Paperwork

D Meaning on Loan Paperwork

Introduction to Loan Paperwork

When dealing with loan paperwork, it’s essential to understand the various terms and conditions that are often included in the documents. One term that is commonly used is “D Meaning,” which can have different interpretations depending on the context. In this article, we will delve into the world of loan paperwork and explore the different meanings of “D” in this context.

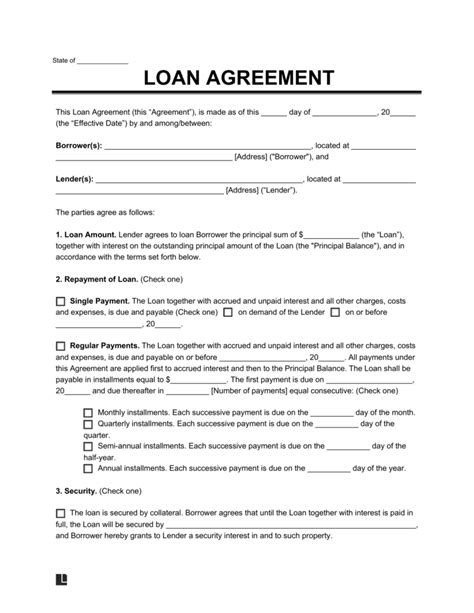

Understanding Loan Paperwork

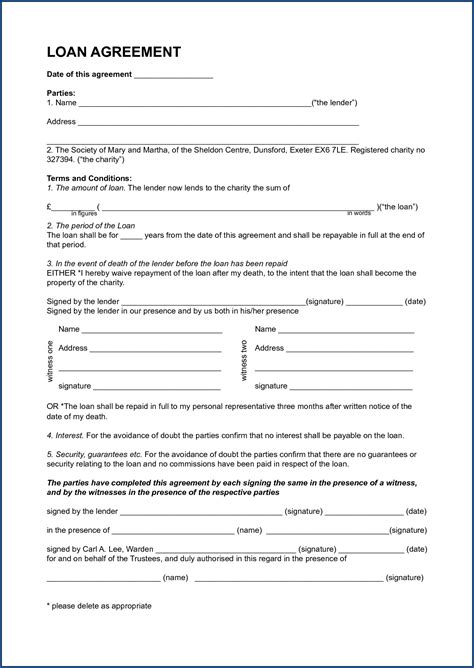

Loan paperwork can be complex and overwhelming, especially for those who are not familiar with the terminology used. The paperwork typically includes various clauses and conditions that outline the terms of the loan, including the interest rate, repayment schedule, and any penalties or fees associated with late payments. It’s crucial to carefully review the paperwork before signing to ensure that you understand all the terms and conditions.

D Meaning in Loan Paperwork

In loan paperwork, the term “D” can have different meanings depending on the context. Here are some possible interpretations: * Demand loan: A demand loan is a type of loan that can be called in by the lender at any time, requiring the borrower to repay the loan immediately. * Default: Default refers to the failure of the borrower to meet the terms and conditions of the loan, including late payments or non-payment. * Debt: Debt refers to the amount of money borrowed by the borrower, which must be repaid with interest. * Discount: Discount refers to a reduction in the interest rate or fees associated with the loan.

Key Components of Loan Paperwork

When reviewing loan paperwork, there are several key components to look out for, including: * Interest rate: The interest rate is the percentage of the loan amount that is charged as interest over a specified period. * Repayment schedule: The repayment schedule outlines the frequency and amount of payments required to repay the loan. * Fees and penalties: Fees and penalties are charges associated with late payments or non-payment. * Collateral: Collateral refers to any assets or property that are used to secure the loan.

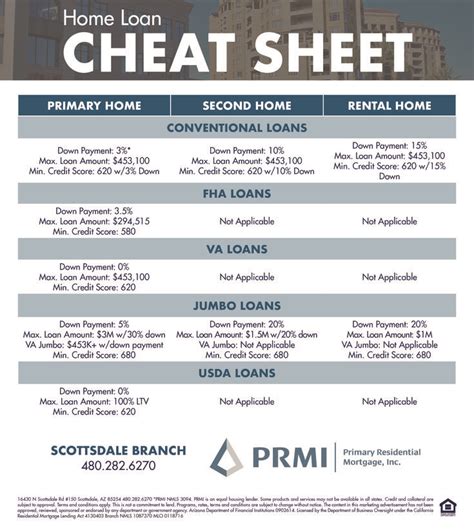

Types of Loans

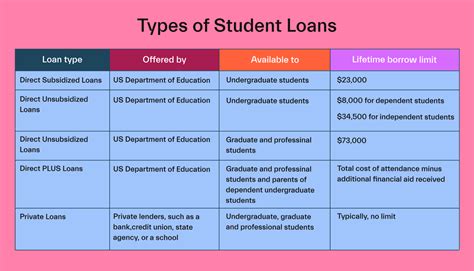

There are several types of loans available, including: * Personal loans: Personal loans are unsecured loans that can be used for various purposes, such as consolidating debt or financing a large purchase. * Mortgage loans: Mortgage loans are secured loans that are used to purchase a home or other real estate. * Auto loans: Auto loans are secured loans that are used to purchase a vehicle. * Student loans: Student loans are loans that are used to finance education expenses.

Importance of Understanding Loan Paperwork

Understanding loan paperwork is crucial to avoiding financial pitfalls and ensuring that you are aware of all the terms and conditions of the loan. It’s essential to carefully review the paperwork before signing and to ask questions if you are unsure about any aspect of the loan.

💡 Note: It's essential to seek professional advice if you are unsure about any aspect of loan paperwork.

Conclusion and Final Thoughts

In conclusion, understanding loan paperwork is vital to making informed decisions about borrowing money. By carefully reviewing the paperwork and understanding the various terms and conditions, you can avoid financial pitfalls and ensure that you are aware of all the terms and conditions of the loan. It’s essential to remember that loan paperwork can be complex, and it’s crucial to seek professional advice if you are unsure about any aspect of the loan.

What is a demand loan?

+

A demand loan is a type of loan that can be called in by the lender at any time, requiring the borrower to repay the loan immediately.

What is default in loan paperwork?

+

Default refers to the failure of the borrower to meet the terms and conditions of the loan, including late payments or non-payment.

What is debt in loan paperwork?

+

Debt refers to the amount of money borrowed by the borrower, which must be repaid with interest.