Federal Exemption Status Filing

Understanding Federal Exemption Status Filing

The process of filing for federal exemption status is a critical step for organizations seeking to operate as tax-exempt entities under the Internal Revenue Code (IRC). This status is typically sought by non-profit organizations, charities, and other entities that aim to serve a public benefit without the burden of income taxation. The most common type of federal exemption status is granted under Section 501©(3) of the IRC, which applies to organizations operating exclusively for charitable, educational, religious, or scientific purposes.

Eligibility for Federal Exemption Status

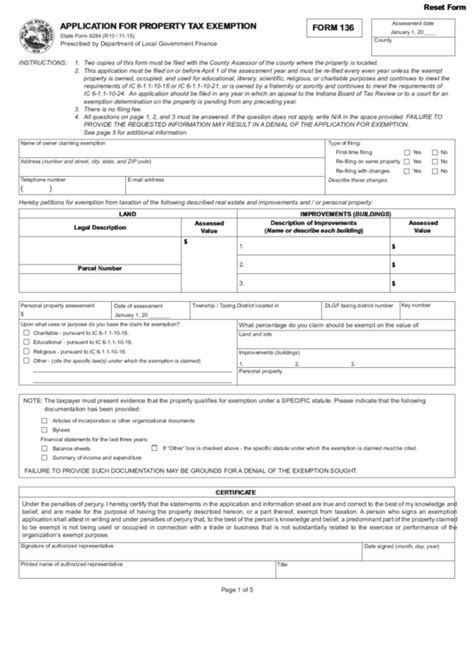

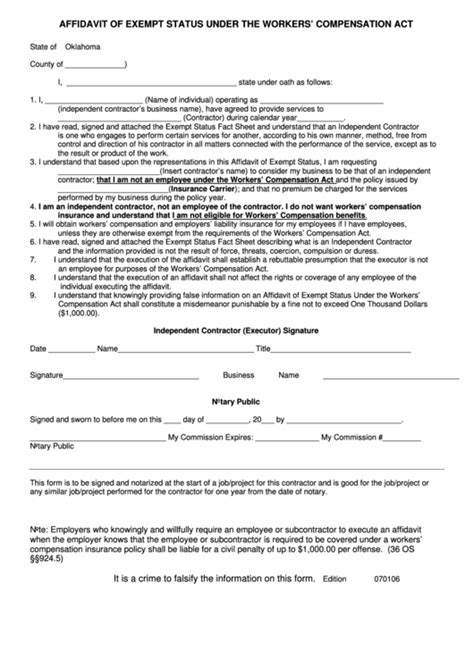

To be eligible for federal exemption status, an organization must meet specific requirements outlined by the Internal Revenue Service (IRS). These requirements include: - Organizational Structure: The organization must be structured as a corporation, trust, or association. - Exclusivity of Purpose: The organization’s purpose must be exclusively charitable, educational, religious, scientific, or other purposes as defined by the IRC. - No Private Benefit: The organization must not be operated for the benefit of private interests, such as shareholders or individuals. - No Lobbying or Political Activities: With certain exceptions, the organization must not engage in substantial lobbying or political campaign activities. - Compliance with Annual Reporting: The organization must comply with annual reporting requirements to the IRS, typically through the filing of Form 990.

