Tax Abatement Refund Paperwork Guide

Introduction to Tax Abatement Refund Paperwork

The process of navigating tax abatement refund paperwork can be complex and overwhelming, especially for individuals or businesses who are not familiar with the intricacies of tax law. Tax abatement refers to a reduction or elimination of tax liability, often granted by a government agency to encourage economic development, renovate properties, or support specific industries. When a tax abatement is approved, the recipient may be eligible for a refund of previously paid taxes. This guide is designed to walk you through the steps involved in preparing and submitting tax abatement refund paperwork, ensuring that you maximize your refund and comply with all regulatory requirements.

Understanding the Tax Abatement Process

Before diving into the refund paperwork, it’s essential to understand the tax abatement process. This typically involves applying for and being granted a tax abatement by a local or state government agency. The application process usually requires submitting detailed information about the project or property, including its location, cost, and potential economic benefits. Once approved, the tax abatement agreement will outline the terms, including the amount of taxes to be abated and the duration of the abatement. Key documents to keep track of during this phase include the application, approval letter, and tax abatement agreement.

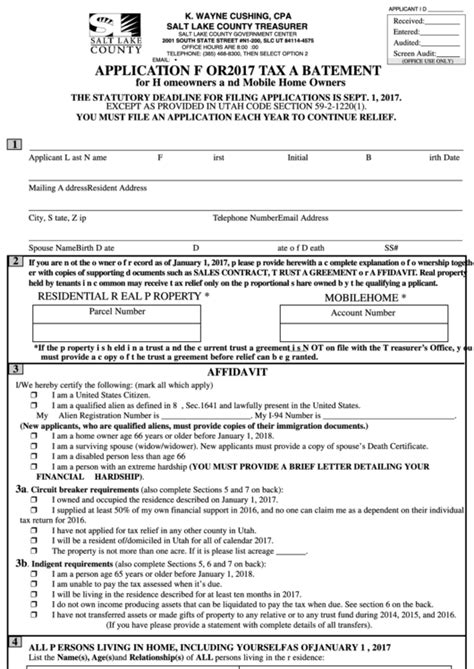

Gathering Necessary Documents for Refund Paperwork

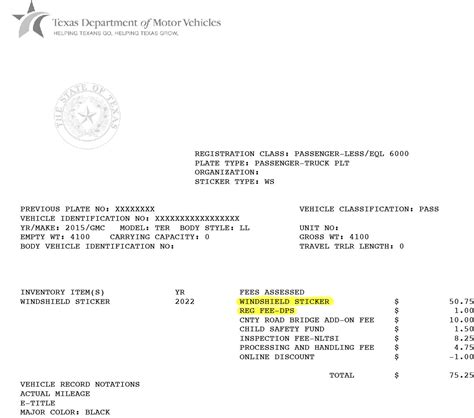

To initiate the refund process, you will need to gather several documents. These may include: - Tax abatement agreement: The original document outlining the terms of the tax abatement. - Proof of tax payments: Receipts or records of taxes paid during the abatement period. - Project completion documents: Certificates of occupancy, final inspection reports, or other documents proving that the project is complete and meets the requirements of the tax abatement agreement. - Accounting records: Detailed financial records showing the expenses related to the project and the taxes paid.

