5 IFTA Paperwork Tips

Understanding IFTA Paperwork: A Comprehensive Guide

IFTA, or the International Fuel Tax Agreement, is a cooperative arrangement between the lower 48 states of the United States and the 10 provinces of Canada to simplify the reporting of fuel use by motor carriers operating in more than one jurisdiction. The primary goal of IFTA is to simplify fuel tax reporting and collection for interstate and international motor carriers. However, the paperwork associated with IFTA can be complex and overwhelming, especially for those new to the industry or unfamiliar with the requirements. In this guide, we will explore five essential tips for managing IFTA paperwork efficiently.

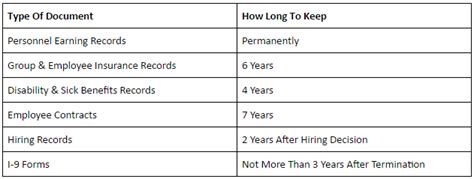

Tip 1: Keep Accurate Records

Maintaining accurate and detailed records is crucial for IFTA compliance. This includes records of all fuel purchases, mileage logs, and other relevant documentation. It’s essential to ensure that all records are up to date and easily accessible in case of an audit. Consider implementing a system for tracking and storing records, such as a digital logbook or a cloud-based storage solution. Accurate records will help you navigate the IFTA paperwork process more smoothly and reduce the risk of errors or penalties.

