Mortgage Application Paperwork Needed

Introduction to Mortgage Application Process

When it comes to purchasing a home, one of the most critical steps in the process is applying for a mortgage. The mortgage application process can be complex and requires a significant amount of paperwork. Understanding what documents are needed and being prepared can help streamline the process and reduce the stress associated with applying for a mortgage. In this article, we will explore the various types of paperwork needed for a mortgage application, the importance of each document, and provide tips on how to ensure a smooth application process.

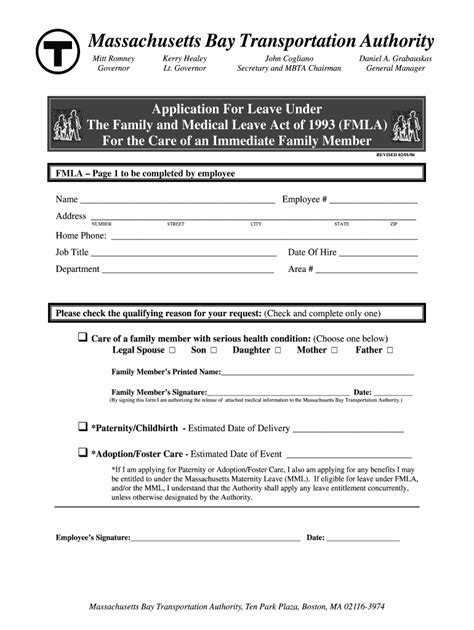

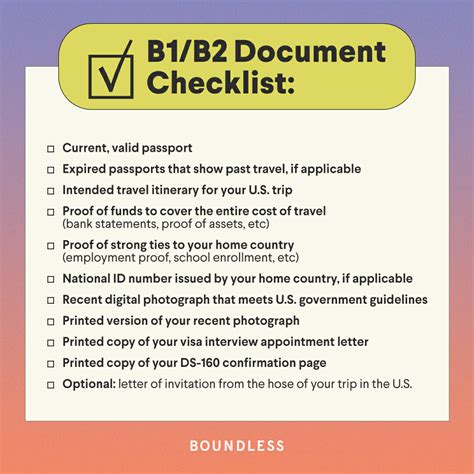

Types of Paperwork Needed

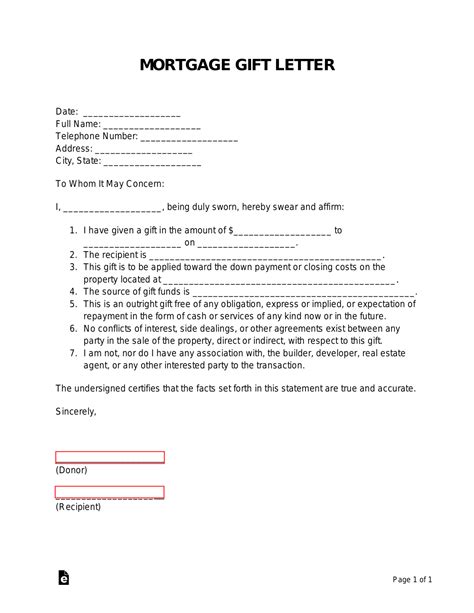

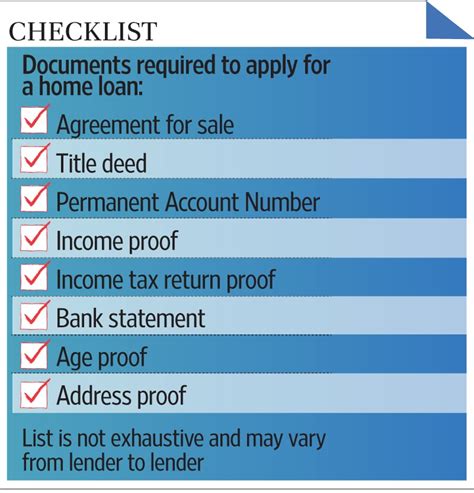

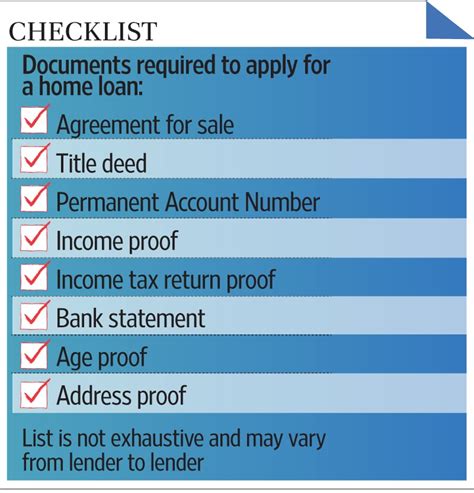

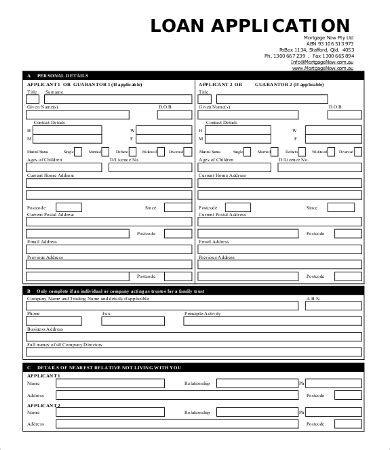

The paperwork required for a mortgage application can vary depending on the lender, the type of mortgage, and the borrower’s individual circumstances. However, there are some common documents that are typically required. These include: * Identification documents: Such as a driver’s license, passport, or state ID * Income verification documents: Such as pay stubs, W-2 forms, and tax returns * Employment verification documents: Such as a letter from the borrower’s employer or a copy of their employment contract * Asset verification documents: Such as bank statements, investment accounts, and retirement accounts * Credit reports: The lender will typically pull the borrower’s credit report to review their credit history and score * Property-related documents: Such as the property appraisal, title report, and any other documents related to the property being purchased

Importance of Each Document

Each of the documents required for a mortgage application plays a critical role in the lender’s decision to approve or deny the loan. The identification documents verify the borrower’s identity and ensure that they are who they claim to be. The income verification documents provide proof of the borrower’s income and employment, which is used to determine their ability to repay the loan. The employment verification documents provide additional proof of the borrower’s employment and income stability. The asset verification documents provide proof of the borrower’s assets and their ability to make a down payment and pay closing costs. The credit reports provide the lender with a comprehensive view of the borrower’s credit history and score, which is used to determine their creditworthiness. Finally, the property-related documents provide information about the property being purchased, including its value and any potential issues with the title.

Tips for Ensuring a Smooth Application Process

