Paperwork

Hiring Paperwork Requirements

Introduction to Hiring Paperwork Requirements

When it comes to hiring new employees, there are numerous paperwork requirements that employers must comply with to ensure a smooth and legal hiring process. These requirements can vary depending on the country, state, or province, but they generally include a range of documents and forms that must be completed and filed. In this article, we will explore the various hiring paperwork requirements that employers need to be aware of, and provide guidance on how to navigate the process.

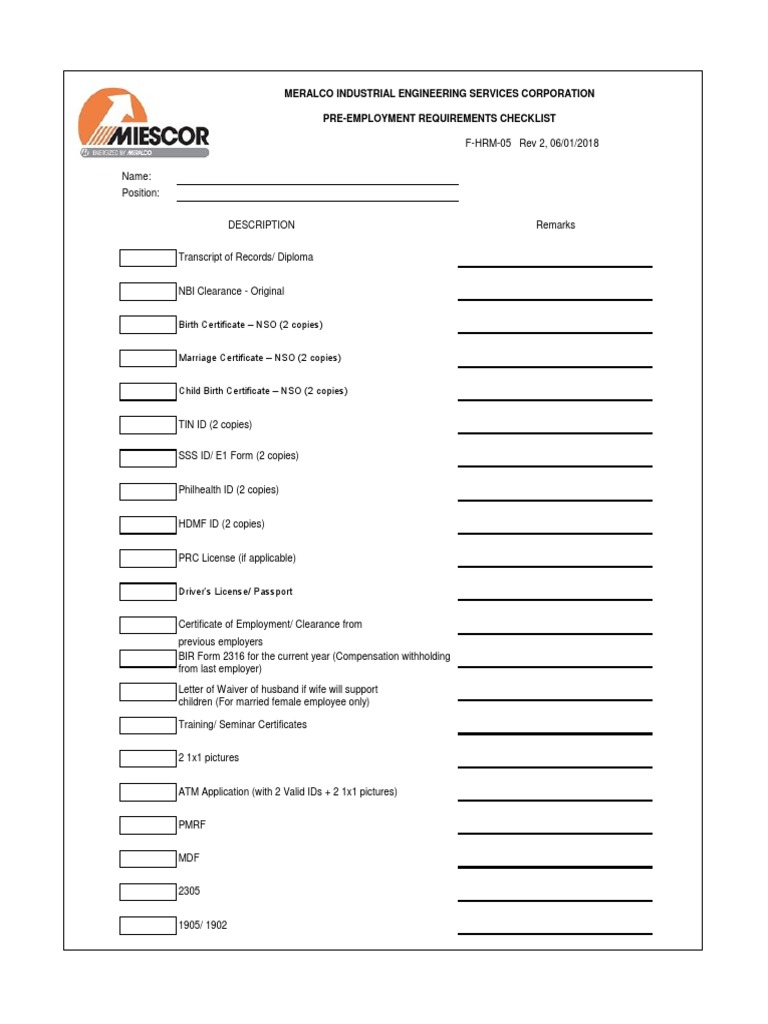

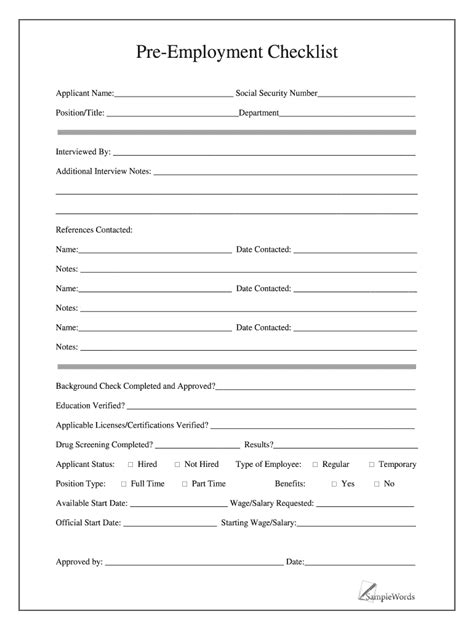

Pre-Hire Paperwork Requirements

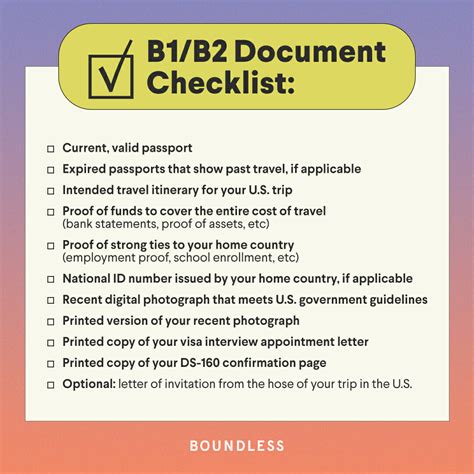

Before hiring a new employee, there are several paperwork requirements that must be completed. These include: * Job application forms: These forms are used to collect information about the applicant’s qualifications, experience, and education. * Resume and cover letter: These documents provide additional information about the applicant’s qualifications and experience. * References: Employers may require applicants to provide professional or personal references to verify their previous work experience and character. * Background check consent forms: Depending on the type of job and industry, employers may require applicants to undergo a background check.

