5 Pension Plan Forms

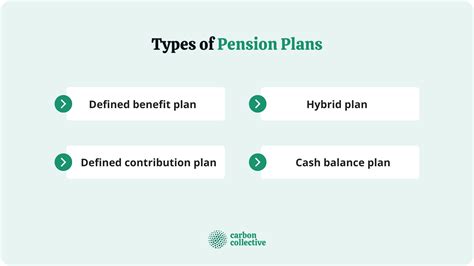

Introduction to Pension Plan Forms

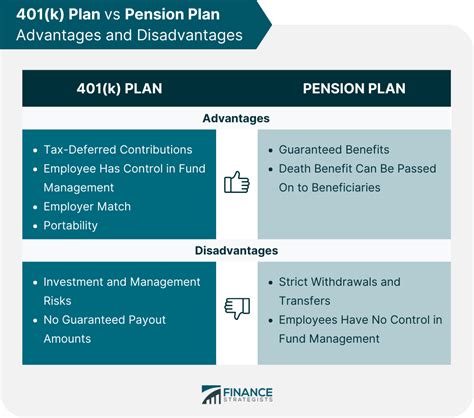

Pension plans are a type of retirement plan that provides a guaranteed income stream to employees after they retire. There are several types of pension plans, including defined benefit plans, defined contribution plans, and hybrid plans. Each type of plan has its own set of rules and requirements, and employers must complete various forms to administer their pension plans. In this article, we will discuss five common pension plan forms that employers must complete.

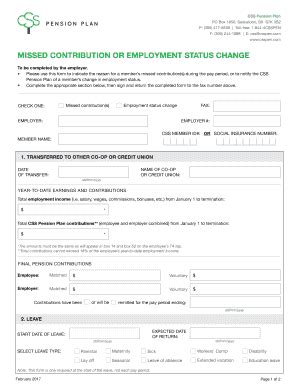

Form 1: Application for Pension Plan Approval

The first form that employers must complete is the application for pension plan approval. This form is typically submitted to the relevant regulatory agency, such as the Internal Revenue Service (IRS) or the Pension Benefit Guaranty Corporation (PBGC). The application must include detailed information about the pension plan, including the plan’s name, type, and benefits. Employers must also provide information about the plan’s funding, investments, and administration.

Form 2: Annual Funding Notice

The annual funding notice is a required form that employers must complete and distribute to plan participants and beneficiaries. The notice provides information about the pension plan’s funding status, including the plan’s assets, liabilities, and funding ratio. The notice must also include information about the plan’s investment performance and any changes to the plan’s benefits or funding.

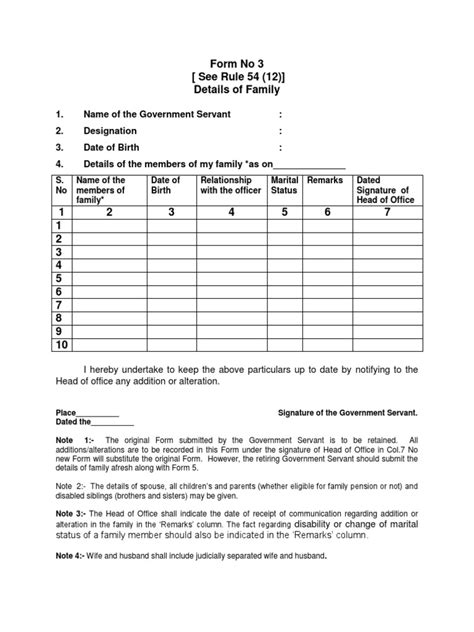

Form 3: Summary Annual Report (SAR)

The summary annual report (SAR) is a required form that employers must complete and distribute to plan participants and beneficiaries. The SAR provides a summary of the pension plan’s financial information, including the plan’s assets, liabilities, and expenses. The SAR must also include information about the plan’s investment performance and any changes to the plan’s benefits or funding.

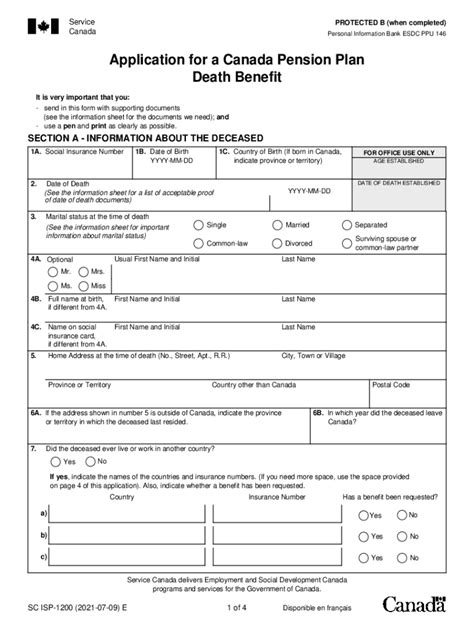

Form 4: Benefit Statement

The benefit statement is a required form that employers must complete and distribute to plan participants and beneficiaries. The statement provides information about the participant’s or beneficiary’s benefits under the pension plan, including the amount of benefits accrued and the vesting schedule. The statement must also include information about the plan’s funding status and any changes to the plan’s benefits or funding.

Form 5: Notice of Plan Termination

The notice of plan termination is a required form that employers must complete and distribute to plan participants and beneficiaries when a pension plan is terminated. The notice must include information about the plan’s termination, including the reason for termination and the impact on plan participants and beneficiaries. The notice must also include information about the plan’s assets, liabilities, and funding status.

📝 Note: Employers must complete and distribute these forms in accordance with the relevant regulations and deadlines to avoid penalties and ensure compliance with pension plan rules.

In addition to these forms, employers must also maintain accurate records and reports, including: * Plan documents and amendments * Funding and investment reports * Participant and beneficiary records * Compliance reports and filings

| Form | Purpose | Frequency |

|---|---|---|

| Application for Pension Plan Approval | Initial plan approval | One-time |

| Annual Funding Notice | Plan funding status | Annual |

| Summary Annual Report (SAR) | Plan financial summary | Annual |

| Benefit Statement | Participant benefit information | Annual or upon request |

| Notice of Plan Termination | Plan termination notice | One-time |

To summarize, pension plan forms are an essential part of administering a pension plan. Employers must complete and distribute these forms in accordance with the relevant regulations and deadlines to ensure compliance with pension plan rules. By understanding the purpose and frequency of each form, employers can better manage their pension plans and provide accurate information to plan participants and beneficiaries. The key points to remember are the different types of pension plan forms, the information required for each form, and the importance of maintaining accurate records and reports. By following these guidelines, employers can ensure that their pension plans are properly administered and that plan participants and beneficiaries receive the benefits they are entitled to.