DC Tax Paperwork You Should Receive

Introduction to DC Tax Paperwork

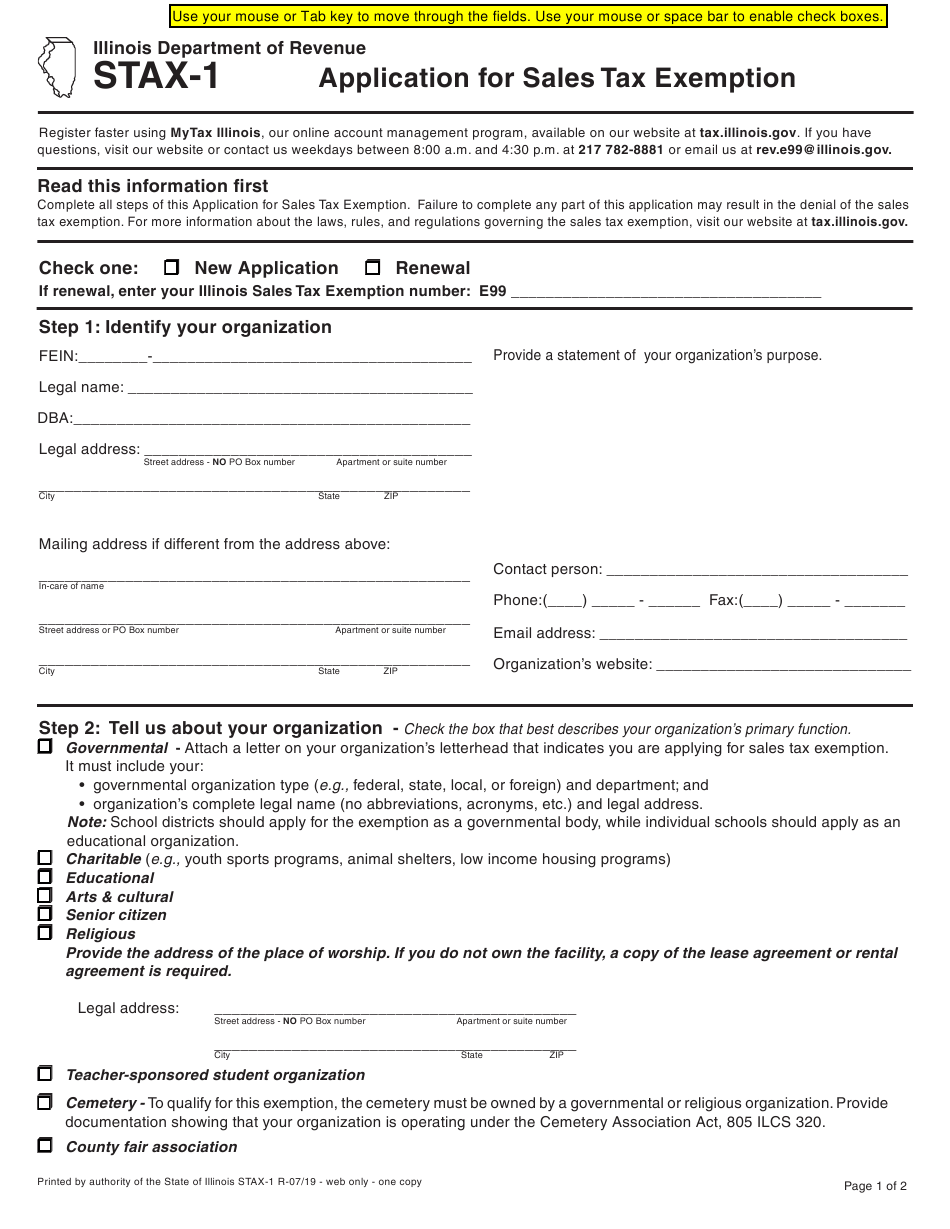

When dealing with taxes in Washington D.C., it’s essential to understand the various types of paperwork you should receive to ensure you’re meeting your tax obligations and taking advantage of the deductions and credits you’re eligible for. The District of Columbia’s tax system is designed to be efficient and straightforward, but navigating the paperwork can be daunting for those who are new to the process or unfamiliar with tax terminology. In this guide, we’ll walk through the key DC tax paperwork you should expect to receive, helping you stay on top of your tax responsibilities.

