Buy Note Paperwork Requirements

Introduction to Buying Note Paperwork Requirements

When considering the purchase of a property, whether it’s a residential home, commercial building, or vacant land, there are numerous factors to take into account. One of the most critical aspects of this process is the buy note paperwork requirements. Understanding these requirements is essential for a smooth and successful transaction. In this article, we will delve into the world of buying note paperwork, exploring what it entails, the necessary documents, and the steps involved in the process.

Understanding Buy Note Paperwork Requirements

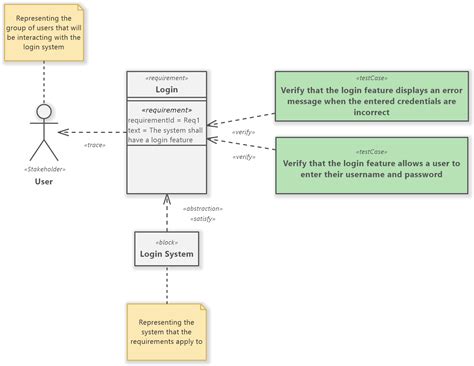

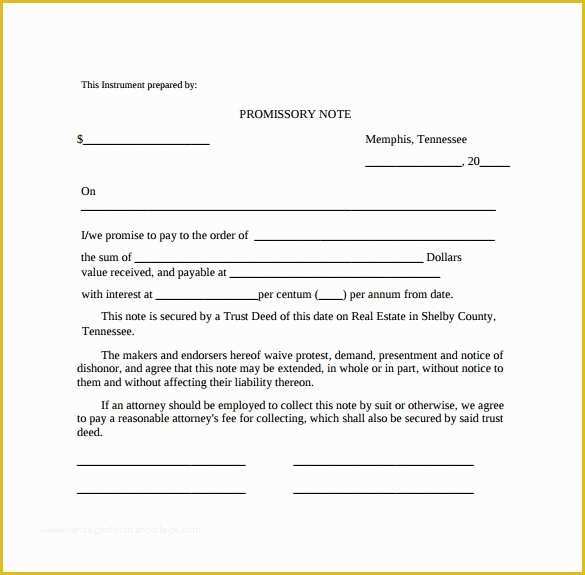

Buy note paperwork refers to the documentation required when purchasing a property. This paperwork is designed to protect both the buyer and the seller by outlining the terms of the sale, including the price, payment method, and any contingencies. The specific requirements may vary depending on the location and type of property being purchased. It is crucial to familiarize oneself with the local laws and regulations to ensure compliance and avoid any potential issues.

