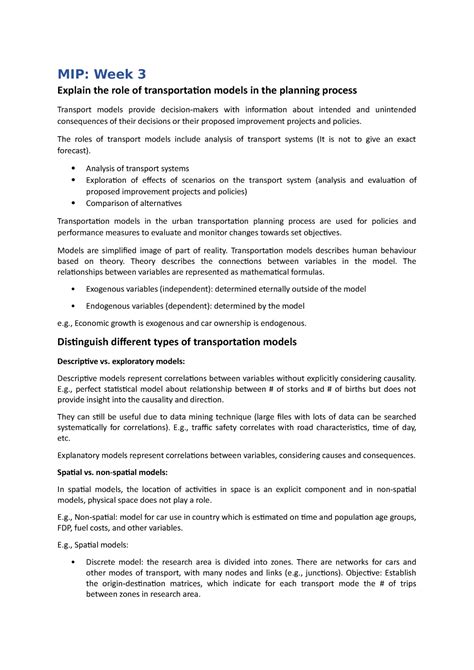

5 MIP Paperwork Facts

Introduction to MIP Paperwork

MIP, or Monthly Investment Plan, is a popular investment strategy that allows individuals to invest a fixed amount of money at regular intervals, usually monthly. This approach helps in reducing the impact of market volatility and timing risks. However, to start and maintain a MIP, certain paperwork and formalities need to be completed. In this article, we will delve into the key facts about MIP paperwork that every investor should be aware of.

Understanding the Basics of MIP

Before we dive into the paperwork aspects, it’s essential to understand what MIP is and how it works. MIP is a type of investment plan where a fixed amount of money is invested in a mutual fund or other investment vehicles at regular intervals. This approach is also known as a systematic investment plan (SIP). The primary benefit of MIP is that it helps in averaging out the market risks by investing a fixed amount of money at regular intervals, regardless of the market’s performance.