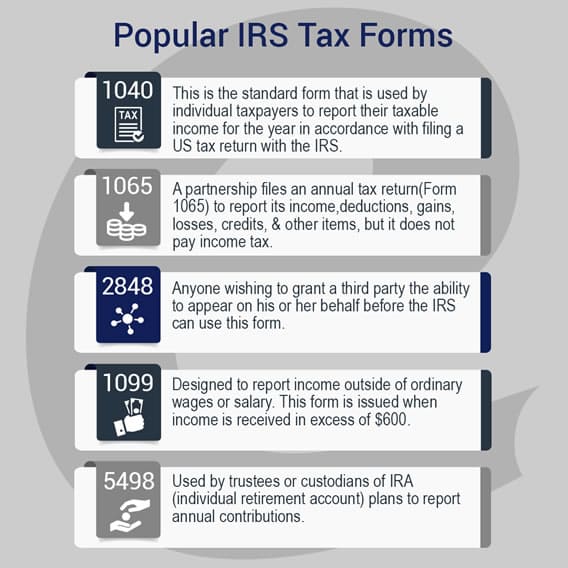

Understanding Your Tax Forms

The most common tax form you’ll encounter is the Form D-40, which is the standard income tax return form for residents of Washington D.C. This form is where you’ll report your income, claim deductions, and calculate your tax liability. You might also receive other forms, such as Form D-40B for non-residents or Form D-40P for part-year residents, depending on your residency status.

