The trust becomes effective upon the death of one spouse, whereupon it is funded with a certain amount of assets from the deceased spouse’s estate. The surviving spouse can then access the income and, in some cases, the principal of the trust, while the assets within the trust are sheltered from estate taxes upon the surviving spouse’s death.

Key Components of Death Trust Paperwork

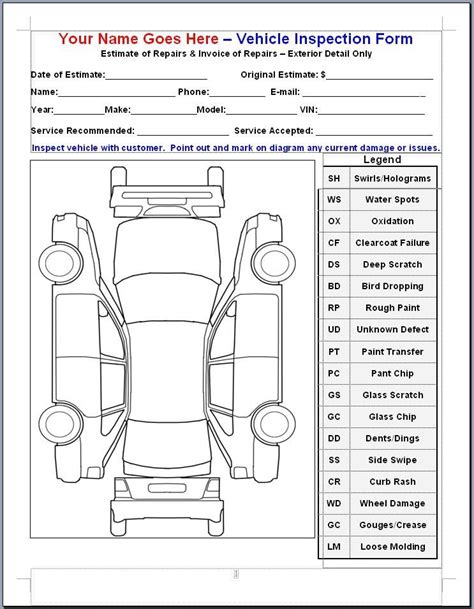

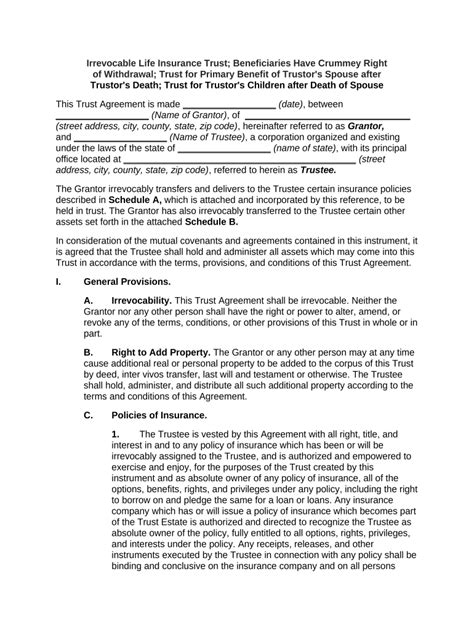

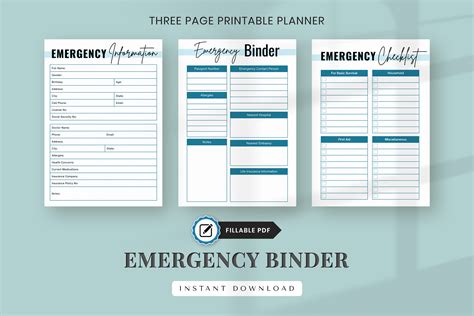

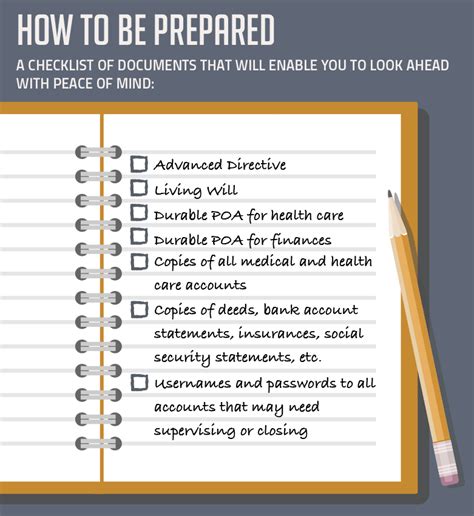

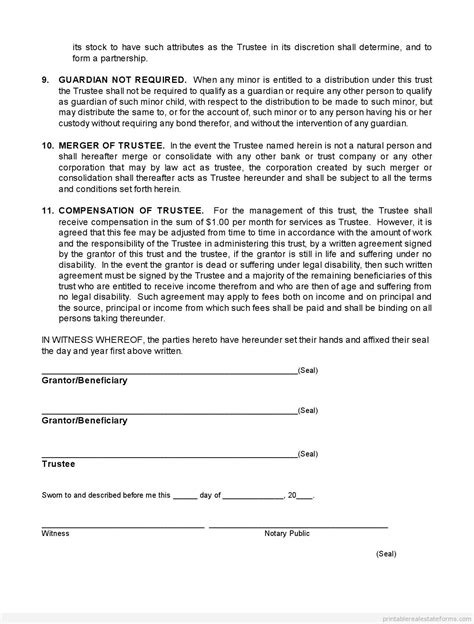

The paperwork involved in setting up and managing a death trust includes several key documents and steps: - Last Will and Testament: This document outlines how the deceased’s assets are to be distributed and names the executor of the estate. - Trust Agreement: The core document of the trust, which details the terms, the trustee’s powers, and the beneficiaries’ rights. - Pour-Over Will: Complements the trust agreement by ensuring that any assets not transferred into the trust during the deceased’s lifetime are “poured over” into the trust upon death. - Letters Testamentary: Issued by the court to the executor, granting them the authority to manage the estate. - Inventory of Assets: A detailed list of the deceased’s assets, which is crucial for funding the trust and distributing assets according to the trust agreement and will.