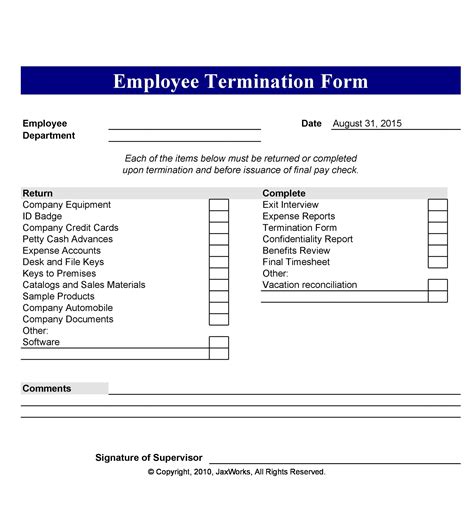

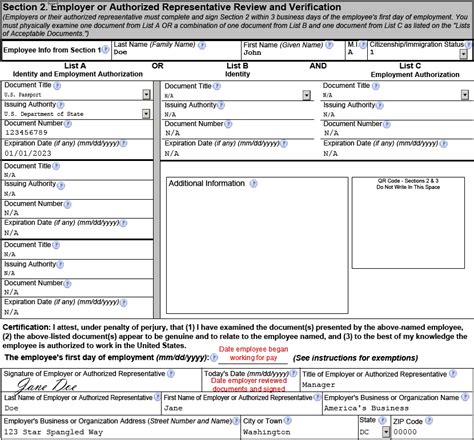

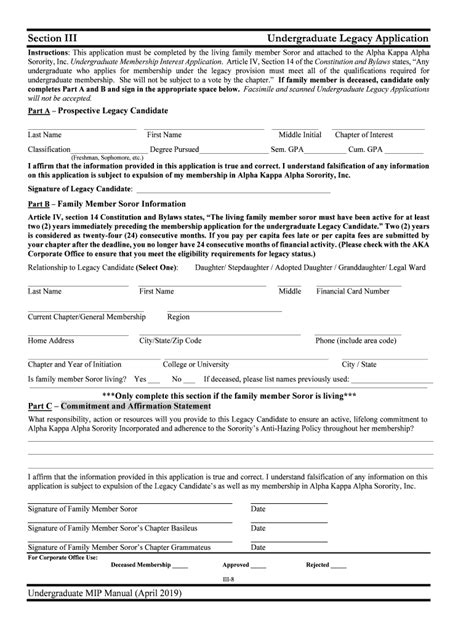

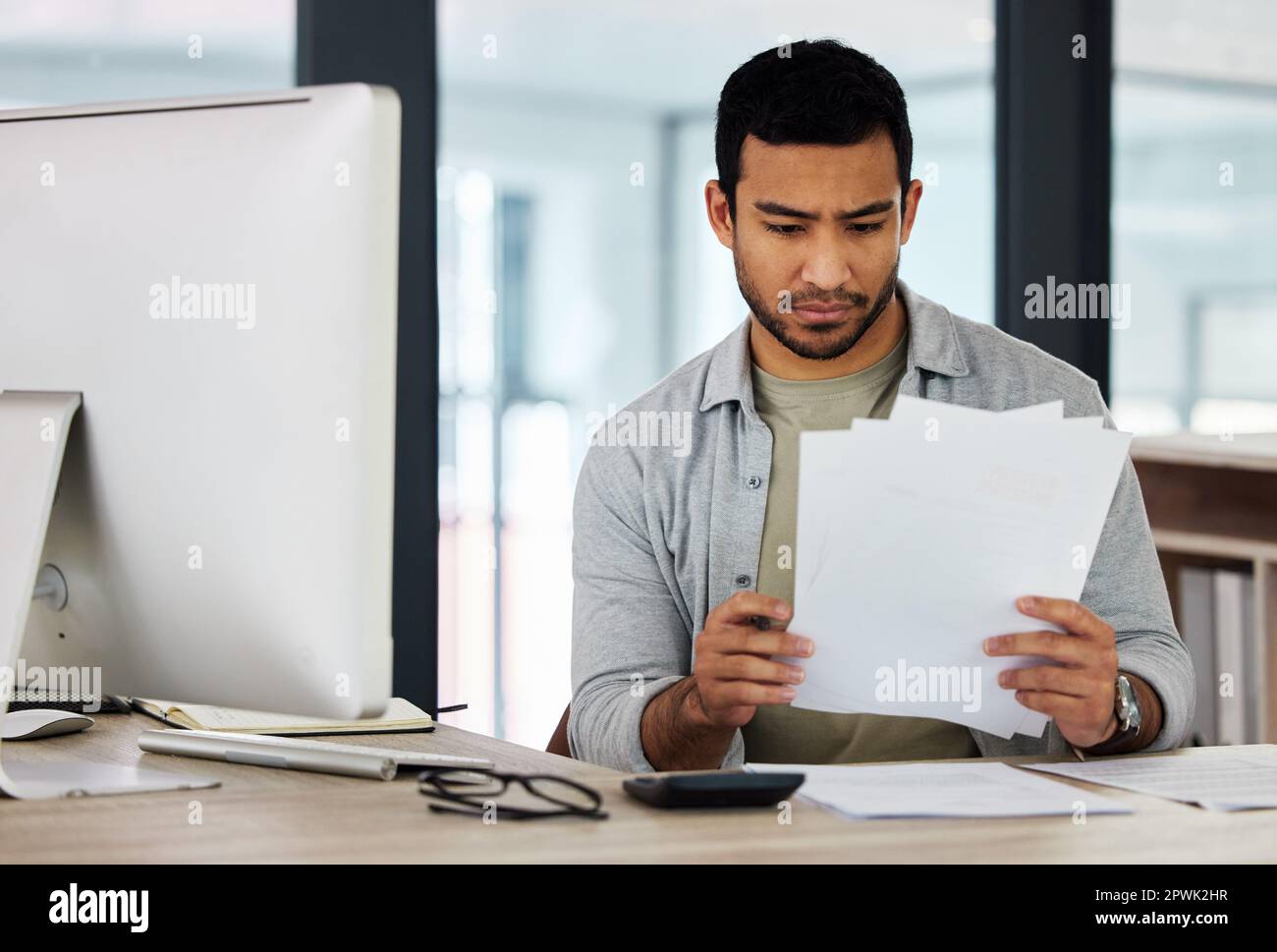

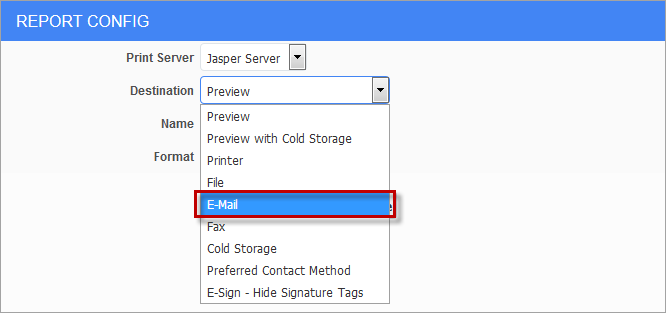

Key Paperwork Requirements for MIP

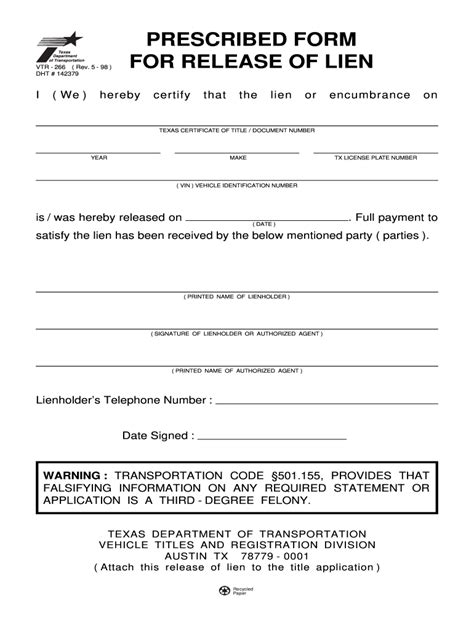

To start a MIP, you will need to complete certain paperwork and provide necessary documents. Here are the key paperwork requirements: * Know Your Customer (KYC) Documents: To invest in a MIP, you need to be KYC compliant. This requires providing identity and address proof documents, such as a PAN card, Aadhaar card, passport, or driving license. * Application Form: You need to fill out an application form to start a MIP. This form will require your personal and bank account details. * Bank Account Details: You need to provide your bank account details to set up the auto-debit facility for your MIP investments. * Nomination Form: It’s recommended to fill out a nomination form to specify the beneficiary of your investments in case of your demise.

Benefits of MIP Paperwork

While the paperwork for MIP may seem tedious, it has several benefits, including: * Convenience: The auto-debit facility set up through the paperwork allows for hassle-free investments. * Discipline: The regular investment schedule enforced by the paperwork helps in maintaining discipline and consistency in investments. * Flexibility: Most MIPs offer flexibility in terms of investment amount, frequency, and tenure, which can be specified in the paperwork. * Tracking: The paperwork provides a record of your investments, making it easier to track and monitor your portfolio.

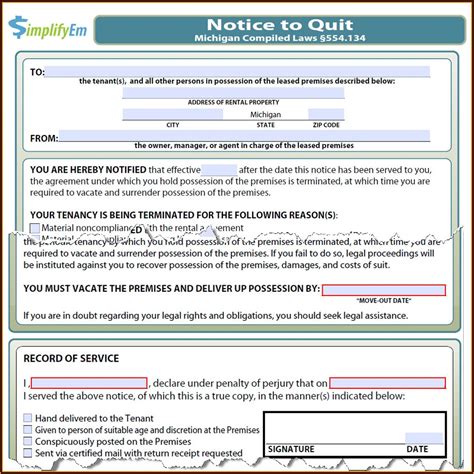

Common Mistakes to Avoid in MIP Paperwork

