Refinance Home Paperwork Requirements

Introduction to Refinancing Home Paperwork Requirements

When considering refinancing a home, it’s essential to understand the paperwork requirements involved in the process. Refinancing a home can be a complex and time-consuming process, but being prepared with the necessary documents can help streamline the process. In this article, we will discuss the various paperwork requirements for refinancing a home, including the types of documents needed, the importance of organization, and tips for a smooth refinancing process.

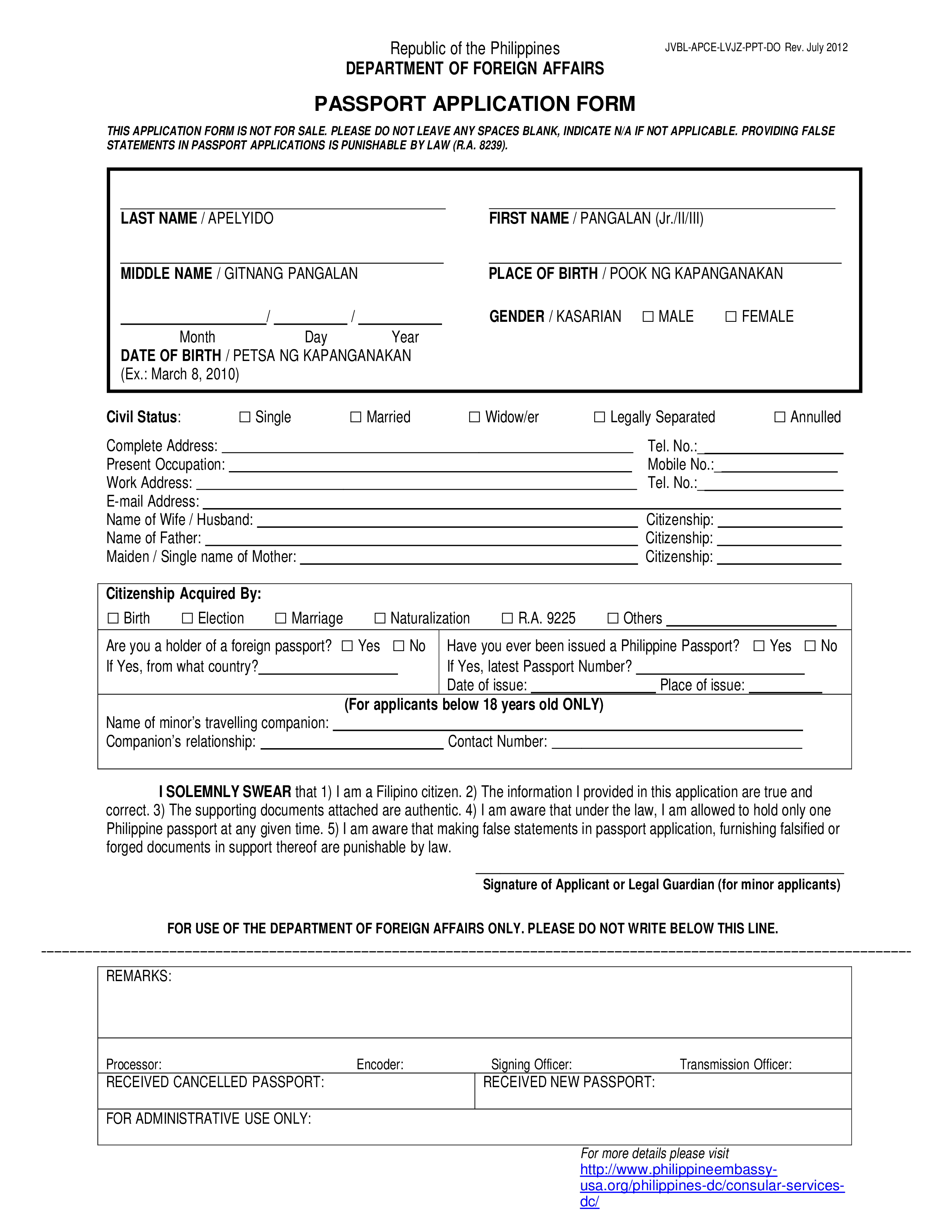

Types of Documents Required for Refinancing

The refinancing process requires a significant amount of paperwork, including: * Identification documents: These include a valid government-issued ID, such as a driver’s license or passport, and social security cards. * Income verification documents: These include pay stubs, W-2 forms, and tax returns to verify income and employment status. * Credit reports: Lenders will pull credit reports to assess creditworthiness and determine interest rates. * Property documents: These include the original mortgage note, deed of trust, and property tax records. * Appraisal reports: An appraisal report may be required to determine the current value of the property. * Insurance documents: Homeowners insurance policies and flood insurance policies (if applicable) will need to be provided.

