Aflac Insurance Paperwork Requirements

Introduction to Aflac Insurance Paperwork Requirements

When it comes to insurance, navigating the paperwork requirements can be a daunting task. Aflac, a leading provider of supplemental insurance, has its own set of paperwork requirements that policyholders must adhere to. In this article, we will delve into the world of Aflac insurance paperwork requirements, exploring the various documents needed, the process of submitting claims, and the importance of accuracy and timeliness.

Understanding Aflac Insurance Policies

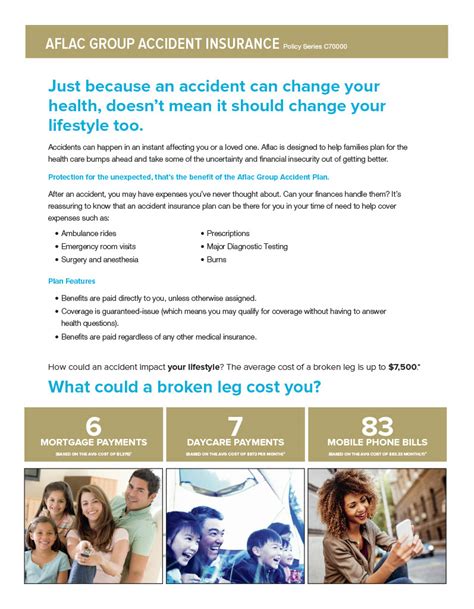

Before we dive into the paperwork requirements, it’s essential to understand the different types of Aflac insurance policies available. Aflac offers a range of supplemental insurance products, including: * Accident Insurance: Provides financial protection in the event of an accident or injury. * Critical Illness Insurance: Offers a lump-sum payment upon diagnosis of a critical illness, such as cancer or heart attack. * Hospital Indemnity Insurance: Helps cover expenses associated with hospital stays, including room and board, and other related costs. * Life Insurance: Provides a death benefit to beneficiaries in the event of the policyholder’s passing.

