Landlord Paperwork Requirements

Introduction to Landlord Paperwork Requirements

Being a landlord comes with a plethora of responsibilities, one of the most critical being the management of paperwork. Accurate and comprehensive documentation is essential for protecting the rights of both landlords and tenants, as well as ensuring compliance with local, state, and federal laws. In this blog post, we will delve into the world of landlord paperwork requirements, exploring the key documents and records that landlords must maintain.

Lease Agreements

A lease agreement is the foundation of the landlord-tenant relationship. It outlines the terms and conditions of the tenancy, including the rent, duration of the lease, and responsibilities of both parties. A well-crafted lease agreement should include:

- Rental amount and payment terms

- Length of the tenancy

- Security deposit details

- Repairs and maintenance responsibilities

- Rules and regulations for the property

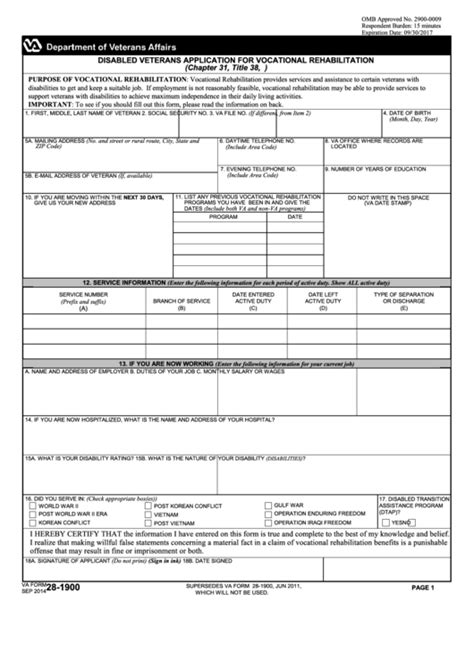

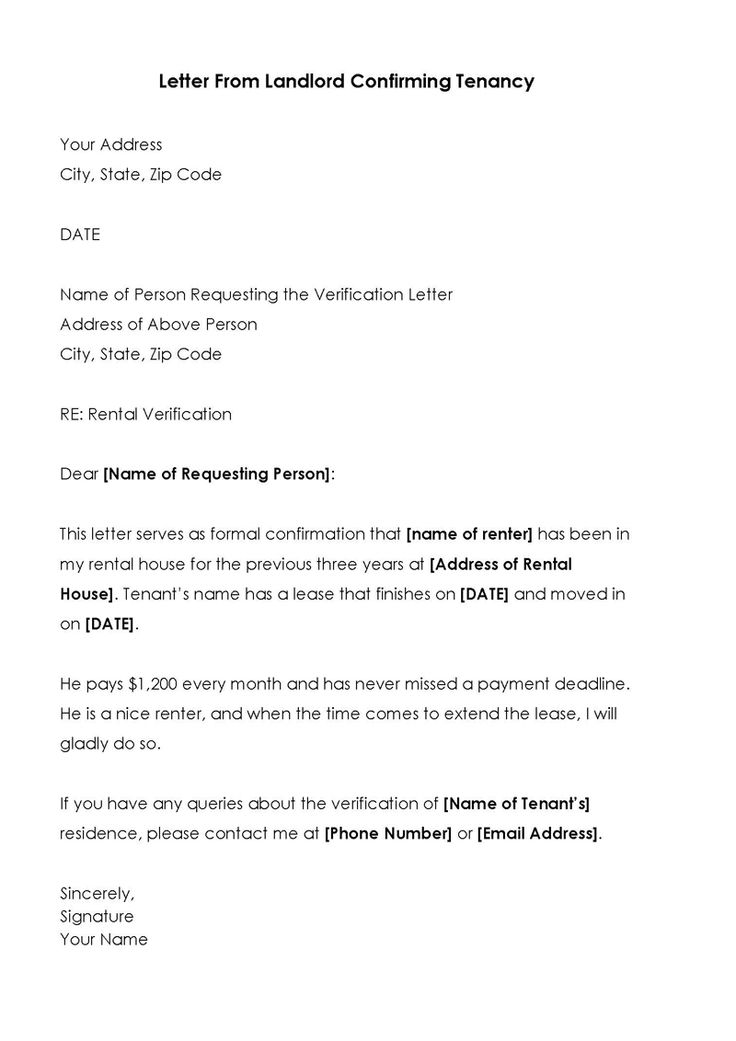

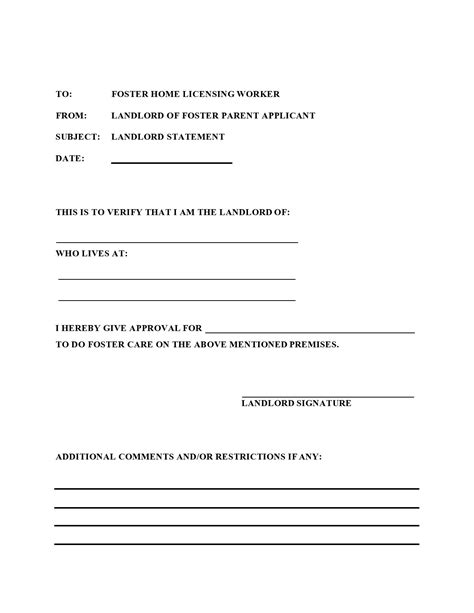

Rental Applications

Before signing a lease agreement, landlords typically require prospective tenants to fill out a rental application. This document provides valuable information about the applicant’s:

