5 Insurance Group Mean Tips

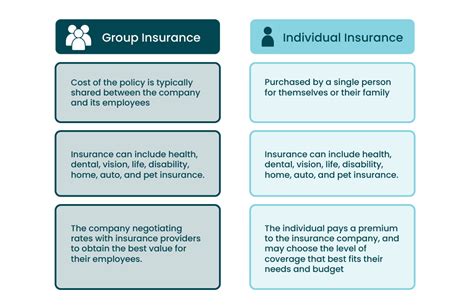

Understanding Insurance Groups

Insurance groups are a way to categorize vehicles based on their insurance costs. In the UK, the Group Rating system is used to determine the cost of insurance for a particular vehicle. The system ranges from 1 to 50, with 1 being the lowest and 50 being the highest. The lower the insurance group, the lower the insurance premium.

When buying a new vehicle, it's essential to consider the insurance group to avoid high insurance costs. Here are some key factors that affect insurance groups:

- Vehicle Performance: Vehicles with high-performance capabilities are typically placed in higher insurance groups.

- Vehicle Value: More expensive vehicles are usually placed in higher insurance groups due to the higher cost of repairs or replacement.

- Security Features: Vehicles with advanced security features, such as immobilizers and alarms, may be placed in lower insurance groups.

- Repair Costs: Vehicles with high repair costs are typically placed in higher insurance groups.

- Safety Features: Vehicles with advanced safety features, such as airbags and anti-lock braking systems (ABS), may be placed in lower insurance groups.

How to Check Your Vehicle's Insurance Group

To check your vehicle's insurance group, you can use the following methods:

- Visit the Group Rating Calculator on the Group Rating website to find your vehicle's insurance group.

- Check your vehicle's V5 registration document for the insurance group rating.

- Consult with your insurance provider to determine your vehicle's insurance group.

Mean Tips for Reducing Insurance Costs

Here are some mean tips to help reduce your insurance costs:

- Choose a vehicle with a low insurance group: Opt for a vehicle with a low insurance group to reduce your insurance premium.

- Install security features: Install advanced security features, such as immobilizers and alarms, to reduce the risk of theft and lower your insurance premium.

- Drive safely: Maintain a good driving record to avoid accidents and reduce your insurance premium.

- Compare insurance quotes: Compare insurance quotes from different providers to find the best deal.

- Consider a black box policy: Consider a black box policy, which uses a device to monitor your driving habits and can help reduce your insurance premium.

Insurance Group Ratings Explained

The insurance group rating system is based on the following factors:

| Insurance Group | Vehicle Type | Insurance Cost |

|---|---|---|

| 1-10 | Low-performance vehicles | Low |

| 11-20 | Medium-performance vehicles | Medium |

| 21-30 | High-performance vehicles | High |

| 31-40 | Very high-performance vehicles | Very High |

| 41-50 | Extremely high-performance vehicles | Extremely High |

💡 Note: The insurance group rating system is subject to change, and the factors that affect insurance groups may vary depending on the insurance provider.

In summary, understanding insurance groups and how they affect insurance costs can help you make informed decisions when buying a new vehicle. By choosing a vehicle with a low insurance group, installing security features, driving safely, comparing insurance quotes, and considering a black box policy, you can reduce your insurance costs. Remember to always check your vehicle’s insurance group and consult with your insurance provider to determine the best insurance option for you. The key to reducing insurance costs is to be mindful of the factors that affect insurance groups and to take steps to minimize risks. By doing so, you can enjoy lower insurance premiums and protect your vehicle and finances.