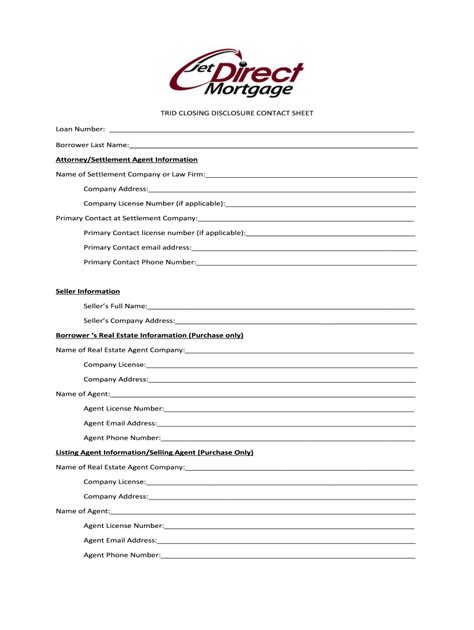

Trid Paperwork Explained

Introduction to Trid Paperwork

The TRID (TILA-RESPA Integrated Disclosure) paperwork is a crucial aspect of the mortgage lending process in the United States. It was introduced by the Consumer Financial Protection Bureau (CFPB) to provide borrowers with a clear understanding of the terms and costs associated with their mortgage. In this article, we will delve into the details of TRID paperwork, its components, and the benefits it offers to borrowers.

What is TRID Paperwork?

TRID paperwork refers to the integrated disclosure forms that lenders are required to provide to borrowers at different stages of the mortgage application process. The primary goal of TRID is to simplify the disclosure process, making it easier for borrowers to understand the terms of their loan. The TRID rule combines the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA) disclosures, providing a more streamlined and transparent process.

Components of TRID Paperwork

The TRID paperwork consists of two primary disclosure forms: the Loan Estimate and the Closing Disclosure. These forms provide borrowers with a detailed breakdown of the loan terms, including the interest rate, monthly payments, and closing costs.

- Loan Estimate (LE): The Loan Estimate is provided to the borrower within three business days of submitting a loan application. It outlines the key terms of the loan, including the loan amount, interest rate, and estimated monthly payments.

- Closing Disclosure (CD): The Closing Disclosure is provided to the borrower at least three business days before the loan closing date. It provides a detailed breakdown of the loan terms, including the loan amount, interest rate, and closing costs.

Benefits of TRID Paperwork

The TRID paperwork offers several benefits to borrowers, including:

- Improved transparency: The TRID disclosures provide borrowers with a clear understanding of the loan terms and costs, enabling them to make informed decisions.

- Simplified process: The integrated disclosure forms reduce the complexity of the mortgage application process, making it easier for borrowers to navigate.

- Enhanced consumer protection: The TRID rule provides borrowers with additional protections, such as the right to review and approve the Closing Disclosure before the loan closing date.

How TRID Paperwork Works

The TRID paperwork process involves several steps:

- Loan Application: The borrower submits a loan application to the lender.

- Loan Estimate: The lender provides the borrower with a Loan Estimate within three business days of submitting the loan application.

- Loan Processing: The lender processes the loan application, ordering appraisals and title reports as necessary.

- Closing Disclosure: The lender provides the borrower with a Closing Disclosure at least three business days before the loan closing date.

- Loan Closing: The borrower reviews and approves the Closing Disclosure, and the loan is closed.

📝 Note: Borrowers should carefully review the TRID disclosures to ensure they understand the loan terms and costs.

TRID Paperwork and the Mortgage Industry

The introduction of TRID paperwork has had a significant impact on the mortgage industry. Lenders must now ensure that they are compliant with the TRID rule, providing borrowers with accurate and timely disclosures. The TRID rule has also led to changes in the way lenders interact with borrowers, with a greater emphasis on transparency and consumer protection.

| Disclosure Form | Purpose | Timing |

|---|---|---|

| Loan Estimate | Outlines key loan terms | Within 3 business days of loan application |

| Closing Disclosure | Provides detailed breakdown of loan terms and costs | At least 3 business days before loan closing |

Best Practices for TRID Compliance

Lenders can ensure TRID compliance by following best practices, such as:

- Providing accurate and timely disclosures: Lenders must ensure that the TRID disclosures are accurate and provided to borrowers within the required timeframe.

- Maintaining detailed records: Lenders should maintain detailed records of the loan application and closing process, including the TRID disclosures.

- Providing borrower education: Lenders can provide borrower education programs to help borrowers understand the TRID disclosures and the loan terms.

As we can see, the TRID paperwork is an essential aspect of the mortgage lending process, providing borrowers with a clear understanding of the loan terms and costs. By understanding the components and benefits of TRID paperwork, borrowers can make informed decisions and navigate the mortgage application process with confidence.

In the end, the TRID paperwork has simplified the mortgage application process, making it easier for borrowers to understand the terms of their loan. With its emphasis on transparency and consumer protection, the TRID rule has had a positive impact on the mortgage industry, providing borrowers with the information they need to make informed decisions.

What is the purpose of the TRID paperwork?

+

The purpose of the TRID paperwork is to provide borrowers with a clear understanding of the loan terms and costs, making it easier for them to make informed decisions.

What are the two primary disclosure forms in the TRID paperwork?

+

The two primary disclosure forms in the TRID paperwork are the Loan Estimate and the Closing Disclosure.

When is the Loan Estimate provided to the borrower?

+

The Loan Estimate is provided to the borrower within three business days of submitting a loan application.