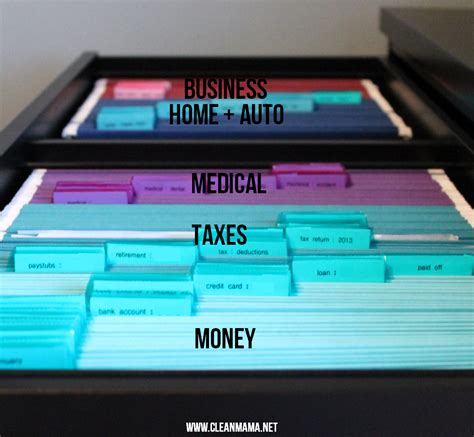

Importance of Organization

Organization is key when it comes to refinancing paperwork. It’s essential to gather all necessary documents and keep them in a secure and easily accessible location. This will help ensure that the refinancing process moves smoothly and efficiently. A well-organized refinancing package can also help to: * Reduce processing time * Minimize errors * Improve communication with lenders * Increase the chances of approval

Tips for a Smooth Refinancing Process

To ensure a smooth refinancing process, consider the following tips: * Start early: Gather documents and submit applications well in advance of the desired refinancing date. * Be thorough: Double-check all documents for accuracy and completeness. * Communicate with lenders: Keep lenders informed of any changes or updates to the refinancing package. * Seek professional advice: Consider consulting with a financial advisor or mortgage broker to navigate the refinancing process.

Common Refinancing Paperwork Mistakes

Avoid common refinancing paperwork mistakes, such as: * Incomplete or inaccurate documentation * Insufficient income verification * Poor credit history * Inadequate property documentation * Failure to disclose debts or liabilities

📝 Note: It's essential to carefully review and understand all refinancing paperwork requirements to avoid delays or rejection of the refinancing application.

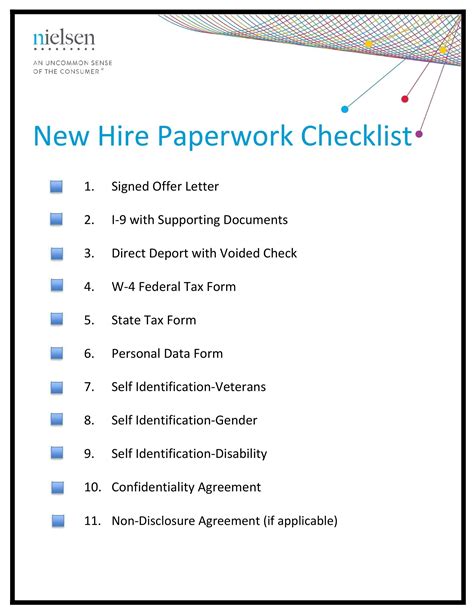

Refinancing Paperwork Checklist

To help ensure that all necessary documents are gathered, use the following refinancing paperwork checklist: * Identification documents * Income verification documents * Credit reports * Property documents * Appraisal reports * Insurance documents * Debt and liability statements * Employment verification

| Document Type | Description |

|---|---|

| Identification documents | Valid government-issued ID, social security cards |

| Income verification documents | Pay stubs, W-2 forms, tax returns |

| Credit reports | Credit history and credit score |

| Property documents | Original mortgage note, deed of trust, property tax records |

As the refinancing process comes to a close, it’s essential to review and finalize all paperwork requirements. This includes signing the refinancing agreement, reviewing the terms and conditions, and ensuring that all documents are in order. By being prepared and organized, homeowners can navigate the refinancing process with confidence and achieve their financial goals.

To finalize, refinancing a home requires a significant amount of paperwork, but being prepared and organized can help streamline the process. By understanding the types of documents required, the importance of organization, and tips for a smooth refinancing process, homeowners can navigate the refinancing process with confidence. Remember to review and finalize all paperwork requirements carefully to ensure a successful refinancing experience.