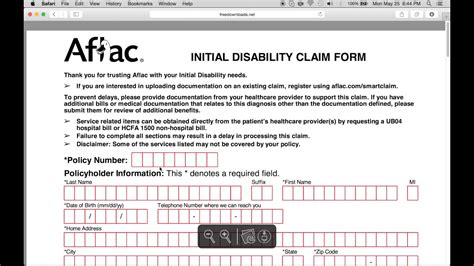

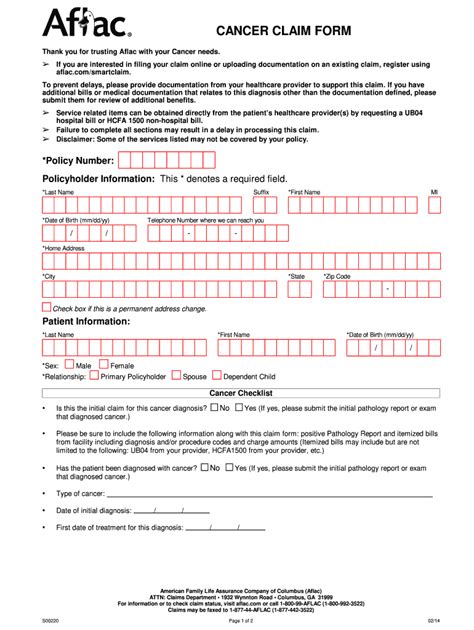

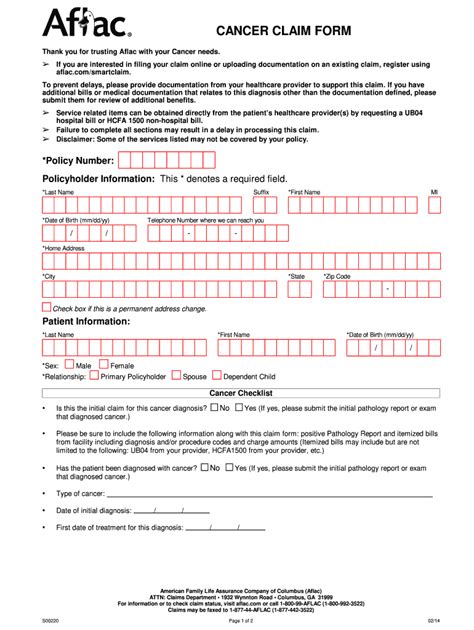

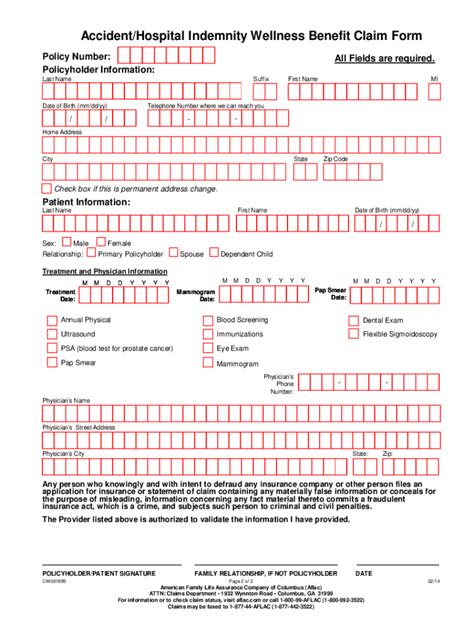

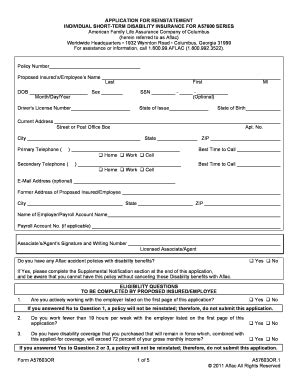

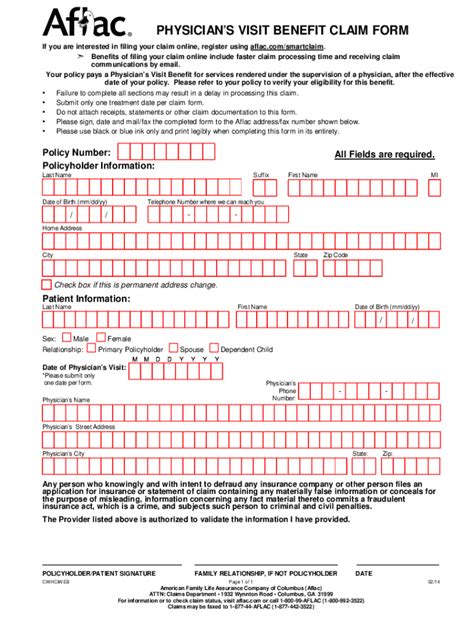

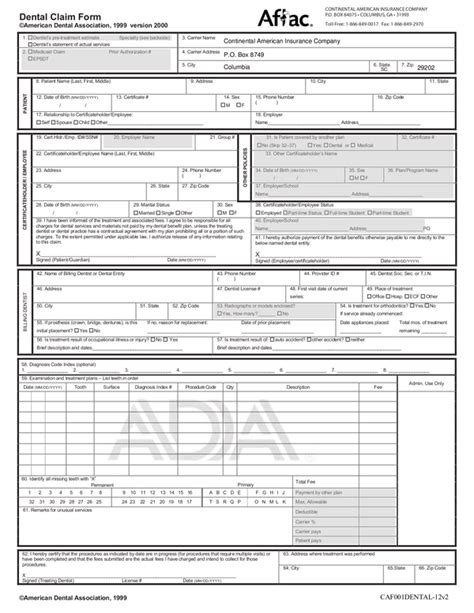

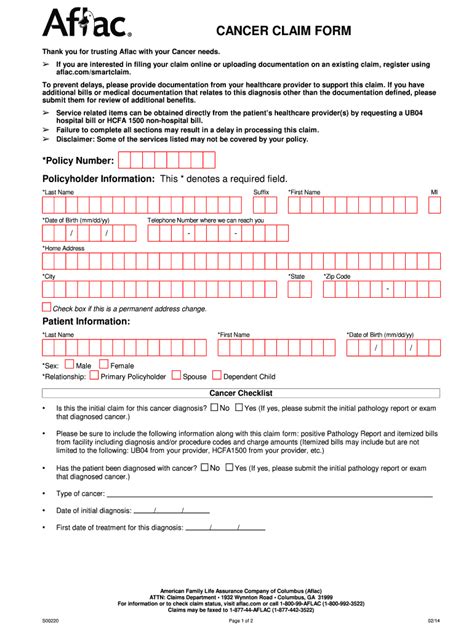

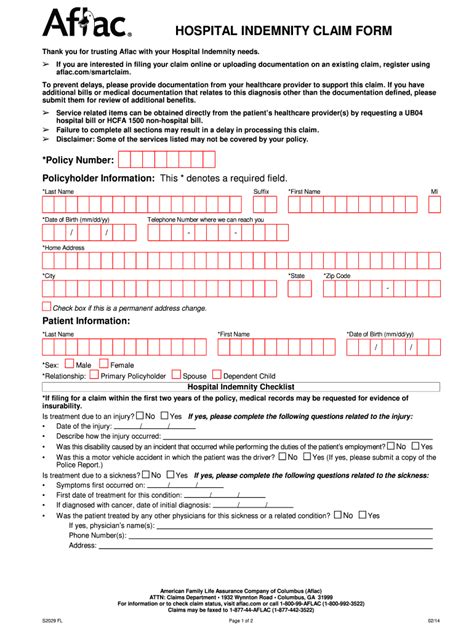

Aflac Insurance Paperwork Requirements

To ensure a smooth claims process, it’s crucial to understand the paperwork requirements for each type of Aflac insurance policy. The following documents are typically required: * Claim Form: A completed claim form, which can be downloaded from the Aflac website or obtained from an Aflac agent. * Proof of Identity: A valid government-issued ID, such as a driver’s license or passport. * Medical Records: Relevant medical records, including doctor’s notes, test results, and hospital records. * Employment Verification: Proof of employment, such as a pay stub or letter from an employer. * Policy Information: A copy of the policy, including the policy number and effective date.

Submitting Aflac Insurance Claims

Once the required paperwork is gathered, the next step is to submit the claim to Aflac. Claims can be submitted: * Online: Through the Aflac website, using the online claim submission tool. * By Mail: By mailing the completed claim form and supporting documentation to the address listed on the claim form. * By Fax: By faxing the completed claim form and supporting documentation to the fax number listed on the claim form. * Through an Agent: By submitting the claim through an Aflac agent, who can assist with the claims process.

Importance of Accuracy and Timeliness

When submitting a claim, it’s essential to ensure that all paperwork is accurate and complete. Incomplete or inaccurate claims can result in delays or even denial of benefits. Additionally, claims must be submitted within the specified timeframe, which varies depending on the type of policy and the state in which the policy was issued.

📝 Note: It's crucial to review the policy documents carefully and understand the claims process to avoid any potential issues or delays.

Aflac Insurance Claims Process

