5 Auto Loan Papers

Understanding the 5 Key Auto Loan Papers You Need to Know

When purchasing a vehicle, it’s essential to understand the various documents involved in the process. One of the most critical aspects of buying a car is securing an auto loan. To finalize the loan, you’ll need to sign several documents, which can be overwhelming if you’re not familiar with them. In this article, we’ll break down the 5 key auto loan papers you need to know to ensure a smooth and informed transaction.

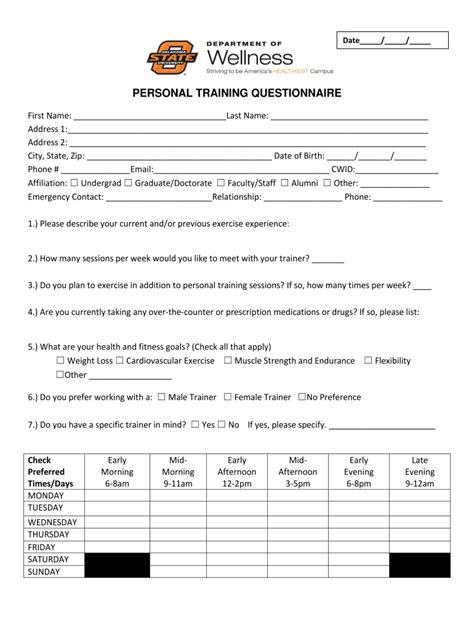

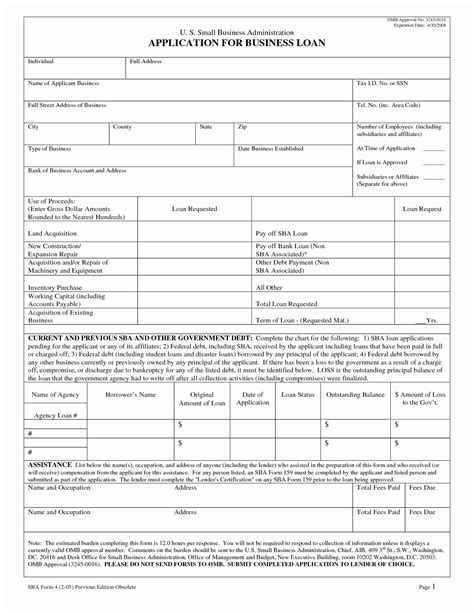

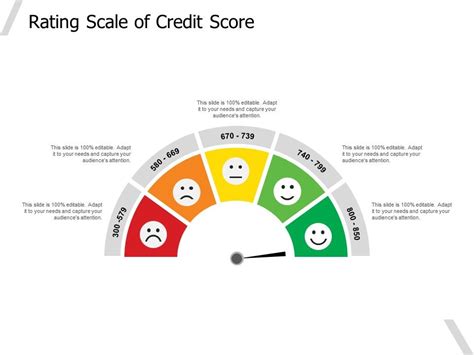

1. Loan Application

The loan application is the first document you’ll encounter when applying for an auto loan. This form requires you to provide personal and financial information, such as your income, employment history, and credit score. The lender uses this information to determine your creditworthiness and decide whether to approve your loan. It’s crucial to fill out the application accurately and honestly to avoid any potential issues with your loan.

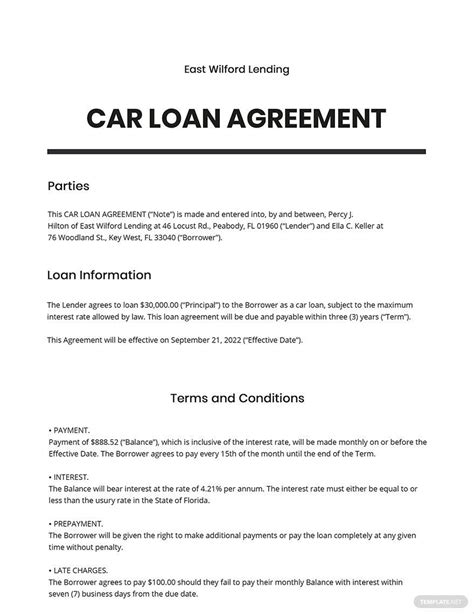

2. Loan Agreement

The loan agreement, also known as the promissory note, is a contract between you and the lender that outlines the terms of the loan. This document includes essential details such as:

- Loan amount

- Interest rate

- Repayment term

- Monthly payment amount

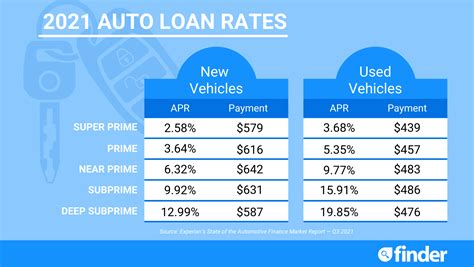

3. Disclosure Statement

The disclosure statement is a document that provides a detailed breakdown of the loan’s terms and conditions. This statement includes information such as:

- Annual percentage rate (APR)

- Finance charge

- Total payments

- Payment schedule

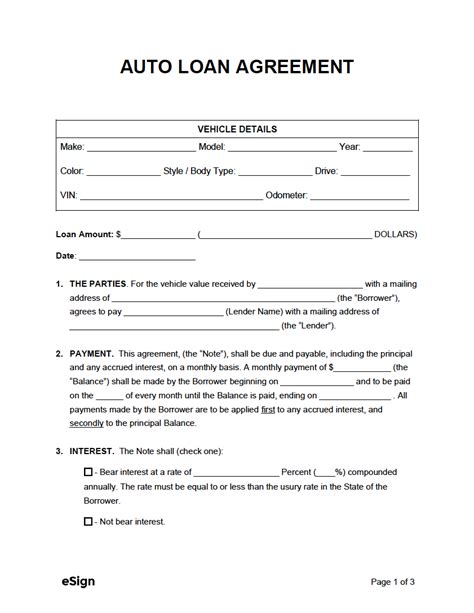

4. Security Agreement

The security agreement is a document that grants the lender a security interest in the vehicle. This means that if you default on the loan, the lender can repossess the vehicle to recover their losses. The security agreement includes details such as:

- Vehicle description

- Vehicle identification number (VIN)

- Lender’s rights and responsibilities

- Borrower’s obligations

5. Title and Registration

The title and registration documents are used to transfer ownership of the vehicle from the seller to you, the buyer. The title proves that you own the vehicle, while the registration allows you to operate the vehicle on public roads. The lender will typically require you to provide proof of title and registration as a condition of the loan.

| Document | Description |

|---|---|

| Loan Application | Provides personal and financial information to determine creditworthiness |

| Loan Agreement | Outlines the terms and conditions of the loan |

| Disclosure Statement | Provides a detailed breakdown of the loan's terms and conditions |

| Security Agreement | Grants the lender a security interest in the vehicle |

| Title and Registration | Transfers ownership of the vehicle and allows operation on public roads |

🚨 Note: It's essential to carefully review all the documents involved in the auto loan process to ensure you understand the terms and conditions of the loan.

In summary, understanding the 5 key auto loan papers is crucial to ensure a smooth and informed transaction when purchasing a vehicle. By carefully reviewing the loan application, loan agreement, disclosure statement, security agreement, and title and registration documents, you can make informed decisions about your purchase and avoid potential issues with the lender.

What is the purpose of the loan application?

+

The loan application provides personal and financial information to determine creditworthiness and decide whether to approve the loan.

What is the difference between the loan agreement and the disclosure statement?

+

The loan agreement outlines the terms and conditions of the loan, while the disclosure statement provides a detailed breakdown of the loan’s terms and conditions, including the APR, finance charge, and total payments.

Why is the security agreement important?

+

The security agreement grants the lender a security interest in the vehicle, allowing them to repossess the vehicle if the borrower defaults on the loan.