Lease Car Paperwork Needed

Introduction to Lease Car Paperwork

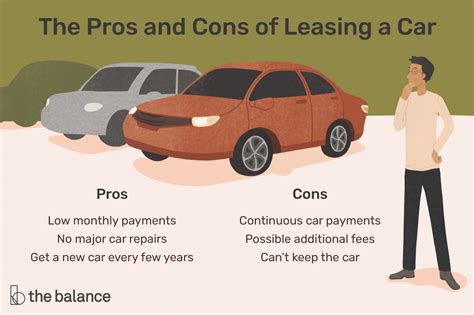

When considering leasing a car, it’s essential to understand the various documents involved in the process. Lease car paperwork can be complex and time-consuming, but being prepared and knowing what to expect can make a significant difference. In this article, we will guide you through the necessary paperwork and provide valuable insights to help you navigate the leasing process smoothly.

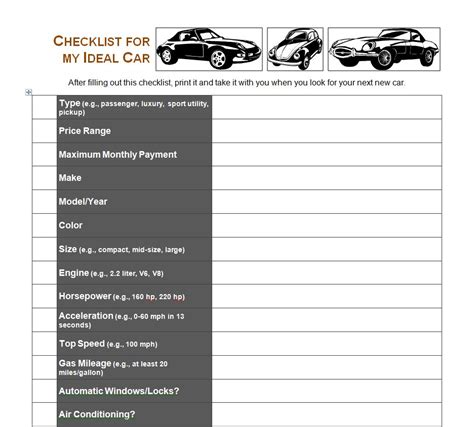

Types of Lease Car Paperwork

There are several types of paperwork required for leasing a car, including: * Lease agreement: This is the primary contract between you and the leasing company, outlining the terms and conditions of the lease. * Vehicle inspection report: This document records the condition of the vehicle at the start of the lease, helping to prevent any disputes when the lease ends. * Insurance documents: You will need to provide proof of insurance that meets the leasing company’s requirements. * Identification and credit documents: You may need to provide identification, such as a driver’s license, and credit information to verify your creditworthiness. * Employment and income verification: The leasing company may require proof of employment and income to ensure you can afford the lease payments.