- Rental history

- Employment and income

- Credit score and history

- Personal references

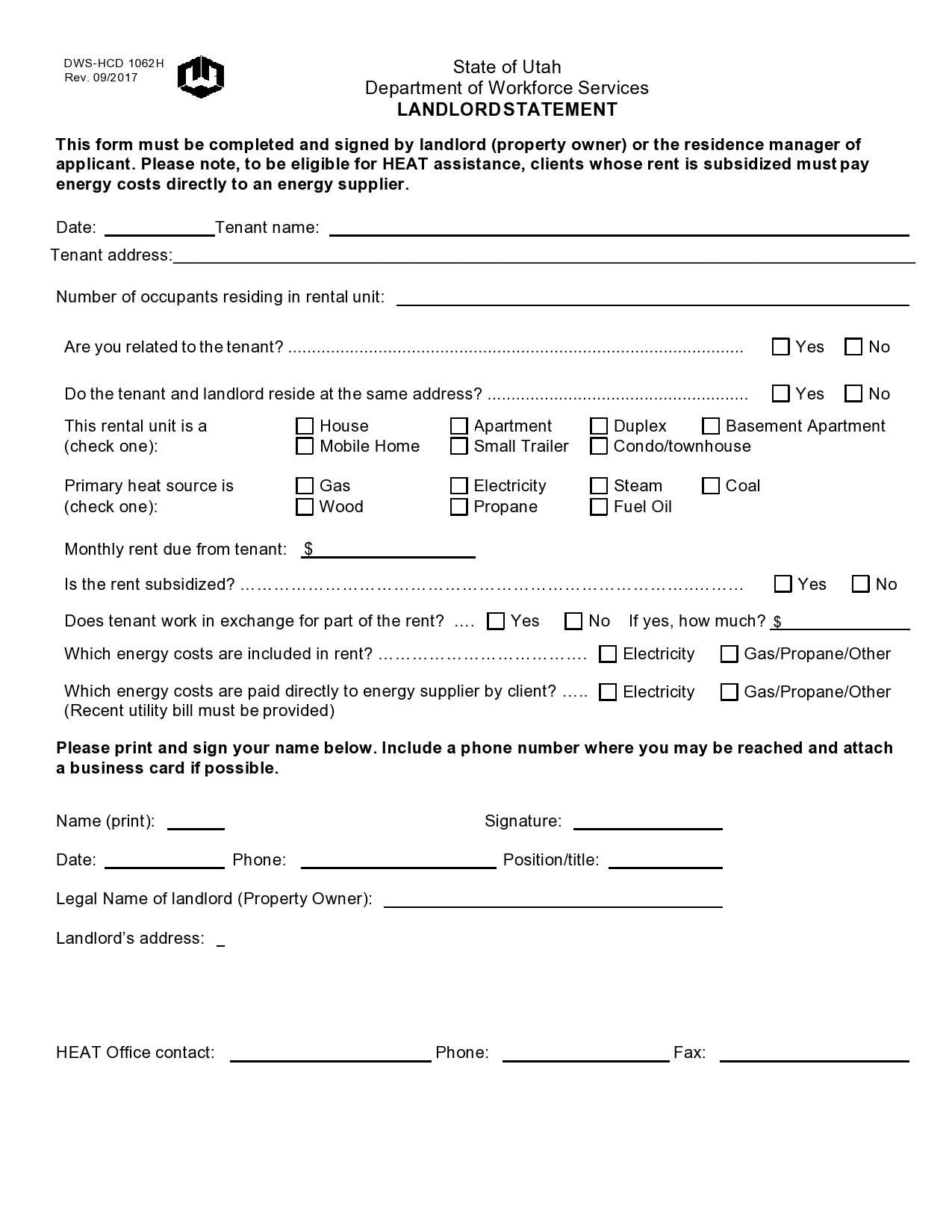

Security Deposit Receipts

When a tenant pays a security deposit, the landlord must provide a receipt that includes:

- Amount of the deposit

- Method of payment

- Condition of the property at move-in

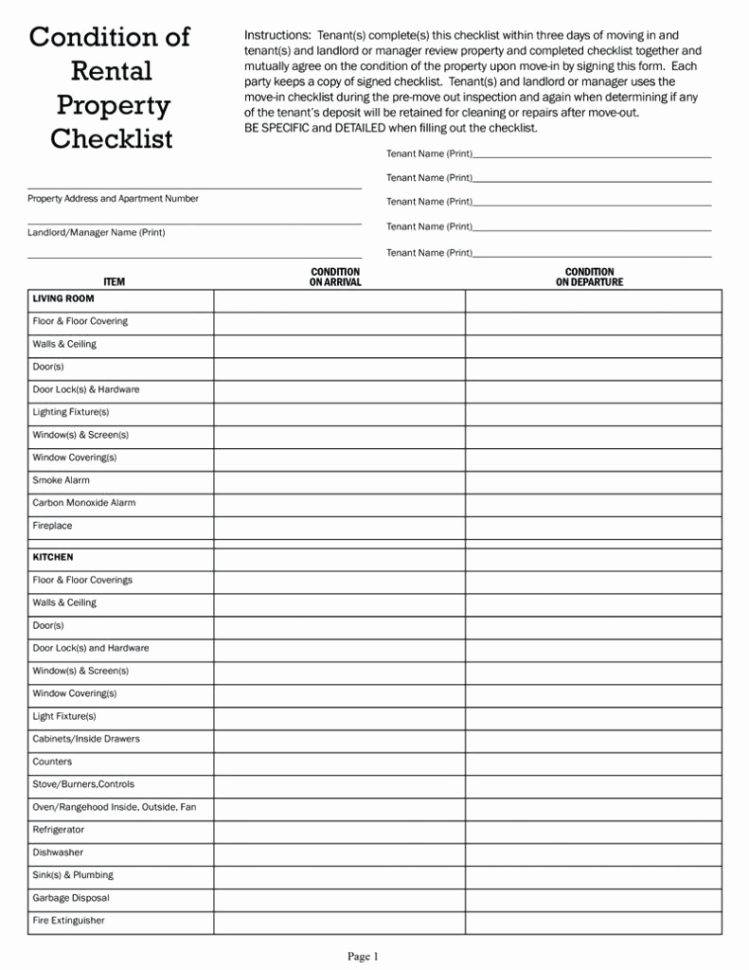

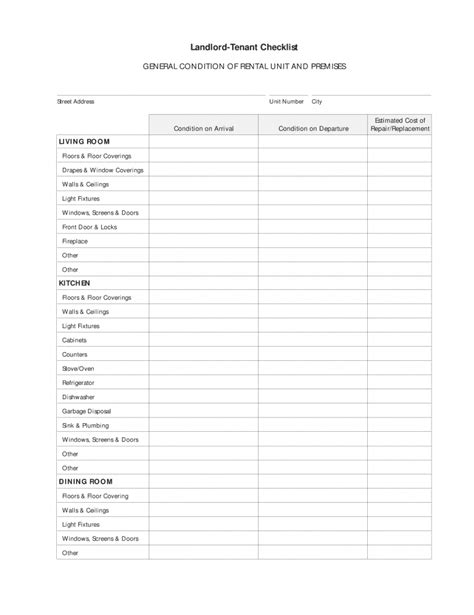

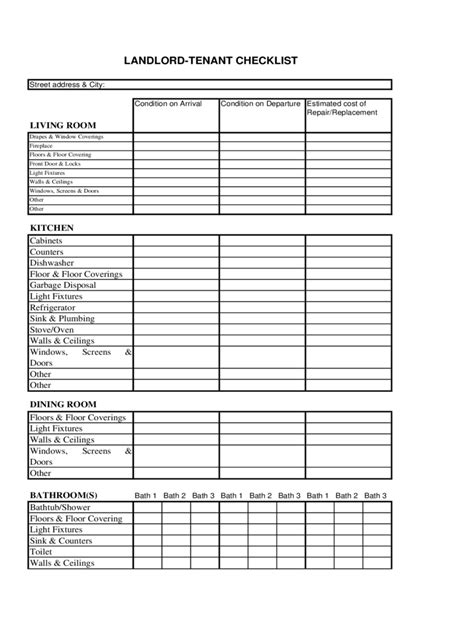

Move-In/Move-Out Inspections

Conducting move-in and move-out inspections is essential for documenting the condition of the property. These inspections should include:

- Photographs and videos of the property

- Notes on any damage or needed repairs

- Tenant’s signature acknowledging the condition of the property

Tax-Related Documents

Landlords must maintain accurate records of their tax-related documents, including:

| Document | Description |

|---|---|

| Form 1099-MISC | Reports rental income to the IRS |

| Schedule E | Reports rental income and expenses on tax returns |

| Depreciation records | Tracks the depreciation of the property over time |

These documents are crucial for accurately reporting rental income and expenses on tax returns.

📝 Note: Landlords should consult with a tax professional to ensure they are meeting all tax-related requirements.

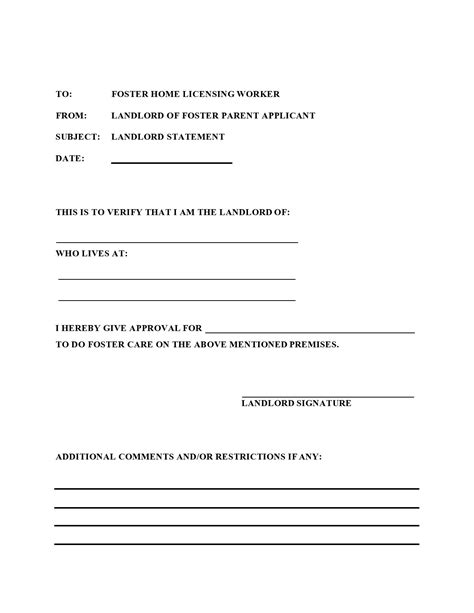

Compliance with Local Laws and Regulations

Landlords must comply with local laws and regulations, including:

- Building codes and zoning ordinances

- Health and safety standards

- Environmental regulations

Maintaining Accurate Records

Maintaining accurate and up-to-date records is essential for landlords. This includes:

- Rental agreements and leases

- Rental applications and screening reports

- Security deposit receipts and records

- Tax-related documents and records

In the final analysis, managing landlord paperwork requirements is a critical aspect of being a successful landlord. By maintaining accurate and comprehensive documentation, landlords can protect their rights, ensure compliance with laws and regulations, and minimize the risk of disputes and legal issues.

What is the purpose of a lease agreement?

+

The purpose of a lease agreement is to outline the terms and conditions of the tenancy, including the rent, duration of the lease, and responsibilities of both parties.

What information should be included in a rental application?

+

A rental application should include information about the applicant’s rental history, employment and income, credit score and history, and personal references.

Why is it important for landlords to maintain accurate records?

+

Maintaining accurate records is essential for landlords to stay organized, ensure compliance with laws and regulations, and provide a paper trail in case of disputes or legal issues.