Paperwork

5 PPI Claim Forms

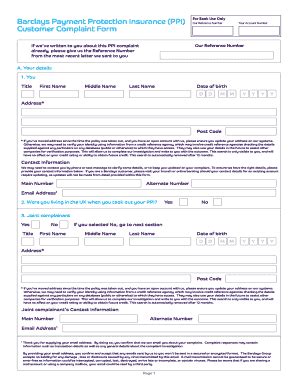

Introduction to PPI Claim Forms

The Payment Protection Insurance (PPI) claim process has been a significant topic of discussion in the financial industry, particularly in the UK. Many individuals have been mis-sold PPI policies, leading to a massive wave of claims. To initiate the claim process, individuals need to fill out a PPI claim form. In this article, we will delve into the world of PPI claim forms, exploring their purpose, types, and the information required to complete them.

What is a PPI Claim Form?

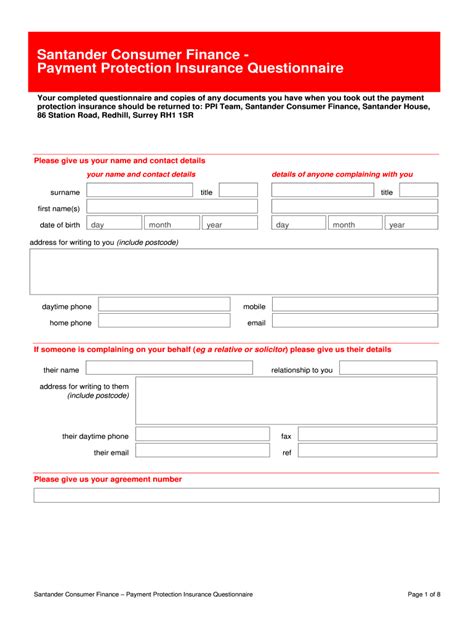

A PPI claim form is a document that individuals need to fill out to start the process of claiming back mis-sold PPI premiums. The form typically requires personal and financial information, as well as details about the PPI policy in question. The purpose of the form is to provide the necessary information to the lender or claims management company to investigate the claim and determine whether the individual is eligible for a refund.

Types of PPI Claim Forms

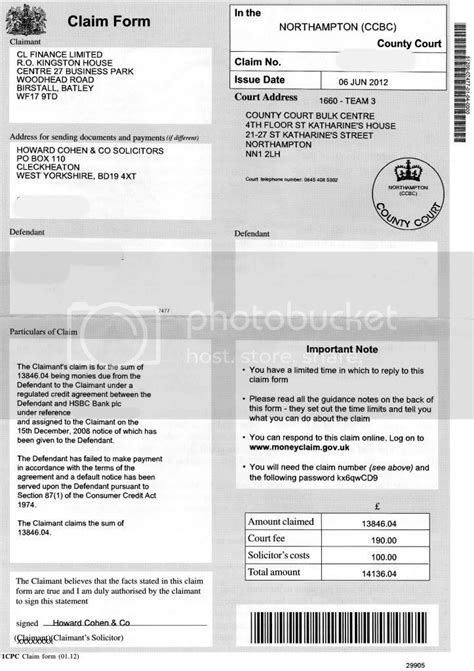

There are several types of PPI claim forms, including: * Standard PPI claim form: This is the most common type of claim form, used for most PPI claims. * Loan-specific PPI claim form: This type of form is used for claims related to loans, such as personal loans or mortgages. * Credit card-specific PPI claim form: This type of form is used for claims related to credit card PPI policies. * Mortgage-specific PPI claim form: This type of form is used for claims related to mortgage PPI policies. * Online PPI claim form: This type of form is used for claims submitted online, either through a lender’s website or a claims management company’s website.

Information Required for a PPI Claim Form

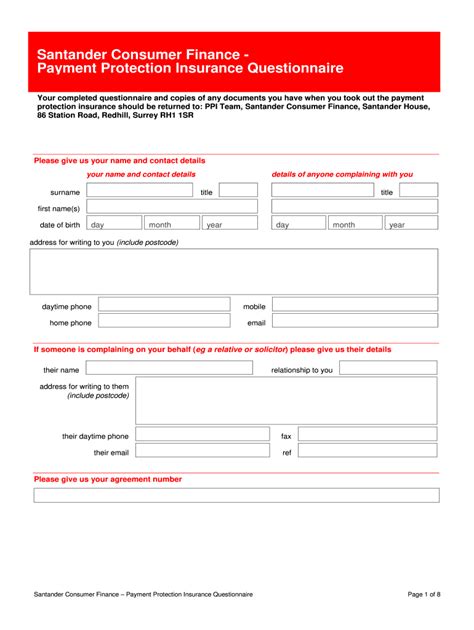

To complete a PPI claim form, individuals will typically need to provide the following information: * Personal details, such as name, address, and date of birth * Financial information, such as account numbers and policy details * Details about the PPI policy, including the policy number and dates of coverage * Information about the mis-sold PPI policy, including the reason for the claim and any relevant documentation

How to Fill Out a PPI Claim Form

Filling out a PPI claim form can be a straightforward process, but it’s essential to ensure that all information is accurate and complete. Here are some steps to follow: * Read the form carefully and follow the instructions provided * Fill out all required fields, using black ink and capital letters * Provide all necessary documentation, such as policy documents and proof of identity * Review the form carefully before submitting it to ensure that all information is accurate and complete

Common Mistakes to Avoid When Filling Out a PPI Claim Form

When filling out a PPI claim form, there are several common mistakes to avoid, including: * Incomplete information: Failing to provide all required information can delay or even reject the claim. * Inaccurate information: Providing inaccurate information can lead to the claim being rejected or delayed. * Missing documentation: Failing to provide necessary documentation can delay or reject the claim. * Not following instructions: Failing to follow the instructions provided with the form can lead to delays or rejection.

📝 Note: It's essential to carefully review the form before submitting it to ensure that all information is accurate and complete.

Conclusion and Next Steps

In conclusion, filling out a PPI claim form is a crucial step in the process of claiming back mis-sold PPI premiums. By understanding the purpose and types of PPI claim forms, individuals can ensure that they provide all necessary information to support their claim. By following the steps outlined in this article and avoiding common mistakes, individuals can increase their chances of a successful claim.

What is a PPI claim form?

+

A PPI claim form is a document that individuals need to fill out to start the process of claiming back mis-sold PPI premiums.

What information do I need to provide on a PPI claim form?

+

To complete a PPI claim form, individuals will typically need to provide personal details, financial information, and details about the PPI policy, including the policy number and dates of coverage.

How long does it take to process a PPI claim?

+

The time it takes to process a PPI claim can vary, but it typically takes several weeks to several months. The length of time will depend on the complexity of the claim and the efficiency of the lender or claims management company.