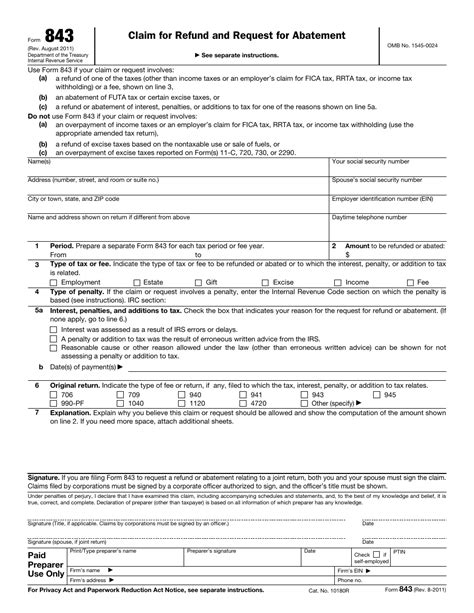

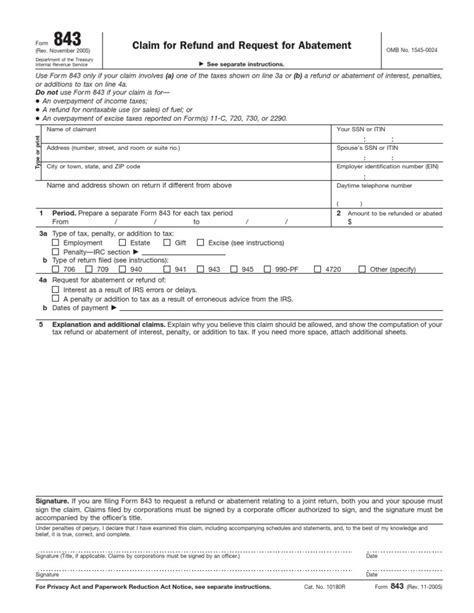

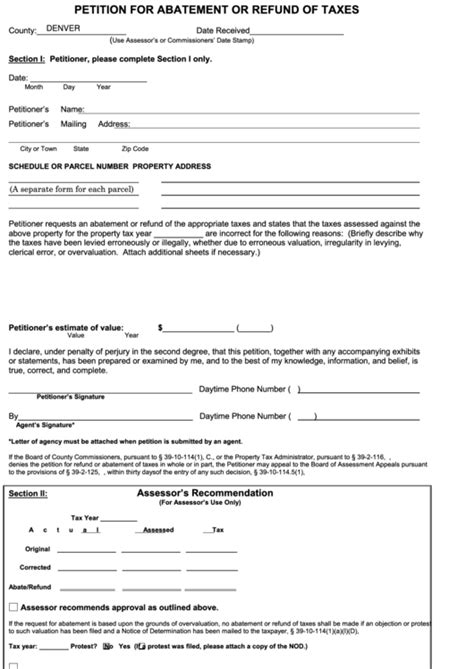

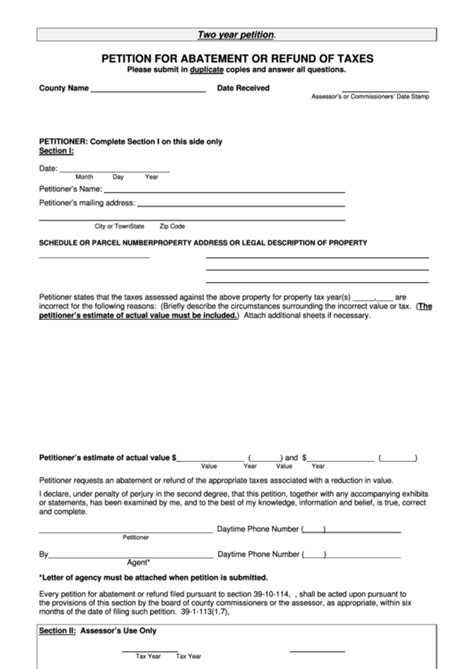

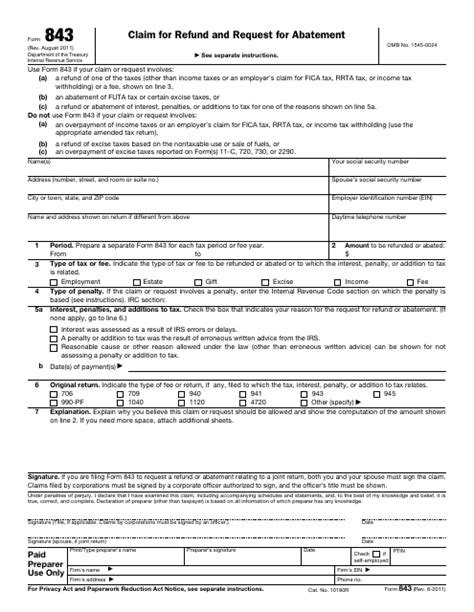

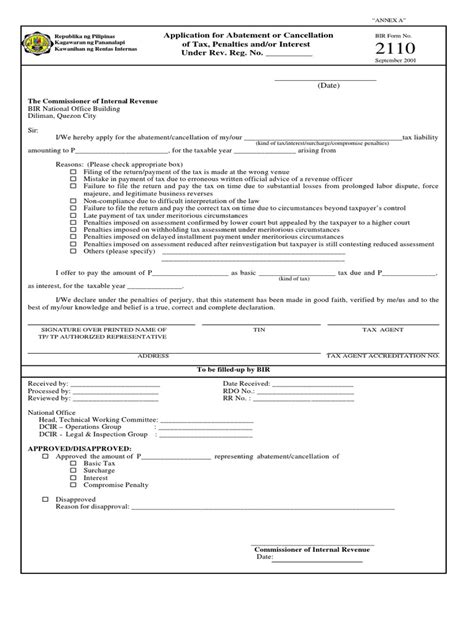

Preparing the Refund Paperwork

With all necessary documents in hand, the next step is to prepare the refund paperwork. This typically involves filling out a refund application form provided by the relevant government agency. The form will require detailed information about the tax abatement, including the amount of taxes paid and the amount being claimed for refund. Accuracy is crucial; any errors or omissions can delay the refund process. It’s also important to attach all supporting documents to the application.

Submitting the Refund Application

Once the refund application is complete, it should be submitted to the appropriate government agency. This can usually be done via mail, email, or through an online portal, depending on the agency’s preferences. It’s a good idea to keep a record of the submission, including the date and method of submission, in case follow-up is needed.

Tracking the Refund Status

After submitting the refund application, it’s essential to track its status. This can typically be done through the agency’s website or by contacting them directly. Patience is key, as the review process can take several weeks or even months. If there are any issues with the application, the agency will contact you, so it’s crucial to be responsive to any inquiries.

📝 Note: Keeping detailed records of all communications with the government agency, including dates, times, and the nature of the discussions, can be very helpful in case of disputes or delays.

Receiving the Refund

Upon approval of the refund application, the government agency will process the refund. This can be in the form of a check, direct deposit, or other payment methods, depending on the agency’s policies. Verify the refund amount to ensure it matches the amount claimed, and report any discrepancies immediately.

