5 Tips Inheritance Advance

Inheritance Advance: Understanding the Basics

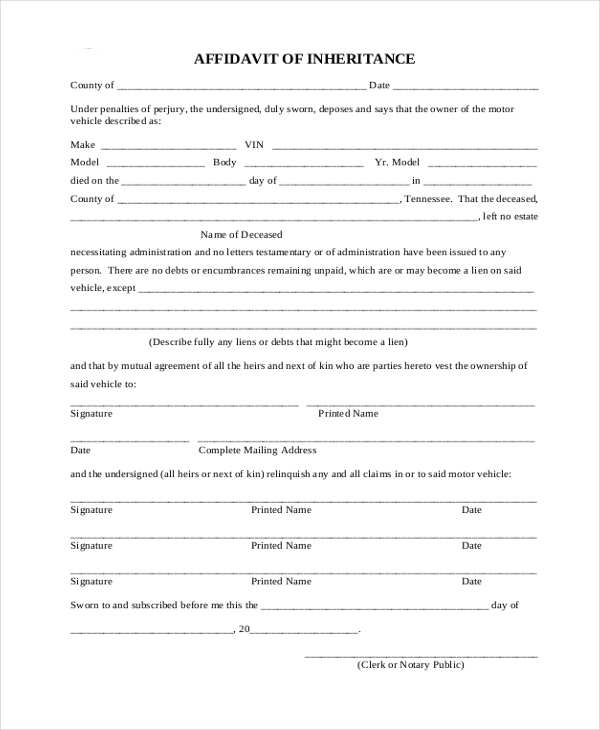

Inheritance advance, also known as inheritance loan or probate advance, refers to a type of financing that allows beneficiaries to access a portion of their inheritance before the estate is fully settled. This can be particularly useful for those who need immediate financial assistance. However, navigating the process of inheritance advance requires careful consideration and understanding of the associated costs, benefits, and potential risks.

Benefits of Inheritance Advance

The primary benefit of an inheritance advance is that it provides beneficiaries with immediate access to funds that they might not otherwise receive for months or even years due to the lengthy probate process. This can be especially beneficial for covering immediate expenses, such as funeral costs, legal fees, or living expenses. Additionally, an inheritance advance can help beneficiaries avoid financial hardships or debts that might accrue while waiting for the estate to be settled.

How Inheritance Advance Works

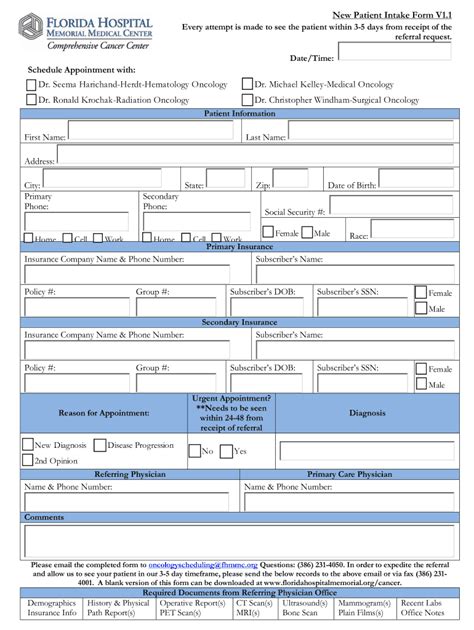

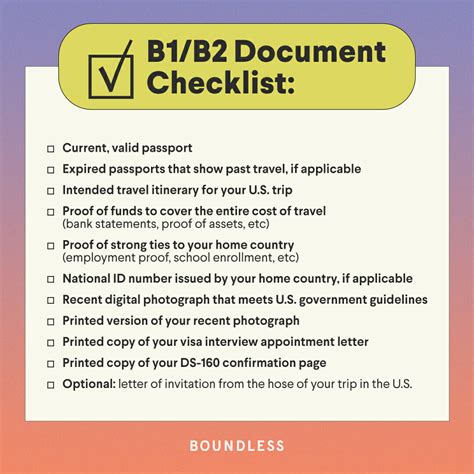

The process of obtaining an inheritance advance typically involves the following steps: - Application: Beneficiaries apply for an inheritance advance through a financial institution or a specialized inheritance funding company. - Review of Estate Documents: The company reviews the estate documents to verify the beneficiary’s claim and estimate the inheritance value. - Approval and Funding: If approved, the company advances a portion of the expected inheritance to the beneficiary. - Repayment: The advance is repaid from the beneficiary’s share of the estate once it is distributed.

5 Tips for Considering an Inheritance Advance

Given the complexities and potential risks associated with inheritance advances, it’s crucial for beneficiaries to approach these financial products with caution. Here are five key tips to consider: * Understand the Fees: Inheritance advances come with fees that can be significant. Beneficiaries should carefully review the terms to understand how much they will be charged and how these fees might impact their inheritance. * Assess the Risks: There are risks involved, such as the potential for the estate to be valued lower than expected or for the probate process to take longer than anticipated. Beneficiaries should assess these risks and consider whether an advance is truly necessary. * Explore Alternatives: Before opting for an inheritance advance, beneficiaries should explore alternative financing options, such as personal loans or assistance from family and friends, which might offer better terms. * Seek Professional Advice: Consulting with a financial advisor or attorney can provide valuable insights into the implications of an inheritance advance and help beneficiaries make an informed decision. * Read Reviews and Check Reputation: It’s essential to research the company offering the inheritance advance. Reading reviews and checking the company’s reputation can help beneficiaries avoid predatory lenders and ensure they are working with a reputable institution.

Potential Risks and Considerations

While an inheritance advance can offer immediate financial relief, it’s not without its potential risks. Beneficiaries might face higher costs due to fees and interest, and there’s a risk that the estate might not yield as much as expected, leaving the beneficiary with a debt. Additionally, the probate process can be unpredictable, and delays or unforeseen complications can impact the timing and amount of the inheritance.

| Benefit | Description |

|---|---|

| Immediate Access to Funds | Beneficiaries can access a portion of their inheritance immediately, helping with urgent financial needs. |

| Avoid Financial Hardships | By receiving an advance, beneficiaries can avoid accumulating debt or facing financial hardships while waiting for the estate to settle. |

📝 Note: Beneficiaries should carefully weigh the benefits against the potential risks and consider seeking professional advice before making a decision.

In summary, an inheritance advance can be a useful financial tool for beneficiaries who need immediate access to their inheritance. However, it’s crucial to understand the process, associated costs, and potential risks. By carefully considering these factors and exploring all available options, beneficiaries can make informed decisions that best suit their financial needs and circumstances. Ultimately, the key to navigating the complex world of inheritance advances lies in informed decision-making and cautious financial planning.

What is an inheritance advance?

+

An inheritance advance is a type of financing that allows beneficiaries to access a portion of their inheritance before the estate is fully settled.

How do I qualify for an inheritance advance?

+

To qualify, beneficiaries typically need to have a verified inheritance and meet the lending criteria set by the financial institution or inheritance funding company.

What are the risks associated with inheritance advances?

+

Risks include higher costs due to fees and interest, the potential for the estate to yield less than expected, and the unpredictable nature of the probate process.