Garnishment Paperwork Less Payments Guide

Understanding Garnishment and Its Impact on Your Finances

When you’re struggling to make ends meet, receiving a garnishment notice can be devastating. Garnishment is a legal process where a creditor obtains a court order to seize a portion of your wages or assets to satisfy a debt. This can significantly reduce your take-home pay, making it even more challenging to manage your finances. In this guide, we’ll walk you through the process of garnishment, how it affects your payments, and provide tips on managing your debt.

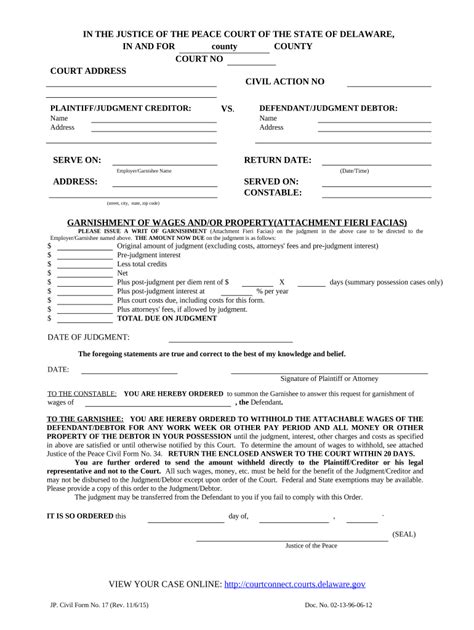

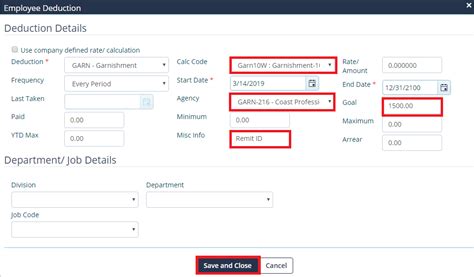

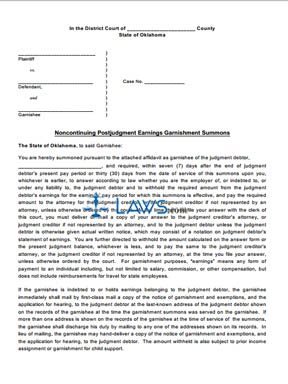

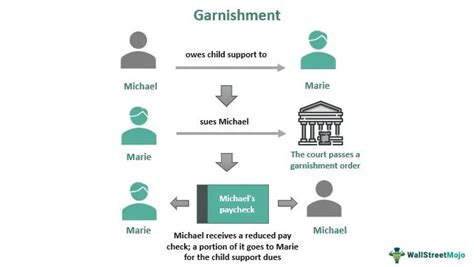

How Garnishment Works

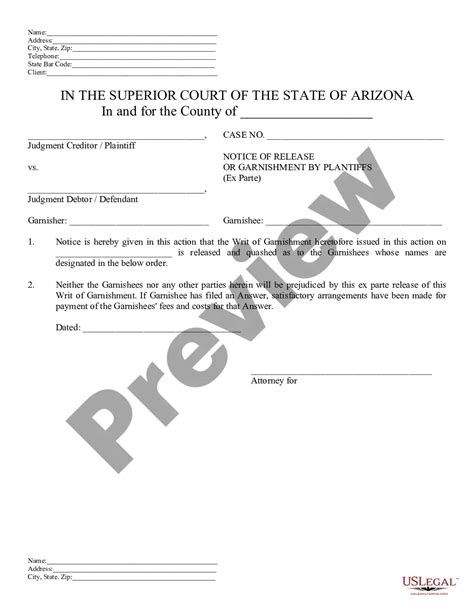

Garnishment typically occurs when you’ve defaulted on a debt, such as a credit card, loan, or medical bill. The creditor will file a lawsuit against you, and if they win, they’ll receive a judgment that allows them to garnish your wages or assets. The garnishment process usually involves the following steps: * The creditor files a lawsuit against you * The court issues a judgment in favor of the creditor * The creditor serves you with a garnishment notice * Your employer or bank is notified to withhold a portion of your wages or assets

Types of Garnishment

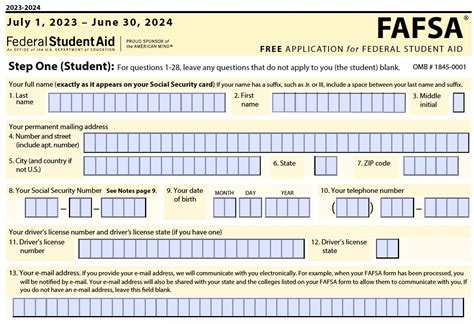

There are several types of garnishment, including: * Wage garnishment: This is the most common type, where a portion of your wages is withheld to satisfy a debt. * Bank garnishment: This type of garnishment involves freezing your bank account to satisfy a debt. * Tax garnishment: The IRS can garnish your tax refund to satisfy a tax debt. * Student loan garnishment: The government can garnish your wages to satisfy a defaulted student loan.

