5 Refinance Papers

Introduction to Refinance Papers

Refinancing is a process where a borrower takes out a new loan to pay off an existing loan, often to secure a better interest rate, lower monthly payments, or to tap into the equity of a property. Refinance papers are the documents that are required to facilitate this process. In this article, we will explore the different types of refinance papers, their importance, and the steps involved in refinancing a loan.

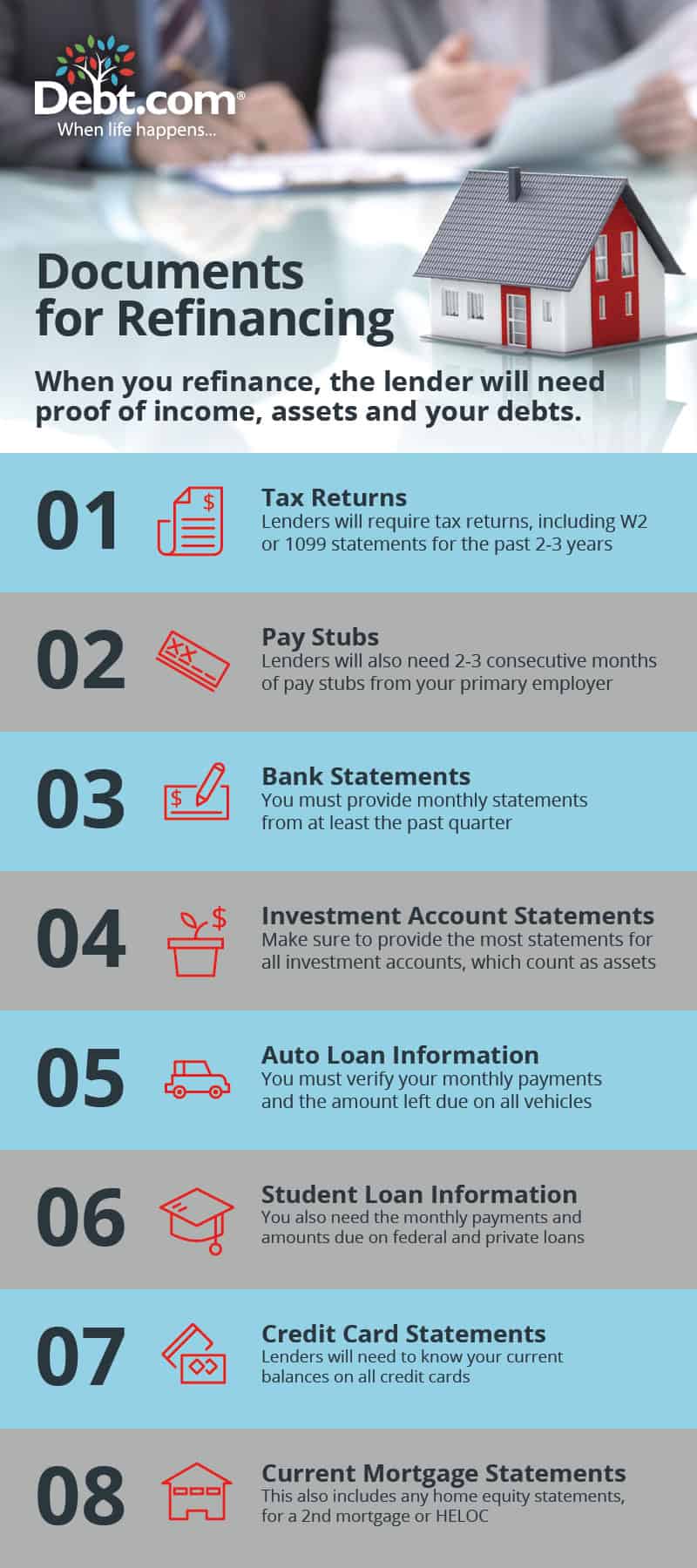

Types of Refinance Papers

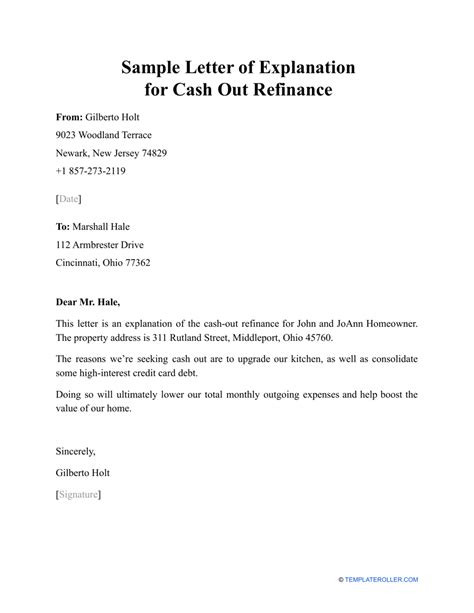

There are several types of refinance papers that are required during the refinancing process. These include: * Loan Application: This is the initial document that is submitted to the lender to apply for a refinance loan. It provides personal and financial information about the borrower. * Credit Report: A credit report is a document that provides information about the borrower’s credit history. It is used by lenders to determine the borrower’s creditworthiness. * Appraisal Report: An appraisal report is a document that provides an estimate of the value of the property being refinanced. * Title Report: A title report is a document that provides information about the ownership of the property and any liens or encumbrances that may exist. * Loan Estimate: A loan estimate is a document that provides an estimate of the terms of the refinance loan, including the interest rate, monthly payments, and closing costs.

Importance of Refinance Papers

Refinance papers are important because they provide lenders with the information they need to make an informed decision about whether to approve a refinance loan. They also provide borrowers with a clear understanding of the terms of the loan and the costs involved. Without refinance papers, the refinancing process would be impossible, and borrowers would not be able to secure the financing they need to refinance their loans.

Steps Involved in Refinancing a Loan

The steps involved in refinancing a loan are as follows: * Determine the need to refinance: The borrower must determine whether refinancing is necessary and whether it will provide any benefits. * Research lenders: The borrower must research different lenders and compare their rates and terms. * Gather refinance papers: The borrower must gather all the necessary refinance papers, including the loan application, credit report, appraisal report, title report, and loan estimate. * Submit the loan application: The borrower must submit the loan application and supporting documents to the lender. * Wait for approval: The borrower must wait for the lender to approve the loan application. * Close the loan: Once the loan is approved, the borrower must close the loan by signing the final documents.

💡 Note: The refinancing process can be complex and time-consuming, and borrowers should be prepared to provide detailed financial information and documentation.

Benefits of Refinancing a Loan

