5 FAFSA Record Tips

Understanding the FAFSA Process

The Free Application for Federal Student Aid (FAFSA) is a crucial step for students seeking financial assistance for their higher education. The application process can be complex, but with the right guidance, students can navigate it successfully. In this post, we will delve into the world of FAFSA records, providing you with valuable tips to ensure a smooth and effective application process.

What is a FAFSA Record?

A FAFSA record is essentially a collection of information that students and their families provide to the federal government to determine their eligibility for financial aid. This record includes personal and financial details, such as income, assets, and dependency status. The information provided in the FAFSA record is used to calculate the Expected Family Contribution (EFC), which determines the amount of financial aid a student is eligible to receive.

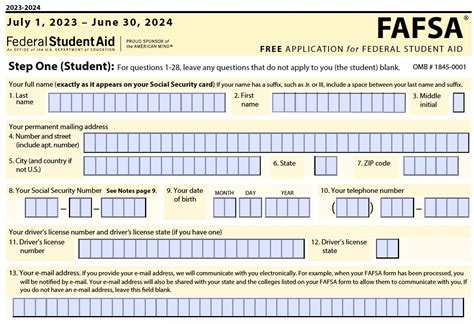

Tip 1: Gather Required Documents

Before starting the FAFSA application, it is essential to gather all the necessary documents. These may include:

- Social Security number or Alien Registration number

- Driver’s license or state ID

- W-2 forms and tax returns

- Records of untaxed income, such as child support or veterans’ benefits

- Information about assets, such as cash, savings, and investments

- List of schools the student is interested in attending

Tip 2: Understand Dependency Status

The dependency status of a student plays a significant role in determining their eligibility for financial aid. Students who are considered dependent must provide parental information on the FAFSA, while independent students do not. It is crucial to understand the criteria for dependency status, which includes:

- Being under the age of 24

- Not being married or in a same-sex marriage

- Not having dependents of their own

- Not being a veteran or on active duty

Tip 3: Report Assets Correctly

When reporting assets on the FAFSA, it is essential to include all relevant information, such as:

- Cash and savings accounts

- Investments, such as stocks and bonds

- Real estate, excluding the family home

- Business assets, if applicable

- Retirement accounts, such as 401(k) or IRA

- Life insurance policies

- Home equity

Tip 4: Use the IRS Data Retrieval Tool

The IRS Data Retrieval Tool is a convenient and secure way to transfer tax information directly from the IRS to the FAFSA. This tool can help reduce errors and streamline the application process. To use the tool, students and their families will need to:

- Have filed their tax return electronically

- Have a valid Social Security number or Alien Registration number

- Not have amended their tax return

Tip 5: Review and Submit the FAFSA Carefully

Once the FAFSA is complete, it is crucial to review the application carefully before submitting it. Students should:

- Verify all personal and financial information

- Ensure all required fields are completed

- Check for any errors or inconsistencies

📝 Note: It is essential to submit the FAFSA as early as possible, as some types of financial aid are awarded on a first-come, first-served basis.

Additional Tips and Reminders

In addition to the tips mentioned above, students should also keep in mind:

- The FAFSA is available on October 1st of each year

- Some states and schools have earlier deadlines for financial aid

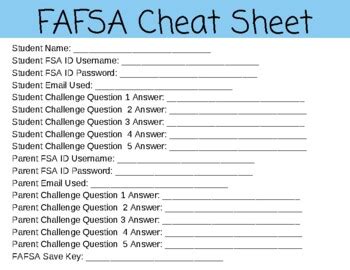

- Students should create an FSA ID to sign and submit the FAFSA electronically

- It is essential to keep a record of the FAFSA submission, including the confirmation number and SAR

| FAFSA Component | Description |

|---|---|

| Student Information | Personal and demographic information about the student |

| Parent Information | Personal and financial information about the student's parents (if dependent) |

| Financial Information | Income, assets, and benefits information about the student and their family |

| School Information | List of schools the student is interested in attending |

In summary, the FAFSA process can be complex, but by following these tips and understanding the components of the application, students can navigate it successfully. Remember to gather required documents, understand dependency status, report assets correctly, use the IRS Data Retrieval Tool, and review and submit the FAFSA carefully. By doing so, students can increase their chances of receiving financial aid and achieving their higher education goals.

What is the deadline for submitting the FAFSA?

+

The FAFSA deadline varies depending on the state and school. Some states and schools have earlier deadlines, while others may have later deadlines. It is essential to check with the school’s financial aid office for specific deadlines.

Do I need to submit the FAFSA every year?

+

Yes, students need to submit the FAFSA every year to determine their eligibility for financial aid. The FAFSA is available on October 1st of each year, and students should submit it as early as possible to ensure they receive the maximum amount of financial aid.

What is the difference between a dependent and independent student?

+

A dependent student is one who is considered to be financially dependent on their parents or guardians. An independent student is one who is considered to be financially independent. The dependency status of a student determines whose information is required on the FAFSA and can impact the amount of financial aid they are eligible to receive.