Paperwork

Sedgwick Claim Paperwork Requirements

Introduction to Sedgwick Claim Paperwork Requirements

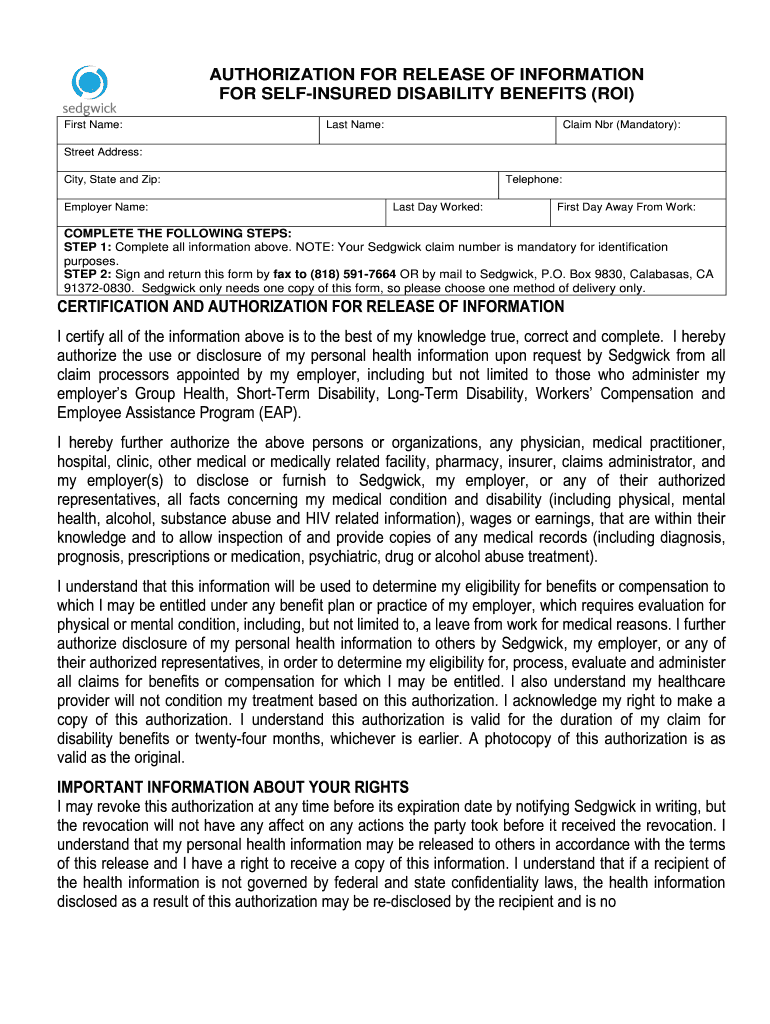

When dealing with insurance claims, it’s essential to understand the paperwork requirements to ensure a smooth and efficient process. Sedgwick, a leading provider of claims management services, has specific requirements for claim paperwork. In this article, we will delve into the details of Sedgwick claim paperwork requirements, exploring the necessary documents, filing procedures, and tips for a successful claims process.

Understanding Sedgwick Claim Paperwork Requirements

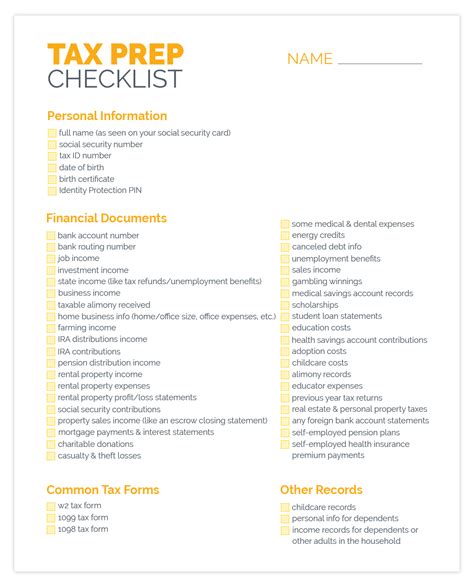

Sedgwick requires claimants to submit specific documents to support their claims. These documents may include:

