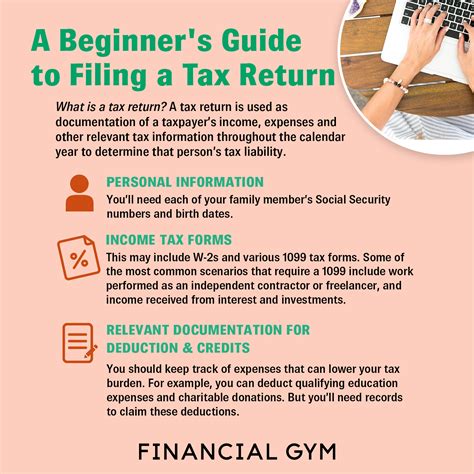

5 Mortgage Tax Forms

Understanding Mortgage Tax Forms

When it comes to mortgage tax forms, there are several documents that homeowners and buyers need to be familiar with. These forms are crucial for claiming tax deductions and credits related to mortgage interest, property taxes, and other expenses. In this article, we will explore five essential mortgage tax forms that you should know about.

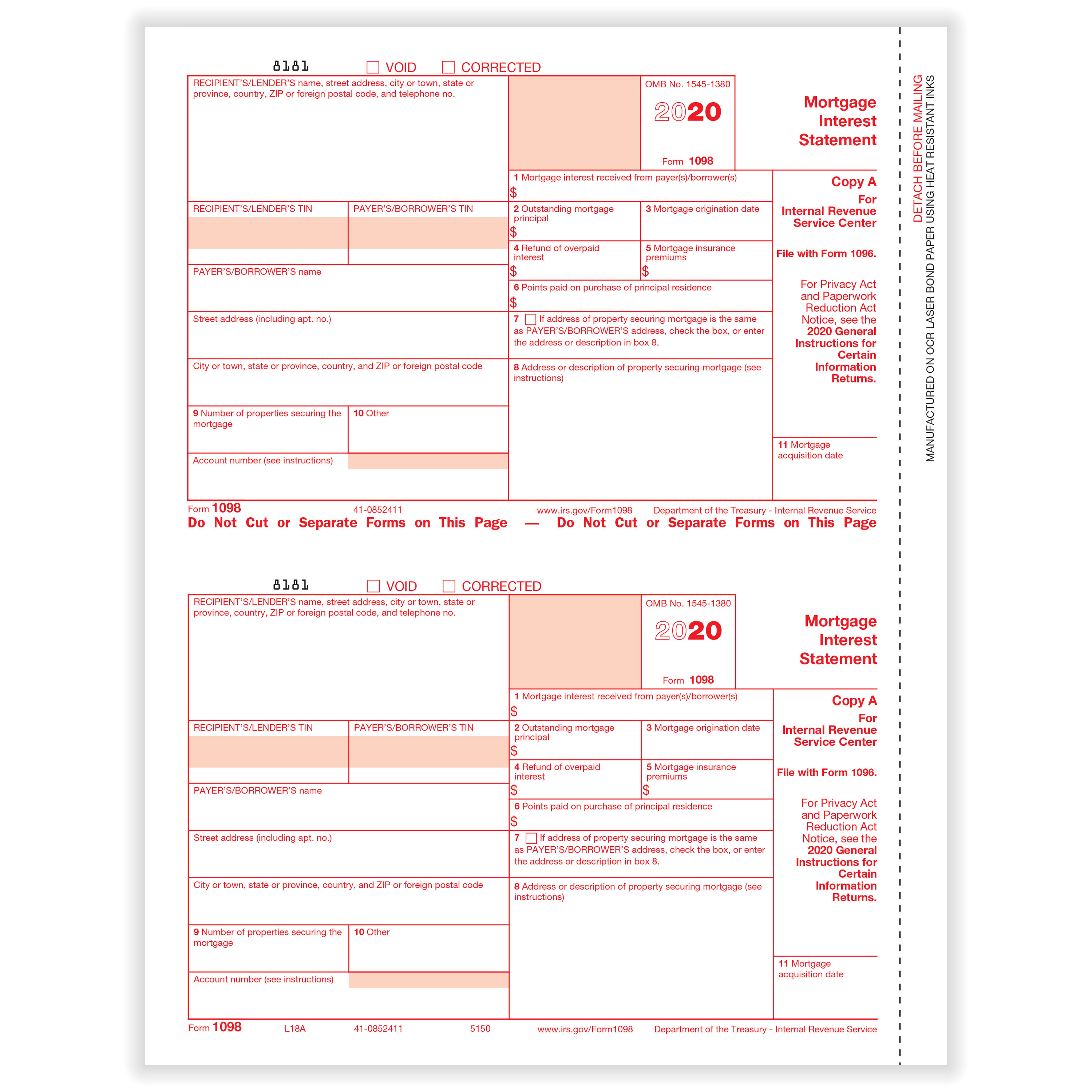

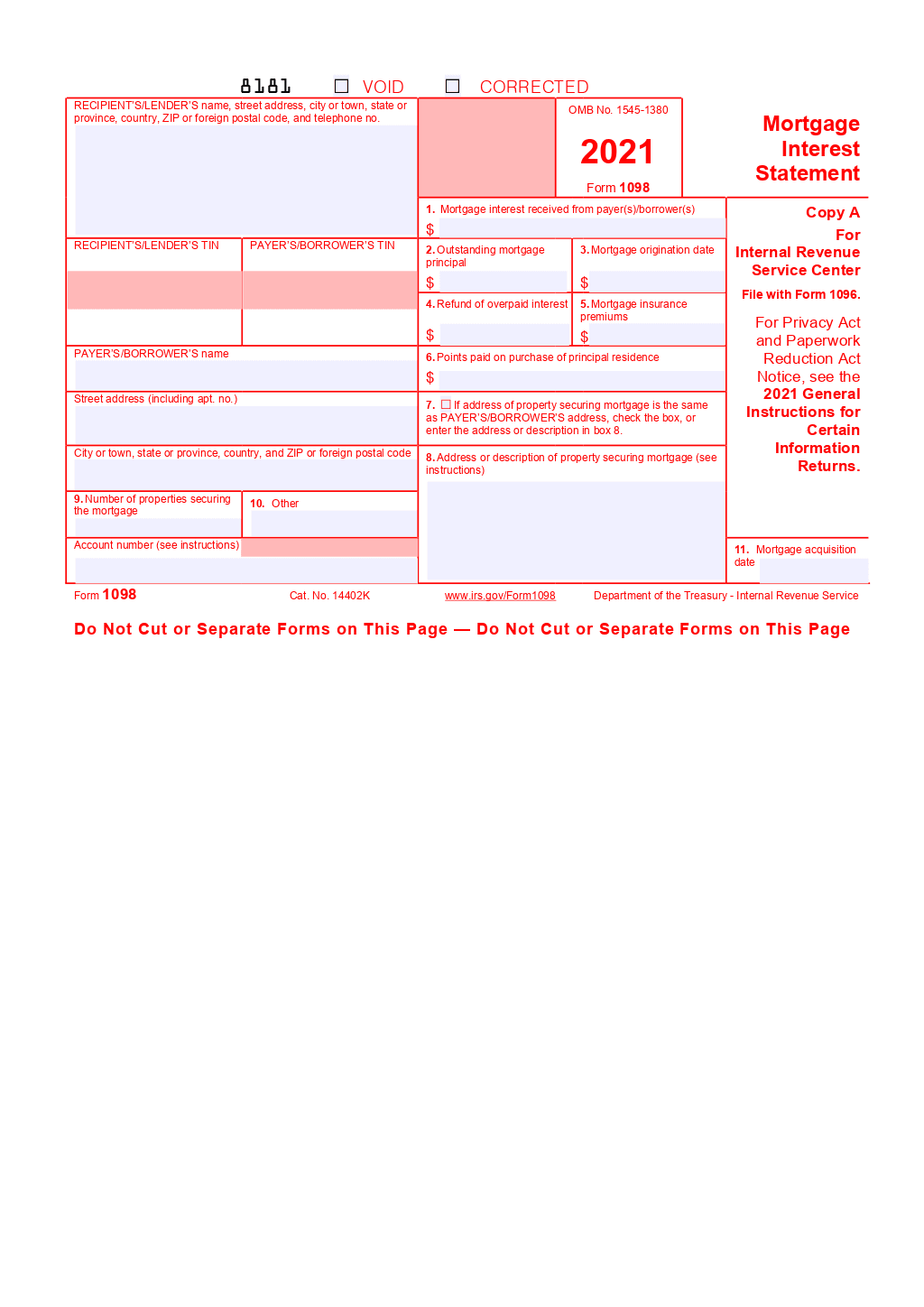

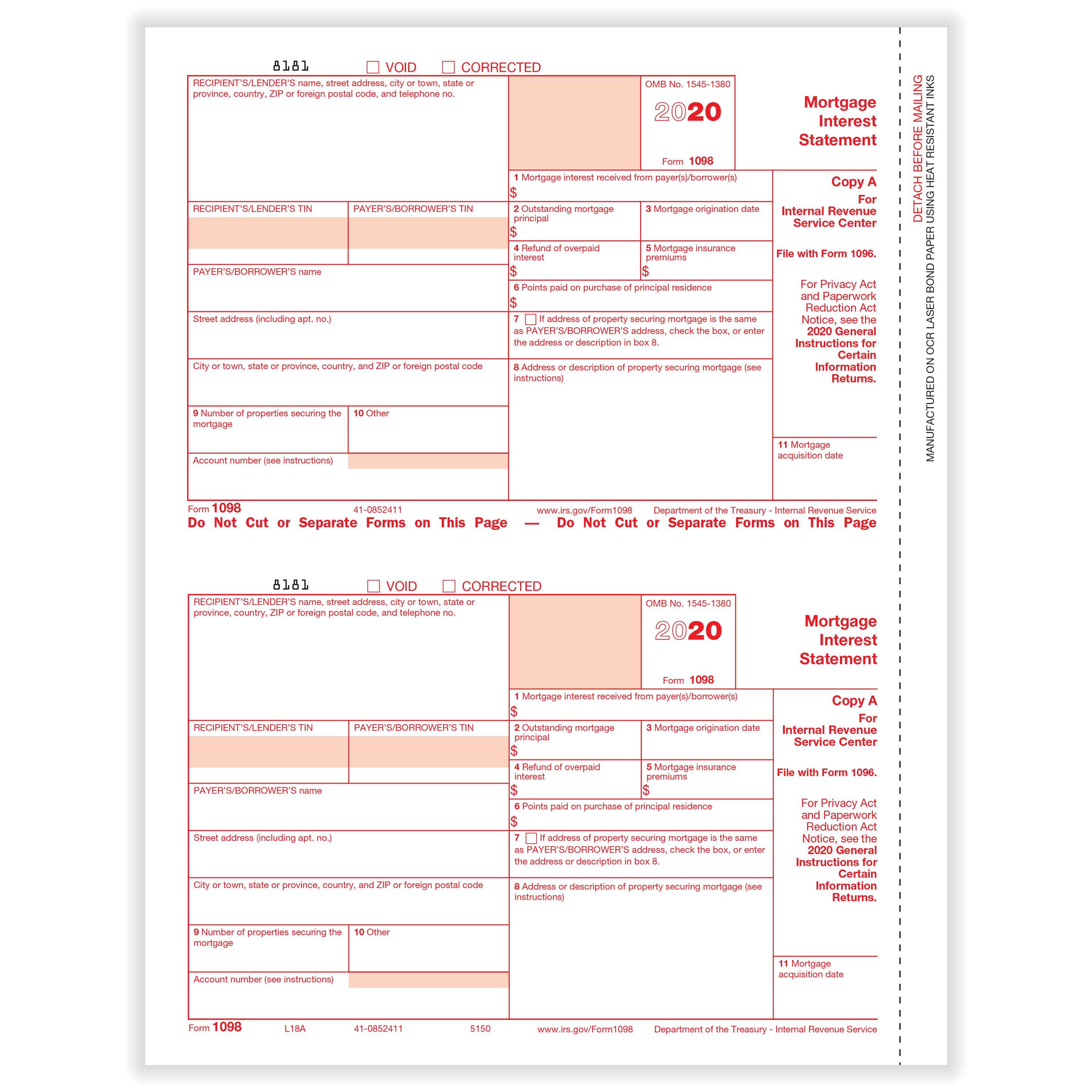