The Aflac insurance claims process typically involves the following steps: * Claim Receipt: Aflac receives the claim and reviews it for completeness and accuracy. * Claim Review: Aflac reviews the claim to determine eligibility for benefits. * Benefit Payment: If the claim is approved, Aflac pays the benefit to the policyholder or beneficiary. * Claim Closure: The claim is closed, and the policyholder is notified of the outcome.

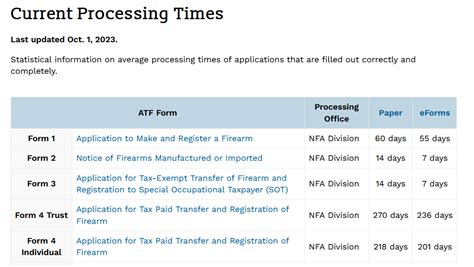

Table of Aflac Insurance Paperwork Requirements

The following table summarizes the paperwork requirements for each type of Aflac insurance policy:

| Policy Type | Required Documents |

|---|---|

| Accident Insurance | Claim Form, Proof of Identity, Medical Records |

| Critical Illness Insurance | Claim Form, Proof of Identity, Medical Records, Diagnosis Report |

| Hospital Indemnity Insurance | Claim Form, Proof of Identity, Medical Records, Hospital Records |

| Life Insurance | Claim Form, Proof of Identity, Death Certificate, Beneficiary Information |

In the end, understanding the Aflac insurance paperwork requirements is essential for a smooth and efficient claims process. By gathering the required documents, submitting claims accurately and timely, and following the claims process, policyholders can ensure that they receive the benefits they need during difficult times. With the right knowledge and preparation, navigating the world of Aflac insurance paperwork requirements can be a breeze.

What is the deadline for submitting an Aflac insurance claim?

+

The deadline for submitting an Aflac insurance claim varies depending on the type of policy and the state in which the policy was issued. It’s essential to review the policy documents carefully to understand the claims process and deadline.

Can I submit an Aflac insurance claim online?

+

Yes, Aflac offers an online claim submission tool, which allows policyholders to submit claims electronically. This option is convenient and can help speed up the claims process.

What happens if my Aflac insurance claim is denied?

+

If an Aflac insurance claim is denied, the policyholder will receive a notification explaining the reason for the denial. Policyholders can appeal the decision by providing additional information or documentation to support their claim.