SBA Loan Paperwork Requirements

Introduction to SBA Loan Paperwork Requirements

When considering applying for a Small Business Administration (SBA) loan, it’s essential to understand the paperwork requirements involved. The SBA loan process can be complex, but being prepared with the necessary documents can help streamline the application and approval process. In this article, we’ll delve into the world of SBA loan paperwork requirements, providing you with a comprehensive guide to help you navigate the process with ease.

Understanding SBA Loan Programs

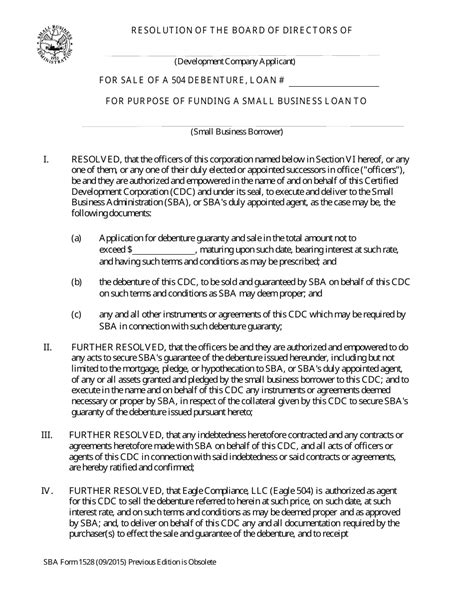

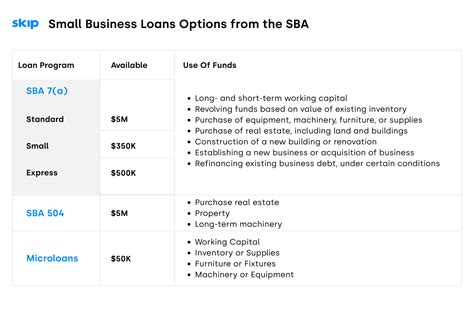

Before we dive into the paperwork requirements, it’s crucial to understand the different SBA loan programs available. The SBA offers several loan programs, each with its unique features and requirements. The most popular SBA loan programs include: * 7(a) Loan Program: The 7(a) loan program is the SBA’s most popular loan program, offering up to 5 million in funding for small businesses. * <i>504 Loan Program</i>: The 504 loan program provides long-term, fixed-rate financing for small businesses, with loans ranging from 50,000 to 5 million. * <i>Microloan Program</i>: The microloan program offers small, short-term loans up to 50,000 for small businesses and not-for-profit child care centers.

