Donate Car Paperwork Needed

Introduction to Donating a Car

Donating a car to charity can be a generous and rewarding act, providing essential funds to support a cause you care about while also offering you a potential tax deduction. However, the process involves several steps, including gathering the necessary paperwork to ensure the donation is handled correctly and legally. Understanding what documents are required and how to navigate the donation process can make the experience smoother for both you and the charity.

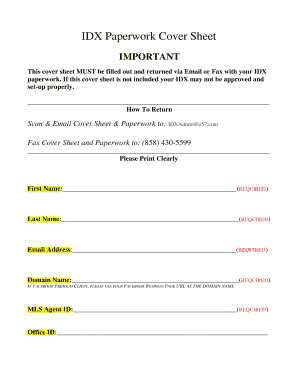

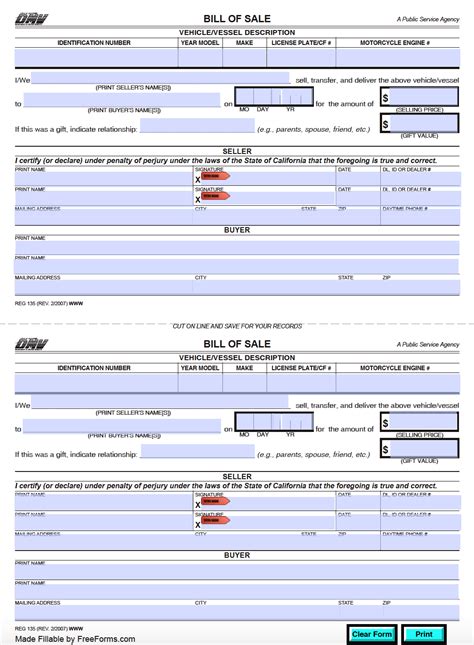

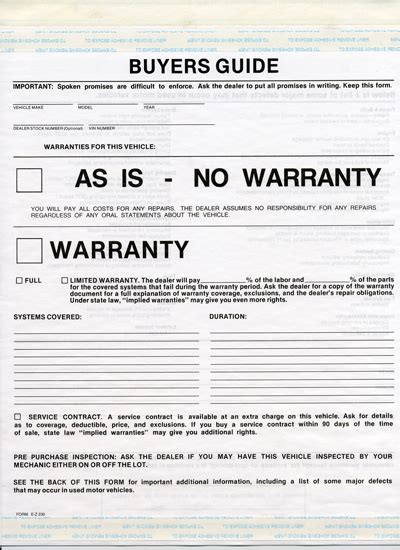

Required Paperwork for Donating a Car

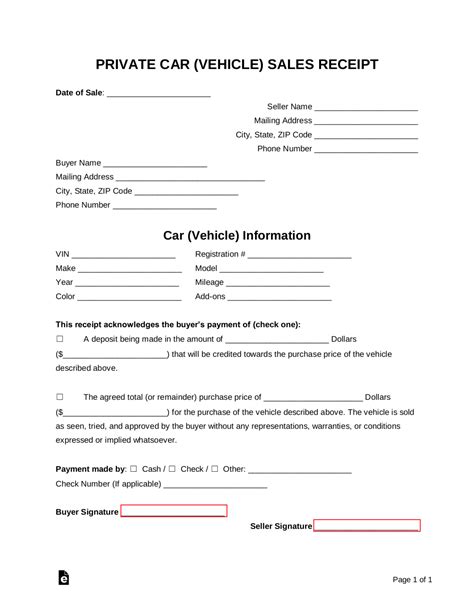

When donating a car, several documents are necessary to complete the transaction. These include: - Vehicle Title: This is the most critical document, as it proves your ownership of the vehicle. Ensure the title is free of any liens, as most charities cannot accept vehicles with outstanding loans. - Registration: While not always necessary, having the current registration can help in the transfer process. - Identification: You’ll need to provide identification, such as a driver’s license, to verify your identity. - Charity Information: The charity should provide you with their Employer Identification Number (EIN) and a receipt or acknowledgement of the donation for tax purposes.

Steps to Donate a Car

The process of donating a car involves several steps: - Research: Find a reputable charity that accepts car donations and supports a cause you believe in. Ensure the charity is registered as a 501©(3) organization to qualify for a tax deduction. - Contact the Charity: Reach out to the charity to initiate the donation process. They will guide you through the necessary steps, which may include filling out a donation form on their website or calling a hotline. - Gather Documents: Collect all the necessary paperwork, including the vehicle title, registration, and your identification. - Schedule Pickup or Drop-off: The charity will arrange for the vehicle to be picked up or provide instructions for dropping it off at a designated location. - Receive Tax Receipt: After the vehicle is sold, the charity will provide you with a receipt stating the sale price, which you can use for your tax deduction.

Tax Deduction Process

The tax deduction process for a donated car can be complex, depending on the sale price of the vehicle: - If the vehicle sells for less than 500</i>, you can claim the fair market value of the vehicle up to 500. - If the vehicle sells for $500 or more, you can claim the amount for which it was sold, but you must receive acknowledgment from the charity, including the sale price and the charity’s EIN.

📝 Note: It's essential to keep detailed records of the donation, including photos of the vehicle, the donation receipt from the charity, and any correspondence related to the sale and tax deduction.

Benefits of Donating a Car

Donating a car offers several benefits: - Supports a Good Cause: Your donation directly supports the charity’s mission and programs. - Potential Tax Deduction: Depending on your tax situation, you may be eligible for a tax deduction based on the sale price of the vehicle or its fair market value. - Convenience: Many charities offer pickup services, making the donation process easy and convenient. - Environmental Impact: Donating an old vehicle can help reduce waste and support environmental sustainability.

Conclusion

Donating a car to charity is a rewarding way to support a cause you believe in while also potentially benefiting from a tax deduction. By understanding the required paperwork and the steps involved in the donation process, you can ensure a smooth and successful transaction. Remember to research the charity thoroughly, keep detailed records, and follow the guidelines for claiming a tax deduction to make the most of your generous donation.

What is the first step in donating a car to charity?

+

The first step is to research and find a reputable charity that accepts car donations and supports a cause you believe in. Ensure the charity is registered as a 501©(3) organization to qualify for a tax deduction.

What documents do I need to donate a car?

+

You will need the vehicle title, registration, and your identification. The charity should also provide their Employer Identification Number (EIN) and a receipt or acknowledgement of the donation for tax purposes.

How do I claim a tax deduction for my donated car?

+

The process for claiming a tax deduction depends on the sale price of the vehicle. If the vehicle sells for less than 500, you can claim the fair market value up to 500. For vehicles sold for $500 or more, you can claim the sale price, but you must receive acknowledgment from the charity, including the sale price and the charity’s EIN.