Paperwork

Bankruptcy Paperwork Retention Period

Introduction to Bankruptcy Paperwork Retention Period

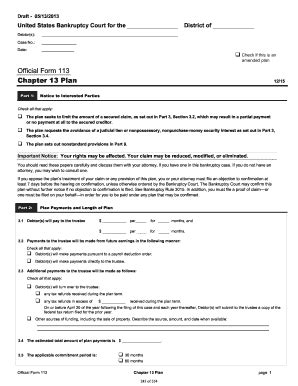

When individuals or businesses file for bankruptcy, they are required to provide a significant amount of documentation to support their claims. This paperwork includes financial records, tax returns, and other relevant documents that help the court determine the best course of action for the bankruptcy case. One crucial aspect of bankruptcy that is often overlooked is the retention period for this paperwork. In this article, we will delve into the world of bankruptcy paperwork retention periods, exploring the various factors that influence how long these documents should be kept.

Understanding Bankruptcy Paperwork

Bankruptcy paperwork encompasses a wide range of documents, including but not limited to:

- Financial statements and records

- Tax returns and related documents

- Credit reports and debt collection notices

- Court filings and legal documents

- Bank statements and investment records

Retention Period for Bankruptcy Paperwork

The retention period for bankruptcy paperwork varies depending on the type of document and the jurisdiction. In general, it is recommended that individuals and businesses retain their bankruptcy paperwork for at least 7-10 years after the bankruptcy case has been closed. This extended retention period allows for the possibility of audits or other legal actions that may arise in the future.

📝 Note: The retention period may vary depending on the specific circumstances of the bankruptcy case, so it is essential to consult with a legal professional to determine the appropriate retention period for your specific situation.

Factors Influencing Retention Period

Several factors can influence the retention period for bankruptcy paperwork, including:

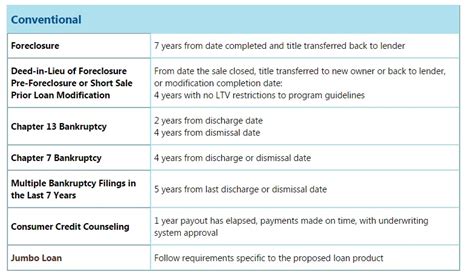

- Type of bankruptcy: The retention period may vary depending on the type of bankruptcy filed, such as Chapter 7 or Chapter 13.

- Jurisdiction: The retention period may differ depending on the state or country in which the bankruptcy was filed.

- Tax implications: The retention period may be influenced by tax implications, such as the need to retain documents for tax audits or disputes.

- Legal requirements: The retention period may be mandated by law or regulatory requirements, such as the need to retain documents for a certain period to comply with financial regulations.

Best Practices for Retaining Bankruptcy Paperwork

To ensure that bankruptcy paperwork is retained for the appropriate period, individuals and businesses should follow these best practices:

- Store documents securely: Bankruptcy paperwork should be stored in a secure and fireproof location, such as a safe or a secure online storage service.

- Organize documents: Documents should be organized and easily accessible, with clear labels and indexing to facilitate retrieval.

- Create digital backups: Digital backups of bankruptcy paperwork should be created and stored in a secure location, such as an external hard drive or cloud storage service.

- Review and update documents: Bankruptcy paperwork should be reviewed and updated regularly to ensure that it remains accurate and complete.

Conclusion and Final Thoughts

In conclusion, the retention period for bankruptcy paperwork is a critical aspect of the bankruptcy process. By understanding the factors that influence the retention period and following best practices for retaining bankruptcy paperwork, individuals and businesses can ensure that they are in compliance with legal and regulatory requirements. It is essential to consult with a legal professional to determine the appropriate retention period for your specific situation and to ensure that you are taking the necessary steps to protect yourself and your business.

What is the typical retention period for bankruptcy paperwork?

+

The typical retention period for bankruptcy paperwork is 7-10 years after the bankruptcy case has been closed.

What factors can influence the retention period for bankruptcy paperwork?

+

The retention period can be influenced by factors such as the type of bankruptcy, jurisdiction, tax implications, and legal requirements.

How should I store my bankruptcy paperwork to ensure it is retained for the appropriate period?

+

Bankruptcy paperwork should be stored in a secure and fireproof location, such as a safe or a secure online storage service, and organized with clear labels and indexing to facilitate retrieval.