5 FMLA Fees

Understanding the Family and Medical Leave Act (FMLA) Fees

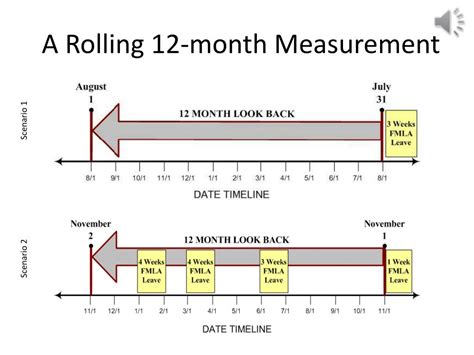

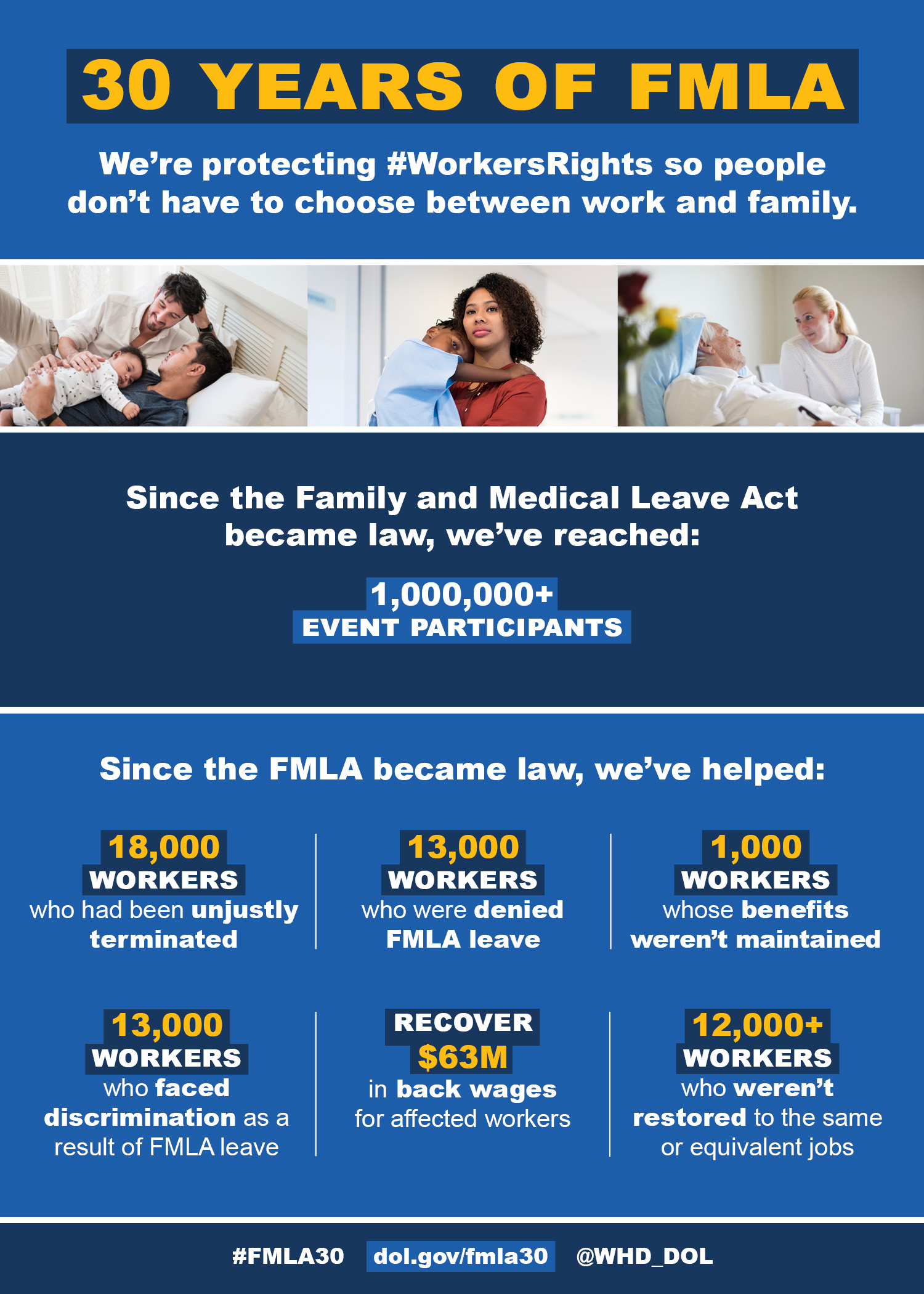

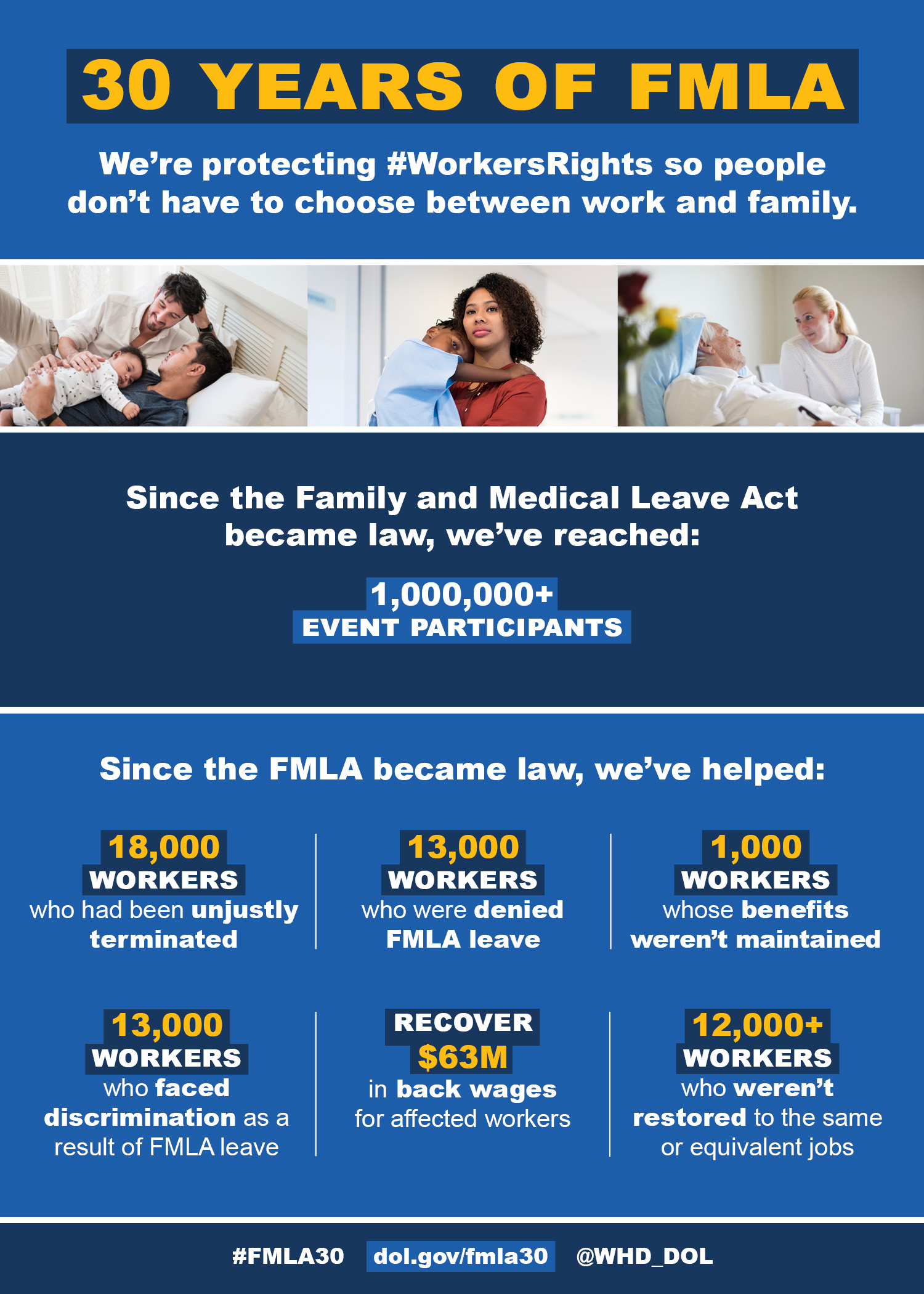

The Family and Medical Leave Act (FMLA) is a federal law that provides eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons. While the law does not require employers to pay employees during this leave, there are certain fees associated with administering the FMLA. In this article, we will explore the different types of fees that employers may incur when implementing the FMLA.

Types of FMLA Fees

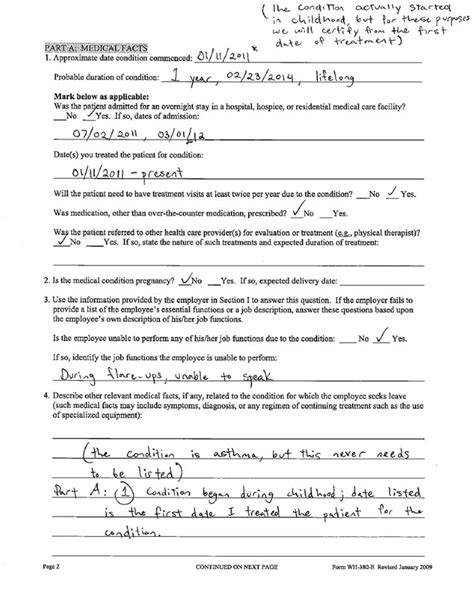

There are several types of fees that employers may incur when administering the FMLA. These fees can include: * Administrative fees: These fees are associated with the administrative tasks involved in managing the FMLA, such as processing leave requests, maintaining records, and communicating with employees. * Medical certification fees: Employers may require employees to provide medical certification to support their leave request. The employee may be required to pay for this certification, but in some cases, the employer may also incur fees. * Temporary replacement fees: If an employer needs to hire a temporary replacement for an employee on FMLA leave, they may incur fees associated with recruiting, hiring, and training the temporary employee. * Benefits continuation fees: Employers may be required to continue providing benefits to employees on FMLA leave, which can include fees associated with maintaining health insurance coverage. * Compliance fees: Employers may incur fees associated with ensuring compliance with the FMLA, such as consulting with attorneys or HR experts to ensure that their leave policies are in compliance with the law.

Calculating FMLA Fees

The cost of administering the FMLA can vary widely depending on the size and type of employer, as well as the number of employees who take leave. Some employers may incur significant fees, while others may incur minimal costs. To calculate the FMLA fees, employers should consider the following factors: * The number of employees who take FMLA leave * The length of time that employees take leave * The type of leave (e.g. intermittent leave may require more administrative effort than continuous leave) * The cost of temporary replacement employees * The cost of benefits continuation