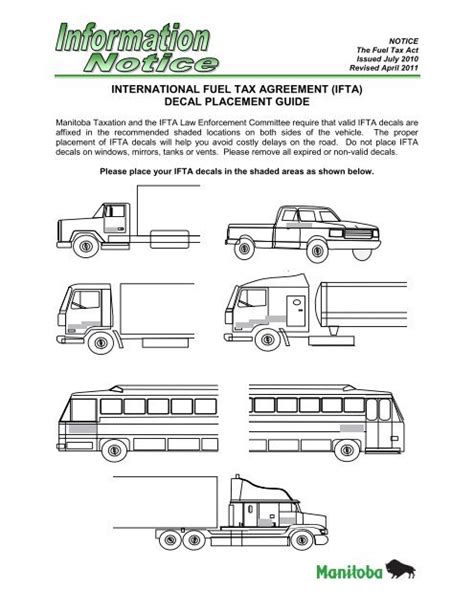

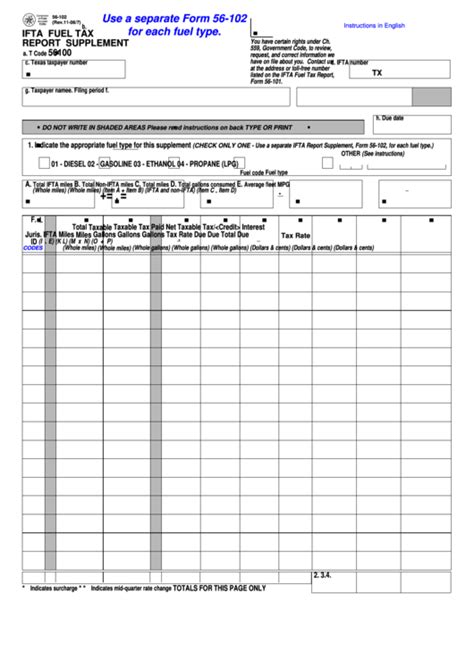

Tip 2: Understand IFTA Requirements

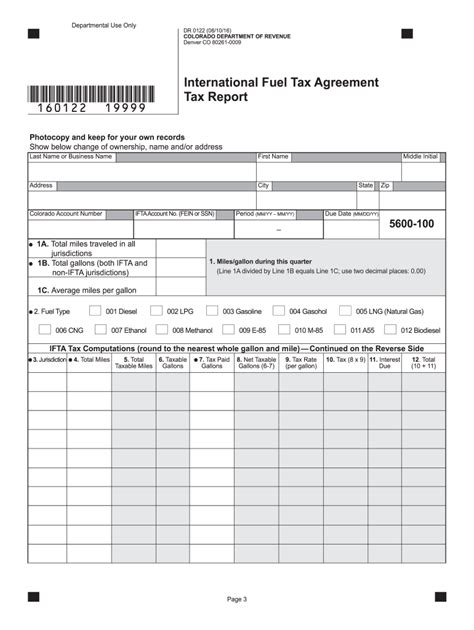

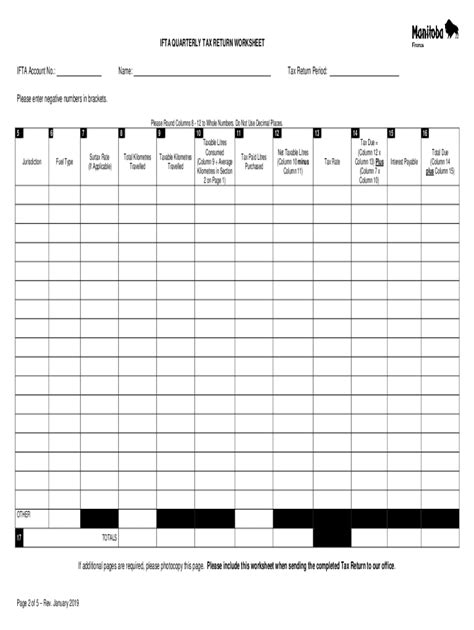

Before delving into the paperwork, it’s vital to have a clear understanding of IFTA requirements. This includes knowing which jurisdictions you operate in, the types of fuel you use, and the necessary documentation for each. IFTA requirements can vary significantly between states and provinces, so it’s crucial to stay informed about any changes or updates. Researching and understanding these requirements will help you prepare the necessary paperwork and avoid potential issues.

Tip 3: Utilize IFTA Software

Managing IFTA paperwork manually can be time-consuming and prone to errors. Utilizing IFTA software can significantly streamline the process, making it more efficient and reducing the risk of mistakes. IFTA software can help with tasks such as tracking mileage, calculating fuel taxes, and generating reports. When selecting IFTA software, consider factors such as ease of use, compatibility with your existing systems, and customer support. Investing in the right software can save you time and reduce stress associated with IFTA paperwork.

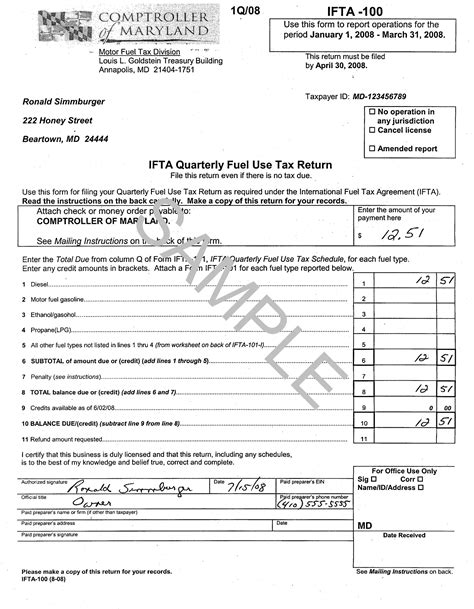

Tip 4: File Quarterly Returns

IFTA requires motor carriers to file quarterly returns, which report fuel use and taxes owed for each jurisdiction. It’s essential to file these returns on time to avoid penalties and interest. When preparing quarterly returns, ensure you have all necessary documentation, including fuel receipts and mileage logs. Consider setting reminders or working with an accountant to ensure timely filing. Filing quarterly returns accurately and on time is critical for maintaining IFTA compliance.

Tip 5: Seek Professional Help When Needed

IFTA paperwork can be complex, and it’s not uncommon for motor carriers to seek professional help. If you’re struggling with IFTA compliance or need assistance with paperwork, consider consulting with a tax professional or accountant experienced in IFTA. They can provide guidance on navigating the paperwork process, ensure accuracy, and help with any issues that may arise. Seeking professional help can be a valuable investment, especially for those new to the industry or facing challenges with IFTA compliance.

📝 Note: It's essential to stay up to date with any changes to IFTA requirements and regulations to ensure ongoing compliance.

As we move forward in the world of transportation and logistics, managing IFTA paperwork efficiently is more important than ever. By following these five tips and staying informed about IFTA requirements, motor carriers can navigate the complexities of IFTA paperwork with confidence. Whether you’re a seasoned veteran of the industry or just starting out, understanding and managing IFTA paperwork is crucial for compliance, efficiency, and success.

In the end, it’s all about finding a balance between compliance and efficiency. By implementing these tips and staying focused on your goals, you can ensure that your IFTA paperwork is in order, and you can focus on what matters most - growing your business and serving your customers.

What is the primary purpose of IFTA?

+

The primary purpose of IFTA is to simplify the reporting of fuel use by motor carriers operating in more than one jurisdiction.

How often do I need to file IFTA returns?

+

IFTA returns must be filed quarterly, reporting fuel use and taxes owed for each jurisdiction.

Can I use software to manage my IFTA paperwork?

+

Yes, there are various IFTA software solutions available that can help streamline the process, reduce errors, and increase efficiency.