Managing Garnishment and Reducing Payments

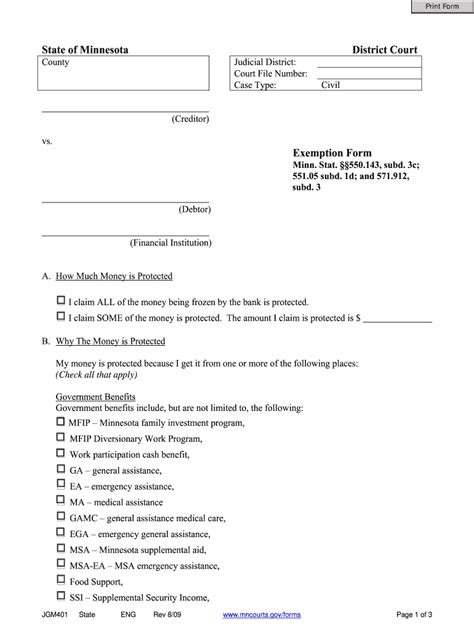

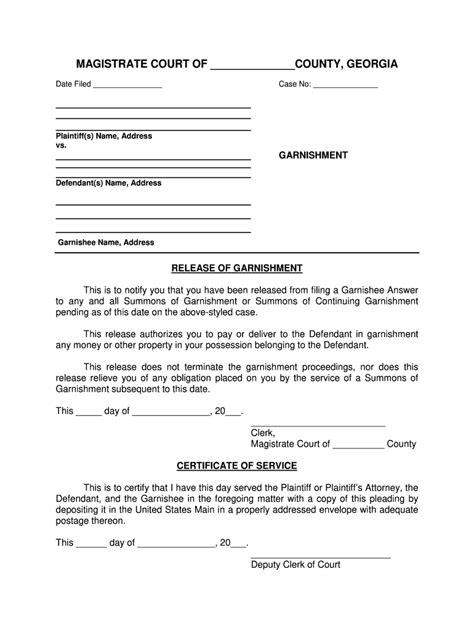

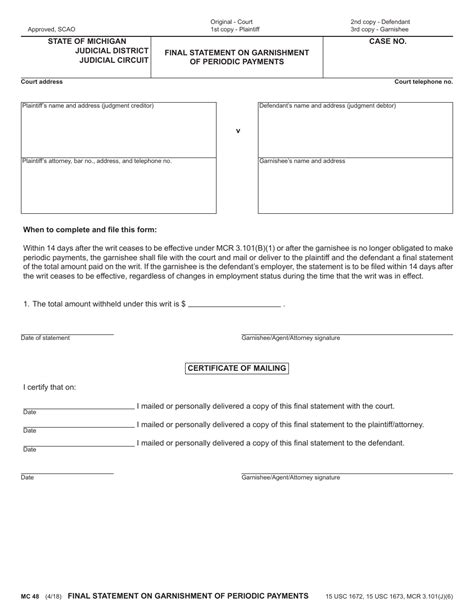

If you’re facing garnishment, it’s essential to take proactive steps to manage your debt and reduce your payments. Here are some tips: * Negotiate with your creditor: Reach out to your creditor to discuss possible payment arrangements or settlements. * Seek debt counseling: Non-profit credit counseling agencies can help you develop a plan to manage your debt. * File an exemption: If you’re experiencing financial hardship, you may be eligible to file an exemption to reduce or stop the garnishment. * Prioritize your debts: Focus on paying essential debts, such as rent/mortgage, utilities, and food, before paying the garnished debt.

Reducing Garnishment Payments

If you’re already facing garnishment, there are ways to reduce your payments: * File a claim of exemption: You can file a claim of exemption to reduce the amount of money being garnished. * Negotiate a payment plan: Work with your creditor to establish a payment plan that reduces your monthly payments. * Seek assistance from a non-profit credit counseling agency: These agencies can help you develop a plan to manage your debt and reduce your payments.

💡 Note: It's crucial to respond to the garnishment notice and seek assistance from a financial advisor or attorney to ensure you're taking the right steps to manage your debt.

Rebuilding Your Finances After Garnishment

Once you’ve managed to reduce or stop the garnishment, it’s essential to focus on rebuilding your finances. Here are some tips: * Create a budget: Develop a budget that accounts for all your expenses, debts, and income. * Build an emergency fund: Save a portion of your income each month to build an emergency fund that can help you avoid future financial difficulties. * Monitor your credit report: Check your credit report regularly to ensure it’s accurate and up-to-date. * Avoid new debt: Avoid taking on new debt, such as credit cards or loans, until you’ve paid off your existing debts.

| Debt Type | Garnishment Limit |

|---|---|

| Credit card debt | 25% of disposable income |

| Student loan debt | 15% of disposable income |

| Tax debt | Varies depending on the tax authority |

In summary, garnishment can have a significant impact on your finances, but there are steps you can take to manage your debt and reduce your payments. By understanding the garnishment process, negotiating with your creditor, and seeking assistance from non-profit credit counseling agencies, you can work towards rebuilding your finances and achieving financial stability.

To wrap things up, it’s essential to remember that managing debt and garnishment requires patience, persistence, and the right guidance. By following the tips and strategies outlined in this guide, you can take control of your finances and work towards a more stable financial future.

What is garnishment, and how does it work?

+

Garnishment is a legal process where a creditor obtains a court order to seize a portion of your wages or assets to satisfy a debt. The creditor will file a lawsuit against you, and if they win, they’ll receive a judgment that allows them to garnish your wages or assets.

Can I stop a garnishment?

+

Yes, you can stop a garnishment by filing a claim of exemption, negotiating a payment plan with your creditor, or seeking assistance from a non-profit credit counseling agency.

How can I rebuild my finances after garnishment?

+

To rebuild your finances after garnishment, focus on creating a budget, building an emergency fund, monitoring your credit report, and avoiding new debt. You can also seek assistance from a financial advisor or credit counselor to help you develop a plan to manage your debt and achieve financial stability.