Itemized Deductions Tax Paperwork Difference

Understanding Itemized Deductions and Their Impact on Tax Paperwork

When it comes to filing taxes, individuals have the option to either take the standard deduction or itemize their deductions. The choice between these two options can significantly impact the amount of taxes owed, as well as the complexity of the tax filing process. In this article, we will explore the concept of itemized deductions, how they differ from the standard deduction, and the implications for tax paperwork.

What are Itemized Deductions?

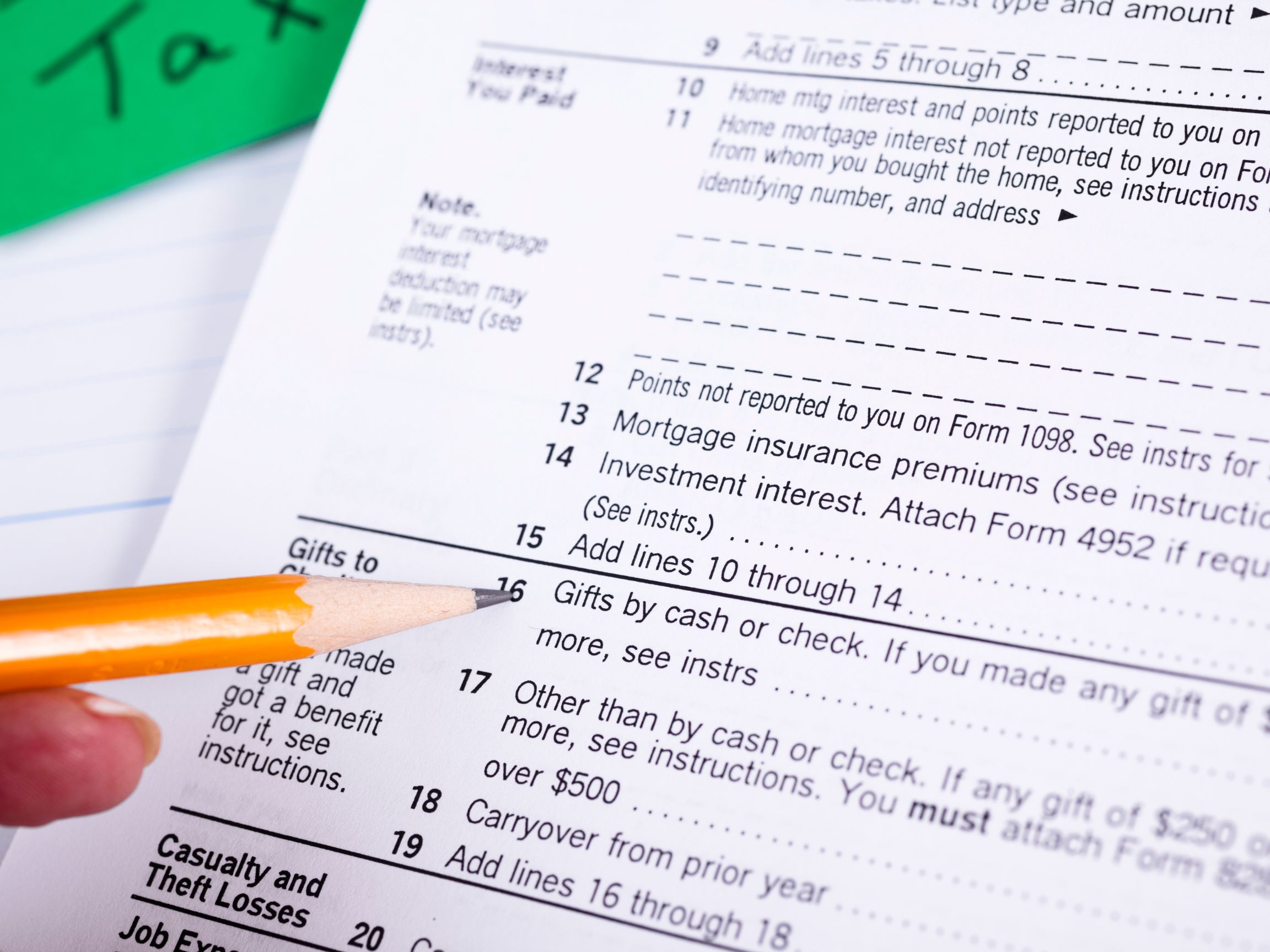

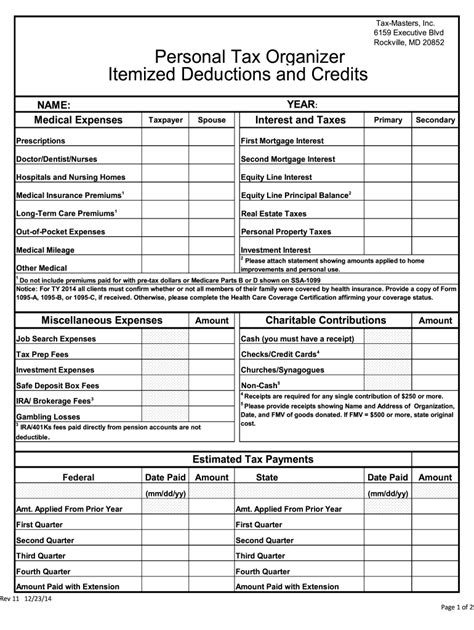

Itemized deductions are expenses that can be subtracted from an individual’s taxable income, reducing the amount of taxes owed. These deductions can include a wide range of expenses, such as: * Medical expenses * Mortgage interest * Charitable donations * State and local