PA Paperwork Explained

Introduction to PA Paperwork

When it comes to navigating the complex world of professional administration, understanding the intricacies of paperwork is essential. In the state of Pennsylvania, also known as PA, the process of managing and submitting paperwork can be overwhelming, especially for those who are new to the field. This article aims to provide a comprehensive guide to PA paperwork, highlighting the key aspects, requirements, and best practices to ensure a smooth and efficient process.

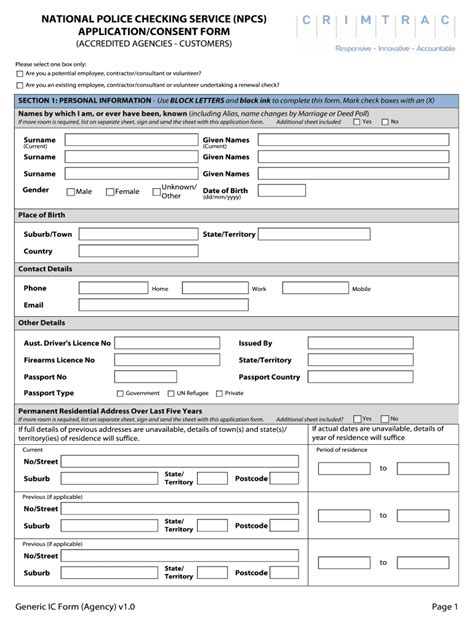

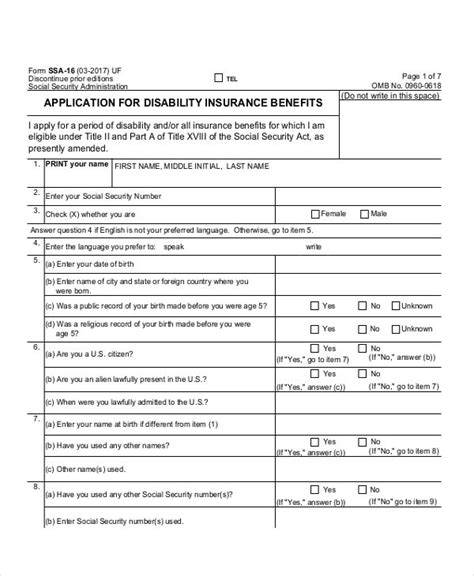

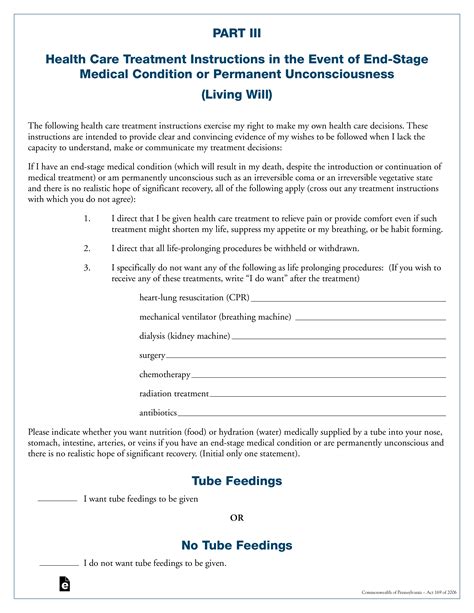

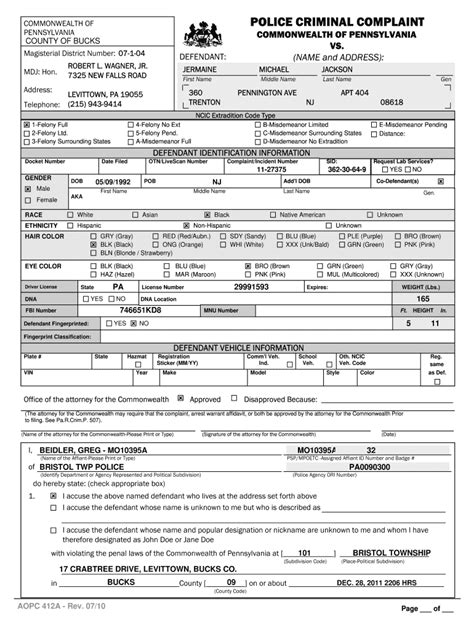

Types of PA Paperwork

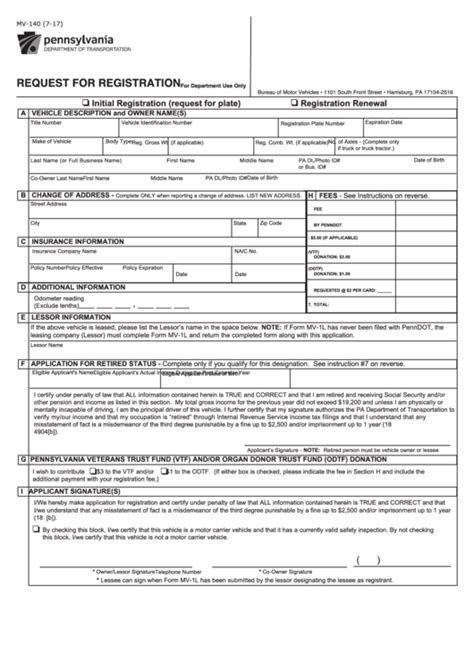

PA paperwork encompasses a wide range of documents, each serving a unique purpose. Some of the most common types of paperwork include: * Business registrations: Necessary for establishing and operating a business in PA. * Tax returns: Required for individuals and businesses to report income and pay taxes. * Employment documents: Used for hiring, managing, and terminating employees. * Contract agreements: Essential for outlining the terms and conditions of business relationships. * Government permits: Needed for various activities, such as construction, environmental projects, and healthcare services.

PA Paperwork Requirements

To ensure compliance with PA regulations, it is crucial to understand the specific requirements for each type of paperwork. Some key considerations include: * Business registrations: Must be filed with the PA Department of State and may require additional documentation, such as articles of incorporation or a business license. * Tax returns: Must be submitted to the PA Department of Revenue and may require supporting documents, such as W-2 forms or 1099 statements. * Employment documents: Must comply with PA labor laws and regulations, including those related to minimum wage, overtime, and worker’s compensation. * Contract agreements: Must be in writing and signed by all parties involved, with clear terms and conditions outlined. * Government permits: Must be obtained before commencing a project or activity, and may require periodic renewals or updates.

| Type of Paperwork | Required Documents | Filing Deadline |

|---|---|---|

| Business Registration | Articles of Incorporation, Business License | Within 30 days of establishment |

| Tax Return | W-2 forms, 1099 statements, Income Statement | April 15th of each year |

| Employment Documents | Employee Handbook, Contract Agreement, Worker's Compensation Insurance | Upon hiring or termination |

| Contract Agreement | Written contract, signed by all parties | Before commencing work or services |

| Government Permit | Application form, supporting documents, fee payment | Varies depending on the permit type |

