Auto Loan Paperwork Requirements

Introduction to Auto Loan Paperwork

When considering purchasing a vehicle, whether new or used, understanding the auto loan paperwork requirements is essential. The process of obtaining an auto loan involves several steps, including application, approval, and finally, the signing of the loan agreement. Each step requires specific documentation to ensure that both the lender and the borrower are protected and aware of their obligations. In this article, we will delve into the details of the necessary paperwork for an auto loan, explaining what each document is for and why it is crucial for the loan process.

Pre-Approval and Application

Before starting the search for the perfect vehicle, many potential buyers opt for pre-approval. This step involves contacting a lender and providing financial information to determine how much they can borrow. The pre-approval process typically requires: - Identification: A valid government-issued ID, such as a driver’s license or passport. - Income Proof: Pay stubs, W-2 forms, or tax returns to verify income. - Credit Report: Permission to check credit history, which affects the interest rate and loan terms. - Employment Verification: Proof of stable employment, which may include contact information for the employer.

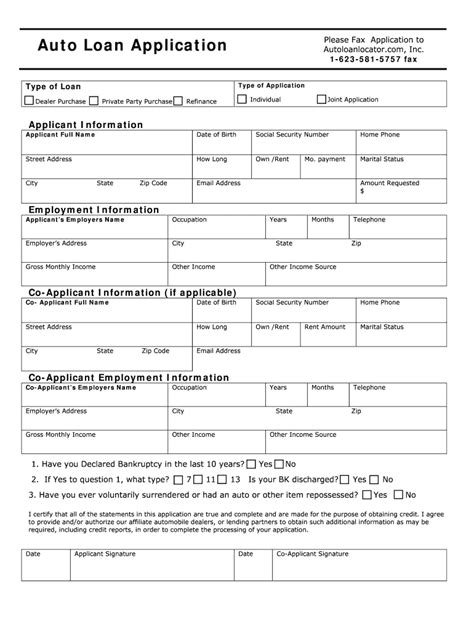

Loan Application and Approval

Once pre-approved, the next step is the formal loan application. This involves providing more detailed financial information and selecting the vehicle. The necessary documents for the loan application include: - Vehicle Information: The make, model, year, and Vehicle Identification Number (VIN) of the vehicle. - Purchase Agreement: A document from the dealer that outlines the purchase price, any trade-in value, and the down payment. - Insurance Information: Proof of insurance that meets the lender’s requirements.

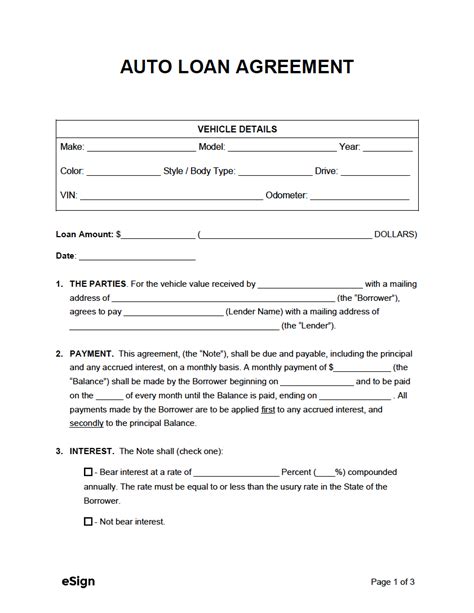

Signing the Loan Agreement

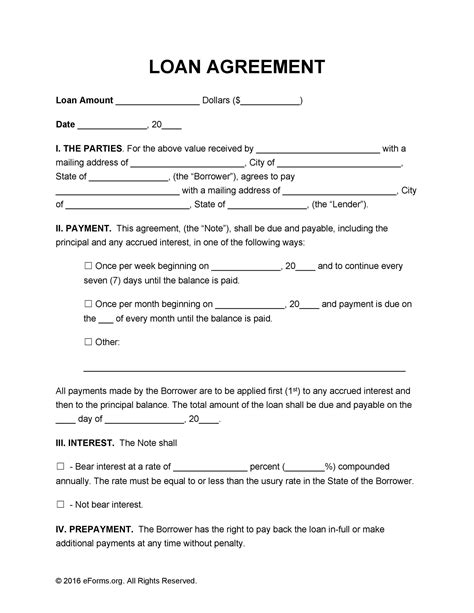

After the loan is approved, the final step is signing the loan agreement. This is a legally binding contract that outlines the terms of the loan, including: - Loan Amount: The total amount borrowed. - Interest Rate: The rate at which interest is calculated. - Repayment Terms: The length of the loan and the monthly payment amount. - Default and Late Payment Policies: The actions the lender can take if payments are missed, and any late fees.

Understanding the Contract

It is crucial for borrowers to carefully review the loan agreement before signing. This contract will include clauses regarding: - Prepayment Penalties: Fees for paying off the loan early. - Warranty and Service Contracts: Information on any additional protection plans purchased. - GAP Insurance: Coverage that pays the difference between the vehicle’s actual cash value and the loan balance if the vehicle is totaled.

Post-Signing Obligations

After signing the loan agreement, borrowers have several obligations to fulfill: - Regular Payments: Making timely monthly payments. - Insurance Maintenance: Ensuring the vehicle is insured at all times. - Vehicle Maintenance: Keeping the vehicle in good condition, as outlined in the loan agreement.

| Document | Description |

|---|---|

| Identification | Government-issued ID for verification purposes. |

| Income Proof | Documents showing income stability. |

| Credit Report | Permission to check credit history. |

| Employment Verification | Proof of stable employment. |

| Vehicle Information | Details about the vehicle being purchased. |

| Purchase Agreement | Document outlining the purchase terms. |

| Insurance Information | Proof of vehicle insurance. |

📝 Note: It is essential to read and understand all the terms and conditions of the loan agreement before signing. Borrowers should ask questions if they are unsure about any part of the contract.

In summary, the process of obtaining an auto loan involves several steps, each requiring specific documentation. Understanding the necessity and purpose of each document can make the process smoother and less daunting. By being prepared and knowledgeable, potential vehicle owners can navigate the auto loan paperwork requirements with confidence, ensuring they secure a loan that meets their needs and financial situation.

What is the typical interest rate for an auto loan?

+

The interest rate for an auto loan varies based on credit score, loan term, and lender. On average, rates can range from around 3% for excellent credit to over 18% for poor credit.

How long does the auto loan process usually take?

+

The length of the auto loan process can vary. Pre-approval can happen within minutes, but the entire process from application to driving away in a new vehicle can take a few days to a week, depending on the lender and the complexity of the application.

Can I negotiate the terms of my auto loan?

+

Yes, it is possible to negotiate the terms of an auto loan. This can include the interest rate, the loan duration, and any fees associated with the loan. It’s beneficial to compare offers from different lenders to find the best deal.