taxes * Home office expenses * Business use of a car To qualify for itemized deductions, taxpayers must keep accurate records of their expenses throughout the year and complete the necessary tax forms, such as Schedule A.

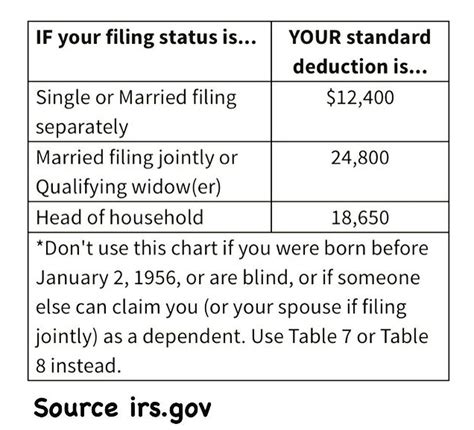

How Do Itemized Deductions Differ from the Standard Deduction?

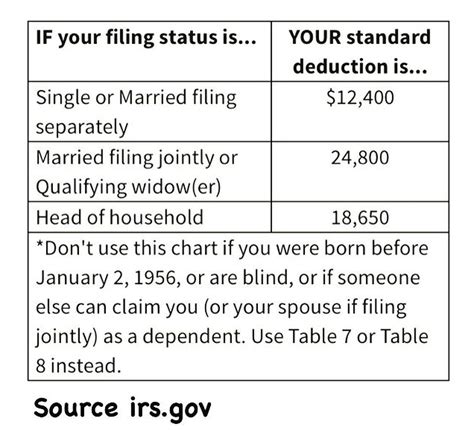

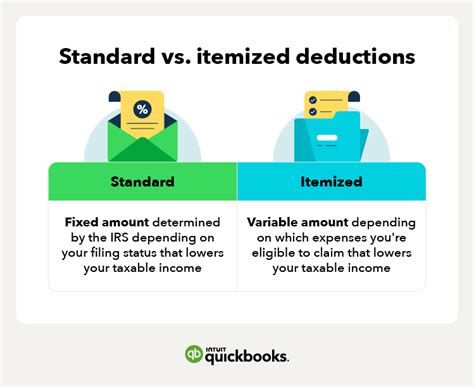

The standard deduction is a fixed amount that can be subtracted from taxable income, without the need to itemize specific expenses. The standard deduction amount varies based on filing status and is adjusted annually for inflation. In contrast, itemized deductions require taxpayers to keep track of their expenses and claim them on their tax return. The main difference between the two is that itemized deductions can provide a larger tax benefit, but they also require more paperwork and documentation.

