5 Tax Return Papers

Introduction to Tax Return Papers

When it comes to filing taxes, there are several documents that individuals and businesses must prepare and submit to the relevant authorities. These documents, known as tax return papers, are used to report income, claim deductions and credits, and calculate the amount of taxes owed or refunds due. In this article, we will discuss the five most common tax return papers that individuals and businesses must file.

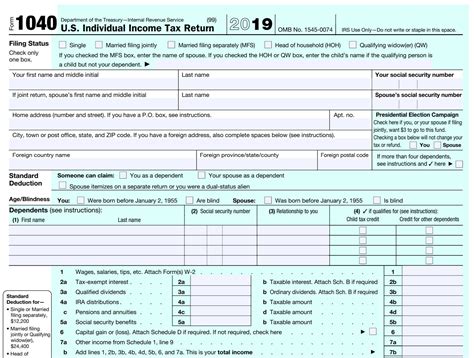

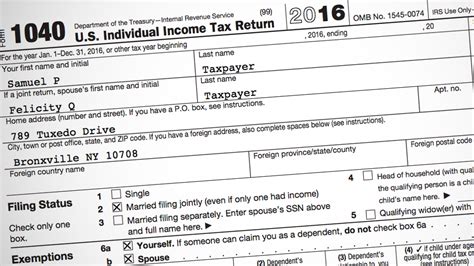

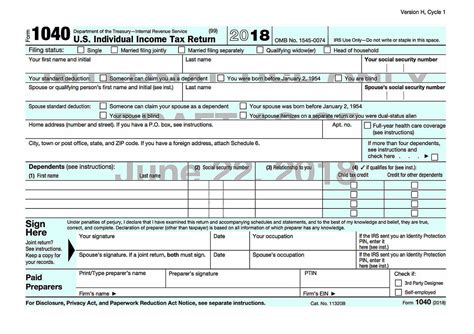

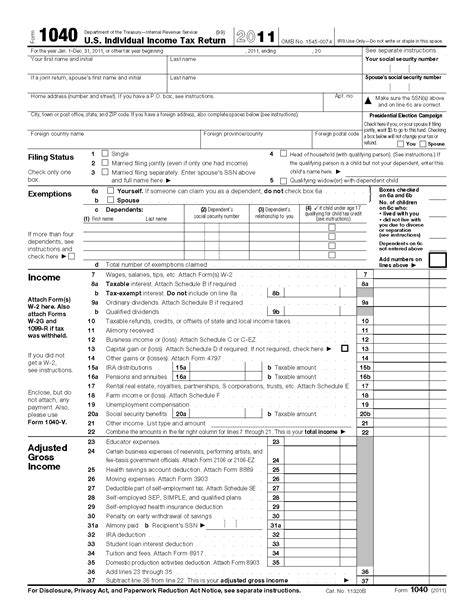

1. Form 1040: Personal Income Tax Return

The Form 1040 is the standard form used by individuals to file their personal income tax returns. This form is used to report income from various sources, such as employment, investments, and self-employment, as well as claim deductions and credits. The form is typically filed annually by April 15th, and it is used to calculate the amount of taxes owed or refunds due.

2. Form 1120: Corporate Income Tax Return

The Form 1120 is the standard form used by corporations to file their income tax returns. This form is used to report income from various sources, such as sales, investments, and other business activities, as well as claim deductions and credits. The form is typically filed annually by March 15th, and it is used to calculate the amount of taxes owed or refunds due.

3. Form 1065: Partnership Income Tax Return

The Form 1065 is the standard form used by partnerships to file their income tax returns. This form is used to report income from various sources, such as sales, investments, and other business activities, as well as claim deductions and credits. The form is typically filed annually by March 15th, and it is used to calculate the amount of taxes owed or refunds due.

4. Form 941: Employer’s Quarterly Federal Tax Return

The Form 941 is the standard form used by employers to file their quarterly federal tax returns. This form is used to report employment taxes, such as Social Security and Medicare taxes, as well as claim credits for certain employment-related expenses. The form is typically filed quarterly, and it is used to calculate the amount of taxes owed or refunds due.

5. Form W-2: Wage and Tax Statement

The Form W-2 is the standard form used by employers to report wage and tax information for their employees. This form is used to report income, taxes withheld, and other relevant information, such as Social Security and Medicare taxes. The form is typically filed annually by January 31st, and it is used to calculate the amount of taxes owed or refunds due.

📝 Note: It is essential to file tax return papers accurately and on time to avoid penalties and interest charges.

Here is a summary of the five tax return papers in a table format:

| Form Number | Form Name | Filing Frequency |

|---|---|---|

| 1040 | Personal Income Tax Return | Annually |

| 1120 | Corporate Income Tax Return | Annually |

| 1065 | Partnership Income Tax Return | Annually |

| 941 | Employer’s Quarterly Federal Tax Return | Quarterly |

| W-2 | Annually |

To ensure compliance with tax laws and regulations, it is essential to understand the different types of tax return papers and their filing requirements. By filing tax return papers accurately and on time, individuals and businesses can avoid penalties and interest charges, and ensure that they are taking advantage of all the deductions and credits available to them.

In summary, tax return papers are an essential part of the tax filing process, and it is crucial to understand the different types of forms and their filing requirements. By filing tax return papers accurately and on time, individuals and businesses can ensure compliance with tax laws and regulations, and avoid penalties and interest charges.

What is the purpose of tax return papers?

+

The purpose of tax return papers is to report income, claim deductions and credits, and calculate the amount of taxes owed or refunds due.

What are the different types of tax return papers?

+

The different types of tax return papers include Form 1040, Form 1120, Form 1065, Form 941, and Form W-2.

What are the filing requirements for tax return papers?

+

The filing requirements for tax return papers vary depending on the type of form and the taxpayer’s situation. Generally, tax return papers are filed annually or quarterly, and the deadline for filing is typically April 15th or March 15th.