When completing the paperwork for your MIP, it’s essential to avoid common mistakes that can lead to delays or rejection of your application. Here are some mistakes to watch out for: * Incomplete or Incorrect Information: Ensure that all the information provided in the application form is complete and accurate. * Insufficient KYC Documents: Make sure you have all the necessary KYC documents and that they are valid. * Incorrect Bank Account Details: Double-check your bank account details to ensure that the auto-debit facility is set up correctly.

💡 Note: It's crucial to read and understand the terms and conditions of the MIP before completing the paperwork.

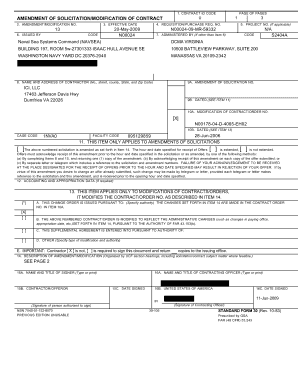

Table: Comparison of MIP Paperwork Requirements

| Document | Requirement | Description |

|---|---|---|

| KYC Documents | Mandatory | Identity and address proof documents |

| Application Form | Mandatory | Personal and bank account details |

| Bank Account Details | Mandatory | Auto-debit facility setup |

| Nomination Form | Optional | Specifying beneficiary of investments |

In conclusion, understanding the paperwork requirements for a MIP is essential to ensure a smooth and hassle-free investment experience. By being aware of the key paperwork requirements, benefits, and common mistakes to avoid, you can make informed decisions about your investments and make the most out of your MIP.

What is the minimum investment amount for a MIP?

+

The minimum investment amount for a MIP varies depending on the mutual fund scheme and the investment platform. Typically, it can range from ₹500 to ₹5,000.

Can I change my MIP investment amount or frequency?

+

Yes, most MIPs allow you to change your investment amount or frequency. However, this may be subject to certain conditions and penalties, so it’s essential to check with your investment platform or mutual fund provider.

How do I track my MIP investments?

+

You can track your MIP investments through your investment platform’s website or mobile app, or by contacting your mutual fund provider directly. You will typically receive regular statements and updates on your investment portfolio.