To ensure a smooth mortgage application process, it’s essential to be prepared and have all the necessary documents ready. Here are some tips to help you prepare: * Gather all the necessary documents and make sure they are up to date and accurate * Review your credit report and dispute any errors or inaccuracies * Check your credit score and work on improving it if necessary * Get pre-approved for a mortgage before starting your home search * Work with a reputable lender who can guide you through the application process and help you navigate any issues that may arise

Common Mistakes to Avoid

There are several common mistakes that borrowers can make during the mortgage application process. These include: * Not providing complete or accurate documentation * Not reviewing and disputing errors on their credit report * Not checking their credit score and working on improving it * Not getting pre-approved for a mortgage before starting their home search * Not working with a reputable lender

📝 Note: It's essential to avoid these common mistakes to ensure a smooth and successful mortgage application process.

Table of Required Documents

The following table provides a summary of the documents typically required for a mortgage application:

| Document Type | Description |

|---|---|

| Identification documents | Driver’s license, passport, or state ID |

| Income verification documents | Pay stubs, W-2 forms, and tax returns |

| Employment verification documents | Letter from employer or copy of employment contract |

| Asset verification documents | Bank statements, investment accounts, and retirement accounts |

| Credit reports | Comprehensive view of credit history and score |

| Property-related documents | Property appraisal, title report, and other property-related documents |

In summary, applying for a mortgage requires a significant amount of paperwork and documentation. Understanding what documents are needed and being prepared can help streamline the process and reduce stress. By gathering all the necessary documents, reviewing your credit report, checking your credit score, getting pre-approved for a mortgage, and working with a reputable lender, you can ensure a smooth and successful mortgage application process.

What is the most important document required for a mortgage application?

+

The most important document required for a mortgage application is the credit report, as it provides a comprehensive view of the borrower’s credit history and score.

How long does the mortgage application process typically take?

+

The mortgage application process typically takes several weeks to several months, depending on the complexity of the application and the lender’s processing time.

Can I apply for a mortgage online?

+

Yes, many lenders offer online mortgage applications, which can be a convenient and efficient way to apply for a mortgage.