Paperwork

DTC Paperwork Explained

Introduction to DTC Paperwork

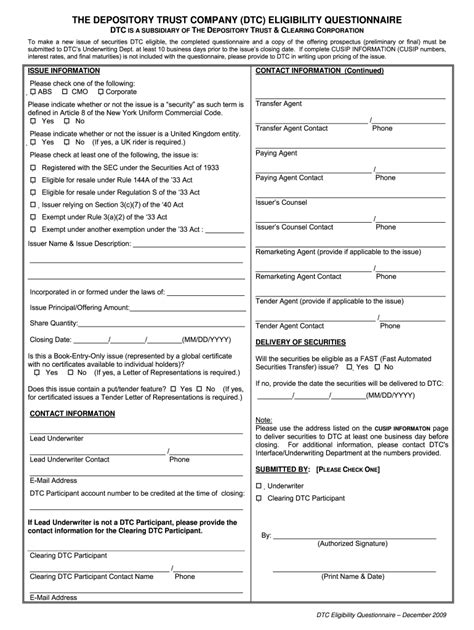

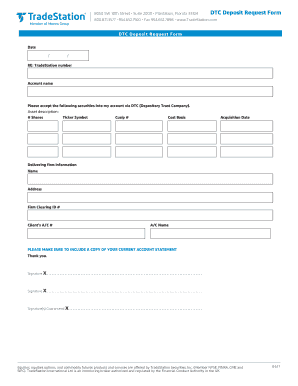

When dealing with the Depository Trust Company (DTC), it’s essential to understand the various types of paperwork involved in the process. The DTC is a subsidiary of the Depository Trust & Clearing Corporation (DTCC) and plays a critical role in the settlement and clearing of securities transactions. In this article, we’ll delve into the world of DTC paperwork, exploring the different types of documents, their purposes, and the importance of accurate completion.

Types of DTC Paperwork

There are several types of paperwork associated with DTC, including: * Deposit Agreements: These agreements outline the terms and conditions for depositing securities with the DTC. * Withdrawal Requests: These requests are used to withdraw securities from the DTC. * Stock Powers: These documents grant the DTC the authority to transfer securities on behalf of the owner. * Medallion Guarantees: These guarantees are required for certain transactions, such as the transfer of securities, and ensure the authenticity of the documents. * Securities Loans: These agreements allow for the lending of securities, which can be used to facilitate settlement or other financial transactions.

DTC Eligibility

To become DTC-eligible, issuers must meet specific requirements, including: * Being a reporting company under the Securities Exchange Act of 1934 * Having a minimum of 10 shareholders * Having a minimum of $1 million in market capitalization * Being listed on a national exchange or quoted on the OTCQB or OTCQX * Meeting the DTC’s operational and financial requirements

Benefits of DTC Eligibility

Becoming DTC-eligible offers several benefits, including: * Increased liquidity: DTC eligibility can increase the liquidity of an issuer’s securities, making it easier to buy and sell shares. * Improved market visibility: DTC eligibility can improve an issuer’s market visibility, making it more attractive to investors. * Reduced costs: DTC eligibility can reduce the costs associated with securities transactions, such as transfer agent fees. * Enhanced credibility: DTC eligibility can enhance an issuer’s credibility, demonstrating its commitment to transparency and regulatory compliance.

DTC Paperwork Process

The DTC paperwork process typically involves the following steps: 1. Initial Application: The issuer submits an initial application to the DTC, including the required paperwork and fees. 2. Review and Verification: The DTC reviews and verifies the application, ensuring the issuer meets the eligibility requirements. 3. Approval and Setup: Once approved, the DTC sets up the issuer’s account and provides the necessary documentation. 4. Ongoing Compliance: The issuer must maintain ongoing compliance with DTC requirements, including submitting periodic reports and updates.

💡 Note: It's essential to ensure accurate completion of DTC paperwork, as errors or omissions can lead to delays or rejection of the application.

Common DTC Paperwork Mistakes

Some common mistakes to avoid when completing DTC paperwork include: * Incomplete or inaccurate information * Failure to submit required documentation * Insufficient or incorrect fees * Not meeting the DTC’s operational and financial requirements

Conclusion and Final Thoughts

In conclusion, understanding the ins and outs of DTC paperwork is crucial for issuers seeking to become DTC-eligible. By avoiding common mistakes and ensuring accurate completion of the required documents, issuers can streamline the process and reap the benefits of DTC eligibility. Whether you’re a seasoned issuer or just starting out, it’s essential to stay informed about the latest DTC requirements and best practices to ensure a smooth and successful experience.

What is the purpose of DTC eligibility?

+

The purpose of DTC eligibility is to increase the liquidity and market visibility of an issuer’s securities, while also reducing costs and enhancing credibility.

What are the benefits of becoming DTC-eligible?

+

The benefits of becoming DTC-eligible include increased liquidity, improved market visibility, reduced costs, and enhanced credibility.

What is the typical DTC paperwork process?

+

The typical DTC paperwork process involves submitting an initial application, review and verification, approval and setup, and ongoing compliance with DTC requirements.