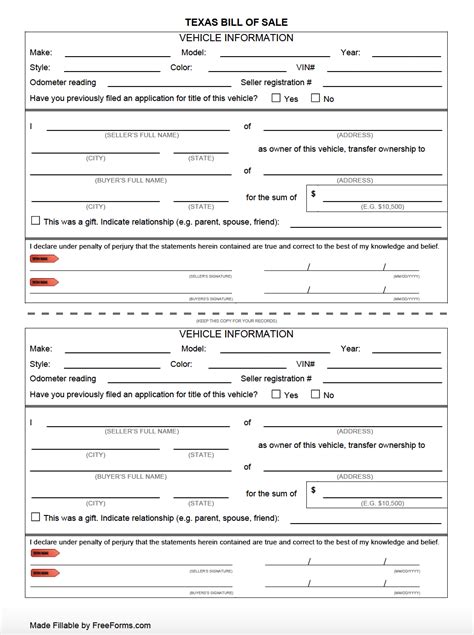

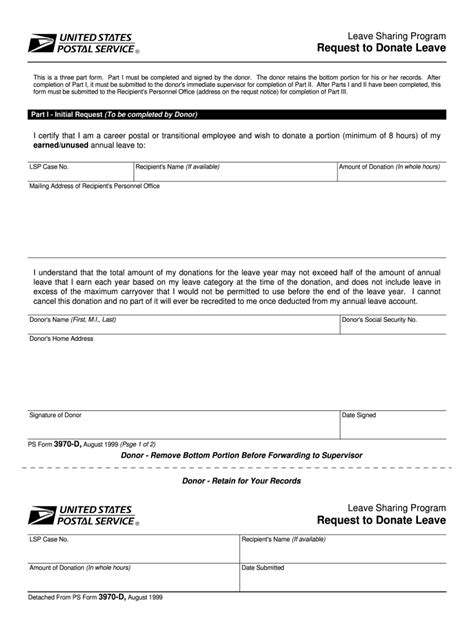

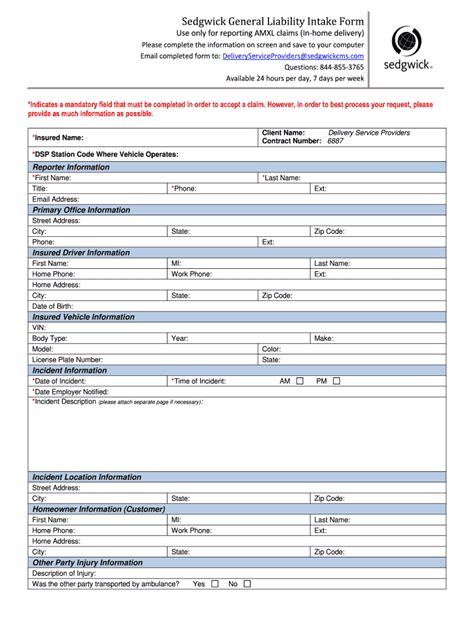

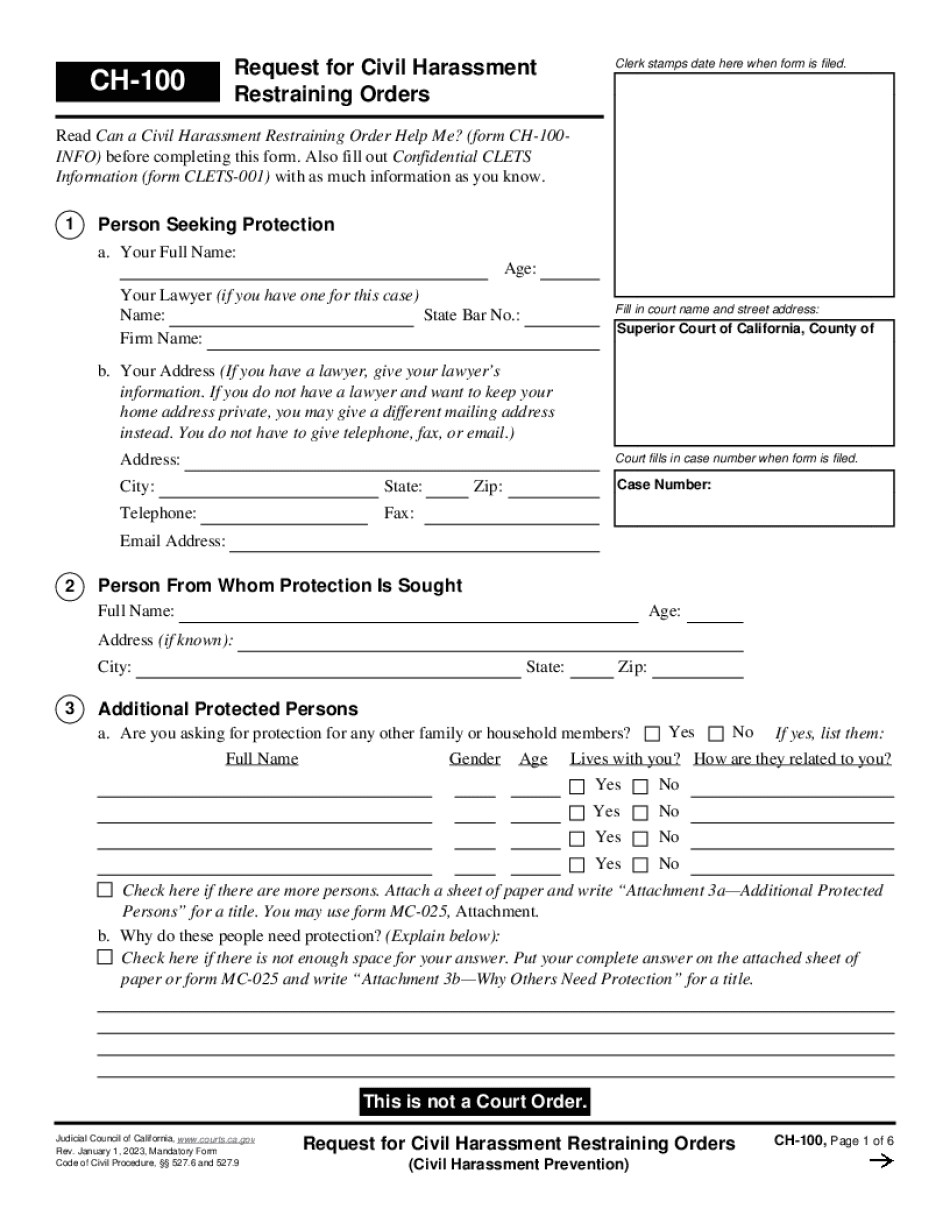