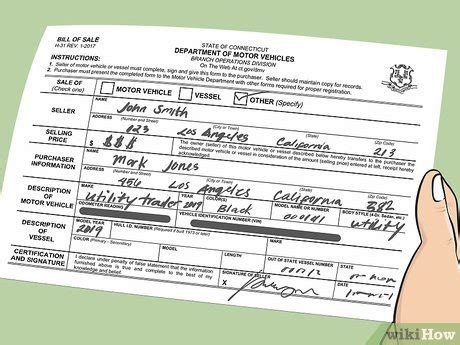

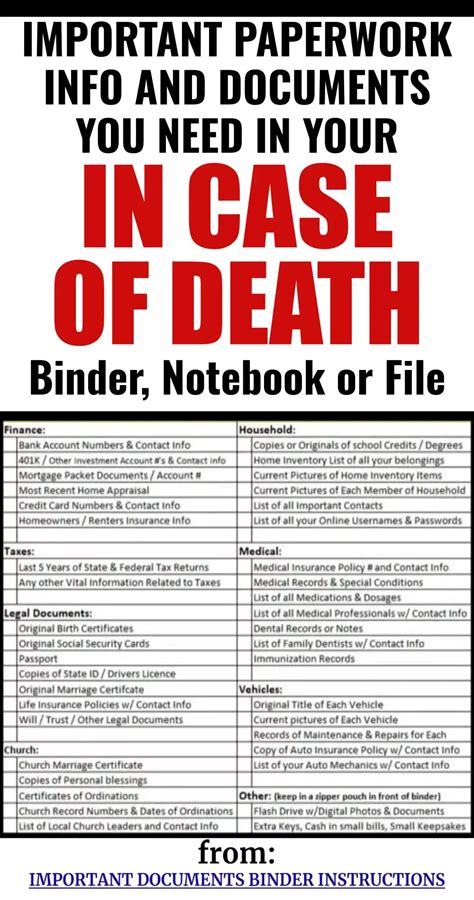

Necessary Documents for Buying Note Paperwork

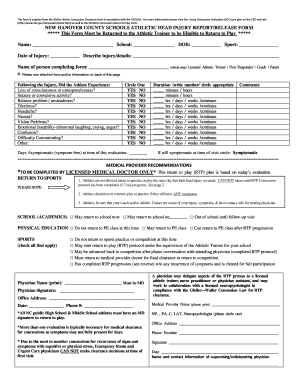

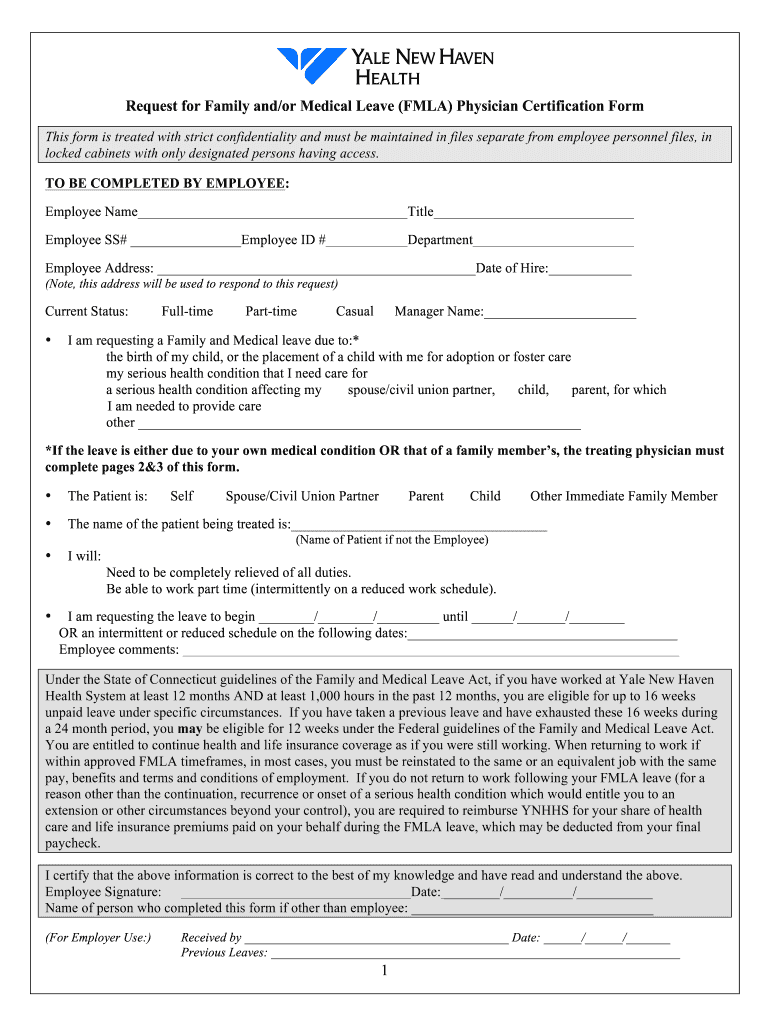

The following are some of the key documents typically involved in the buy note paperwork process: - Purchase Agreement: This is the primary document that outlines the terms of the sale, including the purchase price, payment terms, and any contingencies. - Title Report: This document provides information about the property’s title, including any liens or encumbrances. - Appraisal Report: An appraisal report is used to determine the value of the property. - Inspection Reports: These reports detail the condition of the property, highlighting any defects or needed repairs. - Financing Documents: If the purchase is being financed, documents such as loan applications and approval letters will be required.

Steps Involved in the Buy Note Paperwork Process

The process of buying note paperwork involves several steps: 1. Pre-approval: The buyer should first get pre-approved for a mortgage to understand their budget. 2. Property Selection: The buyer then selects a property that meets their needs and budget. 3. Offer Submission: An offer is made to the seller, which includes the price and terms of the purchase. 4. Inspections and Due Diligence: The buyer conducts inspections and reviews documents to ensure the property is as represented. 5. Financing: The buyer finalizes their financing, which may involve applying for a mortgage. 6. Closing: The final step is the closing, where the buyer and seller sign the necessary documents to transfer ownership.

📝 Note: It's essential to work with a professional, such as a real estate agent or attorney, to ensure all paperwork is correctly filled out and filed.

Challenges and Considerations

The buy note paperwork process can be complex and daunting, especially for first-time buyers. Understanding the local market and being prepared can help mitigate some of the challenges. Additionally, working with experienced professionals can provide valuable guidance and support throughout the process.

Conclusion and Final Thoughts

In conclusion, buying note paperwork requirements are a critical component of the property purchasing process. By understanding what these requirements entail and being prepared, buyers can navigate the process more effectively. Whether you’re a seasoned investor or a first-time buyer, it’s essential to approach the buy note paperwork process with diligence and care, ensuring that all aspects of the transaction are handled correctly.

What is the purpose of a purchase agreement in buy note paperwork?

+

The purpose of a purchase agreement is to outline the terms of the sale, including the price, payment terms, and any contingencies, protecting both the buyer and the seller.

Why is it important to conduct inspections during the buy note paperwork process?

+

Conducting inspections allows the buyer to understand the condition of the property, identifying any defects or needed repairs, which can impact the purchase decision or negotiations.

What role does financing play in the buy note paperwork process?

+

Financing is a critical aspect of the buy note paperwork process, as it determines the buyer’s ability to purchase the property. Financing documents, such as loan applications and approval letters, are essential for completing the transaction.