Refinancing a loan can provide several benefits, including: * Lower interest rates: Refinancing can provide borrowers with a lower interest rate, which can result in lower monthly payments. * Lower monthly payments: Refinancing can provide borrowers with lower monthly payments, which can make it easier to manage their finances. * Cash-out refinancing: Refinancing can provide borrowers with the opportunity to tap into the equity of their property and receive cash. * Debt consolidation: Refinancing can provide borrowers with the opportunity to consolidate their debt into a single loan with a lower interest rate.

Common Mistakes to Avoid When Refinancing a Loan

There are several common mistakes that borrowers should avoid when refinancing a loan, including: * Not researching lenders: Borrowers should research different lenders and compare their rates and terms to ensure they are getting the best deal. * Not reading the fine print: Borrowers should carefully read the loan documents and understand the terms and conditions of the loan. * Not considering the costs: Borrowers should consider the costs involved in refinancing, including closing costs and fees. * Not checking credit reports: Borrowers should check their credit reports to ensure they are accurate and up-to-date.

| Type of Refinance Paper | Description |

|---|---|

| Loan Application | Initial document submitted to the lender to apply for a refinance loan |

| Credit Report | Document that provides information about the borrower's credit history |

| Appraisal Report | Document that provides an estimate of the value of the property being refinanced |

| Title Report | Document that provides information about the ownership of the property and any liens or encumbrances that may exist |

| Loan Estimate | Document that provides an estimate of the terms of the refinance loan, including the interest rate, monthly payments, and closing costs |

In summary, refinance papers are an essential part of the refinancing process. They provide lenders with the information they need to make an informed decision about whether to approve a refinance loan, and they provide borrowers with a clear understanding of the terms of the loan and the costs involved. By understanding the different types of refinance papers, the importance of refinance papers, and the steps involved in refinancing a loan, borrowers can make informed decisions about their financial situation and secure the financing they need to achieve their goals.

What is refinancing?

+

Refinancing is a process where a borrower takes out a new loan to pay off an existing loan, often to secure a better interest rate, lower monthly payments, or to tap into the equity of a property.

What are refinance papers?

+

Refinance papers are the documents that are required to facilitate the refinancing process, including the loan application, credit report, appraisal report, title report, and loan estimate.

Why is refinancing important?

+

Refinancing is important because it can provide borrowers with a better interest rate, lower monthly payments, and the opportunity to tap into the equity of their property.