5 Tax Forms LLC

Understanding the Tax Forms for LLC: A Comprehensive Guide

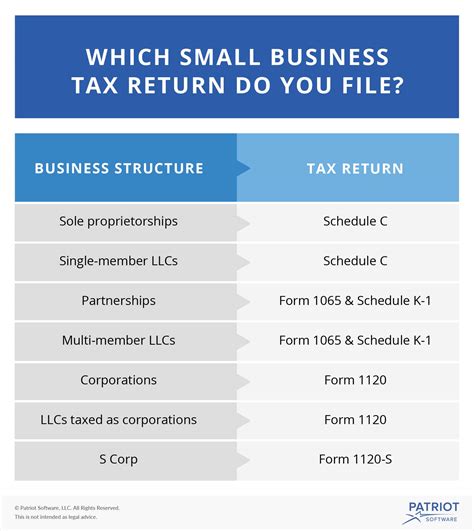

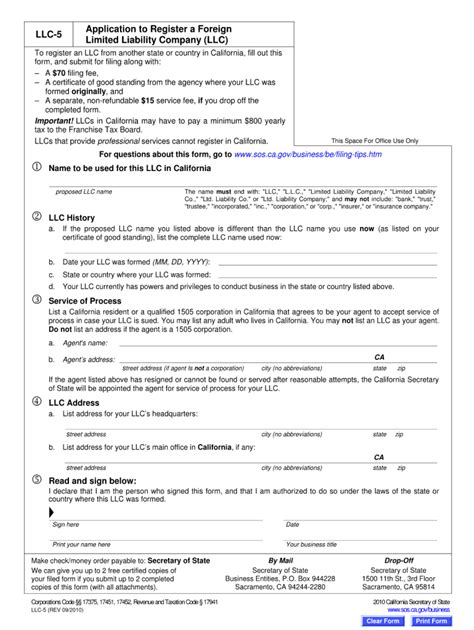

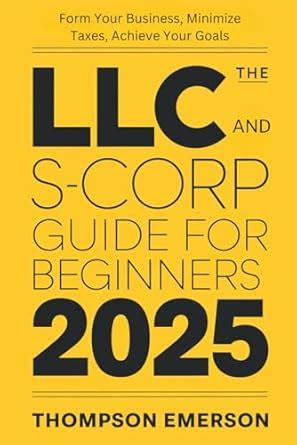

As a Limited Liability Company (LLC) owner, navigating the complex world of taxes can be overwhelming. With numerous tax forms to consider, it’s essential to understand which ones apply to your business and how to accurately complete them. In this article, we’ll delve into the 5 key tax forms that LLCs need to be familiar with, exploring their purposes, requirements, and deadlines.

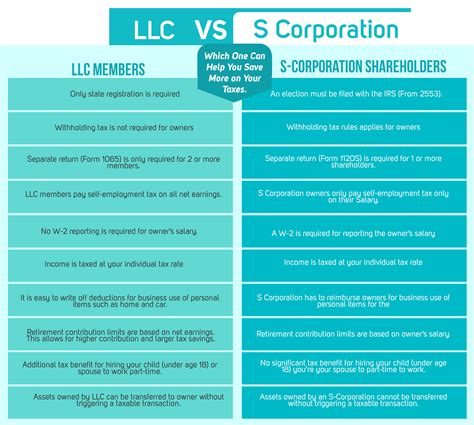

1. Form 1065: U.S. Return of Partnership Income

For LLCs classified as partnerships, Form 1065 is a crucial tax form. This form reports the LLC’s income, deductions, gains, losses, and credits. It’s used to calculate the LLC’s taxable income, which is then allocated to each partner based on their ownership percentage. The deadline for filing Form 1065 is March 15th of each year, and it’s essential to ensure accurate completion to avoid any penalties or delays.

2. Form 1120: U.S. Corporation Income Tax Return

If your LLC is classified as a corporation, you’ll need to file Form 1120. This form is used to report the LLC’s income, deductions, and credits, as well as calculate its tax liability. The deadline for filing Form 1120 is April 15th of each year. It’s vital to accurately complete this form, as errors can result in penalties and interest on any unpaid taxes.

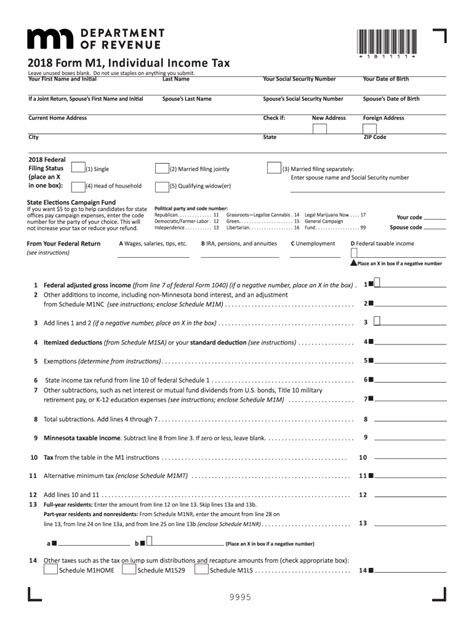

3. Form 1040: U.S. Individual Income Tax Return

As an LLC owner, you’ll also need to report your business income on your personal tax return (Form 1040). This is because the LLC’s income is passed through to the owners, who then report it on their individual tax returns. You’ll need to complete Schedule C (Form 1040) to report your business income and expenses. The deadline for filing Form 1040 is April 15th of each year.