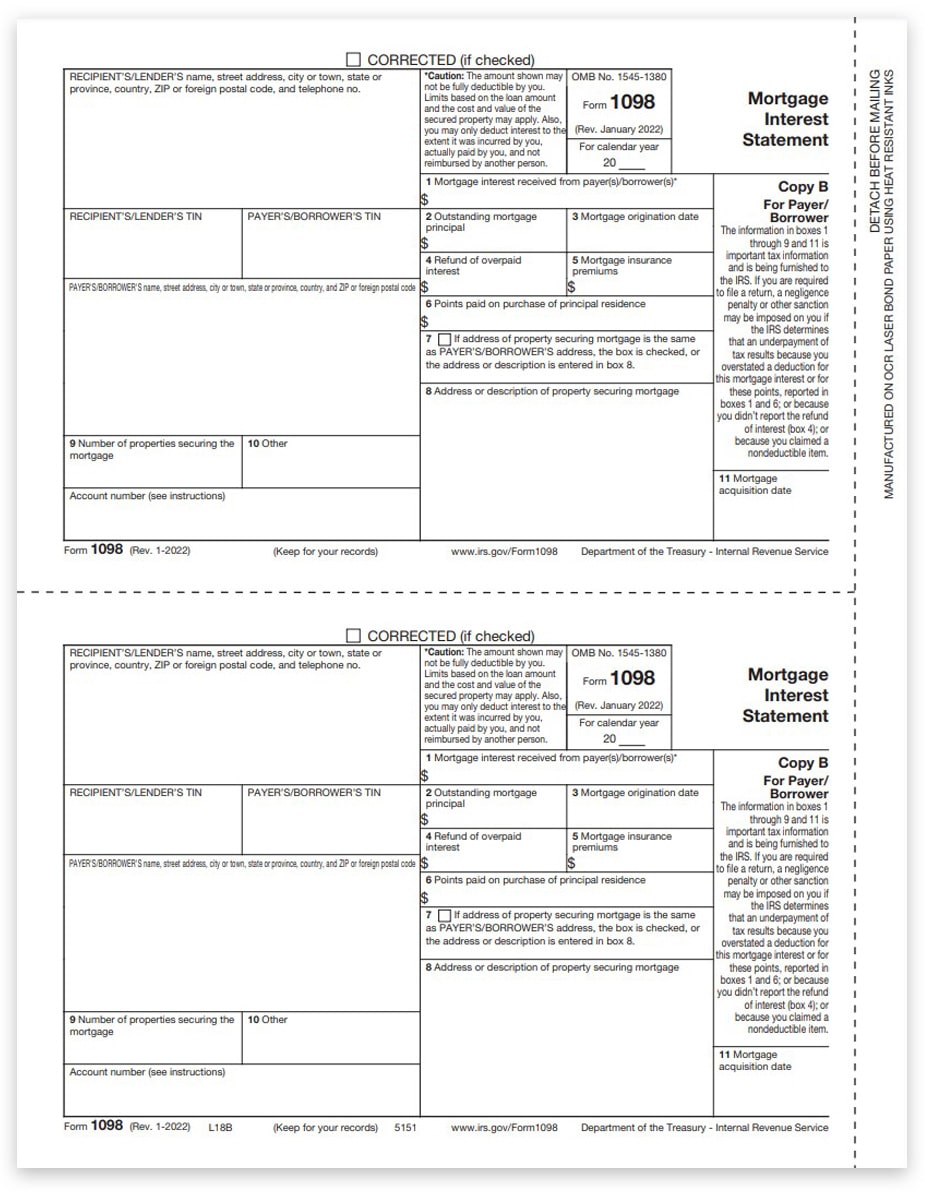

Mortgage Interest Statement (Form 1098)

The Mortgage Interest Statement, also known as Form 1098, is a crucial document that lenders provide to borrowers each year. This form shows the total amount of mortgage interest paid on a loan during the tax year. Homeowners can use this information to claim a mortgage interest deduction on their tax return, which can help reduce their taxable income. To qualify for this deduction, the mortgage must be secured by a primary residence or a second home.

