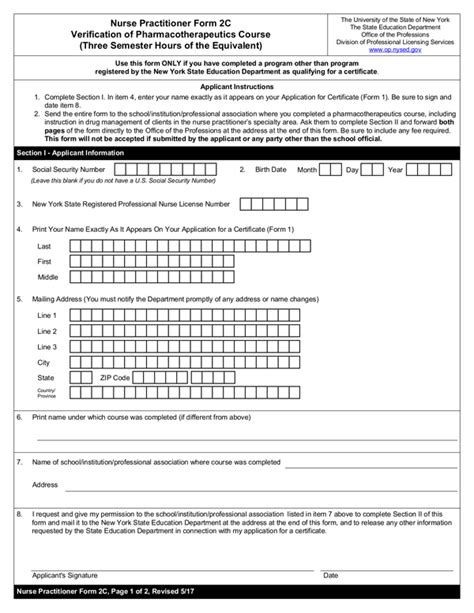

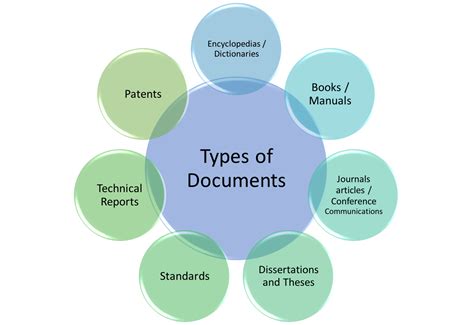

Types of Paperwork Required

Introduction to Paperwork Requirements

When starting a new business, expanding an existing one, or even navigating personal financial matters, understanding the types of paperwork required is essential. Documentation and compliance are key to avoiding legal issues, ensuring smooth operations, and maintaining transparency. In this article, we will delve into the various types of paperwork that individuals and businesses may encounter, highlighting their importance and the consequences of not fulfilling these requirements.

Business Registration Documents

For any business, the first step involves registration. This process includes several critical documents: - Articles of Incorporation: These documents outline the company’s purpose, structure, and ownership. They are filed with the state to formally create a corporation. - Business Licenses: Depending on the business type and location, various licenses are required to operate legally. These can include general business licenses, professional licenses, or environmental permits. - Employer Identification Number (EIN): An EIN is necessary for tax purposes, allowing the business to hire employees, open bank accounts, and file tax returns.

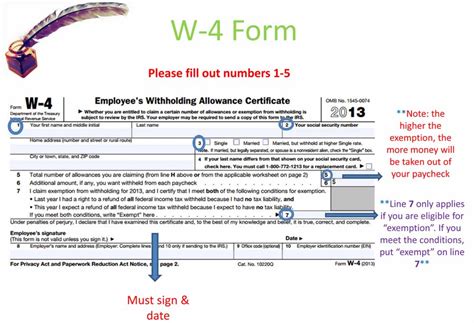

Tax-Related Paperwork

Tax compliance is a significant aspect of both personal and business finance. Key tax-related documents include: - Income Tax Returns: Individuals and businesses must file tax returns annually to report their income and claim deductions. - VAT (Value-Added Tax) Returns: For businesses that sell goods or services subject to VAT, regular returns must be filed to report VAT collected and deductible. - Payroll Tax Filings: Employers are responsible for filing payroll tax returns, reporting wages paid to employees, and taxes withheld.