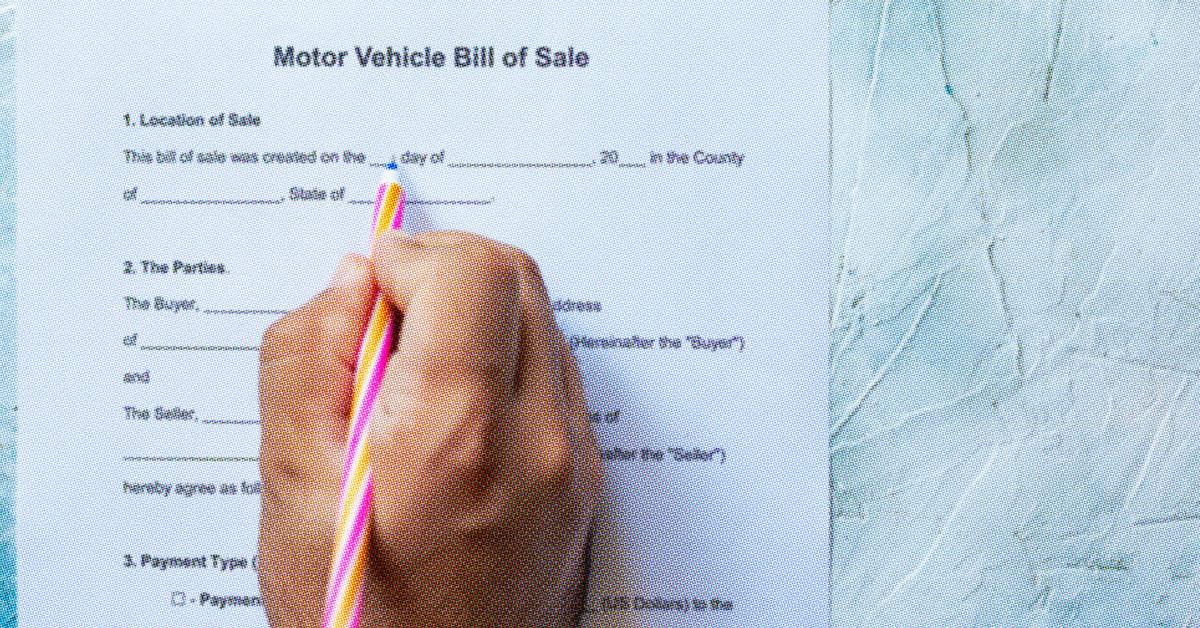

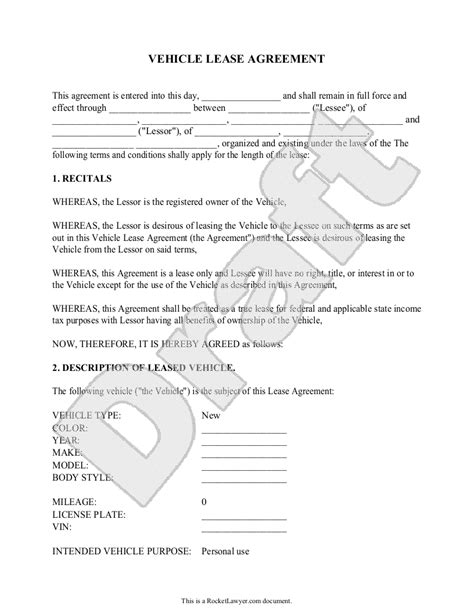

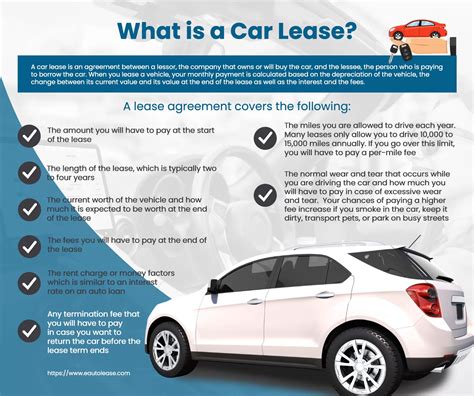

Understanding the Lease Agreement

The lease agreement is a critical document that outlines the terms and conditions of the lease. It’s essential to carefully review and understand the agreement before signing. Key elements to look for include: * Lease term: The length of the lease, usually expressed in months or years. * Monthly payment: The amount you will pay each month, including any taxes and fees. * Mileage allowance: The number of miles you are allowed to drive per year, and any excess mileage charges. * Wear and tear: The expected condition of the vehicle at the end of the lease, and any charges for excessive wear and tear. * Termination fees: Any fees associated with ending the lease early.

Vehicle Inspection Report

The vehicle inspection report is a crucial document that records the condition of the vehicle at the start of the lease. This report helps to prevent any disputes when the lease ends and ensures that you are not charged for any existing damage. The report should include: * Exterior and interior condition: A detailed description of the vehicle’s condition, including any scratches, dents, or other damage. * Mileage: The current mileage of the vehicle. * Any existing damage: A record of any existing damage, such as scratches or dents.

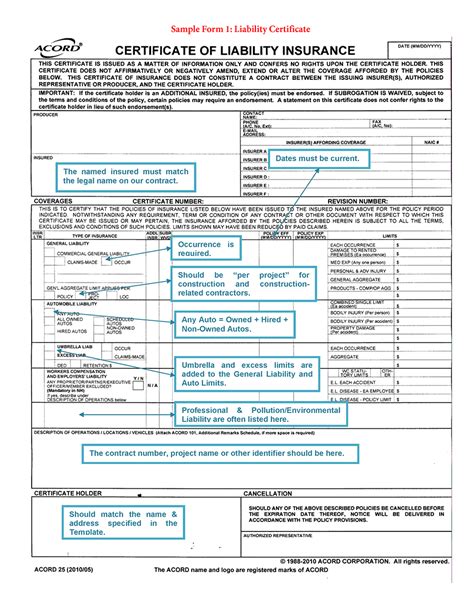

Insurance Requirements

Leasing companies typically require you to have comprehensive insurance coverage for the vehicle. You will need to provide proof of insurance that meets the leasing company’s requirements, which may include: * Collision coverage: Coverage for damage to the vehicle in the event of an accident. * Comprehensive coverage: Coverage for damage to the vehicle from non-collision events, such as theft or vandalism. * Liability coverage: Coverage for damages or injuries to others in the event of an accident.

💡 Note: It's essential to carefully review your insurance policy to ensure it meets the leasing company's requirements.

Identification and Credit Documents

The leasing company may require identification and credit documents to verify your creditworthiness. This may include: * Driver’s license: A valid driver’s license. * Credit report: A copy of your credit report. * Income verification: Proof of income, such as pay stubs or tax returns.

Employment and Income Verification

The leasing company may require proof of employment and income to ensure you can afford the lease payments. This may include: * Pay stubs: Recent pay stubs showing your income. * Employment verification: A letter from your employer verifying your employment. * Tax returns: Recent tax returns showing your income.

Table of Lease Car Paperwork

The following table summarizes the necessary paperwork for leasing a car:

| Document | Description |

|---|---|

| Lease agreement | Primary contract outlining the terms and conditions of the lease |

| Vehicle inspection report | Records the condition of the vehicle at the start of the lease |

| Insurance documents | Proof of insurance that meets the leasing company’s requirements |

| Identification and credit documents | Verifies your creditworthiness and identity |

| Employment and income verification | Verifies your employment and income to ensure you can afford the lease payments |

In the end, understanding the necessary lease car paperwork and being prepared can make a significant difference in the leasing process. By carefully reviewing and understanding the lease agreement, vehicle inspection report, insurance requirements, identification and credit documents, and employment and income verification, you can ensure a smooth and successful leasing experience.

What is the primary contract for leasing a car?

+

The primary contract for leasing a car is the lease agreement, which outlines the terms and conditions of the lease.

What is the purpose of the vehicle inspection report?

+

The vehicle inspection report records the condition of the vehicle at the start of the lease, helping to prevent any disputes when the lease ends.

What type of insurance is required for leasing a car?

+

Leasing companies typically require comprehensive insurance coverage, including collision, comprehensive, and liability coverage.