5 Tips Tax Free Gift

Introduction to Tax-Free Gifts

When it comes to giving gifts, whether it’s to a family member, friend, or charitable organization, understanding the tax implications can be crucial. In many countries, tax laws allow for certain gifts to be made without incurring taxes, which can be beneficial for both the giver and the recipient. This article will explore 5 tips for making tax-free gifts, helping you navigate the complexities of gift tax laws and make the most of your generosity.

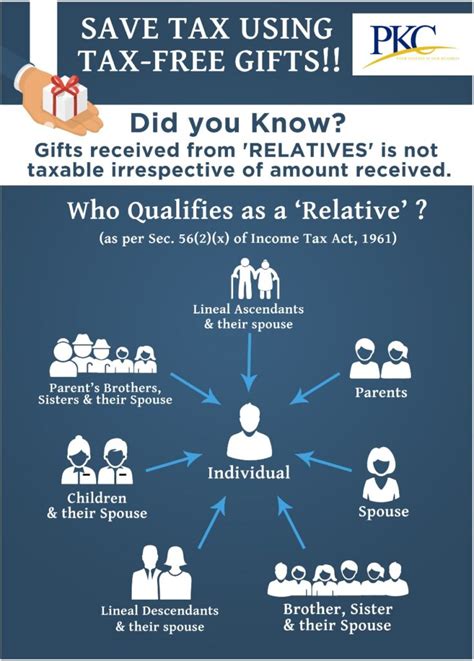

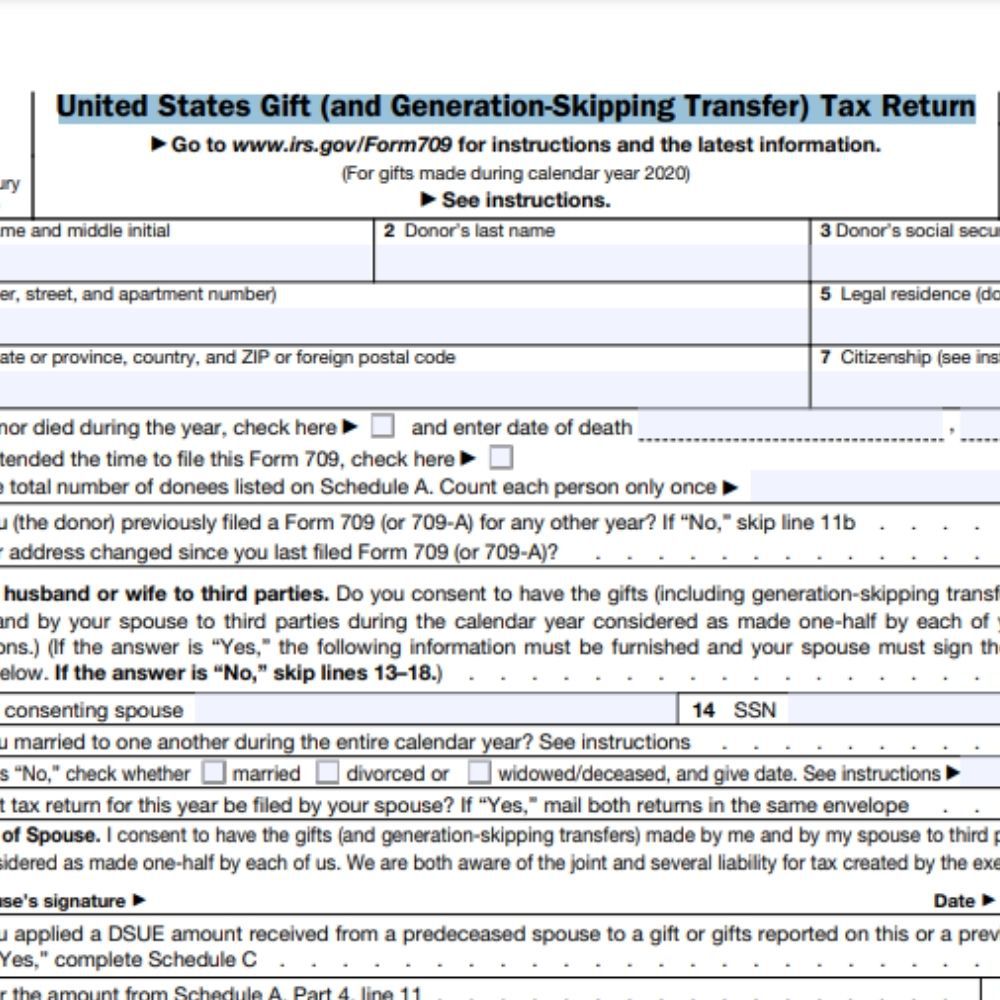

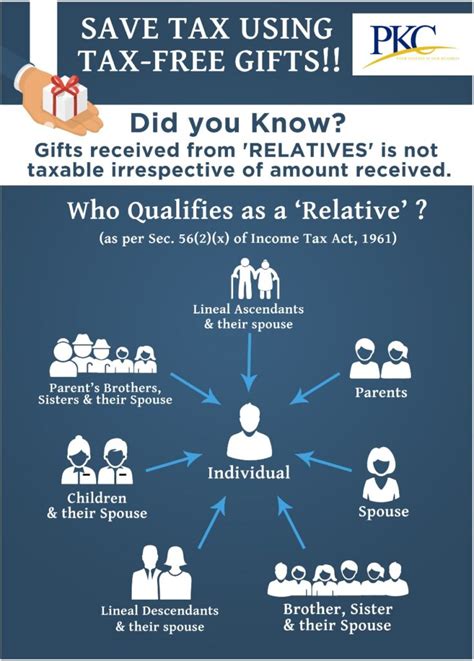

Understanding Gift Tax Laws

Before diving into the tips, it’s essential to have a basic understanding of how gift tax laws work. In general, gift tax is a tax on the transfer of property, such as money or assets, from one person to another. However, there are exemptions and limits that can reduce or eliminate the tax owed on a gift. For instance, in the United States, the annual gift tax exclusion allows individuals to give up to a certain amount ($16,000 in 2022) to any number of recipients without incurring gift tax.

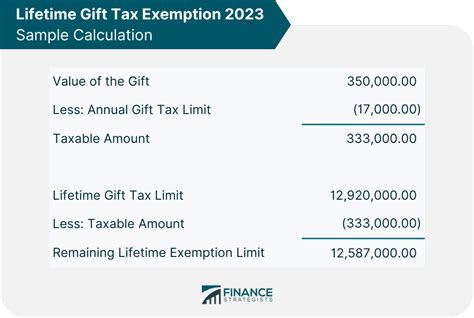

Tip 1: Take Advantage of the Annual Gift Tax Exclusion

One of the simplest ways to make tax-free gifts is to utilize the annual gift tax exclusion. As mentioned earlier, this exclusion allows individuals to give a certain amount to any number of recipients each year without triggering gift tax. This can be a great way to transfer wealth to family members or friends over time, reducing the overall tax liability. For example, if you want to give your child 20,000, you could give 16,000 in one year and the remaining $4,000 in the next year, taking advantage of the exclusion in both years.

Tip 2: Make Gifts to Charity

Gifts to qualified charitable organizations are generally tax-deductible and can also be made tax-free. Donating to charity not only supports a good cause but can also provide tax benefits. When making charitable donations, ensure the organization is recognized as tax-exempt by the relevant tax authority to qualify for the deduction. Additionally, keeping records of donations, such as receipts and bank statements, is crucial for claiming the deduction on your tax return.

Tip 3: Utilize Tax-Free Gift Options for Education

Paying for someone’s education can be a significant gift, and there are tax-free ways to do so. Contributions to a 529 college savings plan, for example, grow tax-free, and withdrawals are tax-free if used for qualified education expenses. Similarly, paying tuition directly to an educational institution for someone else’s benefit can be a tax-free gift, as it is not considered taxable income to the recipient.

Tip 4: Leverage Tax-Free Gifts for Medical Expenses

