Lein Sale Paperwork Explained

Introduction to Lein Sale Paperwork

When dealing with properties, especially in cases of unpaid debts or taxes, the concept of a lien sale emerges as a significant aspect of property law. A lien sale refers to the process where a property is sold to satisfy a debt or lien that has been placed on it. The paperwork involved in such transactions can be complex and overwhelming, involving various documents and legal procedures. This article aims to break down the lein sale paperwork into understandable components, making it easier for individuals to navigate these situations.

Understanding Liens

Before diving into the paperwork, it’s essential to understand what a lien is. A lien is a legal claim or security interest that a creditor has over a property until the debt is paid off. There are several types of liens, including tax liens for unpaid taxes, mechanic’s liens for unpaid construction work, and judgment liens resulting from court judgments. Each type of lien has its own set of rules and procedures for being placed on a property and for being satisfied.

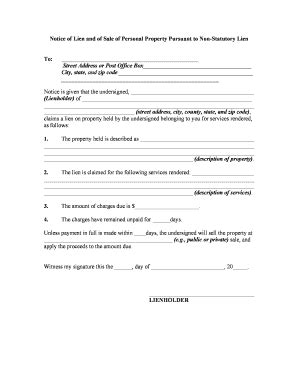

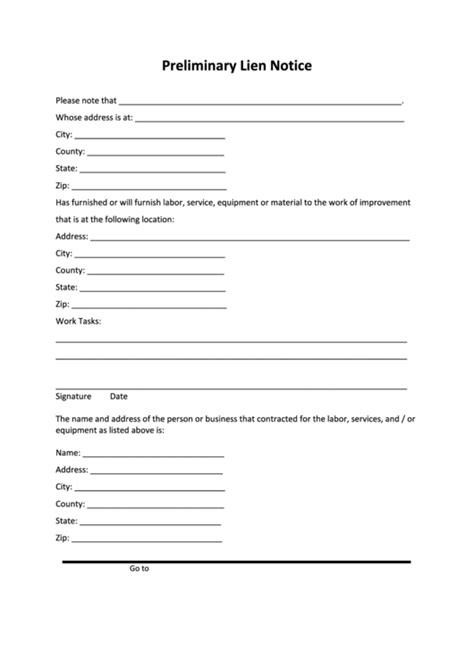

Pre-Lien Sale Process

The process leading up to a lien sale involves several steps, including: - Notice of Lien: The creditor must provide the property owner with a notice of lien, stating the amount of debt and the intention to place a lien on the property if the debt is not paid. - Recording the Lien: The lien is then recorded with the appropriate government office, usually the county recorder’s office, to provide public notice of the lien. - Attempt to Collect: The creditor will attempt to collect the debt through various means before proceeding to a lien sale. - Notice of Sale: If all else fails, the creditor will issue a notice of sale, indicating that the property will be sold to satisfy the lien.