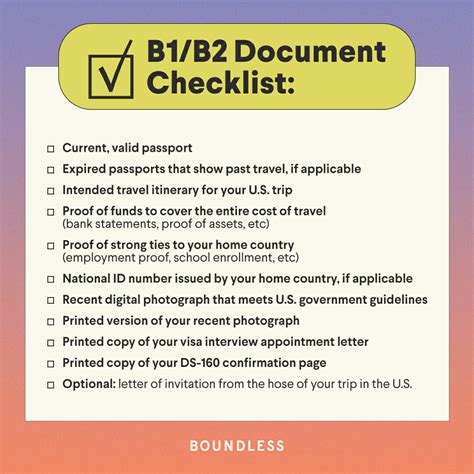

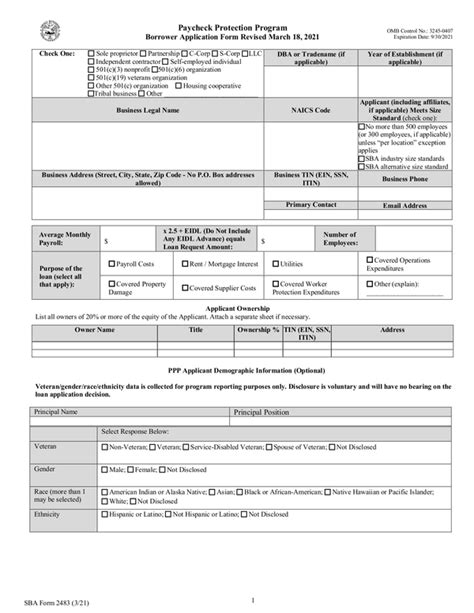

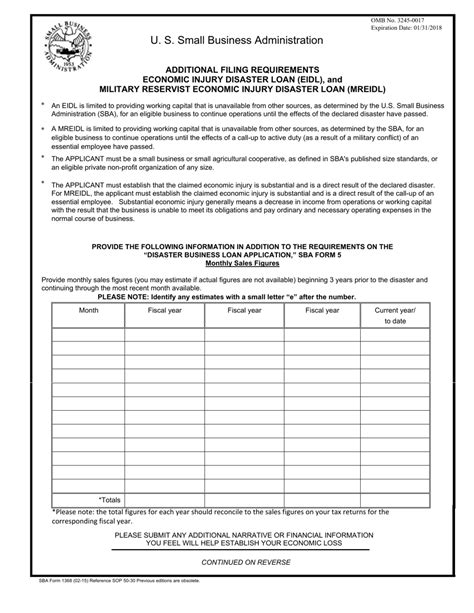

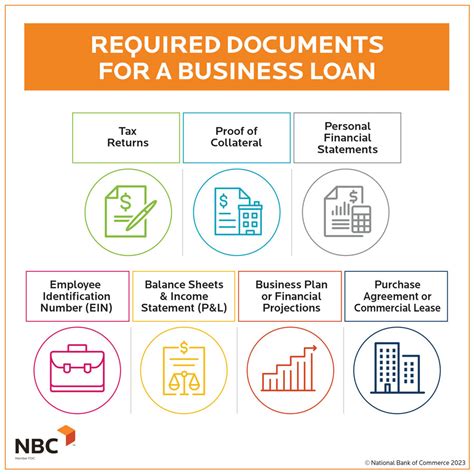

SBA Loan Paperwork Requirements

Now that we’ve covered the different SBA loan programs, let’s move on to the paperwork requirements. The following documents are typically required for an SBA loan application: * Business plan: A comprehensive business plan outlining your company’s goals, objectives, and financial projections. * Financial statements: Personal and business financial statements, including balance sheets, income statements, and cash flow statements. * Tax returns: Personal and business tax returns for the past three years. * Collateral documentation: Documentation of collateral, such as property deeds or equipment titles. * Identification documents: Government-issued identification documents, such as driver’s licenses or passports. * Business licenses and certifications: Copies of business licenses, certifications, and registrations.

Additional Documentation

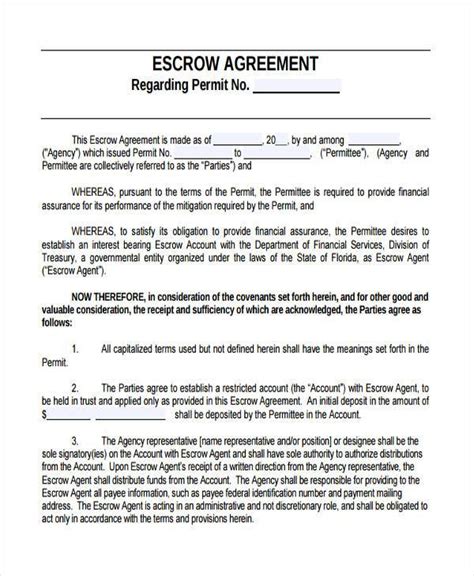

In addition to the above-mentioned documents, you may need to provide additional documentation, depending on the specific SBA loan program and your business type. Some examples include: * Franchise agreements: If you’re purchasing a franchise, you’ll need to provide a copy of the franchise agreement. * Lease agreements: If you’re leasing a property, you’ll need to provide a copy of the lease agreement. * Environmental reports: If your business involves environmental hazards, you may need to provide environmental reports.

Organizing Your Paperwork

To ensure a smooth application process, it’s essential to organize your paperwork carefully. Consider using a checklist to keep track of the required documents and their status. You can also use a secure online platform to upload and store your documents, making it easier to access and share them with your lender.

Working with a Lender

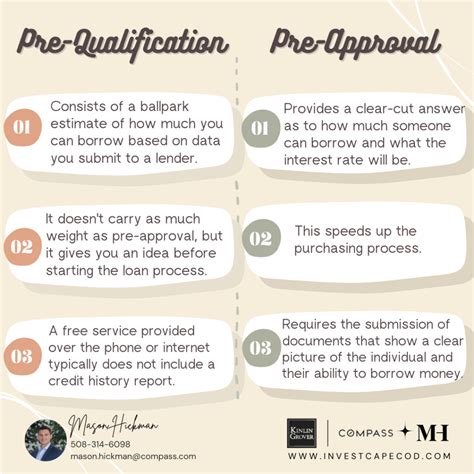

When applying for an SBA loan, you’ll need to work with a lender that is authorized by the SBA. Your lender will guide you through the application process and help you gather the required documents. Be sure to ask your lender about their specific requirements and any additional documentation they may need.

📝 Note: It's essential to choose a lender that is experienced in SBA lending and can provide you with the necessary guidance and support throughout the application process.

Table of SBA Loan Paperwork Requirements

The following table summarizes the SBA loan paperwork requirements:

| Document | Description |

|---|---|

| Business plan | A comprehensive business plan outlining your company’s goals, objectives, and financial projections. |

| Financial statements | Personal and business financial statements, including balance sheets, income statements, and cash flow statements. |

| Tax returns | Personal and business tax returns for the past three years. |

| Collateral documentation | Documentation of collateral, such as property deeds or equipment titles. |

| Identification documents | Government-issued identification documents, such as driver’s licenses or passports. |

| Business licenses and certifications | Copies of business licenses, certifications, and registrations. |

To recap, the SBA loan paperwork requirements can be complex, but being prepared with the necessary documents can help streamline the application and approval process. By understanding the different SBA loan programs and gathering the required documents, you can increase your chances of securing the funding you need to grow your business. Remember to work closely with your lender and stay organized throughout the process to ensure a successful outcome.

What is the maximum loan amount for an SBA 7(a) loan?

+

The maximum loan amount for an SBA 7(a) loan is $5 million.

What is the interest rate for an SBA loan?

+

The interest rate for an SBA loan varies depending on the loan program and the lender. However, SBA loans typically offer competitive interest rates, ranging from 5% to 10%.

How long does it take to get approved for an SBA loan?

+

The approval process for an SBA loan can take anywhere from 30 to 90 days, depending on the complexity of the application and the lender’s processing time.