Employee Paperwork Requirements

Introduction to Employee Paperwork Requirements

When it comes to hiring new employees, there are numerous legal requirements and documentations that must be fulfilled to ensure compliance with labor laws and regulations. Employee paperwork requirements can vary depending on the country, state, or industry, but there are some common documents that are typically required. In this article, we will explore the various employee paperwork requirements, their importance, and the consequences of non-compliance.

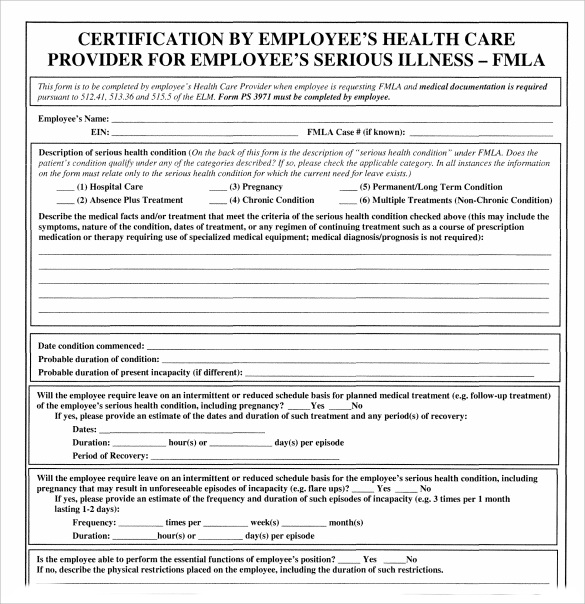

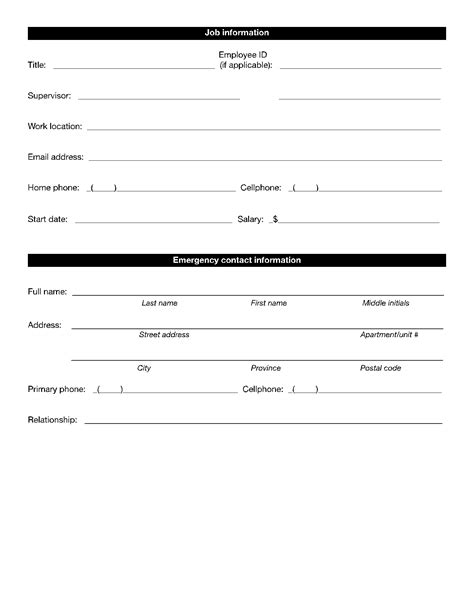

Types of Employee Paperwork Requirements

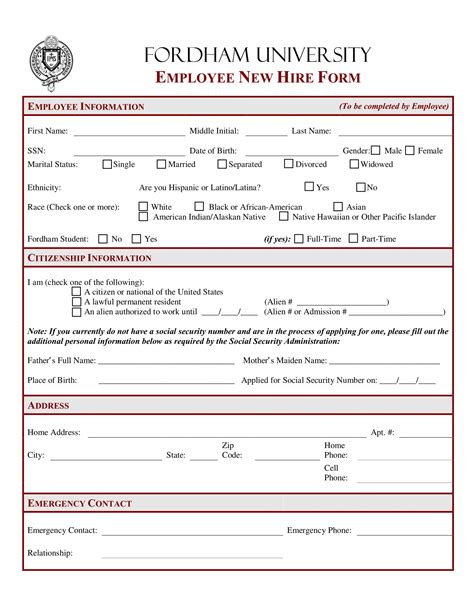

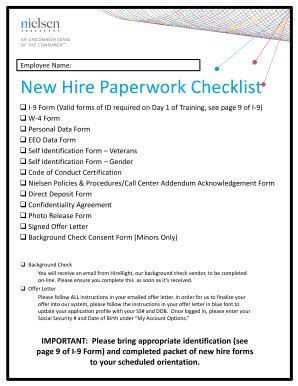

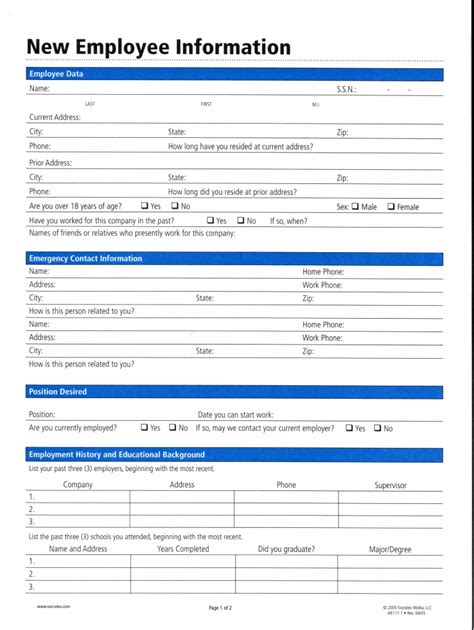

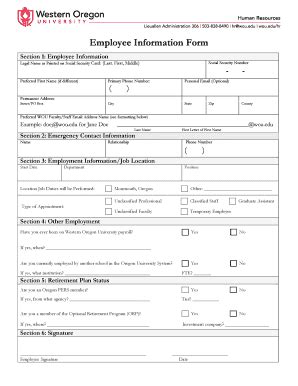

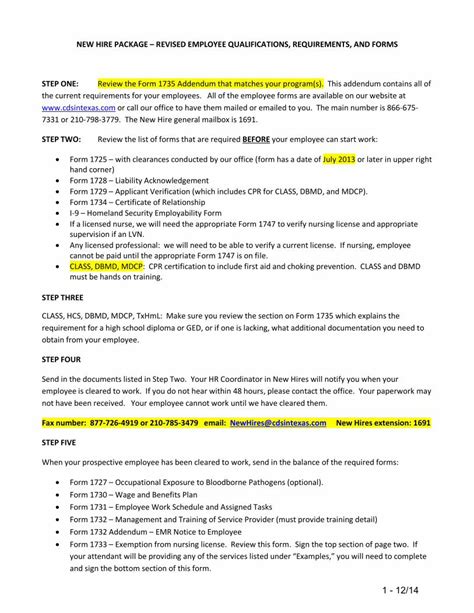

There are several types of employee paperwork requirements that employers must obtain from their employees. These include: * Identification documents: Such as passports, driver’s licenses, or state IDs, which are used to verify the employee’s identity and eligibility to work. * Tax forms: Such as W-4 forms, which are used to determine the amount of taxes to be withheld from the employee’s salary. * Benefits forms: Such as health insurance enrollment forms, which are used to enroll employees in company-sponsored benefits. * Emergency contact information: Which is used in case of an emergency or work-related injury. * Job application and resume: Which are used to verify the employee’s work experience and qualifications.

Importance of Employee Paperwork Requirements

Employee paperwork requirements are crucial for several reasons: * Compliance with labor laws: Failing to obtain the required documents can result in penalties and fines. * Verification of employee identity: Helps to prevent identity theft and ensure that the employee is eligible to work. * Tax compliance: Ensures that the employer is withholding the correct amount of taxes from the employee’s salary. * Benefits administration: Helps to ensure that employees are enrolled in the correct benefits and that the employer is complying with benefits laws.

Consequences of Non-Compliance

