5 Steps to Buy Business

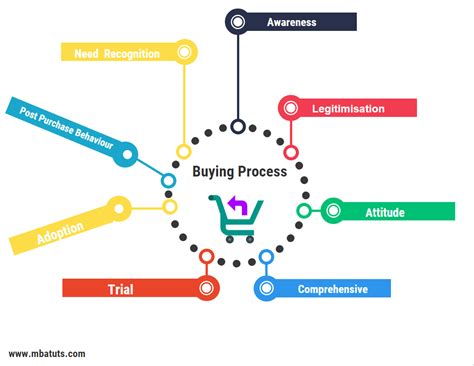

Introduction to Buying a Business

Buying a business can be a complex and daunting task, especially for those who are new to the process. It requires careful consideration, thorough research, and a well-thought-out strategy. Whether you’re a seasoned entrepreneur or a first-time buyer, the process of buying a business involves several crucial steps that must be taken to ensure a successful transaction. In this article, we’ll explore the key steps involved in buying a business, highlighting the importance of each stage and providing valuable insights to help you navigate the process.

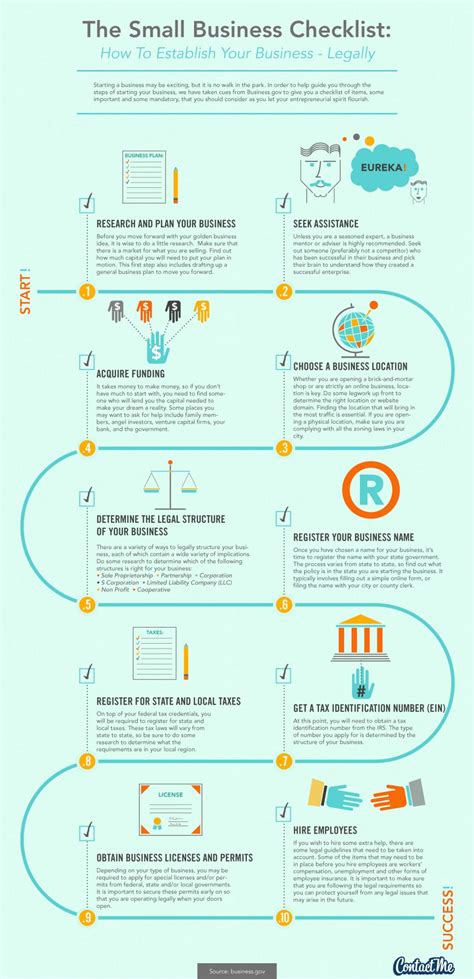

Step 1: Define Your Goals and Objectives

Before starting your search for a business to buy, it’s essential to define your goals and objectives. This involves identifying the type of business you want to acquire, the industry you’re interested in, and the size of the business that suits your budget and expertise. Consider the following factors: * Type of business: Are you interested in a retail, service-based, or manufacturing business? * Industry: Which industry aligns with your skills, experience, and interests? * Size of the business: Are you looking for a small, medium, or large business? * Location: Do you want to buy a business in a specific geographic location? * Budget: What is your budget for the purchase, and what financing options are available to you?

Step 2: Research and Find Potential Businesses

Once you’ve defined your goals and objectives, the next step is to research and find potential businesses that meet your criteria. You can use various resources to find businesses for sale, including: * Business brokers: Professional intermediaries who specialize in buying and selling businesses. * Online marketplaces: Websites that list businesses for sale, such as BizBuySell or BusinessesForSale. * Networking: Reach out to your professional network, including friends, family, and colleagues, to see if they know of any businesses for sale. * Industry associations: Contact industry associations or trade organizations to inquire about businesses for sale in your desired industry.

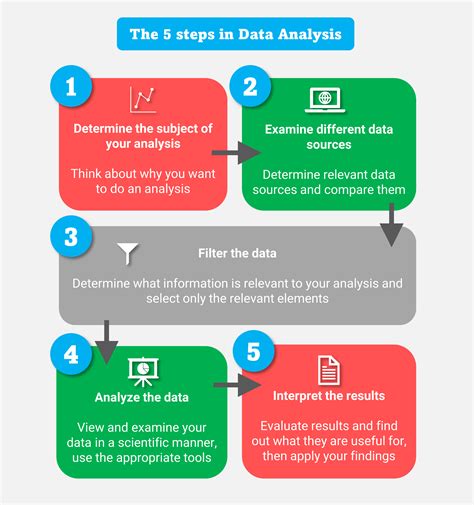

Step 3: Evaluate and Analyze Potential Businesses

After finding potential businesses, it’s crucial to evaluate and analyze each opportunity carefully. This involves reviewing the business’s: * Financial performance: Review the business’s financial statements, including income statements, balance sheets, and cash flow statements. * Market position: Assess the business’s market share, competition, and growth potential. * Operations: Evaluate the business’s operational efficiency, management structure, and employee dynamics. * Assets and liabilities: Review the business’s assets, including equipment, property, and inventory, as well as its liabilities, such as debts and outstanding obligations.

| Business Aspect | Evaluation Criteria |

|---|---|

| Financial Performance | Revenue growth, profitability, cash flow |

| Market Position | Market share, competition, growth potential |

| Operations | Operational efficiency, management structure, employee dynamics |

| Assets and Liabilities | Assets (equipment, property, inventory), liabilities (debts, outstanding obligations) |

Step 4: Negotiate the Purchase Price and Terms

After evaluating and analyzing the business, it’s time to negotiate the purchase price and terms. This involves: * Determining the purchase price: Based on your evaluation, determine a fair purchase price for the business. * Negotiating the terms: Negotiate the terms of the sale, including the payment structure, financing options, and any conditions or contingencies. * Reviewing and signing the sale agreement: Once you’ve agreed on the purchase price and terms, review and sign the sale agreement.

📝 Note: It's essential to work with a professional advisor, such as a lawyer or accountant, to ensure that the sale agreement is thorough and protects your interests.

Step 5: Close the Deal and Transition the Business

The final step is to close the deal and transition the business. This involves: * Completing due diligence: Conduct a thorough review of the business’s financial, legal, and operational aspects. * Obtaining financing: Secure financing for the purchase, if necessary. * Transferring ownership: Transfer ownership of the business, including updating records and notifying relevant parties. * Transitioning the business: Transition the business to your ownership, including introducing yourself to employees, customers, and suppliers.

In summary, buying a business requires careful consideration, thorough research, and a well-thought-out strategy. By following these five steps, you can ensure a successful transaction and set yourself up for success as a business owner.

What are the most important factors to consider when buying a business?

+

The most important factors to consider when buying a business include the type of business, industry, size, location, and budget. It’s also essential to evaluate the business’s financial performance, market position, operations, and assets and liabilities.

How do I find businesses for sale?

+

You can find businesses for sale through business brokers, online marketplaces, networking, and industry associations. It’s essential to research and evaluate each opportunity carefully to ensure it meets your goals and objectives.

What is the role of a business broker in the buying process?

+

A business broker acts as an intermediary between the buyer and seller, facilitating the sale and ensuring a smooth transaction. They can provide valuable guidance and support throughout the process, including evaluating businesses, negotiating the purchase price and terms, and closing the deal.