5 Mortgage Paperworks

Understanding the Mortgage Process: 5 Essential Paperworks

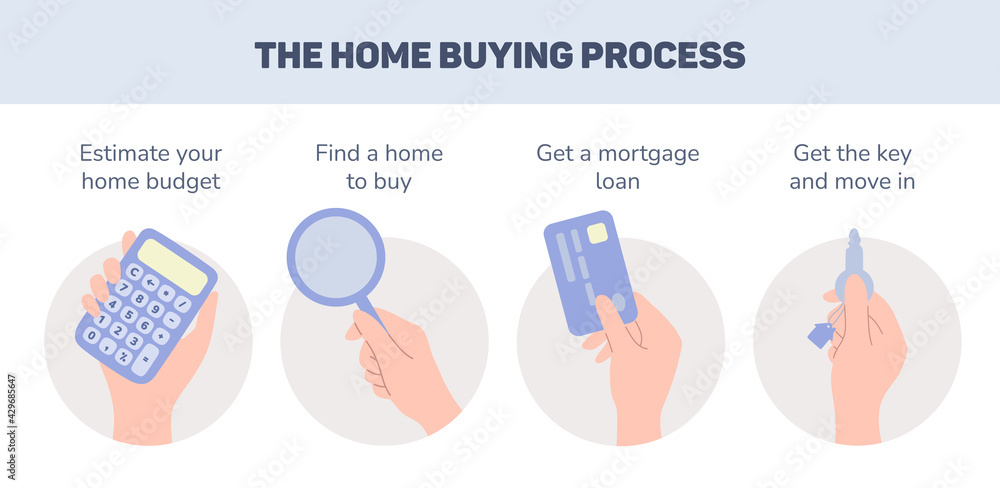

The mortgage process can be complex and overwhelming, especially for first-time homebuyers. With numerous paperwork and documents involved, it’s crucial to understand what each one entails. In this article, we’ll delve into the 5 essential mortgage paperwork that you need to know.

1. Pre-Approval Letter

A pre-approval letter is the first step in the mortgage process. It’s a document issued by a lender stating the amount they are willing to lend you, based on your credit score, income, and other financial factors. This letter is usually valid for 30 to 60 days and gives you an idea of how much you can borrow. Having a pre-approval letter in hand can give you an edge when making an offer on a property, as it shows sellers that you’re a serious buyer.

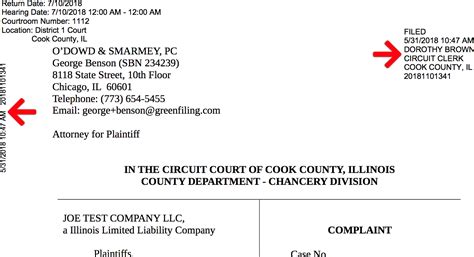

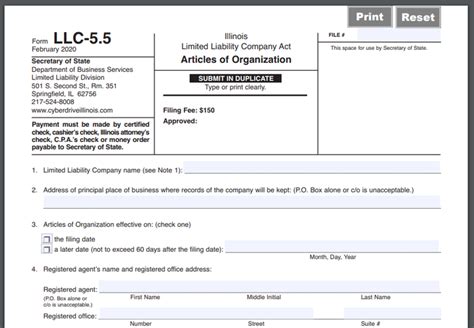

2. Mortgage Application

Once you’ve found a property, you’ll need to fill out a mortgage application. This document requires you to provide detailed financial information, including your income, assets, debts, and credit history. The lender will use this information to determine your creditworthiness and the amount they’re willing to lend. Make sure to fill out the application accurately and completely, as any errors or omissions can delay the process.

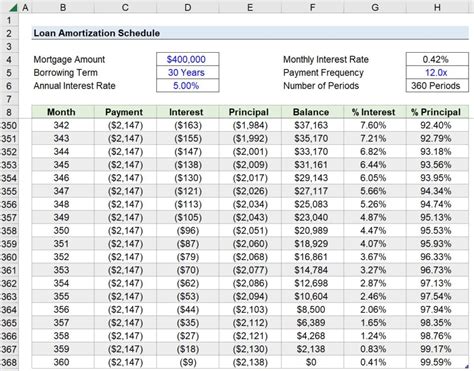

3. Good Faith Estimate (GFE)

The Good Faith Estimate (GFE) is a document that outlines the estimated costs associated with your mortgage, including the interest rate, loan amount, and closing costs. The lender is required to provide you with a GFE within three business days of receiving your mortgage application. Review the GFE carefully, as it can help you compare offers from different lenders and make an informed decision.

4. Appraisal Report

An appraisal report is an independent assessment of the property’s value. The lender hires an appraiser to evaluate the property’s condition, size, and location to determine its worth. The appraisal report is usually required for mortgage applications and can help the lender determine the loan-to-value ratio. Make sure to review the appraisal report carefully, as it can affect the amount you can borrow.

5. Closing Disclosure

The Closing Disclosure (CD) is a document that outlines the final terms of your mortgage, including the interest rate, loan amount, and closing costs. The lender is required to provide you with a CD at least three business days before closing. Review the CD carefully, as it can help you avoid any surprises or errors at closing.

📝 Note: Make sure to keep all your mortgage paperwork organized and easily accessible, as you may need to refer to them during the process.

To summarize, the 5 essential mortgage paperwork include: * Pre-approval letter * Mortgage application * Good Faith Estimate (GFE) * Appraisal report * Closing Disclosure

Each of these documents plays a crucial role in the mortgage process, and understanding what they entail can help you navigate the process with ease.

What is the purpose of a pre-approval letter?

+

A pre-approval letter is a document issued by a lender stating the amount they are willing to lend you, based on your credit score, income, and other financial factors.

What is the difference between a Good Faith Estimate (GFE) and a Closing Disclosure (CD)?

+

A GFE is an estimate of the costs associated with your mortgage, while a CD outlines the final terms of your mortgage.

Why is an appraisal report required for mortgage applications?

+

An appraisal report is an independent assessment of the property's value, which helps the lender determine the loan-to-value ratio.

In the end, understanding the 5 essential mortgage paperwork can help you make informed decisions and navigate the process with ease. By being aware of what each document entails, you can avoid any surprises or errors and ensure a smooth mortgage process.