Paperwork

5 Insurance Paperworks

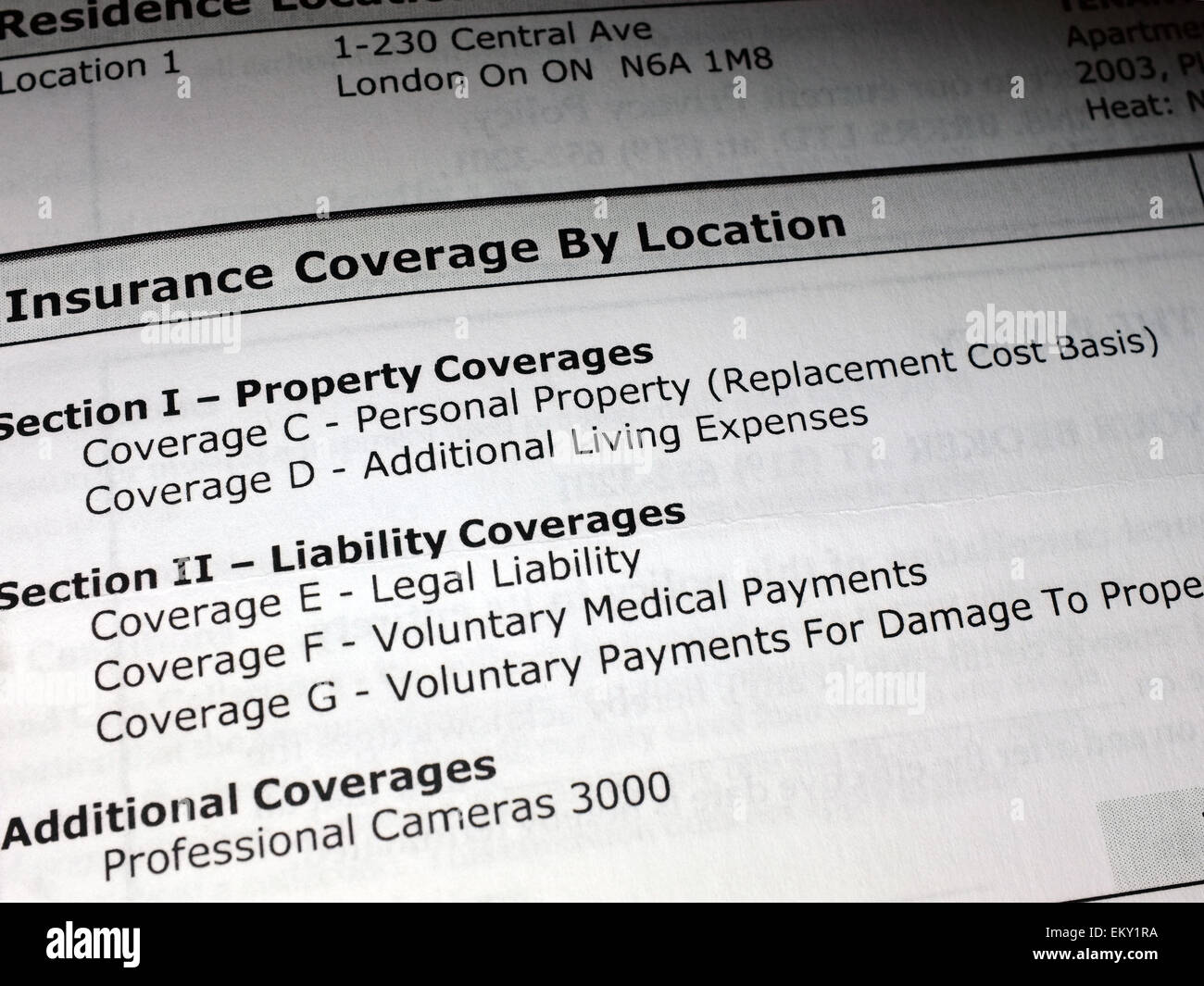

Understanding the Complexities of Insurance Paperwork

Insurance paperwork can be a daunting task for many individuals. The complexity of the documents, coupled with the legal jargon used, can make it difficult to navigate. However, it is essential to understand the various types of insurance paperwork to ensure that you are adequately protected in case of unforeseen circumstances. In this article, we will delve into the world of insurance paperwork, exploring the different types of documents you may encounter and providing tips on how to manage them effectively.