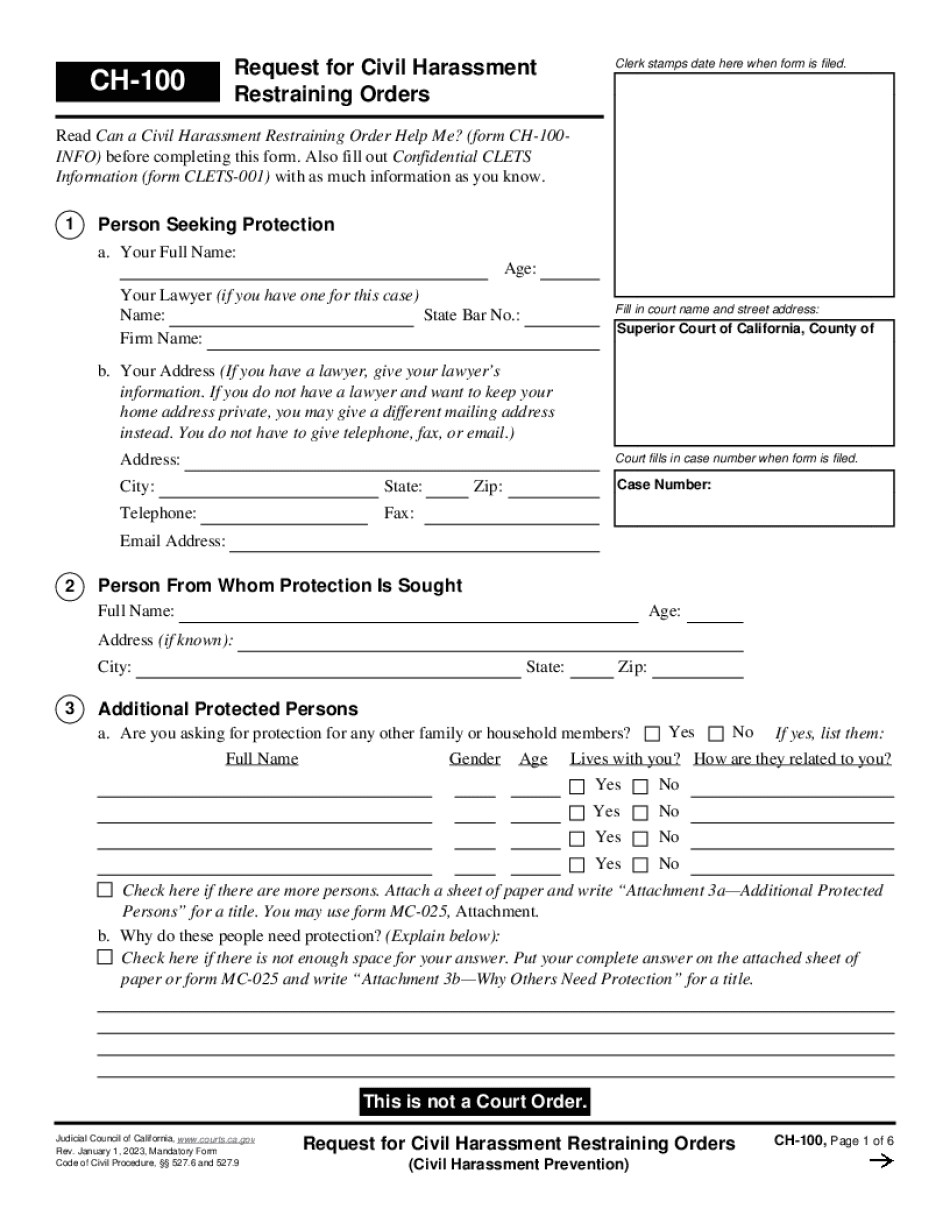

- Claim form: A completed claim form, which can be obtained from Sedgwick’s website or by contacting their customer service.

