Paperwork

Lien Paperwork Explained

Introduction to Lien Paperwork

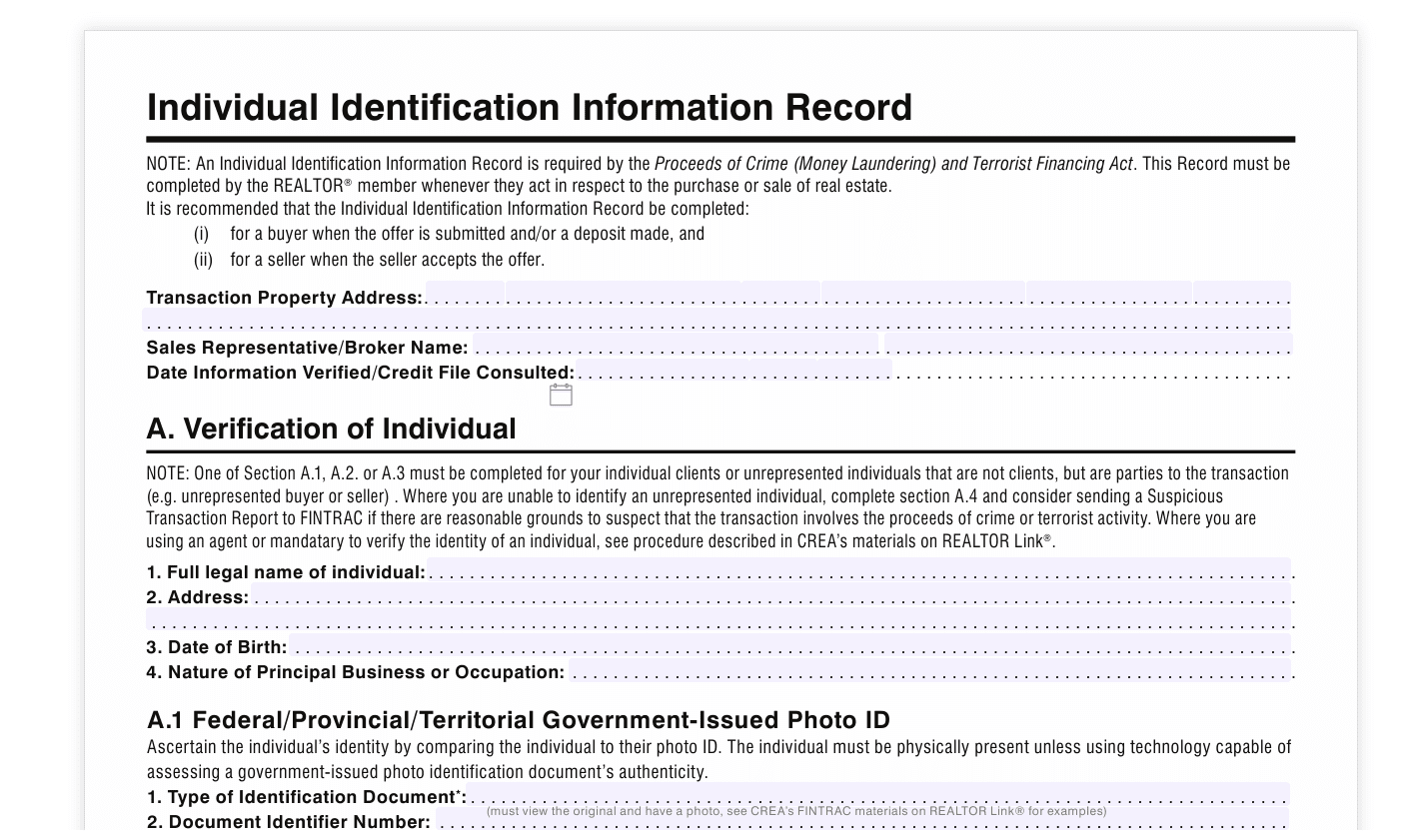

Lien paperwork is a complex and often confusing topic, especially for those who are new to the world of construction and real estate. A lien is a claim or security interest placed on a property to ensure payment for work performed or materials supplied. In this blog post, we will delve into the world of lien paperwork, exploring what it is, why it’s necessary, and how to navigate the process.

What is a Lien?