Importance of Compliance and Record Keeping

Throughout the tax abatement refund process, compliance with all regulations and maintaining detailed records are paramount. This not only ensures a smooth refund process but also provides a defense in case of audits or disputes. Records should include all correspondence with the government agency, refund applications, supporting documents, and proof of refund receipt.

| Document Type | Purpose |

|---|---|

| Tax Abatement Agreement | Outlines terms of tax abatement |

| Proof of Tax Payments | Shows taxes paid during abatement period |

| Project Completion Documents | Proves project completion and compliance |

| Accounting Records | Details project expenses and tax payments |

In summary, navigating the process of tax abatement refund paperwork requires careful preparation, attention to detail, and compliance with regulatory requirements. By understanding the tax abatement process, gathering necessary documents, preparing and submitting the refund application accurately, and maintaining detailed records, individuals and businesses can successfully claim their refunds and maximize the benefits of tax abatement programs.

What is tax abatement, and how does it work?

+

Tax abatement is a reduction or elimination of tax liability granted by a government agency to encourage economic development or support specific projects. It works by reducing or eliminating the amount of taxes that would otherwise be owed on a property or project for a specified period.

How do I apply for a tax abatement refund?

+

To apply for a tax abatement refund, you will need to submit a refund application to the relevant government agency, along with supporting documents such as the tax abatement agreement, proof of tax payments, and project completion documents.

What documents do I need to keep for tax abatement refund purposes?

+

Key documents to keep include the tax abatement agreement, proof of tax payments, project completion documents, and detailed accounting records showing project expenses and tax payments.