5 Tips APN Escrow

Introduction to APN Escrow

When dealing with high-value transactions, particularly in the realm of real estate or business acquisitions, the concept of escrow plays a pivotal role in ensuring the security and integrity of the transaction process. Among the various types of escrow services, APN (Account Purchase Note) escrow is tailored to facilitate the purchase and sale of businesses or real estate properties. This blog post delves into the intricacies of APN escrow, highlighting five essential tips that parties involved in such transactions should be aware of to navigate the process effectively.

Understanding APN Escrow

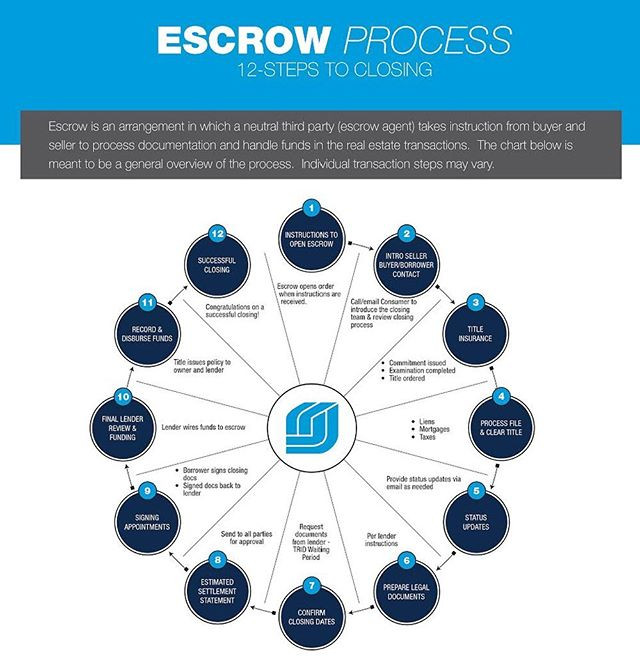

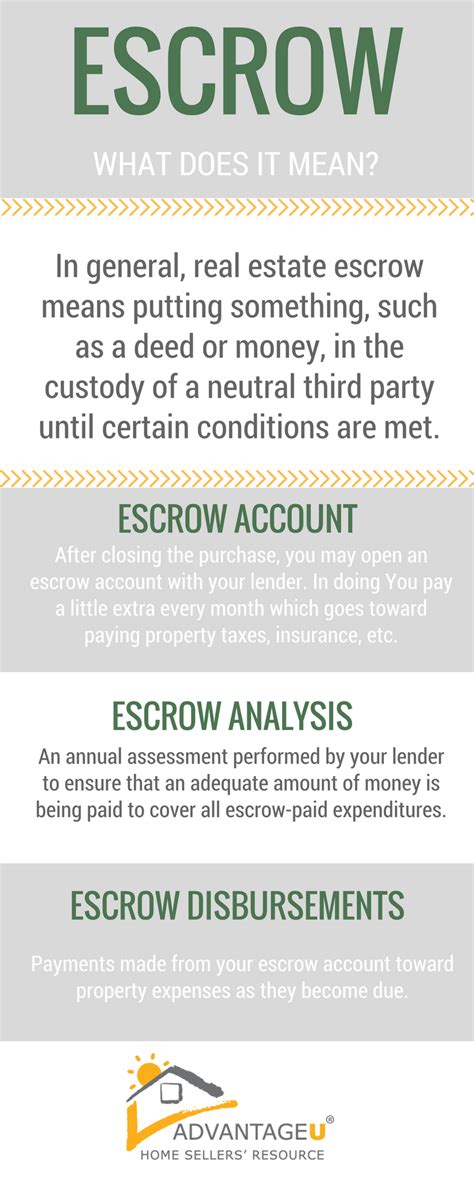

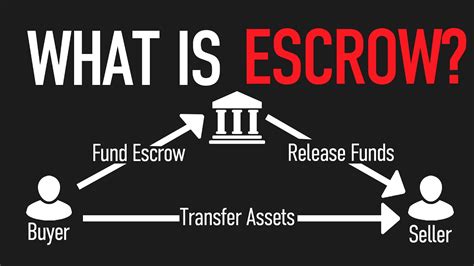

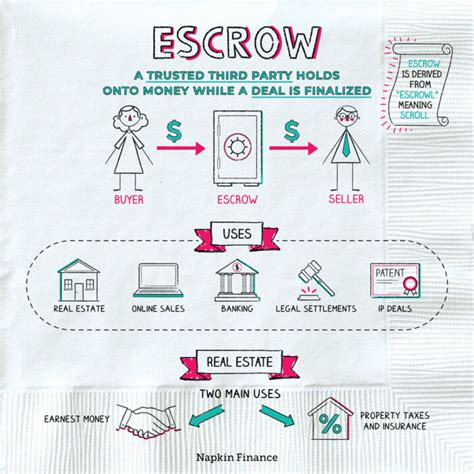

Before diving into the tips, it’s crucial to understand what APN escrow entails. Essentially, APN escrow acts as a neutral third-party service that holds funds, documents, or other assets until specific conditions of a transaction are met. This ensures that all parties adhere to their obligations, thereby reducing the risk of fraud or breach of contract. In the context of buying or selling a business or property, APN escrow can provide an added layer of security and trust among the transacting parties.