Best Practices for PA Paperwork

To avoid delays, fines, or other penalties, it is essential to follow best practices when managing PA paperwork. Some recommendations include: * Stay organized: Keep all paperwork and supporting documents in a secure, easily accessible location. * Verify requirements: Ensure compliance with PA regulations and laws by verifying the specific requirements for each type of paperwork. * Seek professional help: Consult with an attorney, accountant, or other expert if unsure about any aspect of the paperwork process. * Submit paperwork timely: Meet all filing deadlines to avoid late fees, penalties, or other consequences. * Review and update paperwork regularly: Ensure that all paperwork is current, accurate, and compliant with changing regulations.

📝 Note: It is crucial to stay up-to-date with changes in PA regulations and laws, as these can impact the paperwork process and requirements.

Common Challenges and Solutions

Despite the importance of PA paperwork, many individuals and businesses encounter challenges during the process. Some common issues and solutions include: * Delays in processing: Submit paperwork well in advance of deadlines, and follow up with the relevant authorities to ensure timely processing. * Errors or omissions: Carefully review all paperwork before submission, and seek professional help if unsure about any aspect of the process. * Non-compliance: Stay informed about PA regulations and laws, and consult with an expert if unsure about any requirement or procedure. * Lost or missing documents: Keep all paperwork and supporting documents in a secure, easily accessible location, and make regular backups to prevent loss or damage.

In summary, navigating the complex world of PA paperwork requires a thorough understanding of the various types, requirements, and best practices. By staying organized, verifying requirements, seeking professional help, submitting paperwork timely, and reviewing and updating paperwork regularly, individuals and businesses can ensure compliance with PA regulations and laws, avoid common challenges, and maintain a smooth and efficient operation.

What are the most common types of PA paperwork?

+

The most common types of PA paperwork include business registrations, tax returns, employment documents, contract agreements, and government permits.

How can I ensure compliance with PA regulations and laws?

+

To ensure compliance, stay informed about PA regulations and laws, verify requirements for each type of paperwork, and seek professional help if unsure about any aspect of the process.

What are the consequences of non-compliance with PA paperwork requirements?

+

Non-compliance can result in fines, penalties, delays, or even business closure. It is essential to understand the requirements and follow best practices to avoid these consequences.