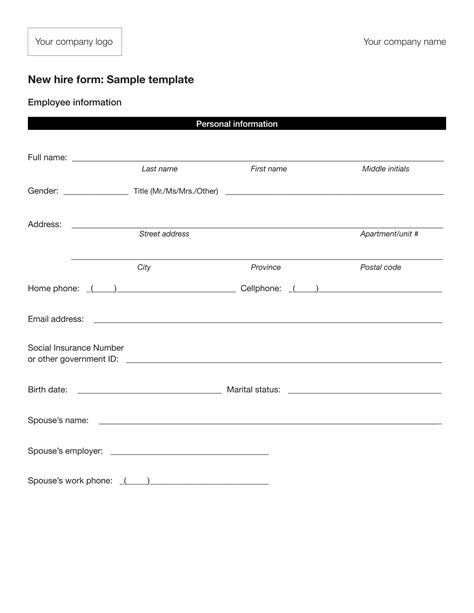

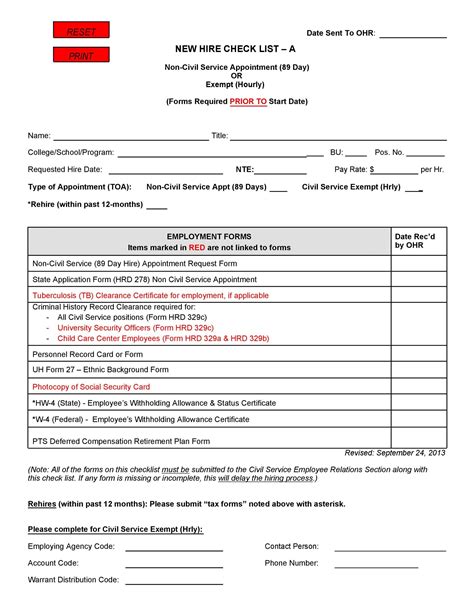

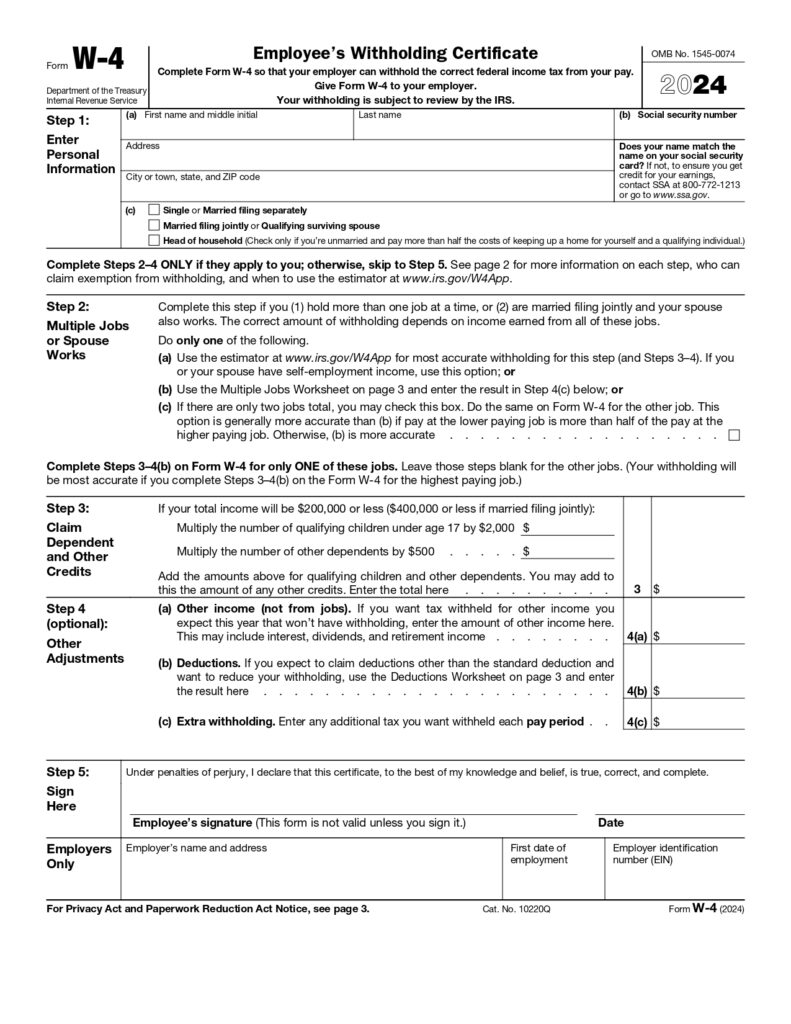

Employment-Related Tax Paperwork

If you’re employed, your employer will provide you with a W-2 form by January 31st of each year, detailing your income and the taxes withheld from your paycheck. This form is crucial for filing your tax return, as it contains the information needed to report your employment income accurately. Additionally, if you’ve made contributions to a retirement plan or have had other deductions from your paycheck, these will also be reported on your W-2.

Interest and Dividend Statements

For individuals with savings accounts, investments, or dividend-paying stocks, you’ll receive 1099-INT and 1099-DIV forms, respectively. These forms detail the interest earned on your savings accounts and the dividends received from your investments. You’ll need these forms to report this income on your tax return.