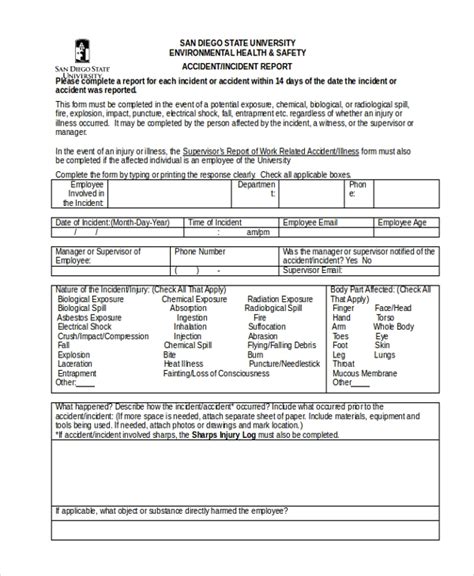

Employment and Labor Law Paperwork

Compliance with employment and labor laws is crucial for businesses with employees. This includes: - Employee Contracts: Outlining terms of employment, including job responsibilities, salary, and benefits. - Non-Disclosure Agreements (NDAs): Protecting confidential business information by requiring employees to keep certain information secret. - Workplace Safety and Health Records: Maintaining records of workplace injuries, safety inspections, and compliance with health and safety regulations.

Financial and Banking Paperwork

Financial transactions and banking operations require specific paperwork, such as: - Loan Applications: Detailed financial information and business plans are needed when applying for loans. - Bank Account Opening Documents: Identification, business registration documents, and sometimes a minimum deposit are required to open a business bank account. - Audited Financial Statements: Regular audits provide a true and fair view of a company’s financial position and performance, often required by investors, lenders, or regulatory bodies.

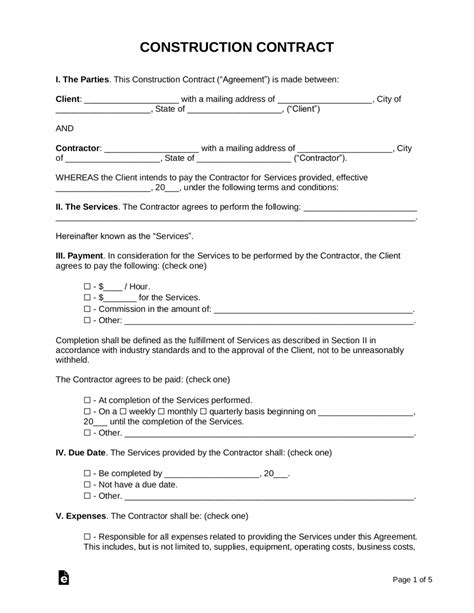

Contractual Agreements

Contractual agreements are fundamental in business for defining relationships and obligations between parties. These include: - Supply Agreements: Outlining the terms for the supply of goods or services. - Partnership Agreements: Defining the roles, responsibilities, and profit-sharing arrangements between partners. - Lease Agreements: For businesses renting premises, these agreements specify the terms of the lease, including rent, duration, and responsibilities.

📝 Note: It's essential to review and understand all contractual agreements carefully before signing, as they are legally binding.

Environmental and Health Regulations

Depending on the industry, businesses may need to comply with environmental and health regulations, which involve paperwork such as: - Environmental Impact Assessments: Evaluating the potential environmental effects of a project or operation. - Health and Safety Policies: Documenting procedures to ensure a safe working environment and compliance with health and safety laws. - Waste Management Records: Keeping records of waste disposal practices to ensure compliance with environmental regulations.

Conclusion and Final Thoughts

In conclusion, navigating the world of paperwork requirements, whether for personal or business purposes, is a complex but essential task. Understanding and complying with these requirements not only ensures legal compliance but also contributes to the transparency and credibility of an organization. By being aware of the types of paperwork needed and maintaining meticulous records, individuals and businesses can avoid legal and financial pitfalls, ultimately paving the way for success and growth.

What is the purpose of an EIN for a business?

+

An Employer Identification Number (EIN) is used to identify a business entity for tax purposes, similar to how a Social Security number is used for individuals. It’s necessary for hiring employees, opening a business bank account, and filing tax returns.

Why are employment contracts important for businesses?

+

Employment contracts are crucial as they outline the terms of employment, including job responsibilities, salary, benefits, and grounds for termination. They protect both the employer and the employee by providing a clear understanding of their obligations and rights.

What are the consequences of not complying with tax paperwork requirements?

+

Failing to comply with tax paperwork requirements can lead to severe penalties, including fines, interest on unpaid taxes, and even business closure in extreme cases. It’s essential to stay on top of tax obligations to avoid these consequences.