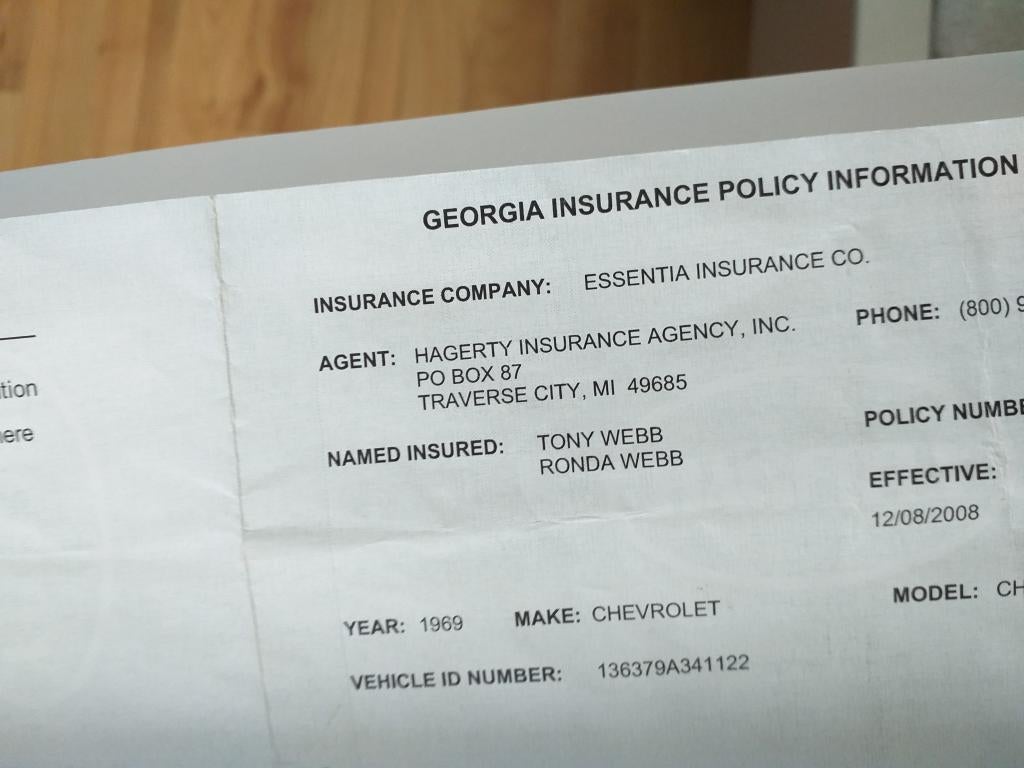

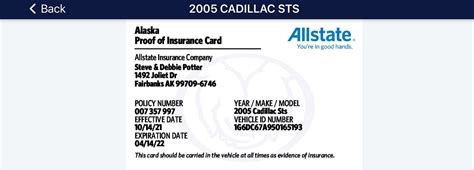

Types of Insurance Paperwork

There are several types of insurance paperwork that you may come across, depending on the type of insurance you have. Some of the most common types of insurance paperwork include: * Policy documents: These documents outline the terms and conditions of your insurance policy, including the coverage, exclusions, and limitations. * Claims forms: These forms are used to submit a claim to your insurance company in the event of a loss or damage. * Proof of insurance: This document serves as proof that you have insurance coverage and is often required by law. * Insurance certificates: These certificates provide a summary of your insurance coverage and are often used to prove insurance coverage to third parties. * Renewal notices: These notices are sent to policyholders to remind them that their policy is up for renewal and to provide information on how to renew their coverage.

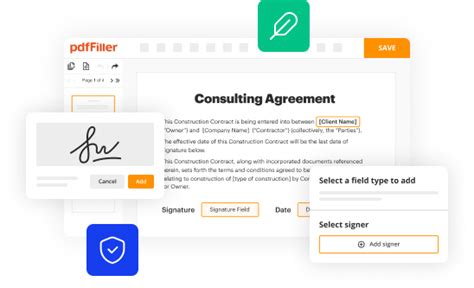

Managing Insurance Paperwork Effectively

Managing insurance paperwork can be a challenging task, but there are several steps you can take to ensure that you stay on top of your documents. Here are a few tips: * Keep all documents in a safe and secure location: This will help prevent loss or damage to your documents and ensure that you can access them when needed. * Review your documents regularly: Regularly reviewing your insurance paperwork can help you stay up-to-date on any changes to your policy and ensure that you understand your coverage. * Make digital copies: Making digital copies of your insurance paperwork can help you stay organized and ensure that you have access to your documents even if the physical copies are lost or damaged. * Stay organized: Keep all your insurance paperwork in one place, such as a file folder or digital storage system, to help you quickly locate the documents you need.

Importance of Accuracy in Insurance Paperwork

Accuracy is crucial when it comes to insurance paperwork. Inaccurate or incomplete information can lead to delays or even denial of claims. It is essential to ensure that all information provided is accurate and up-to-date. Here are a few reasons why accuracy is important: * Avoids delays in claims processing: Inaccurate or incomplete information can cause delays in claims processing, which can lead to financial losses and stress. * Prevents denial of claims: Inaccurate or incomplete information can lead to denial of claims, which can result in significant financial losses. * Ensures compliance with regulations: Accurate and complete information ensures compliance with regulatory requirements, which can help avoid penalties and fines.

Common Mistakes to Avoid in Insurance Paperwork

There are several common mistakes that individuals make when it comes to insurance paperwork. Here are a few mistakes to avoid: * Failing to read and understand policy documents: Failing to read and understand policy documents can lead to misunderstandings about coverage and exclusions. * Not keeping accurate records: Failing to keep accurate records can lead to delays or denial of claims. * Not reviewing and updating documents regularly: Failing to review and update documents regularly can lead to outdated information and potential gaps in coverage.

📝 Note: It is essential to keep accurate records and review documents regularly to ensure that you have adequate coverage and to avoid potential mistakes.

Conclusion

In conclusion, insurance paperwork can be complex and overwhelming, but understanding the different types of documents and managing them effectively can help ensure that you are adequately protected in case of unforeseen circumstances. By following the tips outlined in this article, you can stay on top of your insurance paperwork and avoid common mistakes that can lead to delays or denial of claims. Remember to always keep accurate records, review documents regularly, and seek professional advice if needed.

What is the importance of accuracy in insurance paperwork?

+

Accuracy is crucial in insurance paperwork as it helps avoid delays or denial of claims, ensures compliance with regulations, and prevents financial losses.

How can I manage my insurance paperwork effectively?

+

You can manage your insurance paperwork effectively by keeping all documents in a safe and secure location, reviewing your documents regularly, making digital copies, and staying organized.

What are some common mistakes to avoid in insurance paperwork?

+

Some common mistakes to avoid in insurance paperwork include failing to read and understand policy documents, not keeping accurate records, and not reviewing and updating documents regularly.