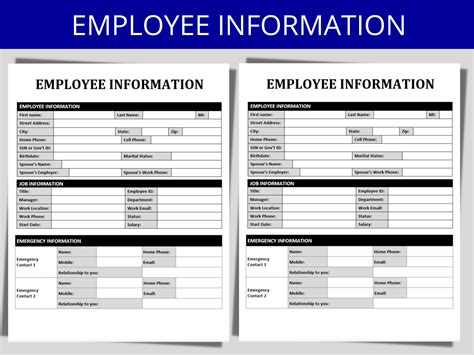

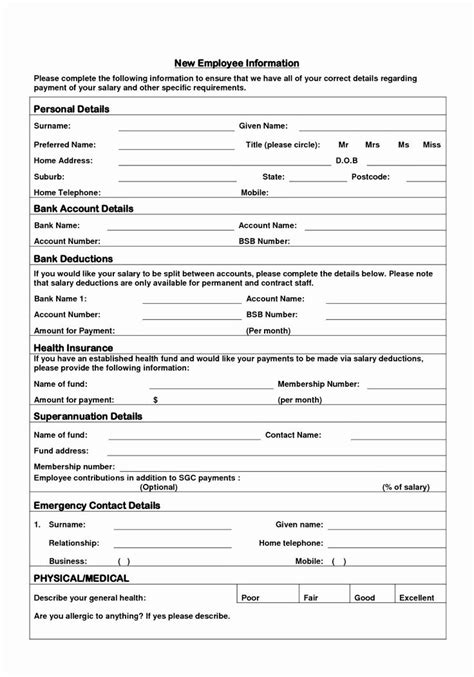

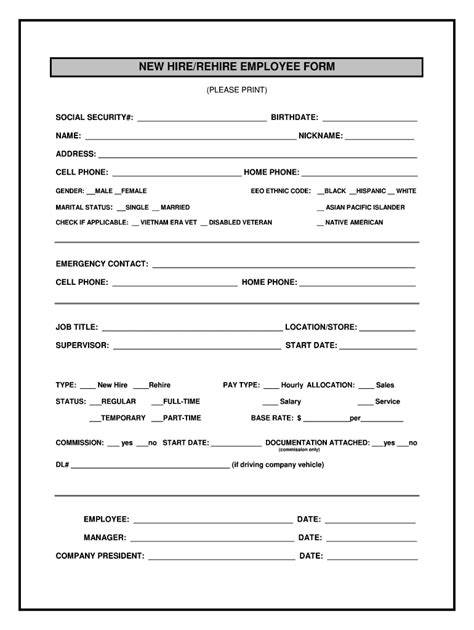

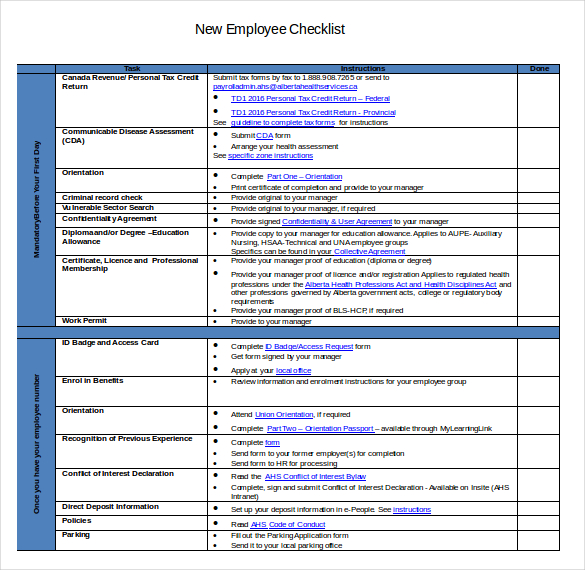

New Hire Paperwork Requirements

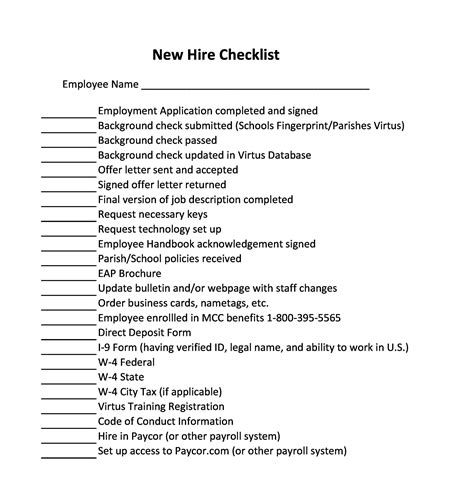

Once an applicant has been selected for a position, there are several new hire paperwork requirements that must be completed. These include: * Employment contract: This document outlines the terms and conditions of employment, including salary, benefits, and job responsibilities. * W-4 form: This form is used to determine the amount of taxes to be withheld from the employee’s paycheck. * I-9 form: This form is used to verify the employee’s identity and eligibility to work in the United States. * Benefits enrollment forms: These forms are used to enroll the employee in company-sponsored benefits, such as health insurance and retirement plans.