Tips for Navigating APN Escrow Successfully

Navigating the complexities of APN escrow requires careful consideration and planning. Here are five tips to help guide you through the process:

- Select a Reputable Escrow Service: The first and arguably most critical step is choosing an escrow service with a proven track record. Look for providers that specialize in APN escrow and have experience handling transactions similar to yours. Their expertise and reliability can significantly impact the success of your transaction.

- Clearly Define Terms and Conditions: Ensure that all terms and conditions of the transaction are explicitly stated and agreed upon by all parties involved. This includes the purchase price, payment schedules, and any contingencies that must be met before the transaction can be completed. Clarity in these aspects helps prevent misunderstandings and potential disputes.

- Understand the Fees Involved: APN escrow services come with associated fees, which can vary depending on the provider and the complexity of the transaction. It’s essential to understand these costs upfront to factor them into your overall transaction budget. Some providers may offer competitive pricing, so it’s worth comparing services to find the best value.

- Maintain Open Communication: Throughout the escrow process, maintaining open and transparent communication with all parties is vital. This includes the buyer, seller, escrow service, and any other stakeholders. Regular updates and prompt responses to queries can help build trust and ensure that the transaction progresses smoothly.

- Be Prepared for Contingencies: Despite the best planning, unforeseen issues can arise during the escrow period. Being prepared for such contingencies by having a clear plan in place can help mitigate risks. This might include negotiating extensions, resolving disputes, or even terminating the transaction if necessary.

Benefits of APN Escrow

The benefits of utilizing APN escrow in transactions are multifaceted:

- Enhanced Security: By holding funds and documents in a secure, neutral environment, APN escrow minimizes the risk of fraud or misappropriation of assets.

- Increased Trust: The involvement of a third-party escrow service can foster trust among transacting parties, knowing that their interests are protected.

- Efficiency: APN escrow can streamline the transaction process by ensuring that all conditions are met before the transfer of ownership or funds, thereby reducing the likelihood of delays or disputes.

📝 Note: It's essential to consult with legal and financial advisors to ensure that the use of APN escrow aligns with your specific needs and complies with all relevant laws and regulations.

Implementing APN Escrow Effectively

To implement APN escrow effectively, consider the following steps:

- Initial Setup: Engage an escrow service and define the terms of the escrow agreement.

- Funding the Escrow: The buyer deposits the purchase funds into the escrow account.

- Due Diligence and Contingencies: The buyer conducts due diligence, and any contingencies (such as inspections or financing) are addressed.

- Closing the Transaction: Once all conditions are met, the escrow service releases the funds, and the transaction is completed.

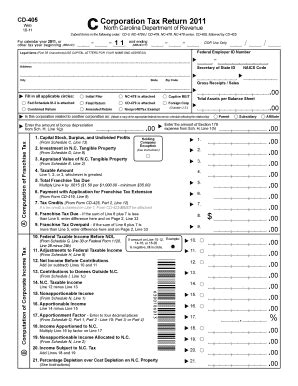

| Step | Description |

|---|---|

| 1. Initial Setup | Engage an escrow service and define the terms. |

| 2. Funding the Escrow | Buyer deposits purchase funds into the escrow account. |

| 3. Due Diligence and Contingencies | Buyer conducts due diligence and addresses contingencies. |

| 4. Closing the Transaction | Escrow service releases funds, completing the transaction. |

As the transaction landscape continues to evolve, understanding and leveraging tools like APN escrow can provide a competitive edge. By grasping the intricacies of this process and implementing the strategies outlined, individuals and businesses can navigate complex transactions with greater confidence and security.

In wrapping up, the key to a successful transaction involving APN escrow lies in careful planning, clear communication, and a thorough understanding of the process. By adhering to these principles and staying informed, parties can ensure a smooth and secure transaction, ultimately achieving their goals in the purchase or sale of a business or property.

What is APN Escrow?

+

APN Escrow refers to a service that facilitates the secure transfer of funds and documents in business or real estate transactions, acting as a neutral third party to ensure all conditions are met before completing the transaction.

How Does APN Escrow Work?

+

APN Escrow works by holding funds and documents in a secure account until all terms and conditions of the transaction are fulfilled. Once these conditions are met, the escrow service releases the funds and completes the transaction.

What Are the Benefits of Using APN Escrow?

+

The benefits of using APN Escrow include enhanced security, increased trust among transacting parties, and efficiency in the transaction process. It protects buyers and sellers by ensuring that funds and assets are handled securely and that all parties fulfill their obligations.