F&A Paperwork Explained

Introduction to F&A Paperwork

When dealing with financial and accounting (F&A) matters, paperwork is an essential aspect that cannot be overlooked. F&A paperwork refers to the various documents and forms required to record, report, and comply with financial regulations. In this blog post, we will delve into the world of F&A paperwork, exploring its importance, types, and best practices for management.

Importance of F&A Paperwork

F&A paperwork plays a crucial role in maintaining the financial health and integrity of an organization. It helps to: * Ensure compliance with regulatory requirements, such as tax laws and financial reporting standards * Provide transparency and accountability in financial transactions and decisions * Facilitate auditing and financial analysis, enabling stakeholders to make informed decisions * Support risk management and internal control, helping to prevent errors and fraudulent activities

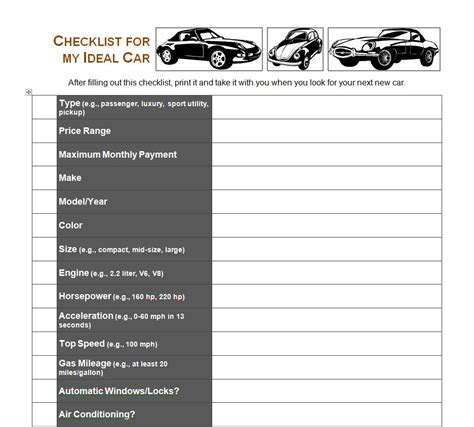

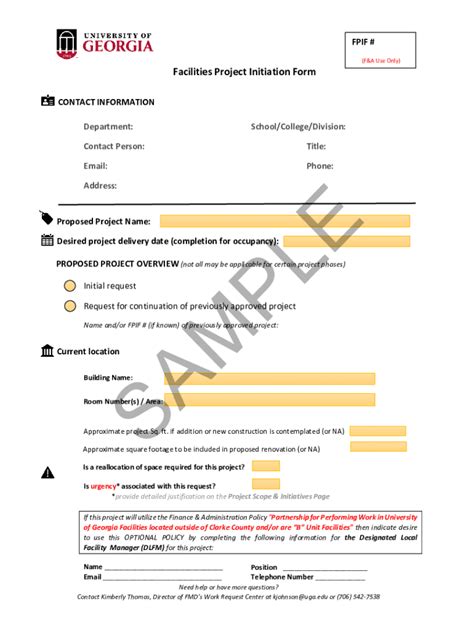

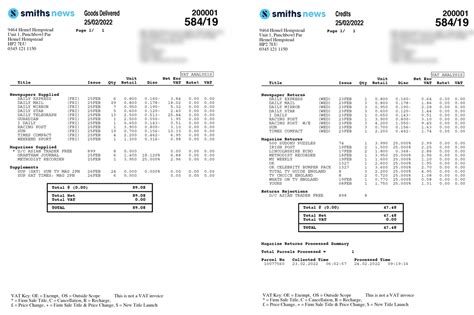

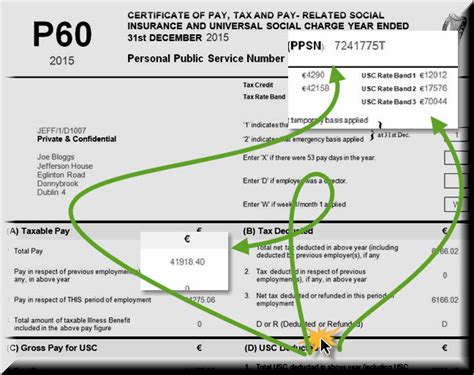

Types of F&A Paperwork

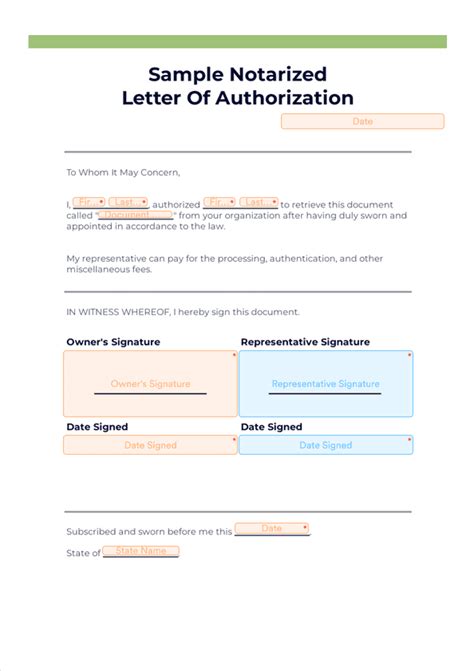

The types of F&A paperwork can be categorized into several groups, including: * Financial statements: balance sheets, income statements, and cash flow statements * Tax returns: income tax returns, sales tax returns, and other tax-related forms * Accounting records: journals, ledgers, and other documents used to record financial transactions * Compliance documents: regulatory filings, such as annual reports and proxy statements * Internal control documents: policies, procedures, and manuals related to financial management and control