Another area where tax-free gifts can be particularly beneficial is in covering medical expenses for others. Payments made directly to a medical provider on behalf of someone else can be tax-free, providing relief to individuals facing significant healthcare costs. This can be especially helpful for family members or close friends dealing with chronic conditions or undergoing expensive treatments.

Tip 5: Consider Gifts of Appreciated Property

Gifts of appreciated property, such as stocks or real estate that have increased in value, can be tax-efficient. When you gift appreciated property, the recipient inherits your tax basis in the property, but if you held the property for more than a year, the recipient can avoid paying capital gains tax on the appreciation until they sell the property. This strategy can be particularly beneficial for reducing taxes on investments that have significantly appreciated in value.

| Gift Type | Tax Implication | Benefit |

|---|---|---|

| Annual Gift Tax Exclusion | No tax owed on gifts up to the exclusion amount | Reduces tax liability, allows for wealth transfer |

| Charitable Donations | Tax-deductible, potentially reduces taxable income | Supports charitable causes, provides tax deduction |

| Education Expenses | Tax-free if used for qualified education expenses | Encourages education, reduces financial burden on students |

| Medical Expenses | Tax-free if paid directly to a medical provider | Relieves financial stress related to medical care |

| Appreciated Property | Avoids capital gains tax on appreciation until sale | Efficiently transfers wealth, reduces capital gains tax liability |

📝 Note: Tax laws and regulations can change, so it's essential to consult with a tax professional or financial advisor to ensure you're making the most tax-efficient gifts possible under current laws.

In summary, making tax-free gifts requires an understanding of the tax laws and exemptions available. By utilizing the annual gift tax exclusion, making charitable donations, contributing to education and medical expenses, and gifting appreciated property, individuals can reduce their tax liability while supporting their loved ones and favorite causes. It’s crucial to stay informed about tax law changes and to seek professional advice to maximize the benefits of tax-free gifting.

What is the annual gift tax exclusion amount?

+

The annual gift tax exclusion amount is $16,000 for the year 2022, allowing individuals to give up to this amount to any number of recipients without incurring gift tax.

Are gifts to charity always tax-deductible?

+

Not all gifts to charity are tax-deductible. The charitable organization must be recognized as tax-exempt by the relevant tax authority for donations to be deductible.

Can I make tax-free gifts for education expenses?

+

Yes, payments made directly to an educational institution for someone else’s education can be tax-free, as can contributions to a 529 college savings plan, which grows tax-free and has tax-free withdrawals for qualified education expenses.