Role of the Attorney in Death Trust Paperwork Protocol

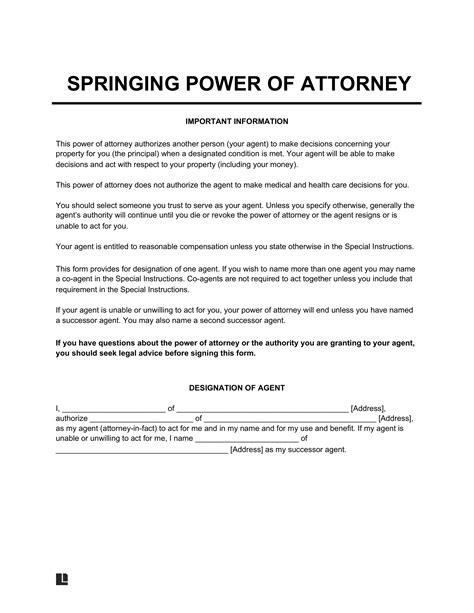

The attorney plays a critical role in the death trust paperwork protocol, including: - Drafting Documents: Preparing the trust agreement, will, pour-over will, and other necessary documents. - Asset Distribution: Ensuring that assets are distributed correctly, both into the trust and according to the terms of the will. - Tax Planning: Advising on tax implications and strategies to minimize tax liabilities. - Probate Proceedings: Representing the estate in court, if necessary, to ensure the will is probated and the trust is funded as intended. - Beneficiary Representation: Communicating with beneficiaries, ensuring their rights are respected, and addressing any disputes that may arise.

Steps in Establishing a Death Trust

Establishing a death trust involves several steps: 1. Consultation: Meeting with an attorney to discuss estate planning goals and objectives. 2. Drafting Documents: The attorney prepares the necessary documents based on the client’s wishes. 3. Execution of Documents: The client signs the documents in the presence of witnesses and a notary, as required by law. 4. Funding the Trust: Transferring assets into the trust, which can be done during the client’s lifetime or upon death through the pour-over will. 5. Review and Update: Periodically reviewing and updating the trust and associated documents to reflect changes in the law, the client’s assets, or their wishes.

Benefits of a Death Trust

The benefits of a death trust include: - Tax Efficiency: Minimizes estate taxes by utilizing the applicable exclusion amount of both spouses. - Control: Allows the deceased to control how their assets are distributed after their death. - Flexibility: Can be designed to accommodate changing circumstances and wishes. - Privacy: Trusts are not public records, providing privacy for the beneficiaries and the assets involved.

Challenges and Considerations

While death trusts offer several benefits, there are also challenges and considerations: - Complexity: Requires careful planning and execution to ensure all legal and tax implications are addressed. - Cost: The establishment and maintenance of a death trust can be costly, including legal fees and potential tax liabilities. - Emotional Sensitivity: Involves making decisions about one’s own death and the distribution of assets, which can be emotionally challenging.

📝 Note: It's essential to work with an experienced attorney to navigate the complexities of death trust paperwork protocol, ensuring that all documents are properly prepared and executed to meet the individual's estate planning goals.

In the process of estate planning and the establishment of a death trust, understanding the legal, financial, and emotional aspects is crucial. With the right guidance and planning, individuals can ensure that their assets are managed and distributed according to their wishes, providing peace of mind for both themselves and their loved ones.

To summarize the key aspects of dealing with the death trust paperwork protocol, it is vital to approach the process with a clear understanding of the legal documents involved, the role of the attorney, and the benefits and challenges associated with death trusts. By doing so, individuals can better navigate the complexities of estate planning, ensuring that their wishes are respected and their assets are protected for future generations.

What is the primary purpose of a death trust?

+

The primary purpose of a death trust is to minimize estate taxes by allocating assets to beneficiaries in a tax-efficient manner, while also allowing the deceased to control how their assets are distributed after their death.

What documents are involved in the death trust paperwork protocol?

+

The key documents include the trust agreement, last will and testament, pour-over will, and letters testamentary, among others. These documents work together to ensure that the deceased’s wishes are carried out and that the estate is managed efficiently.

Why is it important to work with an attorney when establishing a death trust?

+

Working with an attorney is crucial because they can provide the necessary expertise to navigate the complexities of estate planning and ensure that all documents are properly prepared and executed. This helps in avoiding legal issues and ensuring that the deceased’s wishes are respected.