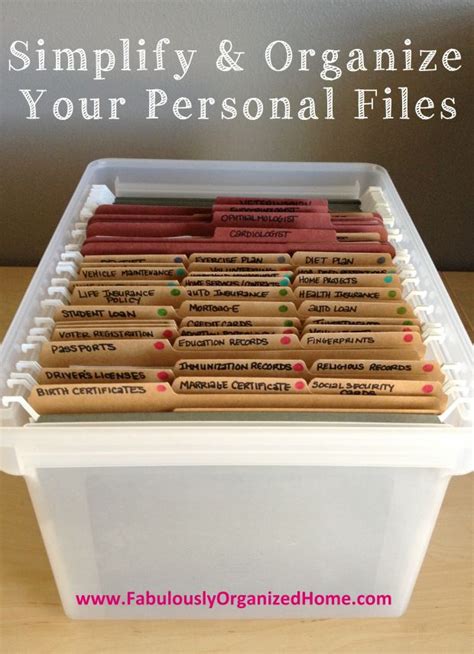

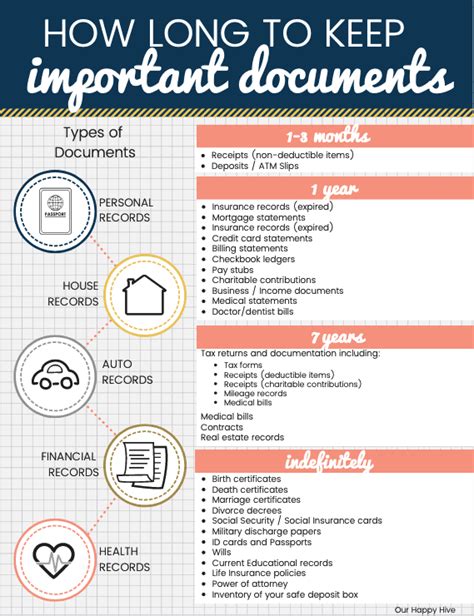

Best Practices for F&A Paperwork Management

To ensure effective management of F&A paperwork, organizations should follow these best practices: * Implement a centralized filing system, using a combination of physical and digital storage solutions * Establish clear policies and procedures for creating, reviewing, and approving F&A documents * Designate responsibilities and authorize access to F&A paperwork, ensuring that only authorized personnel can create, modify, or delete documents * Use technology, such as document management software and automated workflows, to streamline F&A paperwork processes * Regularly review and update F&A paperwork, ensuring that it remains accurate, complete, and compliant with regulatory requirements

| Document Type | Purpose | Frequency |

|---|---|---|

| Financial Statements | Report financial performance and position | Quarterly and Annually |

| Tax Returns | Report tax liabilities and claim refunds | Annually |

| Accounting Records | Record financial transactions and events | Ongoing |

📝 Note: Organizations should consult with financial and legal experts to ensure that their F&A paperwork complies with relevant laws and regulations.

Common Challenges in F&A Paperwork Management

Despite its importance, F&A paperwork management can be challenging, with common issues including: * Inadequate documentation, leading to errors, omissions, or non-compliance * Inefficient processes, resulting in wasted time, resources, and costs * Insufficient training, causing personnel to struggle with F&A paperwork tasks and responsibilities * Inadequate technology, making it difficult to manage, store, and retrieve F&A documents * Lack of oversight, leading to non-compliance, errors, or fraudulent activities

Future of F&A Paperwork

The future of F&A paperwork is likely to be shaped by digital transformation, with technologies such as: * Cloud-based document management systems * Automated workflow tools * Artificial intelligence and machine learning * Blockchain and distributed ledger technology These technologies promise to increase efficiency, reduce costs, and enhance compliance, but also introduce new risks and challenges that must be addressed.

In summary, F&A paperwork is a critical aspect of financial management, requiring careful attention to detail, compliance, and best practices. By understanding the importance, types, and challenges of F&A paperwork, organizations can implement effective management strategies, leveraging technology and expertise to ensure accuracy, efficiency, and compliance.

What is the purpose of F&A paperwork?

+

The purpose of F&A paperwork is to record, report, and comply with financial regulations, ensuring transparency, accountability, and compliance.

What are the common types of F&A paperwork?

+

The common types of F&A paperwork include financial statements, tax returns, accounting records, compliance documents, and internal control documents.

How can organizations manage F&A paperwork effectively?

+

Organizations can manage F&A paperwork effectively by implementing a centralized filing system, establishing clear policies and procedures, designating responsibilities, using technology, and regularly reviewing and updating F&A paperwork.