5 Mortgage Paperwork Tips

Understanding the Mortgage Process

When purchasing a home, one of the most critical steps is navigating the mortgage process. This involves a significant amount of paperwork, which can be overwhelming for many buyers. The mortgage paperwork process is designed to ensure that both the lender and the borrower are protected and that the terms of the loan are clearly understood by both parties. However, this process can be complex and time-consuming. In this article, we will delve into the details of mortgage paperwork, providing you with essential tips to make this process smoother and less daunting.

Tip 1: Gather All Necessary Documents

Before applying for a mortgage, it’s crucial to gather all the necessary documents. These typically include:

- Identification documents (such as a driver’s license or passport)

- Proof of income (pay stubs, W-2 forms, etc.)

- Proof of employment (letter from your employer, etc.)

- Tax returns for the past few years

- Bank statements and investment accounts

- Credit reports

Tip 2: Understand the Loan Options

There are various types of mortgage loans available, each with its own set of advantages and disadvantages. Fixed-rate loans offer predictable monthly payments, while adjustable-rate loans may offer lower initial interest rates but can increase over time. Other options include FHA loans, VA loans, and USDA loans, each with specific eligibility criteria. Understanding the differences between these loan types can help you choose the one that best suits your financial situation and goals.

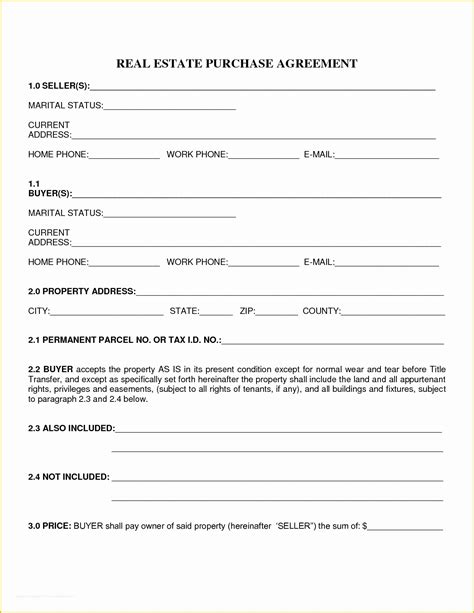

Tip 3: Review and Understand the Mortgage Contract

The mortgage contract is a legally binding document that outlines the terms of your loan, including the interest rate, repayment terms, and any penalties for late payments. It’s essential to carefully review this document to ensure you understand all the terms and conditions. Look for details such as:

- The total cost of the loan

- The monthly payment amount

- The interest rate and whether it’s fixed or adjustable

- Any prepayment penalties

- The loan term (e.g., 15 years, 30 years)

Tip 4: Consider Working with a Mortgage Broker

A mortgage broker can act as an intermediary between you and potential lenders. They can help you navigate the mortgage market, find the best loan options for your situation, and assist with the application process. Mortgage brokers often have relationships with multiple lenders, which can give you access to a wider range of loan products. However, be aware that using a mortgage broker may come with additional costs, such as brokerage fees.

Tip 5: Keep Detailed Records

Throughout the mortgage process, you’ll be dealing with a lot of paperwork and communication with your lender. It’s crucial to keep detailed records of all correspondence, including emails, letters, and phone calls. This can help prevent misunderstandings and provide a paper trail in case any disputes arise. Consider keeping a folder or digital file with all your mortgage-related documents, including:

| Document Type | Description |

|---|---|

| Mortgage Application | The initial application for the mortgage |

| Loan Estimate | A document outlining the terms of the loan |

| Closing Disclosure | A final document detailing the loan terms before closing |

| Identification Documents | Documents used to verify your identity |

By keeping these records organized, you can ensure a smoother mortgage process and easier access to important information when you need it.

📝 Note: Always review your mortgage contract carefully before signing, as it is a legally binding document.

As you navigate the complex world of mortgage paperwork, remembering these tips can make a significant difference in your experience. From gathering necessary documents to understanding the loan options and reviewing the mortgage contract, being prepared and informed is key. By taking a proactive and detailed approach to the mortgage process, you can ensure that you find the right loan for your needs and set yourself up for long-term financial success.

The process of obtaining a mortgage and the subsequent homeownership is a significant milestone for many individuals and families. By understanding the intricacies of the mortgage process and being diligent in your approach, you can turn this often-daunting task into a manageable and rewarding experience. With the right mindset and preparation, you can successfully navigate the mortgage paperwork, securing the home of your dreams with a loan that fits your financial situation and goals.