5 Mortgage Papers

Understanding the Key Documents Involved in a Mortgage Process

When navigating the complex world of mortgage applications, it’s essential to understand the various documents involved. These papers are crucial for both the lender and the borrower, as they outline the terms of the loan, the borrower’s financial situation, and the legal obligations of both parties. In this context, we will delve into five critical mortgage papers that play a significant role in the mortgage process.

The Role of the Mortgage Note

The mortgage note, also known as the promissory note, is a legal document that outlines the borrower’s promise to repay the loan. It includes the loan amount, interest rate, repayment terms, and the borrower’s obligation to make timely payments. This document serves as a contract between the lender and the borrower, detailing the borrower’s commitment to fulfill the loan obligations.

The Mortgage Deed

The mortgage deed, or deed of trust, is another vital document in the mortgage process. This document transfers the legal title of the property from the borrower to the lender as security for the loan. It outlines the lender’s right to sell the property if the borrower defaults on the loan. The mortgage deed is recorded in public records, providing notice to potential buyers or creditors that the property is subject to a mortgage lien.

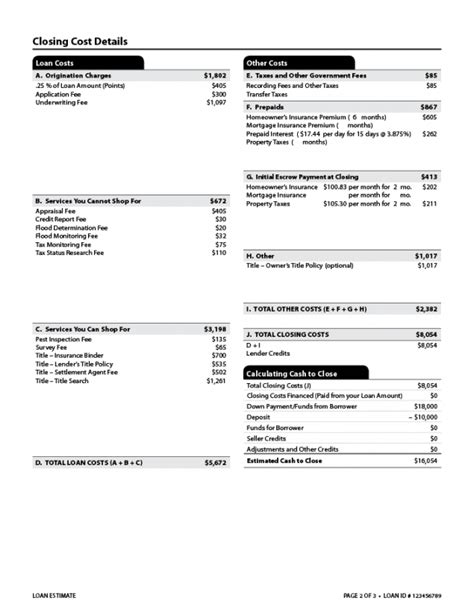

The Good Faith Estimate (GFE)

The Good Faith Estimate (GFE) is a document provided by the lender to the borrower, detailing the estimated costs associated with the mortgage. This includes the loan amount, interest rate, monthly payment, and other expenses such as closing costs and title insurance. The GFE is designed to help borrowers compare offers from different lenders and make informed decisions about their mortgage options.

The Truth-in-Lending (TIL) Disclosure

The Truth-in-Lending (TIL) disclosure is a document that provides borrowers with a clear understanding of the loan’s terms and costs. It includes information such as the annual percentage rate (APR), finance charge, amount financed, and total payments. The TIL disclosure is intended to protect borrowers from deceptive lending practices and ensure they have a comprehensive understanding of their loan obligations.

The Settlement Statement (HUD-1)

The Settlement Statement (HUD-1) is a document that outlines the final terms of the loan and the disbursement of funds. It includes a detailed breakdown of the costs associated with the mortgage, such as closing costs, title insurance, and escrow fees. The Settlement Statement is typically reviewed and signed by the borrower at the loan closing, ensuring that all parties are aware of the final terms and costs of the loan.

📝 Note: It's essential for borrowers to carefully review and understand all the documents involved in the mortgage process to avoid any potential issues or disputes.

Some key points to consider when reviewing mortgage papers include: * Ensuring all documents are complete and accurate * Understanding the terms and conditions of the loan * Reviewing the interest rate and repayment terms * Checking for any errors or discrepancies in the documents * Seeking professional advice if necessary

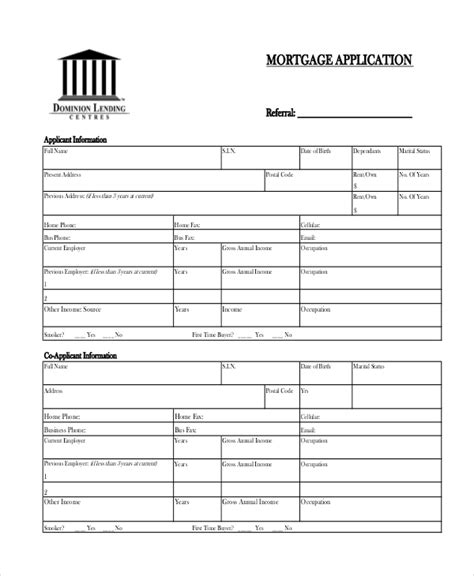

In terms of the mortgage process, the following steps are typically involved: * Pre-approval: The lender reviews the borrower’s creditworthiness and provides a pre-approval letter * Application: The borrower submits a mortgage application, providing financial and personal information * Processing: The lender reviews the application and orders an appraisal of the property * Underwriting: The lender reviews the borrower’s credit report and verifies their income and employment * Closing: The borrower signs the final documents, and the loan is disbursed

| Document | Description |

|---|---|

| Mortgage Note | Outlines the borrower's promise to repay the loan |

| Mortgage Deed | Transfers the legal title of the property from the borrower to the lender |

| Good Faith Estimate (GFE) | Details the estimated costs associated with the mortgage |

| Truth-in-Lending (TIL) Disclosure | Provides a clear understanding of the loan's terms and costs |

| Settlement Statement (HUD-1) | Outlines the final terms of the loan and the disbursement of funds |

In the end, understanding the key documents involved in the mortgage process is crucial for both lenders and borrowers. By carefully reviewing and understanding these documents, borrowers can ensure they are making informed decisions about their mortgage options and avoiding potential pitfalls. The mortgage process can be complex, but with the right knowledge and guidance, borrowers can navigate it with confidence and secure the financing they need to achieve their goals.

What is the purpose of the mortgage note?

+

The mortgage note is a legal document that outlines the borrower’s promise to repay the loan, including the loan amount, interest rate, and repayment terms.

What is the difference between the Good Faith Estimate (GFE) and the Truth-in-Lending (TIL) disclosure?

+

The GFE provides an estimate of the costs associated with the mortgage, while the TIL disclosure provides a clear understanding of the loan’s terms and costs, including the APR and finance charge.

Why is the Settlement Statement (HUD-1) important?

+

The Settlement Statement outlines the final terms of the loan and the disbursement of funds, ensuring that all parties are aware of the final costs and terms of the loan.