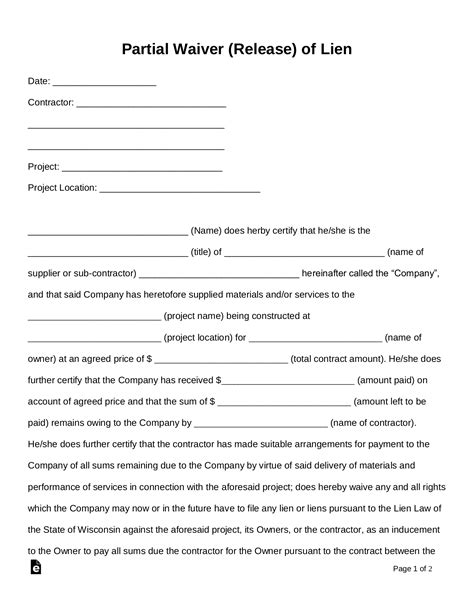

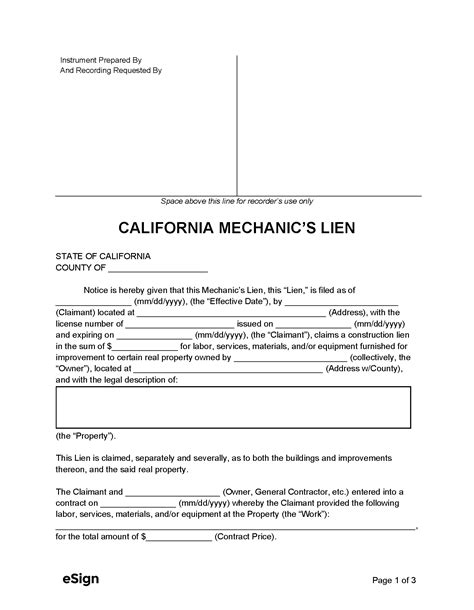

A lien is a legal document that gives a creditor the right to sell a property to satisfy a debt. In the context of construction, a lien is typically filed by a contractor, subcontractor, or supplier who has not been paid for their work or materials. The lien is recorded with the county recorder’s office and is usually filed against the property owner’s title. This means that the property owner cannot sell or refinance the property without first resolving the lien.

Types of Liens

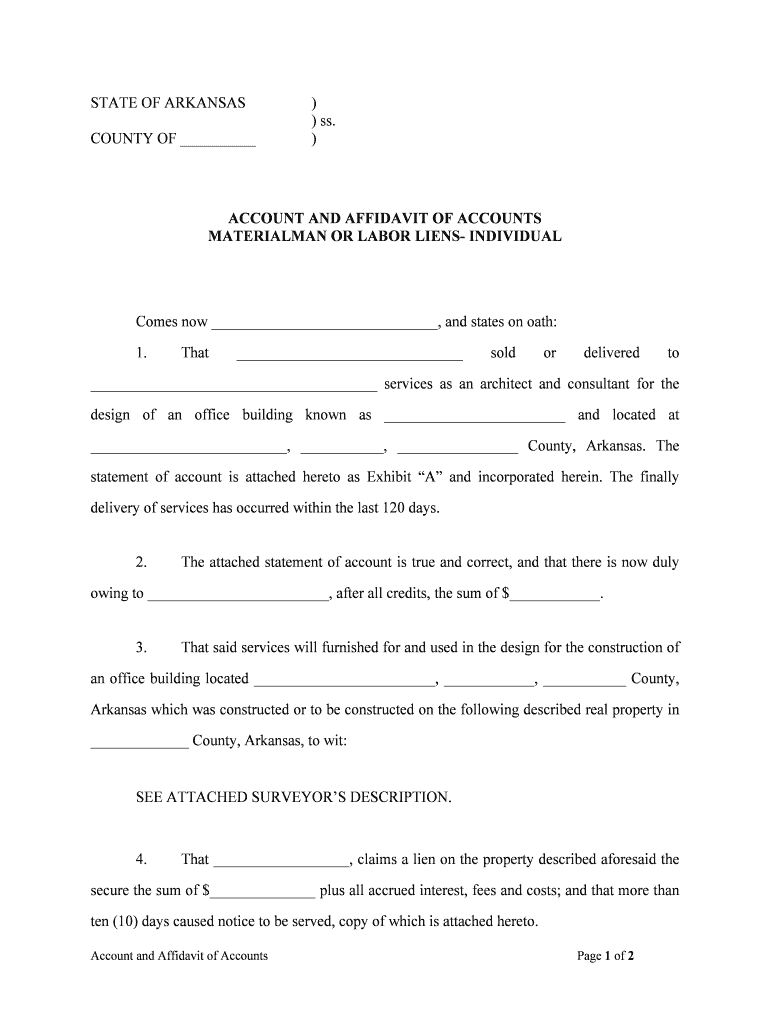

There are several types of liens, including: * Mechanic’s lien: This type of lien is filed by a contractor or subcontractor who has performed work on a property. * Materialman’s lien: This type of lien is filed by a supplier who has provided materials for a construction project. * Judgment lien: This type of lien is filed by a creditor who has obtained a court judgment against a property owner.