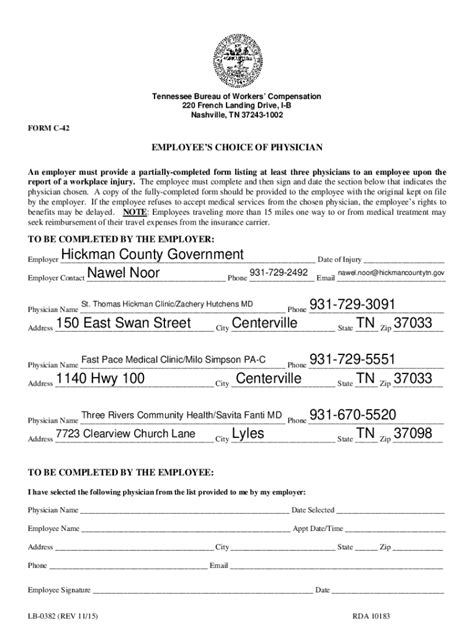

- Proof of loss: Documentation that proves the loss or damage, such as police reports, fire reports, or medical records.

- Supporting documents: Additional documents that support the claim, such as receipts, invoices, or estimates.

Filing Sedgwick Claim Paperwork

To file a claim with Sedgwick, claimants can follow these steps:

- Step 1: Obtain the claim form: Download the claim form from Sedgwick’s website or request one by phone or email.

- Step 2: Complete the claim form: Fill out the claim form accurately and thoroughly, providing all required information.

- Step 3: Gather supporting documents: Collect all necessary supporting documents, such as proof of loss and receipts.

- Step 4: Submit the claim: Submit the completed claim form and supporting documents to Sedgwick via mail, email, or fax.

Table of Required Documents

The following table outlines the required documents for a Sedgwick claim:

| Document Type | Description |

|---|---|

| Claim Form | A completed claim form, which can be obtained from Sedgwick’s website or by contacting their customer service. |

| Proof of Loss | Documentation that proves the loss or damage, such as police reports, fire reports, or medical records. |

| Supporting Documents | Additional documents that support the claim, such as receipts, invoices, or estimates. |

📝 Note: Claimants should ensure they have all required documents before submitting their claim to avoid delays in the process.

Tips for a Successful Claims Process

To ensure a successful claims process, claimants should:

- Act promptly: Submit the claim as soon as possible to avoid delays.

- Be thorough: Provide all required information and supporting documents to avoid requests for additional information.

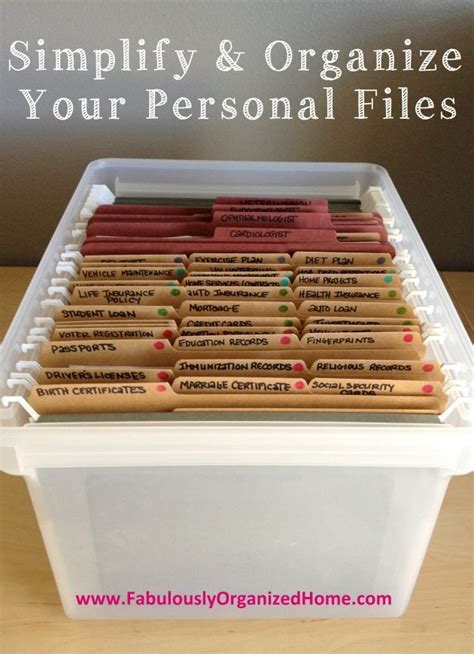

- Stay organized: Keep a record of all correspondence and submissions to Sedgwick.

Conclusion and Final Thoughts

In conclusion, understanding Sedgwick claim paperwork requirements is crucial for a successful claims process. By providing all required documents and following the filing procedures, claimants can help ensure a smooth and efficient process. It’s essential to review the claim form and supporting documents carefully and submit the claim promptly to avoid delays. By following these guidelines and tips, claimants can navigate the Sedgwick claims process with confidence.

What is the first step in filing a Sedgwick claim?

+

The first step in filing a Sedgwick claim is to obtain the claim form, which can be downloaded from Sedgwick’s website or requested by phone or email.

What documents are required to support a Sedgwick claim?

+

The required documents to support a Sedgwick claim include a completed claim form, proof of loss, and supporting documents such as receipts, invoices, or estimates.

How can I submit my Sedgwick claim?

+

You can submit your Sedgwick claim via mail, email, or fax. It’s essential to keep a record of your submission, including the date and method of submission.