Tax Paperwork Needed

Introduction to Tax Paperwork

When it comes to managing finances, one of the most critical aspects is dealing with tax paperwork. Tax season can be overwhelming, especially for those who are not familiar with the process. To ensure a smooth and stress-free experience, it’s essential to understand the different types of tax paperwork needed. In this article, we will delve into the world of tax paperwork, exploring the various forms, documents, and requirements necessary for individuals and businesses.

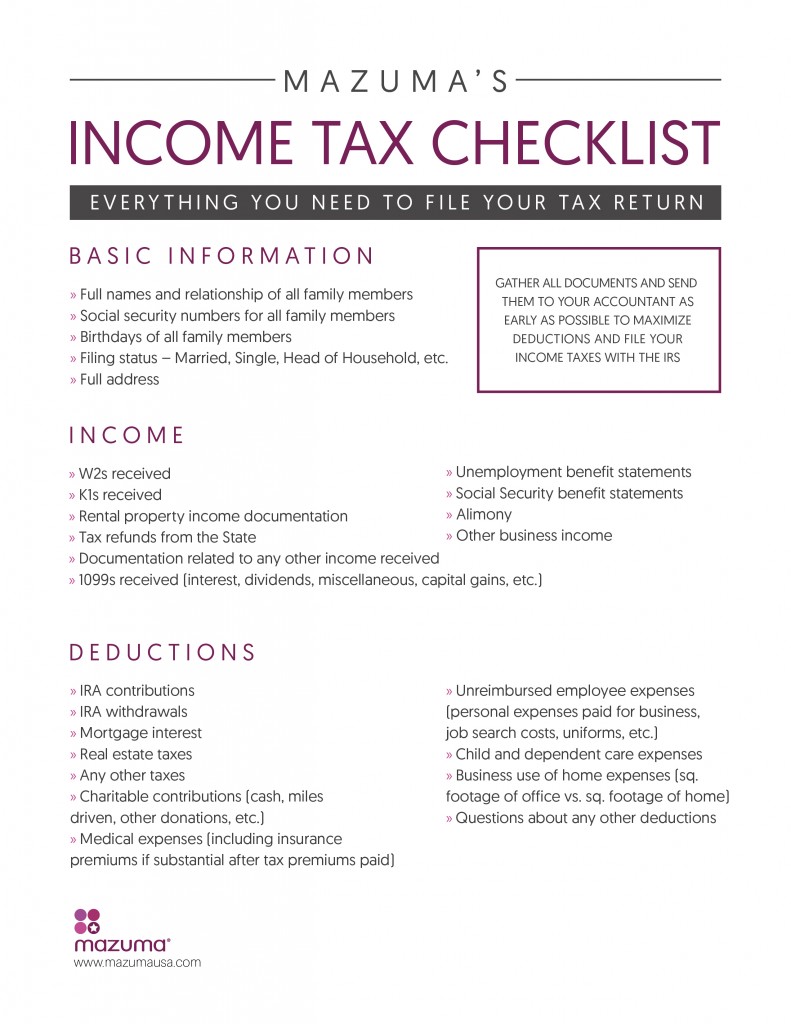

Types of Tax Paperwork

There are several types of tax paperwork that individuals and businesses need to be aware of. These include: * W-2 forms: Used to report income and taxes withheld from employees * 1099 forms: Used to report income earned by independent contractors and freelancers * Tax returns: Used to report income, deductions, and credits to the government * Schedule C: Used to report business income and expenses for sole proprietors * Schedule E: Used to report rental income and expenses

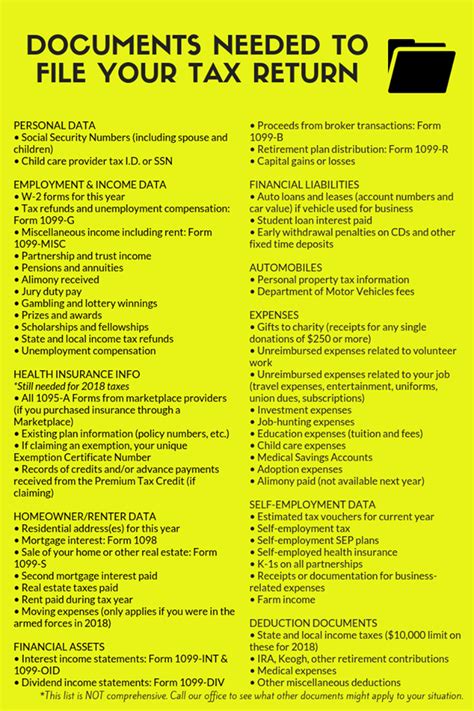

Individual Tax Paperwork

Individuals need to gather various documents to complete their tax returns. These include: * Social Security number or Individual Taxpayer Identification Number (ITIN) * W-2 forms from employers * 1099 forms for any freelance or contract work * Interest statements from banks and investments * Charitable donation receipts * Medical expense receipts