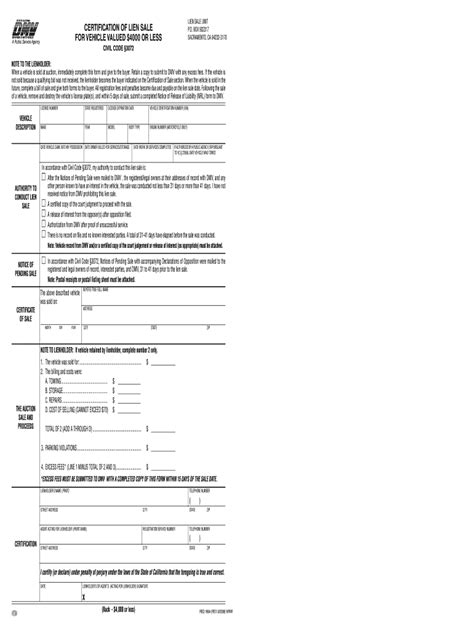

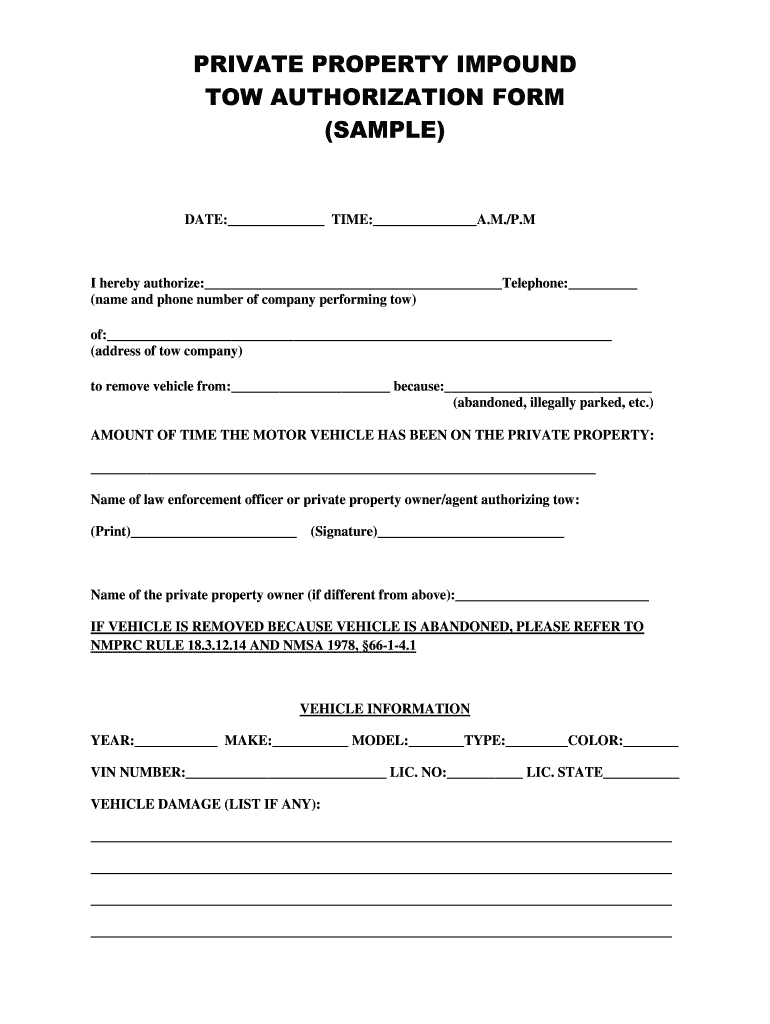

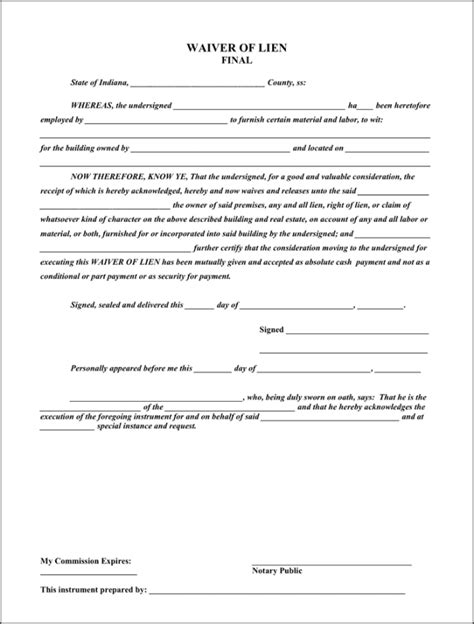

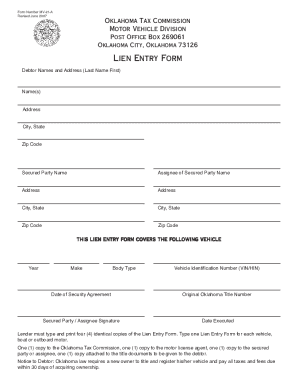

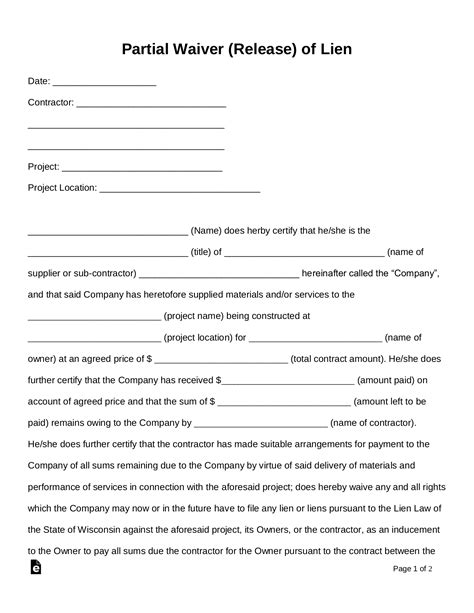

Lien Sale Paperwork

The paperwork involved in a lien sale can be extensive and includes: - Lien Document: The original document creating the lien. - Notice of Default: A notice sent to the property owner indicating that they have defaulted on the debt. - Auction Notice: Public notice that the property will be sold at auction, including details such as date, time, location, and a description of the property. - Deed of Trust: If the property is being sold through a trust deed foreclosure, this document outlines the terms of the sale. - Transfer Documents: After the sale, documents such as a warranty deed or quitclaim deed are used to transfer ownership of the property to the buyer.

Post-Lien Sale Process

After the lien sale, several steps must be taken to finalize the transaction: - Payment Distribution: The proceeds from the sale are distributed according to the priority of the liens, with the costs of the sale and the most senior liens being paid first. - Recording the Sale: The sale is recorded with the county recorder’s office, updating the public record to reflect the change in ownership. - Notification of Parties: All parties involved, including the previous owner and any other lienholders, are notified of the sale and its outcome.

📝 Note: It's crucial for all parties involved in a lien sale to understand their rights and obligations under the law, as the process can be complex and may vary significantly depending on the jurisdiction.

Conclusion and Next Steps

Navigating the world of lien sales and the associated paperwork requires a deep understanding of property law and the specific regulations governing such transactions in your area. Whether you are a property owner facing a lien sale or a buyer looking to purchase a property through this process, it’s essential to seek professional advice to ensure your rights are protected and that the transaction proceeds smoothly. By understanding the pre-lien sale process, the paperwork involved, and the post-lien sale procedures, individuals can better manage their expectations and outcomes in these often challenging situations.

What is a lien sale, and how does it affect property owners?

+

A lien sale is the process of selling a property to satisfy a debt or lien. It can significantly affect property owners, potentially leading to the loss of their property if debts are not paid.

How can property owners avoid a lien sale?

+

Property owners can avoid a lien sale by paying off the debt that the lien is based on. In some cases, they may also be able to negotiate a payment plan with the creditor or seek legal advice to explore other options.

What are the rights of buyers in a lien sale?

+

Buyers in a lien sale have the right to purchase the property under the terms of the sale. However, they must also be aware of any potential issues with the title and ensure that they are purchasing the property free of any encumbrances, aside from those disclosed in the sale process.