Property Tax Statement

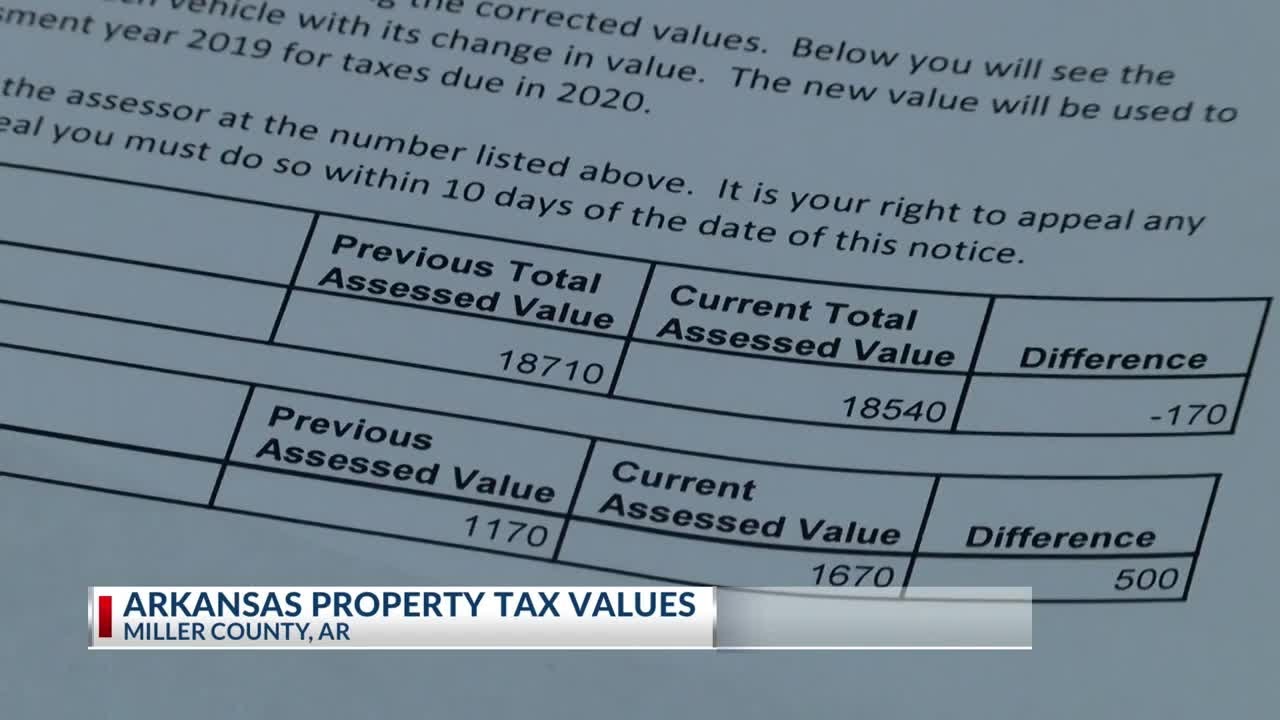

A Property Tax Statement is another important document that homeowners receive from their local government or lender. This statement shows the amount of property taxes paid on a property during the tax year. Like mortgage interest, property taxes are deductible on a tax return, and this statement provides the necessary information to claim this deduction. It’s essential to keep accurate records of property tax payments, as these can add up to significant deductions.

Points Paid on Mortgage (Form 1098)

When buying a home, borrowers may pay points on their mortgage to secure a lower interest rate. These points can be deductible as mortgage interest, but only if they meet specific requirements. The Mortgage Interest Statement (Form 1098) will show the amount of points paid, and borrowers can use this information to claim a deduction. It’s essential to note that points paid on a refinance loan are amortized over the life of the loan, while points paid on a purchase loan can be deducted in the year paid.

Mortgage Credit Certificate (MCC)

A Mortgage Credit Certificate (MCC) is a tax credit program designed for low-income homebuyers. This program allows borrowers to claim a tax credit of up to $2,000 per year for a portion of the mortgage interest paid. To qualify for an MCC, borrowers must meet specific income and purchase price limits, and they must use the property as their primary residence. The MCC program can provide significant tax savings for eligible borrowers, making homeownership more affordable.

Residential Energy Property Credit (Form 5695)

The Residential Energy Property Credit is a tax credit program that incentivizes homeowners to make energy-efficient improvements to their properties. This credit can be claimed for expenses such as solar panels, energy-efficient windows, and insulation. The Residential Energy Property Credit (Form 5695) is used to calculate the credit, which can be up to 30% of the total cost of eligible improvements. This credit can provide significant tax savings for homeowners who invest in energy-efficient upgrades.

📝 Note: It's essential to consult with a tax professional to ensure you are eligible for these tax forms and credits, and to understand the specific requirements and limitations that apply to your situation.

To summarize, the five mortgage tax forms and credits discussed in this article are: * Mortgage Interest Statement (Form 1098) * Property Tax Statement * Points Paid on Mortgage (Form 1098) * Mortgage Credit Certificate (MCC) * Residential Energy Property Credit (Form 5695) These forms and credits can provide significant tax savings for homeowners and buyers, making it essential to understand the requirements and benefits of each.

What is the purpose of the Mortgage Interest Statement (Form 1098)?

+

The Mortgage Interest Statement (Form 1098) shows the total amount of mortgage interest paid on a loan during the tax year, allowing homeowners to claim a mortgage interest deduction on their tax return.

Can I claim a tax credit for energy-efficient improvements to my home?

+

Yes, the Residential Energy Property Credit (Form 5695) allows homeowners to claim a tax credit of up to 30% of the total cost of eligible energy-efficient improvements, such as solar panels and insulation.

What is the Mortgage Credit Certificate (MCC) program?

+

The Mortgage Credit Certificate (MCC) program is a tax credit program designed for low-income homebuyers, allowing them to claim a tax credit of up to $2,000 per year for a portion of the mortgage interest paid.

In the end, understanding these mortgage tax forms and credits can help homeowners and buyers navigate the complex world of tax deductions and credits, making it essential to consult with a tax professional to ensure you are taking advantage of all the tax savings available to you.