| Document | Description |

|---|---|

| W-2 form | Reports income and taxes withheld from employees |

| 1099 form | Reports income earned by independent contractors and freelancers |

| Tax return | Reports income, deductions, and credits to the government |

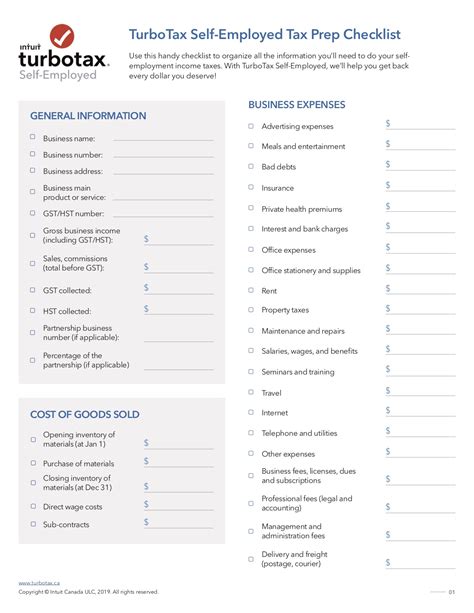

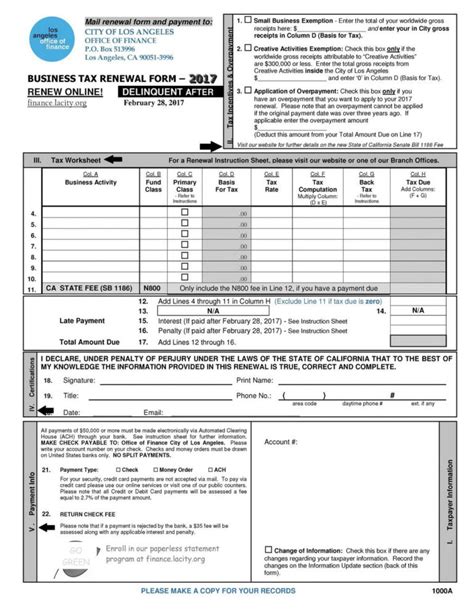

Business Tax Paperwork

Businesses require additional tax paperwork, including: * Business license * Employer Identification Number (EIN) * W-2 forms for employees * 1099 forms for independent contractors * Business income statements * Expense records

📝 Note: Businesses may need to file additional forms, such as Form 1120 for corporations or Form 1065 for partnerships.

Tax Filing Options

There are several tax filing options available, including: * E-filing: Electronic filing of tax returns * Paper filing: Mailing paper tax returns to the government * Tax software: Using software, such as TurboTax or H&R Block, to prepare and file tax returns * Tax professional: Hiring a tax professional to prepare and file tax returns

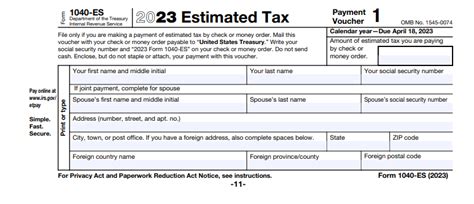

Tax Deadlines

It’s essential to be aware of tax deadlines to avoid penalties and fines. The tax filing deadline is typically April 15th, but this can vary depending on the type of tax return and the taxpayer’s situation.

📆 Note: Taxpayers can request an automatic six-month extension to file their tax returns, but this does not extend the payment deadline.

In summary, tax paperwork is a critical aspect of managing finances, and understanding the different types of tax paperwork needed can help individuals and businesses navigate the tax season with ease. By gathering the necessary documents, choosing the right tax filing option, and meeting tax deadlines, taxpayers can ensure a smooth and stress-free experience.

What is the deadline for filing tax returns?

+

The tax filing deadline is typically April 15th, but this can vary depending on the type of tax return and the taxpayer’s situation.

What is the difference between a W-2 and a 1099 form?

+

A W-2 form reports income and taxes withheld from employees, while a 1099 form reports income earned by independent contractors and freelancers.

Can I file my tax return electronically?

+

Yes, you can file your tax return electronically using tax software or by hiring a tax professional.