| Fee Type | Cost |

|---|---|

| Administrative fees | $500 - $1,000 per year |

| Medical certification fees | $50 - $200 per employee |

| Temporary replacement fees | $5,000 - $10,000 per year |

| Benefits continuation fees | $1,000 - $5,000 per year |

| Compliance fees | $1,000 - $5,000 per year |

Minimizing FMLA Fees

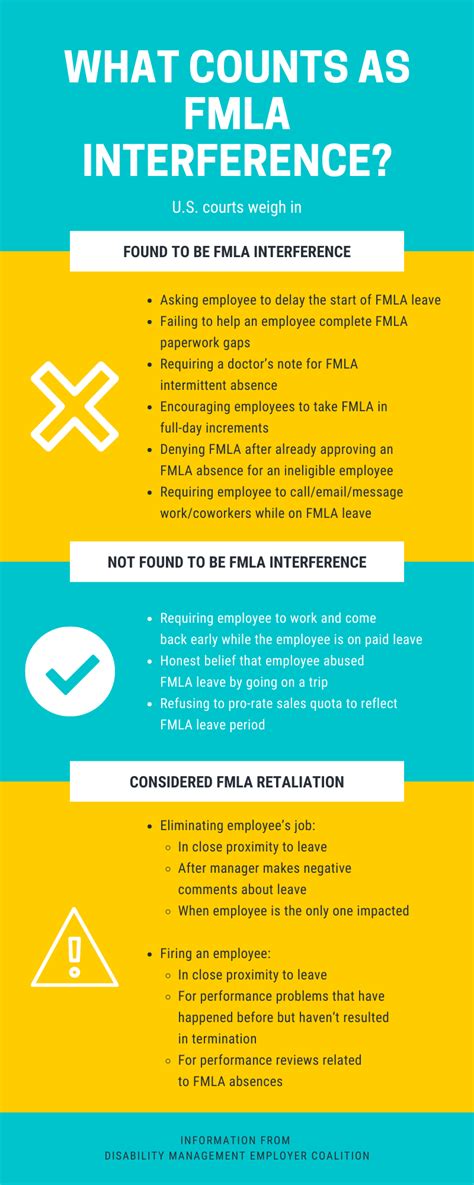

While the FMLA fees can be significant, there are steps that employers can take to minimize these costs. Some strategies include: * Developing a clear and comprehensive leave policy that outlines the procedures for requesting and approving leave * Providing training to HR staff and managers on the FMLA and its requirements * Implementing efficient administrative processes for managing leave requests and maintaining records * Considering the use of temporary staffing agencies to reduce the cost of recruiting and hiring temporary replacement employees * Reviewing benefits continuation policies to ensure that they are compliant with the FMLA and minimize costs

📝 Note: Employers should consult with HR experts or attorneys to ensure that their leave policies and procedures are compliant with the FMLA and minimize the risk of costly errors or lawsuits.

To summarize, the FMLA fees can be significant, but employers can take steps to minimize these costs by developing clear policies, providing training, and implementing efficient administrative processes. By understanding the types of fees associated with the FMLA and taking steps to minimize these costs, employers can ensure that they are in compliance with the law while also managing their expenses.

What is the purpose of the FMLA?

+

The purpose of the FMLA is to provide eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons, while also protecting their job and benefits.

Who is eligible for FMLA leave?

+

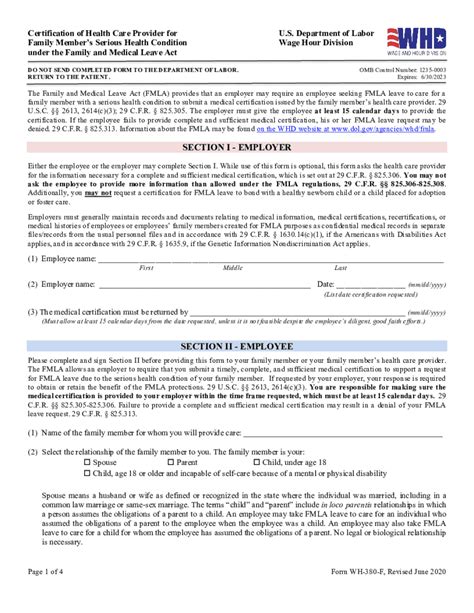

Eligible employees include those who have worked for a covered employer for at least 12 months, have completed at least 1,250 hours of service in the 12 months preceding the start of leave, and are seeking leave for a qualifying reason.

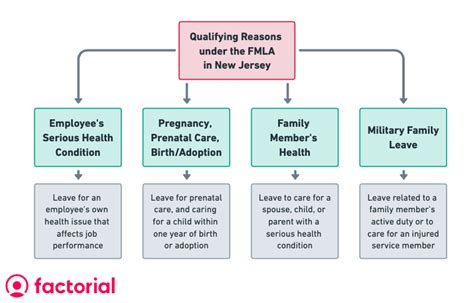

What are the qualifying reasons for FMLA leave?

+

The qualifying reasons for FMLA leave include the birth or adoption of a child, the serious health condition of the employee or a family member, and qualifying exigency related to a family member’s military service.