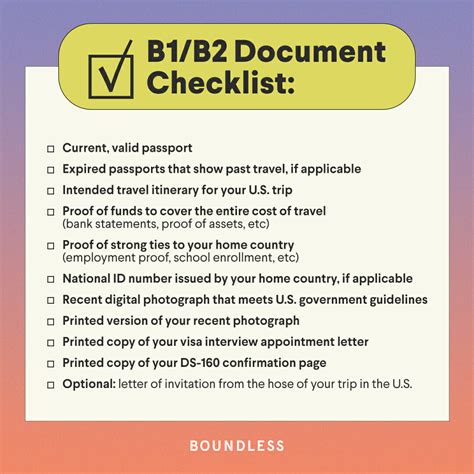

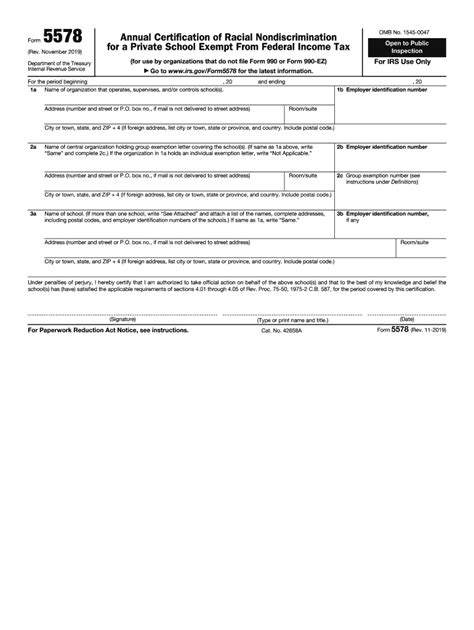

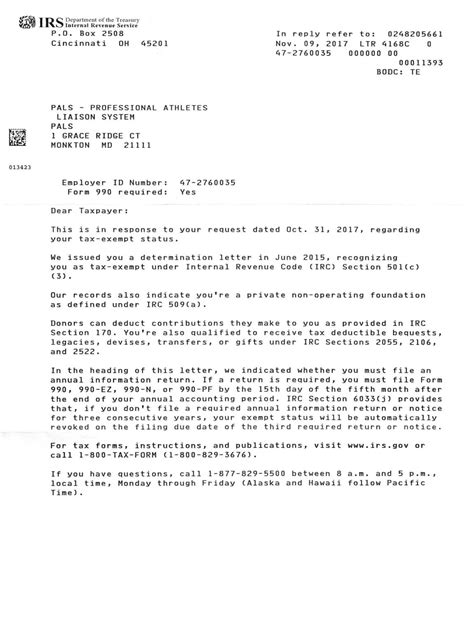

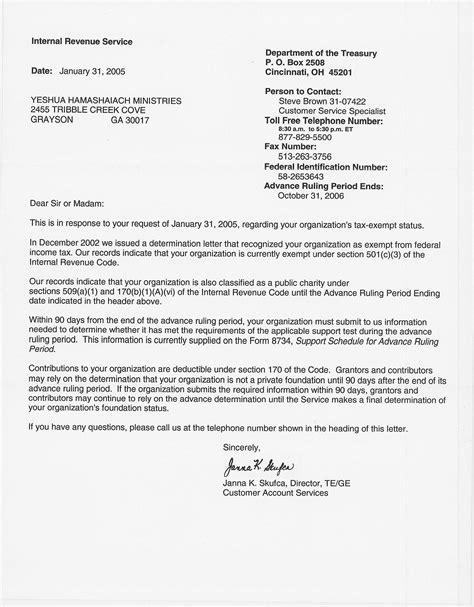

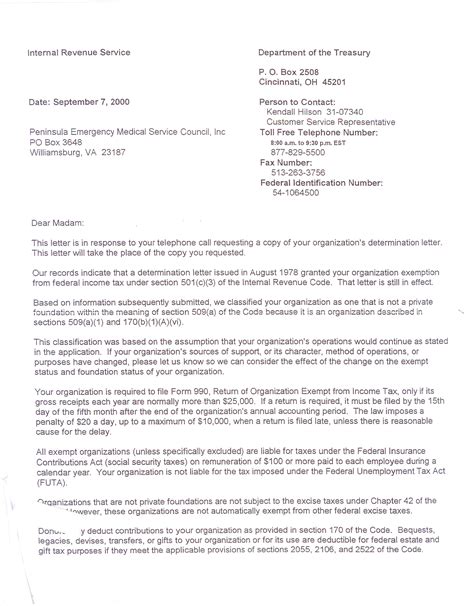

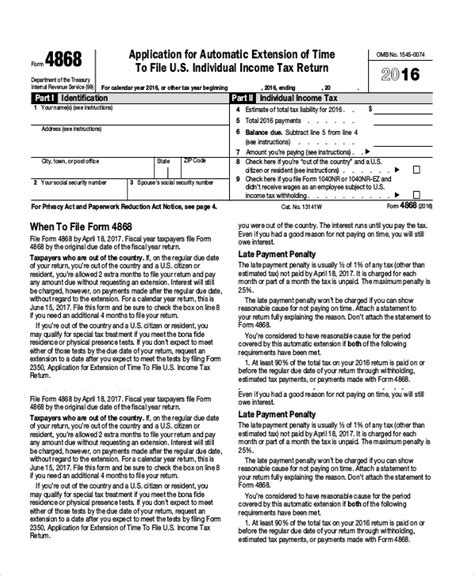

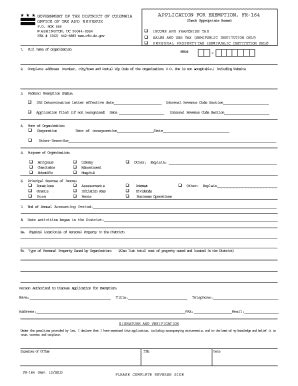

Steps to Apply for Federal Exemption Status

The application process for federal exemption status involves several key steps: - Determine the Type of Exemption: Identify the section of the IRC under which the organization qualifies for exemption, such as 501©(3) for charitable organizations. - Obtain an Employer Identification Number (EIN): Apply for an EIN from the IRS, which is required for all tax-exempt organizations. - Prepare and File Form 1023: For 501©(3) organizations, submit Form 1023, Application for Recognition of Exemption, along with the required user fee. - Submit Supporting Documents: Include the organization’s articles of incorporation, bylaws, and other supporting documents as required by the IRS. - Wait for IRS Review and Approval: The IRS will review the application and may request additional information before making a determination.