Failure to obtain the required employee paperwork can result in serious consequences, including: * Penalties and fines: For non-compliance with labor laws and regulations. * Lawsuits: From employees who claim that their rights have been violated. * Loss of business licenses: In severe cases, failure to comply with employee paperwork requirements can result in the loss of business licenses. * Reputational damage: Non-compliance can damage the employer’s reputation and make it difficult to attract and retain top talent.

📝 Note: Employers must ensure that they are complying with all applicable labor laws and regulations, including those related to employee paperwork requirements.

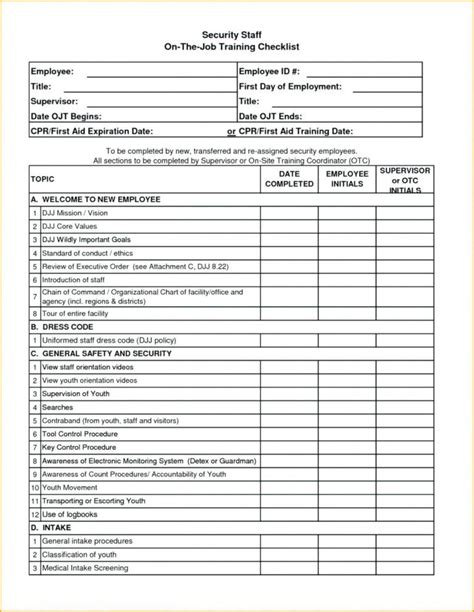

Best Practices for Managing Employee Paperwork

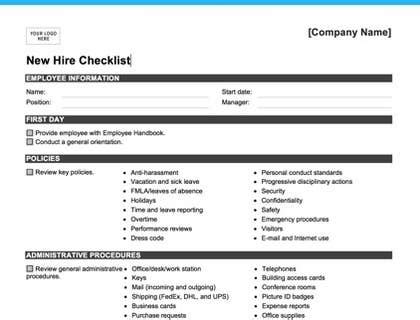

To ensure compliance with employee paperwork requirements, employers should follow these best practices: * Develop a comprehensive onboarding process: That includes obtaining all required documents and verifying employee information. * Use electronic document management systems: To store and manage employee documents securely. * Train HR staff: On the importance of employee paperwork requirements and the consequences of non-compliance. * Conduct regular audits: To ensure that all required documents are up-to-date and compliant with labor laws and regulations.

| Document | Purpose | Retention Period |

|---|---|---|

| W-4 form | Tax withholding | 4 years |

| I-9 form | Verification of employment eligibility | 3 years after hire date or 1 year after termination date |

| Benefits enrollment forms | Enrollment in company-sponsored benefits | 6 years |

In summary, employee paperwork requirements are a critical aspect of the hiring process, and employers must ensure that they are complying with all applicable labor laws and regulations. By following best practices and using electronic document management systems, employers can ensure that they are obtaining all required documents and verifying employee information. This helps to prevent penalties and fines, lawsuits, loss of business licenses, and reputational damage.

What are the consequences of non-compliance with employee paperwork requirements?

+

The consequences of non-compliance with employee paperwork requirements can include penalties and fines, lawsuits, loss of business licenses, and reputational damage.

What is the purpose of the I-9 form?

+

The I-9 form is used to verify the employment eligibility of new hires.

How long must employers retain employee paperwork documents?

+

The retention period for employee paperwork documents varies depending on the type of document, but employers must typically retain documents for at least 3-6 years.