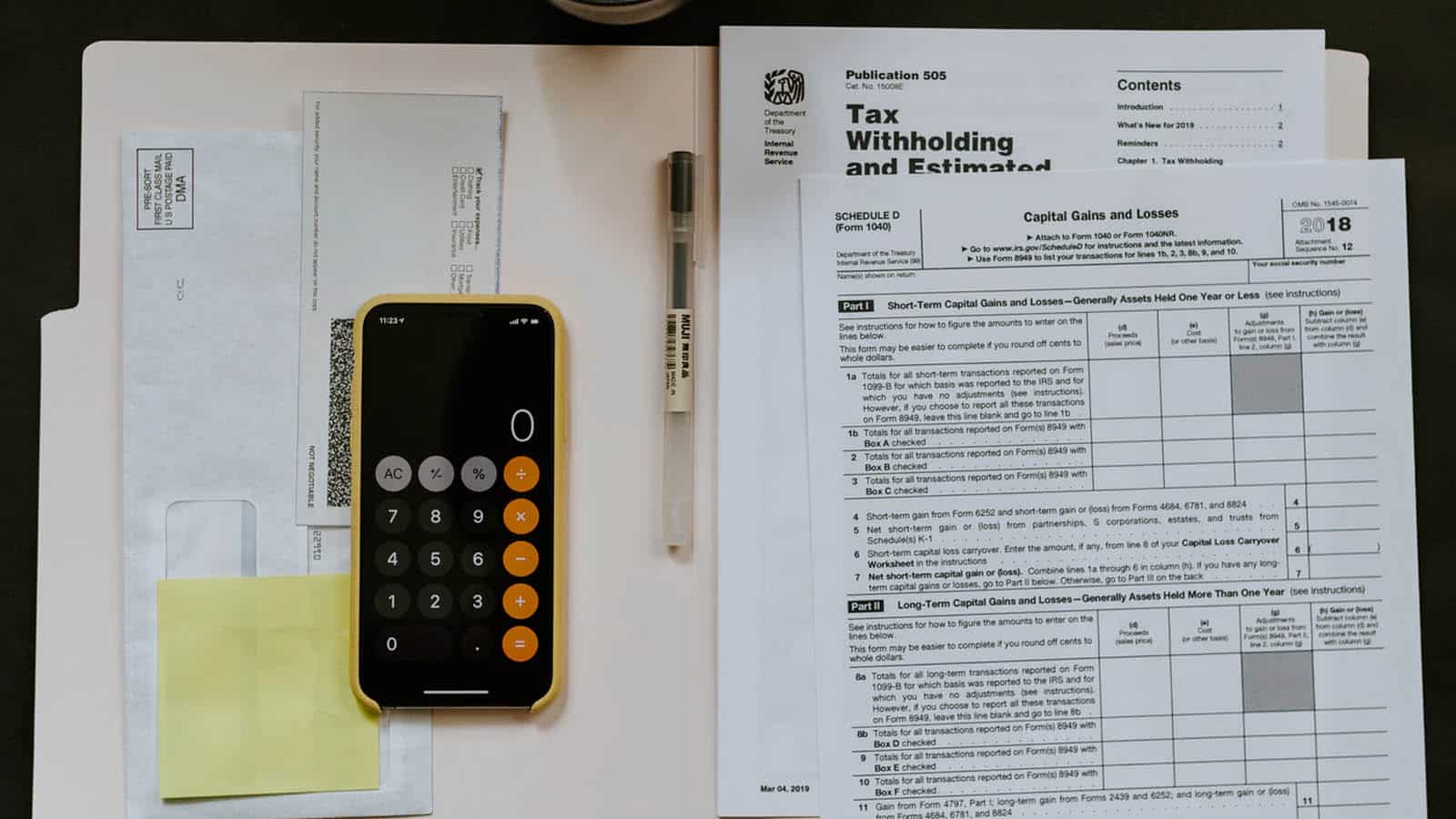

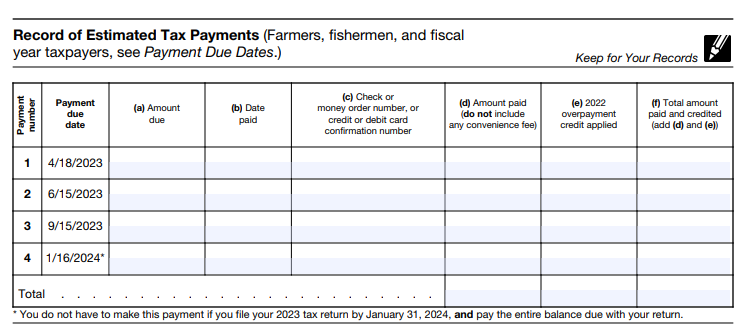

Capital Gains and Losses

If you’ve sold any assets, such as stocks, bonds, or real estate, you’ll receive a 1099-B form from your broker or financial institution. This form reports the proceeds from the sale and any costs associated with the sale, which you’ll use to calculate your capital gains or losses.

Charitable Contributions

For those who have made charitable donations, you should receive acknowledgement letters from the charities. These letters serve as proof of your donations, which can be deducted on your tax return. Keep these letters with your tax records, as you may need them if you’re audited.

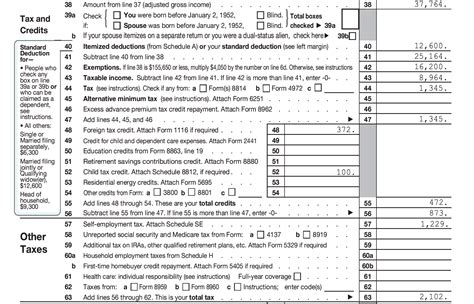

Tax Credits and Deductions

Washington D.C. offers various tax credits and deductions to help reduce your tax liability. For example, the Earned Income Tax Credit (EITC) is available to low-to-moderate-income working individuals and families. Additionally, there are credits for child and dependent care, education expenses, and retirement savings contributions. Understanding which credits and deductions you’re eligible for can significantly impact your tax refund or liability.

Table of Common DC Tax Forms

| Form Name | Description |

|---|---|

| Form D-40 | Standard income tax return form for DC residents |

| Form D-40B | Income tax return form for non-residents |

| Form D-40P | Income tax return form for part-year residents |

| W-2 | Employment income and tax withholding statement |

| 1099-INT | Interest income statement |

| 1099-DIV | Dividend income statement |

| 1099-B | Proceeds from broker and barter exchange transactions |

📝 Note: It's crucial to review each form carefully to ensure accuracy and completeness, as errors can lead to delays in processing your tax return or even an audit.

