5 Mortgage Papers

Understanding the Key Documents Involved in a Mortgage

When navigating the process of obtaining a mortgage, it’s essential to understand the various documents involved. These papers are crucial for both the lender and the borrower, as they outline the terms of the loan, the responsibilities of each party, and the legal framework that governs the mortgage. In this article, we’ll delve into five critical mortgage papers that play a significant role in the mortgage process.

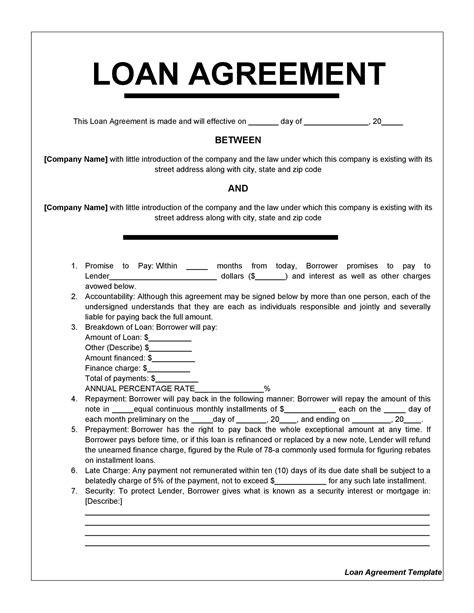

The Promissory Note

The Promissory Note is a document that outlines the borrower’s promise to repay the loan. It includes details such as the loan amount, interest rate, repayment terms, and the borrower’s obligations. This note serves as a legally binding agreement between the lender and the borrower, ensuring that the borrower will make timely payments. The Promissory Note is often accompanied by the mortgage itself, which provides security for the loan by placing a lien on the property.

The Mortgage or Deed of Trust

The Mortgage or Deed of Trust is another vital document in the mortgage process. This document establishes the lender’s lien on the property and outlines the terms under which the lender can seize the property if the borrower defaults on the loan. The Mortgage or Deed of Trust is recorded in public records, providing notice to potential buyers or other creditors that the property is subject to a lien. In some states, a Deed of Trust is used instead of a Mortgage, but both serve the same purpose: to provide security for the loan.

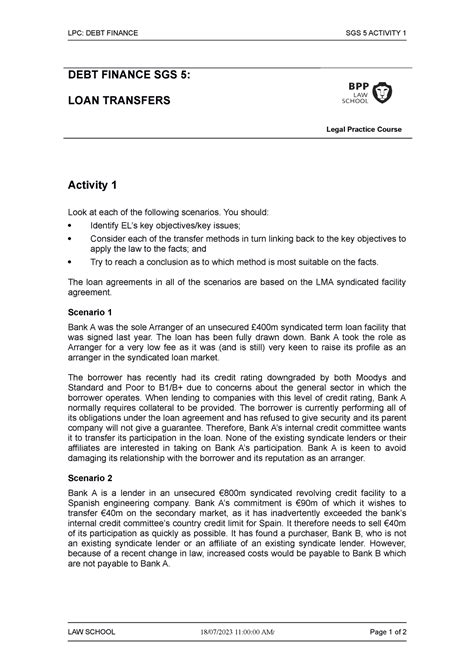

The Truth-in-Lending Disclosure

The Truth-in-Lending Disclosure is a document that provides the borrower with a clear understanding of the loan’s terms and costs. This disclosure is required by federal law and must be provided to the borrower within three business days of applying for the loan. The Truth-in-Lending Disclosure includes information such as the annual percentage rate (APR), the finance charge, and the total payments the borrower will make over the life of the loan. This document helps borrowers compare different loan offers and make informed decisions about their mortgage.

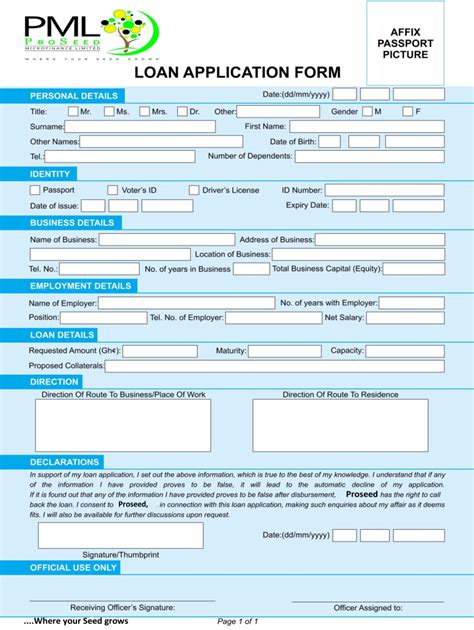

The Good Faith Estimate

The Good Faith Estimate is a document that outlines the estimated costs associated with the mortgage. This estimate includes items such as origination fees, title insurance, and appraisal fees. The Good Faith Estimate is typically provided to the borrower within three business days of applying for the loan and is intended to give the borrower a clear understanding of the costs involved in obtaining the mortgage. While the Good Faith Estimate is not a binding contract, it provides a useful tool for borrowers to compare the costs of different loan offers.

The Closing Disclosure

The Closing Disclosure is a document that provides a final breakdown of the loan’s terms and costs. This disclosure is typically provided to the borrower at least three business days before closing and includes information such as the loan amount, interest rate, and repayment terms. The Closing Disclosure also outlines the borrower’s obligations and the lender’s responsibilities, ensuring that both parties are aware of their roles in the mortgage process.

📝 Note: It's essential to carefully review each of these documents to ensure that you understand the terms and conditions of your mortgage.

To summarize, the five mortgage papers discussed in this article are crucial components of the mortgage process. They provide a framework for the loan, outline the terms and costs, and establish the legal relationship between the lender and the borrower. By understanding these documents, borrowers can make informed decisions about their mortgage and ensure a smooth transaction.

What is the purpose of the Promissory Note?

+

The Promissory Note is a document that outlines the borrower's promise to repay the loan, including details such as the loan amount, interest rate, and repayment terms.

What is the difference between a Mortgage and a Deed of Trust?

+

A Mortgage and a Deed of Trust both provide security for the loan by placing a lien on the property. However, the terms and procedures for foreclosing on the property differ between the two.

What information is included in the Truth-in-Lending Disclosure?

+

The Truth-in-Lending Disclosure includes information such as the annual percentage rate (APR), the finance charge, and the total payments the borrower will make over the life of the loan.

In final consideration, understanding the five mortgage papers is vital for a successful and stress-free mortgage process. By carefully reviewing each document and seeking professional advice when necessary, borrowers can ensure that they are well-informed and prepared for the responsibilities and obligations that come with homeownership.