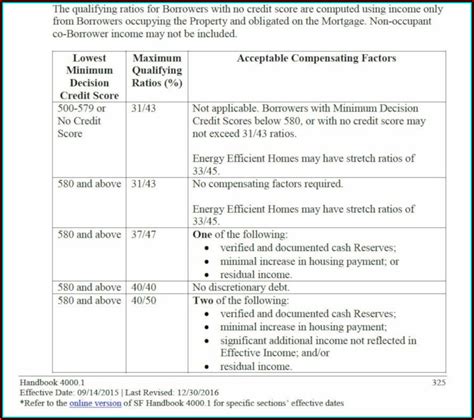

Tax-Related Paperwork Requirements

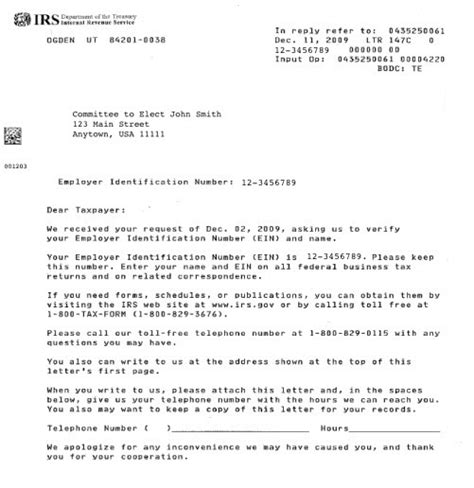

Employers are required to complete several tax-related paperwork requirements for new hires. These include: * W-2 form: This form is used to report the employee’s income and taxes withheld to the Internal Revenue Service (IRS). * 941 form: This form is used to report the employer’s tax liability and payroll taxes to the IRS. * State and local tax forms: Depending on the state and locality, employers may be required to complete additional tax forms, such as state income tax withholding forms and local tax forms.

Other Paperwork Requirements

In addition to the paperwork requirements mentioned above, there are several other requirements that employers must comply with. These include: * OSHA forms: Employers are required to complete OSHA forms to report workplace injuries and illnesses. * Workers’ compensation forms: Employers are required to complete workers’ compensation forms to report workplace injuries and illnesses. * Unemployment insurance forms: Employers are required to complete unemployment insurance forms to report employee separations and pay unemployment insurance taxes.

📝 Note: Employers should consult with their HR department or legal counsel to ensure compliance with all applicable paperwork requirements.

Best Practices for Managing Hiring Paperwork

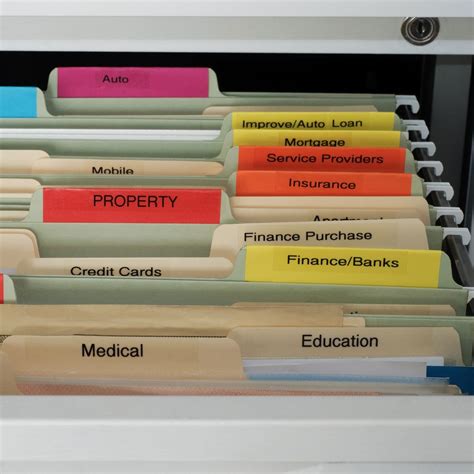

To ensure compliance with hiring paperwork requirements, employers should implement the following best practices: * Develop a comprehensive onboarding process that includes all necessary paperwork requirements. * Use electronic signatures to streamline the paperwork process and reduce errors. * Store paperwork electronically to ensure secure and compliant storage of sensitive employee information. * Provide training to HR staff on hiring paperwork requirements and compliance.

Conclusion

In conclusion, hiring paperwork requirements are a critical aspect of the hiring process that employers must comply with to ensure a smooth and legal hiring process. By understanding the various paperwork requirements and implementing best practices for managing hiring paperwork, employers can reduce errors, ensure compliance, and improve the overall hiring experience for new employees. The key is to stay organized, be thorough, and ensure that all necessary paperwork is completed and filed in a timely manner.

What is the purpose of the I-9 form?

+

The I-9 form is used to verify the identity and eligibility to work in the United States of new employees.

What is the difference between a W-2 and a W-4 form?

+

A W-2 form is used to report an employee’s income and taxes withheld to the IRS, while a W-4 form is used to determine the amount of taxes to be withheld from an employee’s paycheck.

What are the consequences of non-compliance with hiring paperwork requirements?

+

Non-compliance with hiring paperwork requirements can result in fines, penalties, and legal action, as well as damage to an employer’s reputation and relationships with employees.