The Lien Process

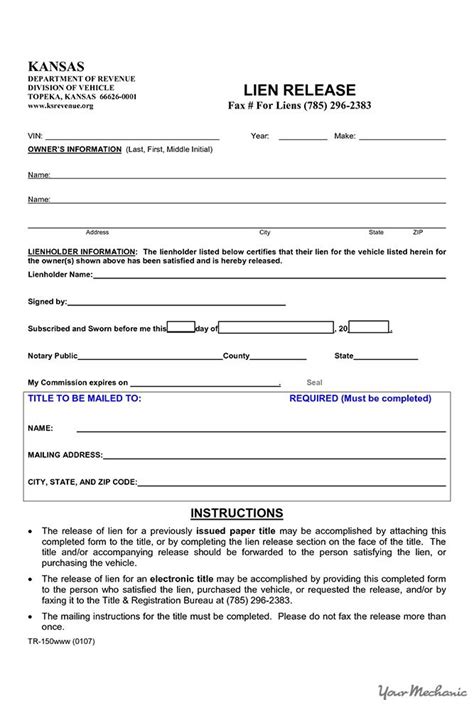

The lien process typically involves the following steps: * Notice of intent: The creditor sends a notice of intent to the property owner, stating their intention to file a lien if payment is not made. * Lien filing: The creditor files the lien with the county recorder’s office. * Recording: The lien is recorded with the county recorder’s office and is usually filed against the property owner’s title. * Notice of lien: The creditor sends a notice of lien to the property owner, informing them that a lien has been filed.

📝 Note: The lien process can vary depending on the state and local laws, so it's essential to understand the specific requirements in your area.

How to Remove a Lien

To remove a lien, the property owner must take the following steps: * Pay the debt: The property owner must pay the debt in full, including any interest and fees. * Obtain a release: The creditor must provide a release of lien, which is a document that states the lien has been satisfied. * Record the release: The release of lien must be recorded with the county recorder’s office.

Consequences of Not Paying a Lien

If a property owner fails to pay a lien, the creditor can take further action, including: * Foreclosure: The creditor can foreclose on the property, which means the property will be sold to satisfy the debt. * Lawsuit: The creditor can file a lawsuit against the property owner to collect the debt.

Best Practices for Avoiding Liens

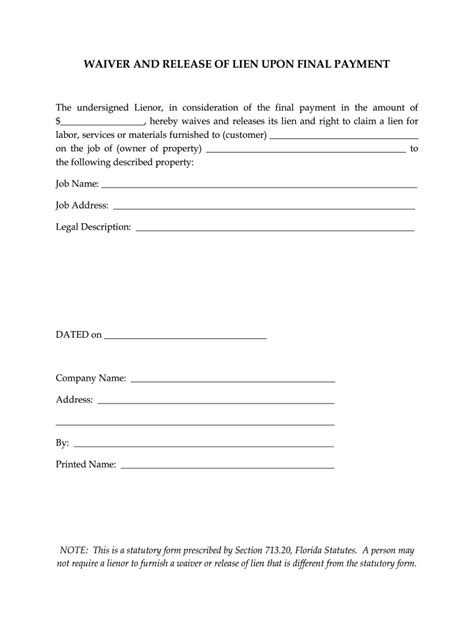

To avoid liens, property owners and contractors should follow these best practices: * Use a payment bond: A payment bond is a type of insurance that guarantees payment to subcontractors and suppliers. * Make timely payments: Property owners should make timely payments to contractors and suppliers to avoid liens. * Use a lien waiver: A lien waiver is a document that waives a contractor’s or supplier’s right to file a lien.

Conclusion Summary

In summary, lien paperwork is a complex topic that requires careful attention to detail. By understanding what a lien is, the types of liens, and the lien process, property owners and contractors can navigate the process with ease. Remember to follow best practices, such as using a payment bond, making timely payments, and using a lien waiver, to avoid liens.

What is a lien waiver?

+

A lien waiver is a document that waives a contractor’s or supplier’s right to file a lien.

How do I remove a lien from my property?

+

To remove a lien, you must pay the debt in full, obtain a release of lien from the creditor, and record the release with the county recorder’s office.

What are the consequences of not paying a lien?

+

If you fail to pay a lien, the creditor can foreclose on your property or file a lawsuit against you to collect the debt.