I-9 Paperwork Error Minimum Penalty

Understanding I-9 Paperwork Errors and Their Consequences

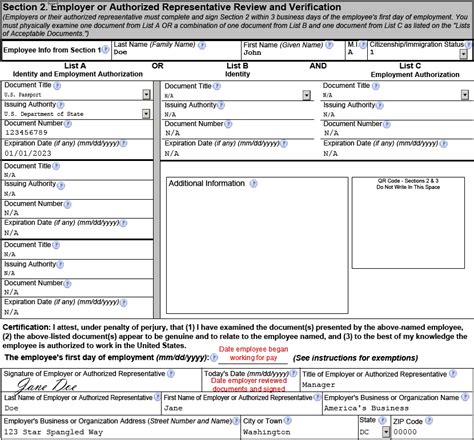

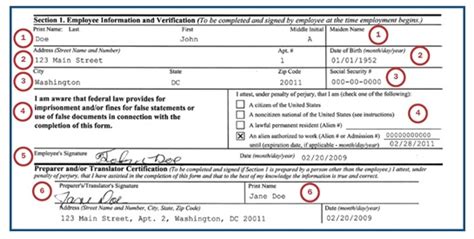

The Immigration and Nationality Act (INA) requires all U.S. employers to verify the identity and employment eligibility of their employees. This process is facilitated through the completion of Form I-9, which must be accurately filled out for each new hire. Failure to comply with I-9 regulations can result in significant penalties, emphasizing the importance of precise and timely completion of the form. The minimum penalty for I-9 paperwork errors can be substantial, making it crucial for employers to understand the requirements and potential consequences of non-compliance.

What Constitutes an I-9 Paperwork Error?