Benefits of Federal Exemption Status

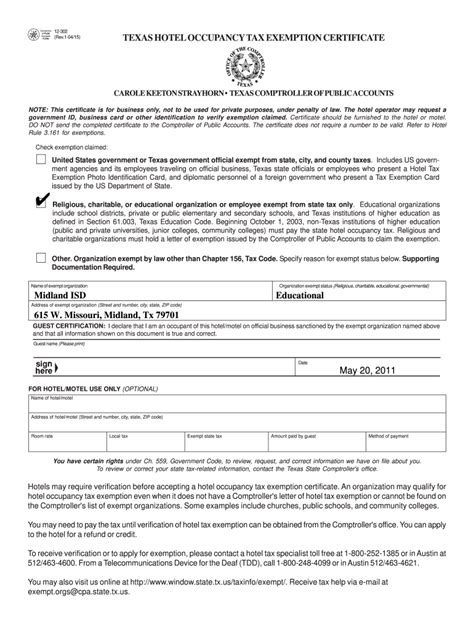

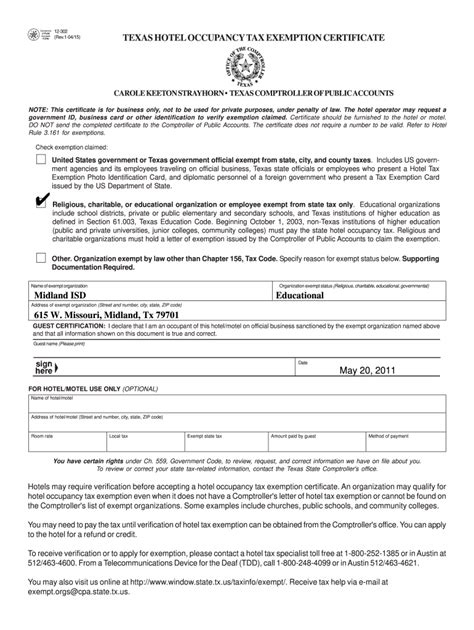

Obtaining federal exemption status provides several benefits to qualifying organizations, including: - Exemption from Income Tax: The organization is exempt from paying federal income tax on its exempt income. - Deductibility of Donations: Donors can deduct their contributions to the organization from their taxable income. - Eligibility for Grants: Many grants from foundations and government agencies are available only to tax-exempt organizations. - Increased Credibility: Federal exemption status can enhance the organization’s credibility and reputation among donors, partners, and the public.

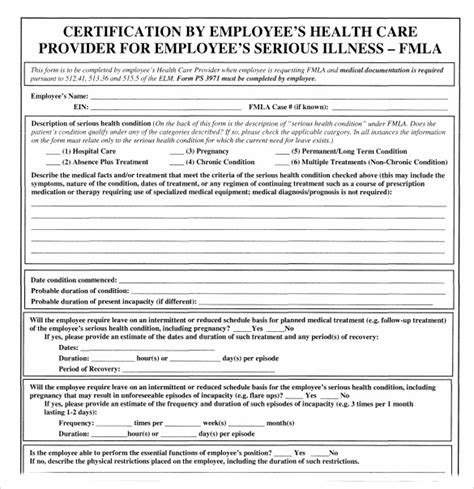

Compliance and Maintenance

After obtaining federal exemption status, organizations must comply with ongoing requirements to maintain their exempt status. These include: - Annual Reporting: Filing the appropriate Form 990 with the IRS each year. - Record Keeping: Maintaining accurate and detailed records of financial transactions, governance, and activities. - Governance and Compliance: Ensuring that the organization’s governance structure and practices comply with the IRC and IRS regulations.

📝 Note: Failure to comply with these requirements can result in the revocation of federal exemption status, so it is essential for organizations to stay informed and seek professional advice when necessary.

Common Challenges and Considerations

Organizations applying for federal exemption status may encounter several challenges, including: - Complexity of the Application Process: The application process can be lengthy and complex, requiring significant time and resources. - IRS Backlog and Delayed Processing: The IRS may experience backlogs, leading to delays in processing applications. - Compliance with Ongoing Requirements: Maintaining exempt status requires ongoing compliance with IRS regulations and reporting requirements.

To navigate these challenges, organizations should: - Seek Professional Advice: Consult with tax professionals or attorneys experienced in non-profit law. - Plan Ahead: Allow sufficient time for the application process and plan for potential delays. - Stay Informed: Regularly review IRS guidelines and updates to ensure compliance with all requirements.

Conclusion and Final Thoughts

Obtaining federal exemption status is a significant step for organizations seeking to operate as tax-exempt entities. By understanding the eligibility requirements, application process, and ongoing compliance obligations, organizations can successfully navigate the process and maintain their exempt status. It is crucial for these entities to stay informed about IRS regulations and seek professional advice when needed to ensure continued compliance and the ability to fulfill their public benefit missions.

What is the purpose of filing for federal exemption status?

+

The primary purpose of filing for federal exemption status is to operate as a tax-exempt entity under the Internal Revenue Code, allowing organizations to focus on their public benefit missions without the burden of income taxation.

How long does it take to obtain federal exemption status?

+

The time it takes to obtain federal exemption status can vary significantly depending on the complexity of the application and the current IRS processing times. It is essential to plan ahead and allow sufficient time for the application process.

What are the consequences of failing to comply with ongoing requirements?

+

Failure to comply with ongoing requirements, such as annual reporting and maintaining accurate records, can result in the revocation of federal exemption status. This can have severe consequences, including the loss of tax-exempt status and the ability to receive deductible donations.