What are the benefits of refinancing a home?

+

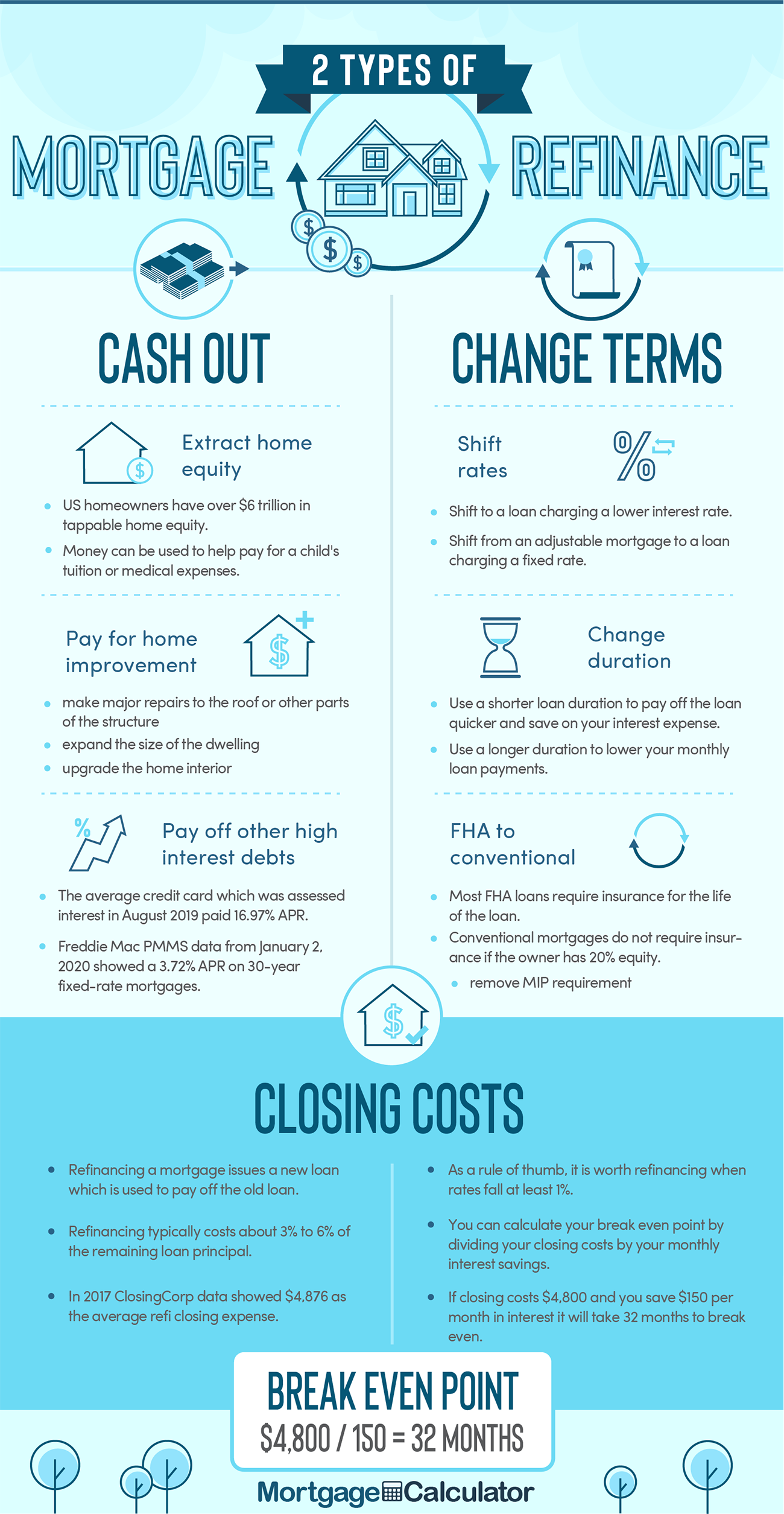

The benefits of refinancing a home include lower monthly payments, reduced interest rates, and the ability to tap into home equity.

What is the difference between refinancing and a home equity loan?

+

Refinancing involves replacing the existing mortgage with a new loan, while a home equity loan is a separate loan that uses the home’s equity as collateral.

How long does the refinancing process typically take?

+

The refinancing process typically takes 30-60 days, but can vary depending on the complexity of the loan and the lender’s processing time.