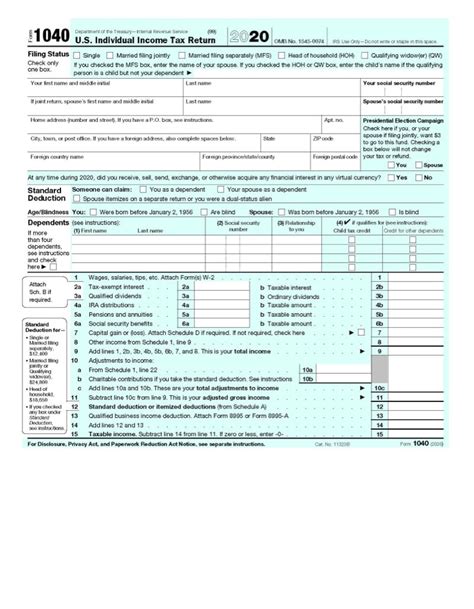

Impact on Tax Paperwork

Itemized deductions can significantly increase the complexity of tax paperwork. Taxpayers who choose to itemize must complete additional forms, such as Schedule A, and attach supporting documentation, such as receipts and bank statements. This can lead to a longer and more complicated tax filing process. On the other hand, taking the standard deduction is generally simpler and requires less paperwork.

📝 Note: It's essential to weigh the benefits of itemized deductions against the increased complexity of tax paperwork. Taxpayers should consider consulting with a tax professional to determine which option is best for their individual situation.

Benefits of Itemized Deductions

Despite the increased complexity, itemized deductions can provide significant tax benefits. Some of the advantages of itemized deductions include: * Larger tax savings: Itemized deductions can result in a larger tax refund or reduced tax liability, especially for taxpayers with high expenses. * More control: Itemized deductions allow taxpayers to claim specific expenses, giving them more control over their tax situation. * Potential for larger charitable donations: Itemized deductions can encourage charitable giving, as donations can be claimed as a deduction.

Drawbacks of Itemized Deductions

While itemized deductions can provide tax benefits, there are also some drawbacks to consider: * Increased complexity: Itemized deductions require more paperwork and documentation, which can lead to a longer and more complicated tax filing process. * Record-keeping requirements: Taxpayers must keep accurate records of their expenses throughout the year, which can be time-consuming and tedious. * Potential for audit: Itemized deductions may increase the risk of an audit, as the IRS may scrutinize expenses more closely.

Table: Comparison of Standard Deduction and Itemized Deductions

| Option | Benefits | Drawbacks |

|---|---|---|

| Standard Deduction | Simpler tax filing process, less paperwork | May not provide largest tax benefit, limited control |

| Itemized Deductions | Potential for larger tax savings, more control | Increased complexity, more paperwork, record-keeping requirements |

In summary, itemized deductions can provide significant tax benefits, but they also require more paperwork and documentation. Taxpayers should carefully consider their individual situation and weigh the benefits against the drawbacks before deciding whether to itemize or take the standard deduction. By understanding the differences between these two options, individuals can make informed decisions about their tax filing and potentially reduce their tax liability.

As we wrap up our discussion on itemized deductions and their impact on tax paperwork, it’s clear that this topic is complex and multifaceted. By taking the time to understand the benefits and drawbacks of itemized deductions, taxpayers can make informed decisions about their tax filing and potentially reduce their tax liability. Whether you choose to itemize or take the standard deduction, it’s essential to stay organized and keep accurate records to ensure a smooth tax filing process.

What is the main difference between itemized deductions and the standard deduction?

+

The main difference between itemized deductions and the standard deduction is that itemized deductions require taxpayers to keep track of their expenses and claim them on their tax return, while the standard deduction is a fixed amount that can be subtracted from taxable income without the need to itemize specific expenses.

What are some common expenses that can be claimed as itemized deductions?

+

Common expenses that can be claimed as itemized deductions include medical expenses, mortgage interest, charitable donations, state and local taxes, home office expenses, and business use of a car.

How can I determine whether itemized deductions or the standard deduction is best for my individual situation?

+

To determine whether itemized deductions or the standard deduction is best for your individual situation, consider consulting with a tax professional who can help you weigh the benefits and drawbacks of each option and make an informed decision.