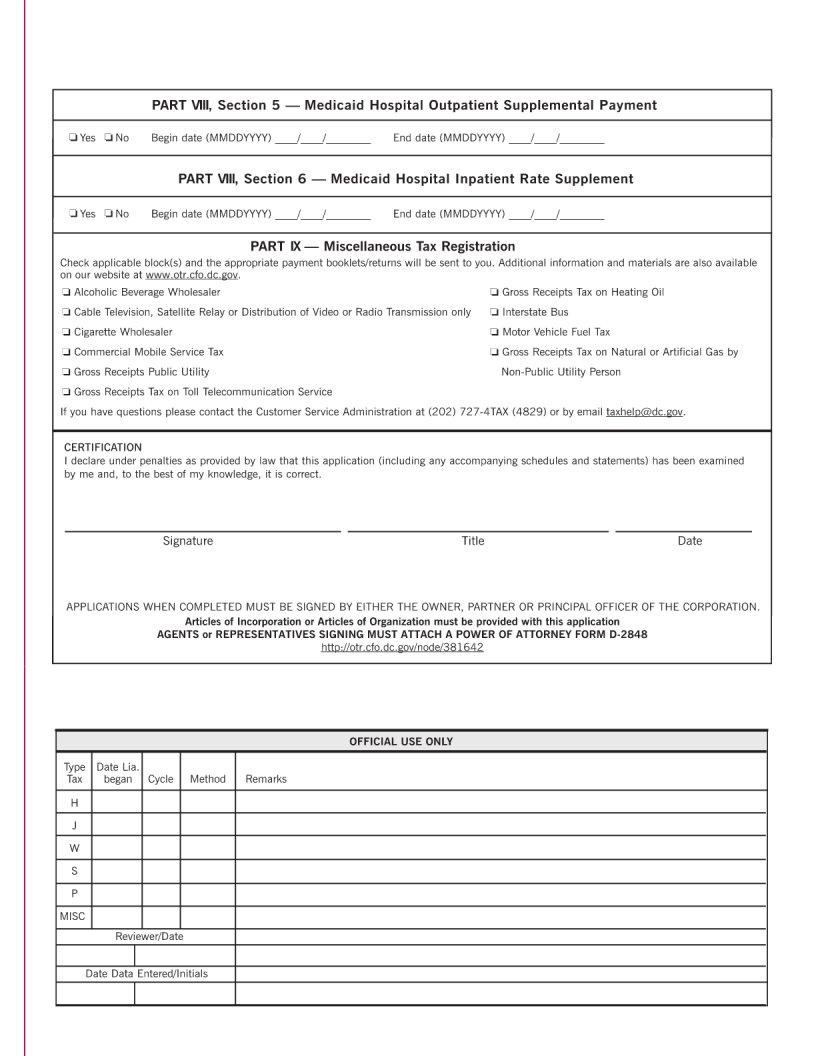

Finalizing Your Tax Return

After gathering all the necessary paperwork, you can proceed to file your tax return. Ensure you’ve claimed all eligible deductions and credits, and double-check your math to avoid any errors. If you’re filing electronically, you’ll receive an acknowledgement from the DC Office of Tax and Revenue once your return is processed.

In wrapping up the discussion on DC tax paperwork, it’s clear that understanding and organizing the various forms you receive is key to a smooth and successful tax filing experience. By being aware of what to expect and how to use each form, you’ll be better equipped to manage your tax obligations and make the most of the credits and deductions available to you.

What is the deadline for filing DC tax returns?

+

The deadline for filing DC tax returns typically follows the federal tax filing deadline, which is April 15th of each year. However, if the 15th falls on a weekend or federal holiday, the deadline is the next business day.

How do I file for an extension on my DC tax return?

+

To file for an extension, you can submit Form FR-127 by the original deadline. This will give you an automatic six-month extension. However, any tax due must still be paid by the original deadline to avoid penalties and interest.

Can I file my DC tax return electronically?

+

Yes, the DC Office of Tax and Revenue encourages electronic filing for faster processing and fewer errors. You can file electronically through the district’s tax website or through a tax professional.