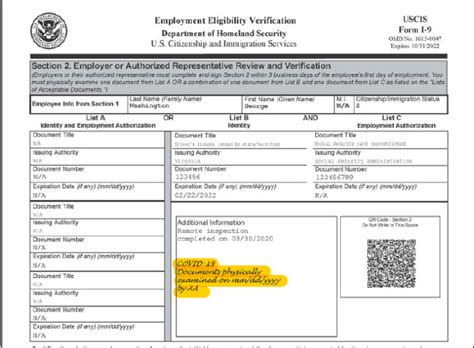

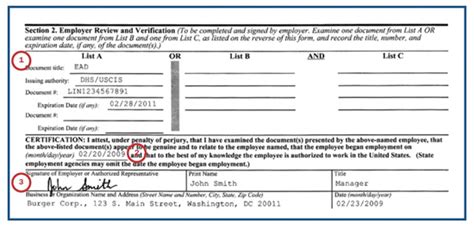

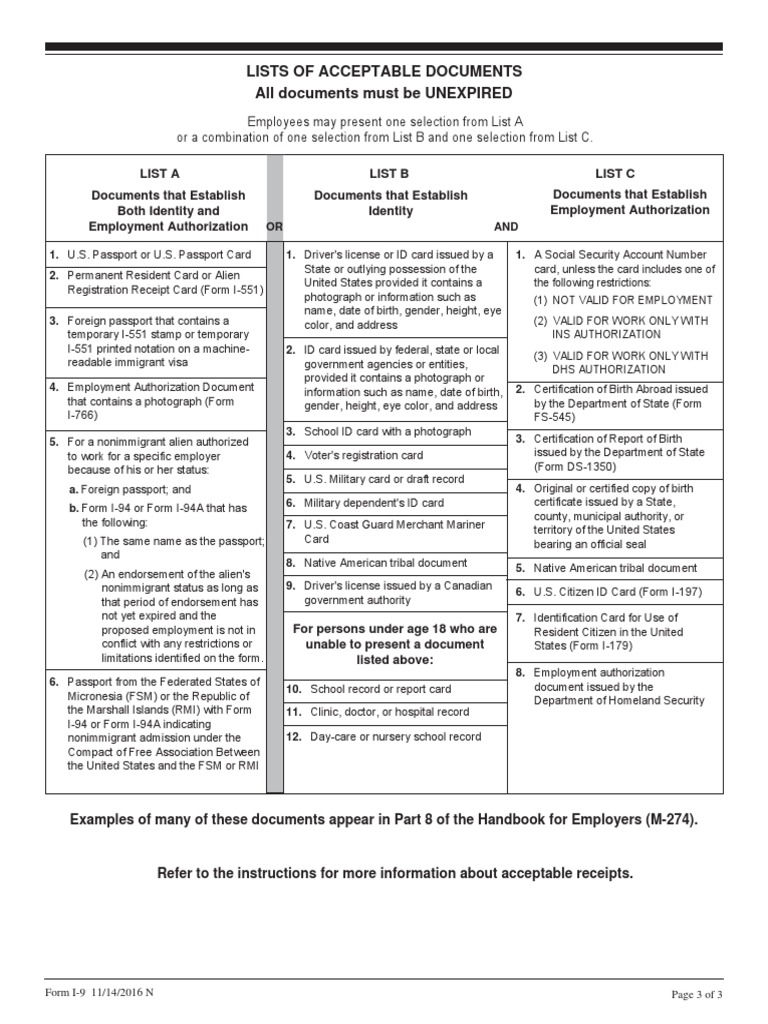

I-9 paperwork errors can range from minor technical errors, such as missing or incomplete information, to more serious substantive violations, such as failing to properly verify an employee’s identity or work authorization documents. The U.S. Citizenship and Immigration Services (USCIS) and Immigration and Customs Enforcement (ICE) are responsible for enforcing I-9 compliance, and their inspections can uncover a variety of errors, including but not limited to: - Failure to present required documents - Improper completion of the form - Untimely completion of the form - Failure to update or reverify the form as necessary

Minimum Penalty for I-9 Paperwork Errors

The penalties for I-9 violations are adjusted periodically for inflation. As of the last update, the minimum penalty for each substantive or uncorrected technical violation can range, but it’s essential to consult the most current regulations for the exact figures. These penalties are imposed per violation, meaning that if an employer has multiple errors in their I-9 records, the total fine can quickly escalate. It’s also worth noting that repeat offenders can face significantly higher penalties.

Importance of Compliance and Accuracy

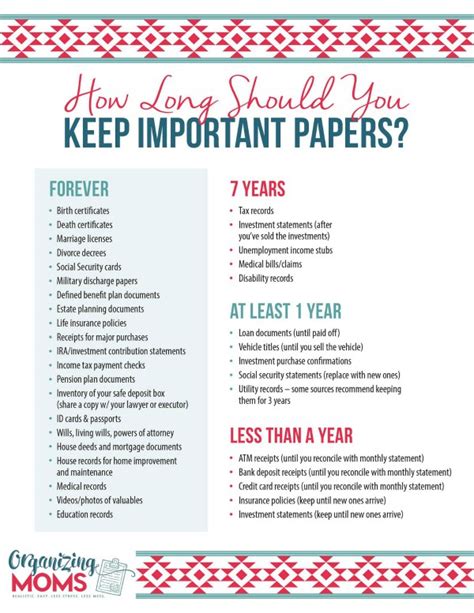

Given the potential financial consequences of I-9 paperwork errors, it’s critical for employers to prioritize compliance. This involves not only ensuring that all new hires complete the I-9 form accurately and on time but also conducting regular audits of existing I-9 records to identify and correct any errors. Employers should also stay informed about any updates to I-9 regulations or changes in the acceptable documents list to avoid unintentional non-compliance.

Best Practices for Avoiding I-9 Paperwork Errors

To minimize the risk of I-9 paperwork errors and subsequent penalties, employers should adopt the following best practices: - Provide clear instructions to new hires on completing the I-9 form. - Designate a responsible person to oversee the I-9 completion process. - Conduct regular audits of I-9 records to identify and correct errors. - Stay updated on the latest I-9 regulations and document requirements. - Implement an electronic I-9 system to streamline the process and reduce errors.

Consequences Beyond Financial Penalties

While financial penalties are a significant concern, I-9 non-compliance can have broader consequences for employers. These can include damage to the company’s reputation, loss of business licenses, and in severe cases, criminal penalties for patterns of egregious violations. Furthermore, an employer found to have knowingly hired unauthorized workers could face debarment from participating in federal contracts.

📝 Note: Employers should regularly review their I-9 processes to ensure compliance and consider seeking legal counsel if they are unsure about any aspect of I-9 requirements.

In summary, the implications of I-9 paperwork errors can be severe, from significant financial penalties to broader legal and reputational consequences. Employers must prioritize I-9 compliance, adopting best practices to minimize errors and ensure they are always up-to-date with the latest regulations. By doing so, they can avoid the costly repercussions of non-compliance and maintain a legal and ethical hiring process.

What is the purpose of the I-9 form?

+

The I-9 form is used to verify the identity and employment eligibility of new hires in the United States.

How often should I-9 records be audited?

+

It’s recommended to conduct regular audits of I-9 records, but the frequency can depend on the size of the company and its hiring practices. Annual audits are a common practice.

Can I-9 paperwork errors lead to more severe consequences than financial penalties?

+

Yes, severe or repeated violations can lead to criminal penalties, debarment from federal contracts, and significant damage to a company’s reputation.