4. Form 940: Employer’s Annual Federal Unemployment (FUTA) Tax Return

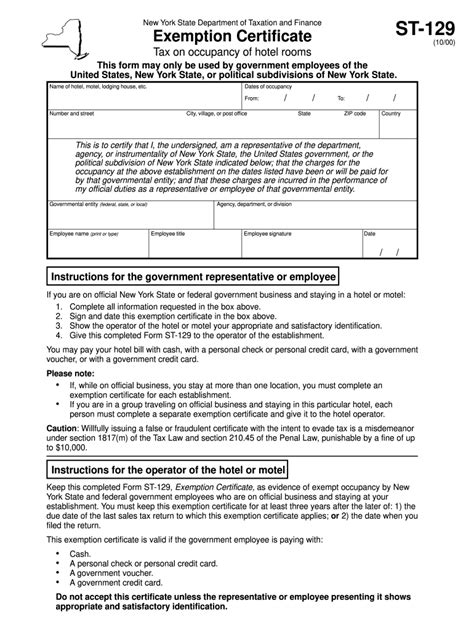

If your LLC has employees, you’ll need to file Form 940 to report your federal unemployment tax liability. This tax is used to fund state workforce agencies and provide unemployment benefits to eligible employees. The deadline for filing Form 940 is January 31st of each year. You’ll need to report your FUTA tax liability and pay any due taxes to avoid penalties and interest.

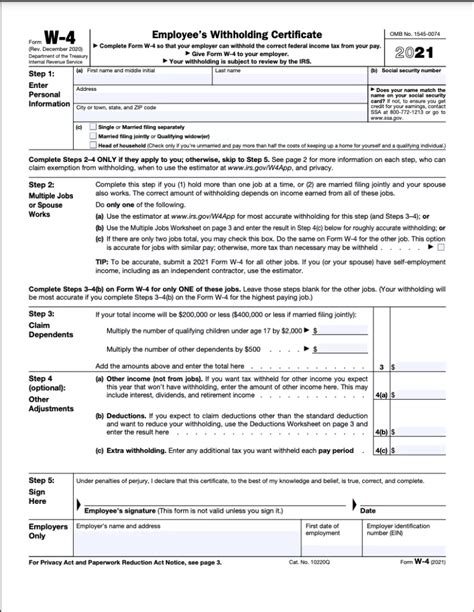

5. Form W-2: Wage and Tax Statement

As an employer, you’re required to provide each employee with a Form W-2 by January 31st of each year. This form reports the employee’s wages, tips, and other compensation, as well as the taxes withheld. You’ll also need to file a copy of Form W-2 with the Social Security Administration (SSA) by January 31st. Accurate completion of this form is crucial, as errors can result in penalties and delays in processing tax returns.

📝 Note: It's essential to consult with a tax professional or accountant to ensure you're meeting all the necessary tax requirements for your LLC. They can help you navigate the complex tax landscape and ensure accurate completion of all required tax forms.

In addition to these tax forms, LLCs may need to file other forms, such as Form 1099-MISC for independent contractors or Form 4562 for depreciation and amortization. It’s crucial to stay organized and keep accurate records to ensure compliance with all tax requirements.

To help you better understand the tax forms and requirements, here’s a summary table:

| Form Number | Form Name | Deadline |

|---|---|---|

| 1065 | U.S. Return of Partnership Income | March 15th |

| 1120 | U.S. Corporation Income Tax Return | April 15th |

| 1040 | U.S. Individual Income Tax Return | April 15th |

| 940 | Employer's Annual Federal Unemployment (FUTA) Tax Return | January 31st |

| W-2 | Wage and Tax Statement | January 31st |

In conclusion, understanding the various tax forms required for LLCs is crucial for maintaining compliance and avoiding penalties. By familiarizing yourself with these 5 key tax forms, you’ll be better equipped to navigate the complex tax landscape and ensure accurate completion of all required forms. Remember to consult with a tax professional or accountant to ensure you’re meeting all the necessary tax requirements for your LLC.

What is the deadline for filing Form 1065?

+

The deadline for filing Form 1065 is March 15th of each year.

Do I need to file Form 1120 if my LLC is classified as a partnership?

+

No, if your LLC is classified as a partnership, you’ll need to file Form 1065 instead of Form 1120.

What is the purpose of Form W-2?

+

Form W-2 is used to report an employee’s wages, tips, and other compensation, as well as the taxes withheld.